So my story has been that while most thought QE was a bumper crop for the dollar- Fed printing money and flooding the system with liquidity and all that-

It was in fact a crop failure for the dollar, as evidenced by the Fed turning over $79 billion in QE profits (that would have otherwise gone to the economy) to the Tsy.

And because everyone thought it was a bumper crop, they all sold the heck out of dollars in all kinds of theaters and iterations, from outright selling of dollars, to buying of commodities and stocks and in general making all kinds of dollar ‘inflation bets.’

And then a few weeks ago Chairman Bernanke comes on tv and starts talking about how his policies are strong dollar policies, just as the dollar index hit its lows and within a day or so headed north.

At the time it seemed strange to me that he’d suddenly, out of nowhere, break silence on the dollar and make those kinds of strong dollar statements previously left to Treasury. Unless he had a pretty good idea the dollar would start going up.

And only a few days ago he again spoke about how his policies were strong dollar policies, and the dollar traded around a bit, but remained above the lows and then headed back up. Especially vs the euro.

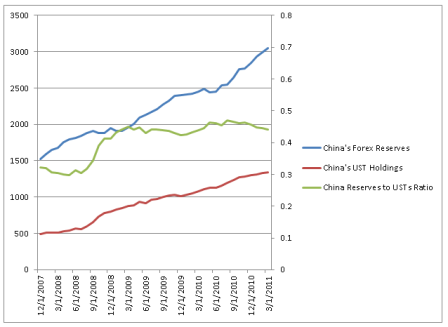

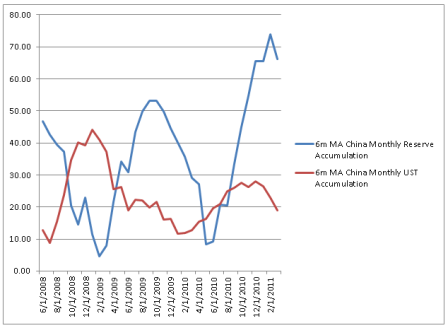

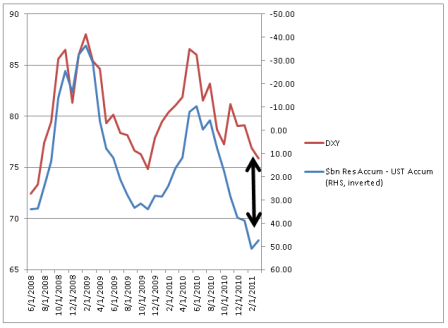

And shortly after that we find out China had let maybe $200 billion in T bills run off since QE2 started, and while their dollar holdings didn’t fall, their reserve growth was allocated elsewhere, and, from market action, there were substantial allocations to the euro. This hunch was further supported by their earlier announcement that they would be buying Spanish bonds to ‘help them out’ as a Trojan horse to buy euro to support their exports to the euro zone.

So my story is maybe the T bill runoff thing was a shot across the Fed’s bow? China was in the news objecting to QE and demanding what they considered ‘sound money’ policy. So it would make sense, to let the Fed know they were serious, to do something like let their T bills run off and alter fx allocation ratios away from the dollar and toward the euro, all of which caused the dollar to sell off for several months. And with the implication, and maybe also in private conversation, that any more QE would mean outright selling of dollar reserves. And the Fed Chairman taking this to heart and with other FOMC members also objecting to more QE, and maybe even knowing that QE doesn’t do anything anyway apart from scaring global portfolio managers, including those in China and Russia, etc. out of dollars, maybe somehow reached an understanding with China, where China would return to ‘normal’ fx allocations and there would be no QE3? And the subsequent strong dollar speeches that followed had the knowledge behind them that China had returned to dollar financial asset accumulation, which would likely end the dollar slide and reverse it?

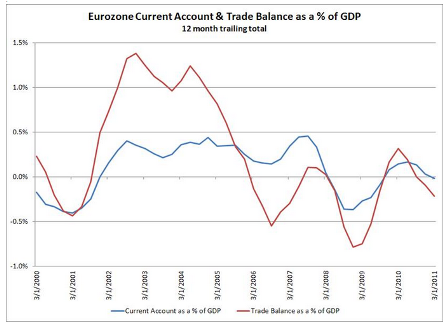

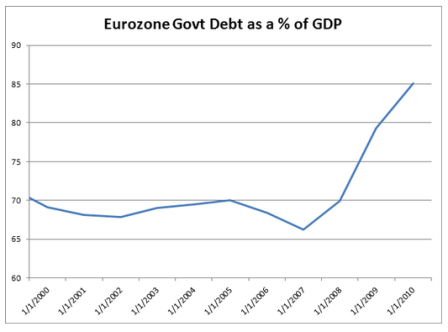

This also means the euro has lost this ‘extra’ support it’s ‘enjoyed’ for the prior several months, which means it’s all a lot worse for the euro than it is good for the dollar, as they have bigger fish to get deep fried than just the level of the currency. Seems the last thing they need now is for a major buyer of euro denominated debt to switch allocations to dollars.

And it also could be that this ‘extra’ euro debt buying has been delaying the euro crisis for the last several months as well. This means it’s all been propped up while getting worse down deep, which means if that support has now been pulled, it falls that much harder.

A lower euro also works to ‘inflate away’ euro zone national govt debt ratios, and currency depreciation in general as a market induced path to debt relief is a well known phenomena, though one the ECB is likely to fight to comply with its low inflation mandate. And fighting inflation means hiking interest rates, which, while initially helping some, actually work to increase national govt deficits and hurt their credit ratings, as well as further depress the euro.