Today is year and in Japan,

which means the last few days could be mainly quarter end and year end maneuvers,

with a high probability of ‘buy the rumor sell the news’ types of unwinds coming up.

This would include the anticipation of another 200,000 new private sector jobs to be reported tomorrow am.

And the euro strength we’ve seen in front of the announced ECB rate hike next week.

There have been lots of promotional reasons to rush to get stocks on your books for year and/quarter end reporting,

as well as a bit of gold, silver, foods, and other commodities.

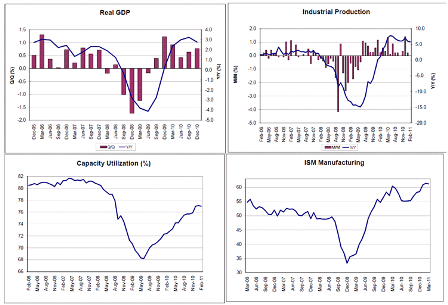

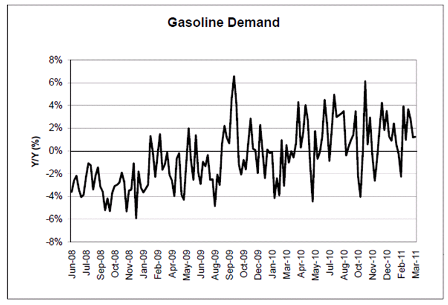

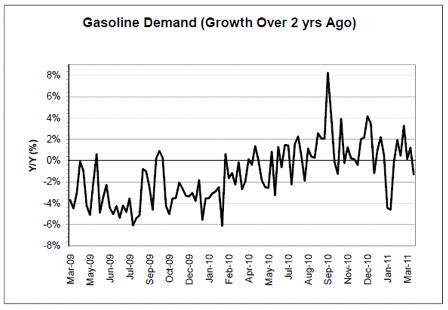

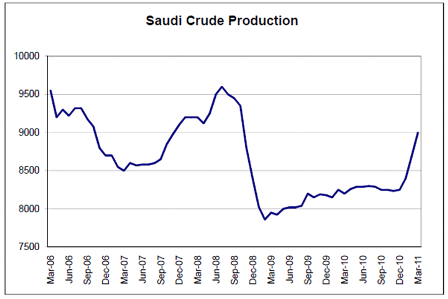

But fundamentally I see what’s going on below- a world heck bent on removing aggregate demand.

More noises from Japan on how they will pay for the rebuild, which looks to be a very modest appropriation tempered by fears of being at a fiscal tipping point.

UK austerity ratchets up April 1.

China still fighting inflation with further reduced spending and lending.

The euro zone demanding and getting austerity in return for funding, with signs in some members of austerity no longer bringing down deficits as revenues fall off from economic weakness. And no fiscal safety net if it does all go bad as markets have shown extreme reluctance to fund countercyclical deficits.

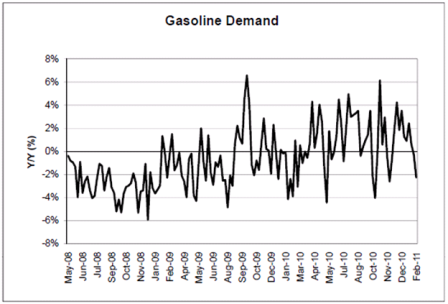

And food and fuel from monopoly pricing both eating into consumer demand and driving large segments of the world population into desperation.

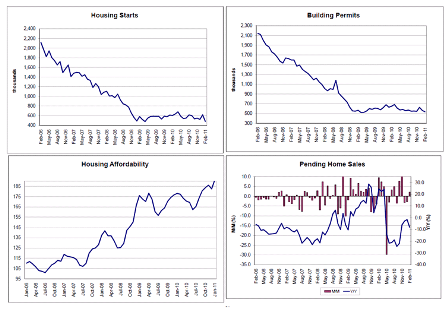

Talk of Q1 US GDP down to maybe only +2%, housing still bumping along the bottom, and Q2 threatened by supply shortages due to the earthquake in Japan.

And the US debt ceiling showdown now possibly happing late next week as the deficit terrorists seal their congressional victory with the promised down payment on net spending cuts that won’t end there.

In fact, their army of support is now all but universal.

Everyone in DC and the mainstream media and economics profession agrees on the problem.

The only discussion is where the cuts should be, and who should pay more.

March 31, 2011

President Barack Obama

The White House

1600 Pennsylvania Avenue, NW

Washington, DC 20500

The Honorable John Boehner

Speaker of the House

1101 Longworth House Office Building

Washington, DC 20515

The Honorable Nancy Pelosi

House Minority Leader

235 Cannon House Office Building

Washington, DC 20515

The Honorable Harry Reid

Senate Majority Leader

522 Hart Senate Office Building

Washington, DC 20510

The Honorable Mitch McConnell

Senate Minority Leader

361-A Russell Senate Office Building

Washington, DC 20510

Dear President Obama, Speaker Boehner, Minority Leader Pelosi, Majority Leader Reid, and Minority Leader McConnell:

As you continue to work on our current budget situation, we are writing to let you know that we join with the 64 Senators who recently wrote that comprehensive deficit reduction measures are imperative, and to urge you to work together in support of a broad approach to solving the nation’s fiscal problems. As they said in their letter to President Obama:

“As you know, a bipartisan group of Senators has been working to craft a comprehensive deficit reduction package based upon the recommendations of the Fiscal Commission. While we may not agree with every aspect of the Commission’s recommendations, we believe that its work represents an important foundation to achieve meaningful progress on our debt. The Commission’s work also underscored the scope and breadth of our nation’s long-term fiscal challenges.

Beyond FY2011 funding decisions, we urge you to engage in a broader discussion about a comprehensive deficit reduction package. Specifically, we hope that the discussion will include discretionary spending cuts, entitlement changes and tax reform.

By approaching these negotiations comprehensively, with a strong signal of support from you, we believe that we can achieve consensus on these important fiscal issues. This would send a powerful message to Americans that Washington can work together to tackle this critical issue. Thank you for your attention to this matter.”

We agree with this letter and hope that you will work together to agree on a comprehensive, multi-year debt stabilization package.

Sincerely,

The Honorable Roger C. Altman

Former Assistant Secretary of the U.S.

Department of the Treasury; Founder

and Chairman, Evercore Partners

Barry Anderson

Former Acting Director, Congressional

Budget Office

Joseph Antos

Wilson H. Taylor Scholar in Health Care

and Retirement Policy, American

Enterprise Institute

The Honorable Martin Baily

Former Chairman, Council of Economic

Advisers

Robert Bixby

Executive Director, Concord Coalition

Charles Blahous

Research Fellow, Hoover Institute

Erskine Bowles

Former Co-Chair, National Commission

on Fiscal Responsibility and Reform

The Honorable Charles Bowsher

Former Comptroller General of the

United States

The Honorable John E. Chapoton

Former Assistant Secretary for Tax

Policy, U.S. Department of the Treasury

David Cote

Former Member, National Commission

on Fiscal Responsibility and Reform;

Chairman and CEO, Honeywell

International

Pete Davis

President, Davis Capital Investment

Ideas

John Endean

President, American Business

Conference

The Honorable Vic Fazio

Former Member of Congress

The Honorable Martin Feldstein

Former Chairman, Council of Economic

Advisers

The Honorable William Frenzel

Former Ranking Member, House

Budget Committee; Co-Chair,

Committee for a Responsible Federal

Budget

Ann Fudge

Former Member, National Commission

on Fiscal Responsibility and Reform;

Former CEO, Young & Rubicam Brands

William G. Gale

Senior Fellow, Brookings Institution William A. Galston

Senior Fellow and Ezra K. Zilkha Chair,

Brookings Institution

The Honorable Bill Gradison

Former Ranking Member, House

Budget Committee

The Honorable Judd Gregg

Former Chairman, Senate Budget

Committee

Ron Haskins

Senior Fellow, Brookings Institution

Kevin Hassett

Senior Fellow and Director of Economic

Policy Studies, American Enterprise

Institute

G. William Hoagland

Former Staff Director, Senate Budget

Committee

The Honorable Glenn Hubbard

Former Chairman, Council of Economic

Advisers; Dean, Columbia Business

School

David B. Kendall

Senior Fellow for Health and Fiscal

Policy, Third Way

The Honorable Bob Kerrey

Former Member of Congress

Donald F. Kettl

Dean, School of Public Policy,

University of Maryland

The Honorable Charles E.M. Kolb

President, Committee for Economic

Development

The Honorable Jim Kolbe

Former Member of Congress

Lawrence B. Lindsey

President and CEO, The Lindsey Group;

Former Director, National Economic

Council

Maya MacGuineas

President, Committee for a Responsible

Federal Budget

The Honorable N. Gregory Mankiw

Former Chairman, Council of Economic

Advisers

The Honorable Donald Marron

Director, Urban-Brookings Tax Policy

Center; Former Acting Director,

Congressional Budget Office

William Marshall

President, Progressive Policy Institute

The Honorable James T. McIntyre, Jr.

Former Director, Office of Management

and Budget

Olivia S. Mitchell

Economist

The Honorable William A. Niskanen

Chairman Emeritus and Distinguished

Senior Economist, Cato Institute; Former

Acting Chairman, Council of Economic

Advisers

The Honorable Jim Nussle

Former Director, Office of Management

and Budget; Former Chairman, House

Budget Committee; Co-Chair,

Committee for a Responsible Federal

Budget Michael E. O’Hanlon

Senior Fellow and Sydney Stein Jr.

Chair, Brookings Institution

The Honorable Paul O’Neill

Former Secretary of the U.S.

Department of the Treasury

Marne Obernauer, Jr.

Chairman, Beverage Distributors

Company

Rudolph G. Penner

Former Director, Congressional Budget

Office

The Honorable Timothy Penny

Former Member of Congress; Co-Chair,

Committee for a Responsible Federal

Budget

The Honorable Alice Rivlin

Former Director, Congressional Budget

Office; Former Director, Office of

Management and Budget; Former

Member, National Commission on

Fiscal Responsibility and Reform

The Honorable Charles Robb

Former Member of Congress

Diane Lim Rogers

Chief Economist, Concord Coalition

The Honorable Christina Romer

Former Chairwoman, Council of

Economic Advisers

The Honorable Robert E. Rubin

Former Secretary of the U.S.

Department of the Treasury

The Honorable Martin Sabo

Former Chairman, House Budget

Committee

Isabel V. Sawhill

Senior Fellow, Brookings Institution

Allen Schick

Distinguished University Professor,

University of Maryland

Sylvester J. Schieber

Former Chairman, Social Security

Advisory Board

Daniel N. Shaviro

Wayne Perry Professor of Taxation,

New York University School of Law

The Honorable George P. Shultz

Former Secretary of the U.S.

Department of the Treasury; Former

Secretary of the U.S. Department of

State; Former Secretary of the U.S.

Department of Labor

The Honorable Alan K. Simpson

Former Member of Congress; Co-Chair,

National Commission on Fiscal

Responsibility and Reform

C. Eugene Steuerle

Institute Fellow and Richard B. Fisher

Chair, Urban Institute

The Honorable Charlie Stenholm

Former Member of Congress; Co-Chair,

Committee for a Responsible Federal

Budget The Honorable Phillip Swagel

Former Assistant Secretary for

Economic Policy, U.S. Department of the

Treasury

The Honorable John Tanner

Former Member of Congress

John B. Taylor

Mary and Robert Raymond Professor of

Economics, Stanford University; George

P. Shultz Senior Fellow in Economics,

Hoover Institution

The Honorable Laura D. Tyson

Former Chairwoman, Council of

Economic Advisers; Former Director,

National Economic Council

The Honorable George Voinovich

Former Member of Congress

The Honorable Paul Volcker

Former Chairman, Federal Reserve

System

Carol Cox Wait

Former President, Committee for a

Responsible Federal Budget

The Honorable David M. Walker

Former Comptroller General of the

United States

The Honorable Murray L.

Weidenbaum

Former Chairman, Council of Economic

Advisers

The Honorable Joseph R. Wright, Jr.

Former Director, Office of Management

and Budget

Mark Zandi

Chief Economist, Moody’s Analytics