By Paul Krugman

Aug 21 (NYT) — Rand Paul said something funny the other day. No, really — although of course it wasn’t intentional. On his Twitter account he decried the irresponsibility of American fiscal policy, declaring, “The last time the United States was debt free was 1835.”

Which consequently was followed by the worst depression in US history.

Wags quickly noted that the U.S. economy has, on the whole, done pretty well these past 180 years, suggesting that having the government owe the private sector money might not be all that bad a thing. The British government, by the way, has been in debt for more than three centuries, an era spanning the Industrial Revolution, victory over Napoleon, and more.

But is the point simply that public debt isn’t as bad as legend has it? Or can government debt actually be a good thing?

Believe it or not, many economists argue that the economy needs a sufficient amount of debt out there to function well.

Yes, to offset desires to not spend income (save) when private sector borrowing to spend isn’t sufficient, as evidenced by unemployment.

And how much is sufficient? Maybe more than we currently have. That is, there’s a reasonable argument to be made that part of what ails the world economy right now is that governments aren’t deep enough in debt.

Yes, it’s called unemployment, which is the evidence that deficit spending is insufficient to offset desires to not spend income. Something economists have known by identity for at least 300 years.

I know that may sound crazy. After all, we’ve spent much of the past five or six years in a state of fiscal panic, with all the Very Serious People declaring that we must slash deficits and reduce debt now now now or we’ll turn into Greece, Greece I tell you.

But the power of the deficit scolds was always a triumph of ideology over evidence, and a growing number of genuinely serious people — most recently Narayana Kocherlakota, the departing president of the Minneapolis Fed — are making the case that we need more, not less, government debt.

Why?

This is the right answer- because the US public debt, for example, is nothing more than the dollars spent by the govt that haven’t yet been used to pay taxes. Those dollars constitute the net financial dollar assets of the global economy (net nominal savings), as actual cash, or dollar balances in bank accounts at the Federal Reserve Bank called reserve accounts and securities accounts. Functionally, it is not wrong to call these dollars the ‘monetary base’. And a growing economy that generates increasing quantities of unspent income likewise needs an increasing quantity of spending that exceeds income- private or public- for a growing output to get sold.

One answer is that issuing debt is a way to pay for useful things, and we should do more of that when the price is right.

Wrong answer. It’s never about ‘when the price is right’. It is always a political question regarding resource allocation between the public sector and private sector.

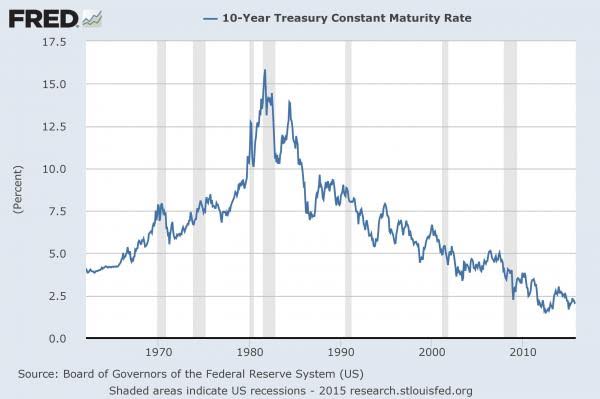

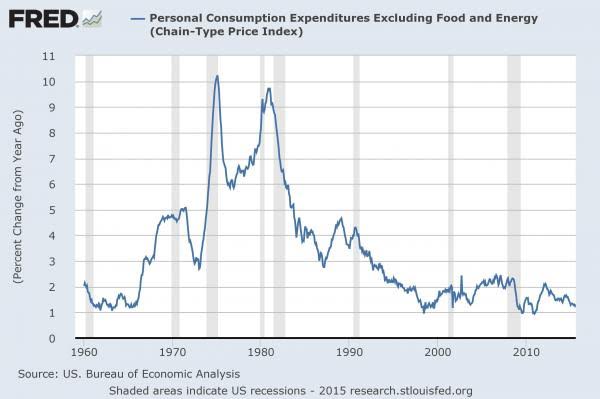

The United States suffers from obvious deficiencies in roads, rails, water systems and more; meanwhile, the federal government can borrow at historically low interest rates.

Wrong answer. Yes, there is a serious infrastructure deficiency. The right question, however, is whether the US has the available resources and whether it wants to allocate them for that purpose.

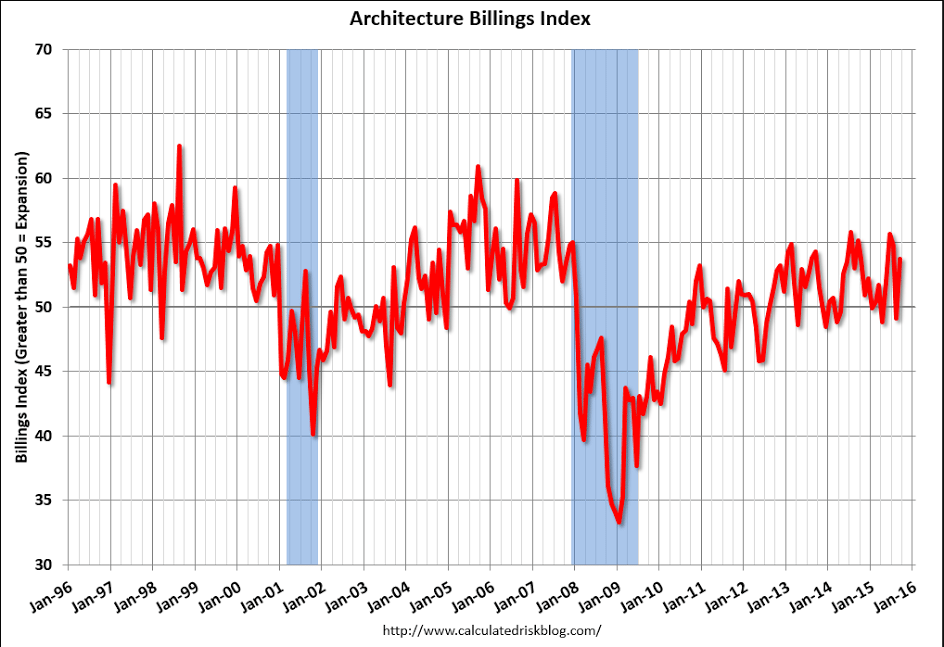

So this is a very good time to be borrowing and investing in the future, and a very bad time for what has actually happened: an unprecedented decline in public construction spending adjusted for population growth and inflation.

I agree it’s a good time to fund infrastructure investment, due to said deficiencies.

However, whether or not it’s a good time to increase deficit spending is a function of how much slack is in the economy, as evidenced by the unemployment rates, participation rates, etc. And not by infrastructure needs.

And my read based on that criteria is that it’s a good time for proactive fiscal expansion.

Nor in any case is deciding whether or not to increase deficit spending rightly about whether or not to increase borrowing per se for a government that, under close examination, from inception necessarily spends or lends first, and then borrows. As Fed insiders say, ‘you can’t do a reserve drain without first doing a reserve add.’

Beyond that, those very low interest rates are telling us something about what markets want.

Wrong, they are telling is something about what level market participants think the fed will target the Fed funds rate over time.

I’ve already mentioned that having at least some government debt outstanding helps the economy function better. How so?

Right answer- deficit spending adds income and net financial assets to the economy to support sufficient spending to get the output sold.

The answer, according to M.I.T.’s Ricardo Caballero and others, is that the debt of stable, reliable governments provides “safe assets” that help investors manage risks, make transactions easier and avoid a destructive scramble for cash.

Wrong answer. Net govt spending provides in the first instance provides dollars (tax credits) in the form of dollar deposits in reserve accounts at the Federal Reserve Bank. Treasury securities are nothing more than alternative deposits in securities accounts at the Federal Reserve Bank for those dollars. Both are equally ‘safe’.

Now, in principle the private sector can also create safe assets, such as deposits in banks that are universally perceived as sound. In the years before the 2008 financial crisis Wall Street claimed to have invented whole new classes of safe assets by slicing and dicing cash flows from subprime mortgages and other sources.

But all of that supposedly brilliant financial engineering turned out to be a con job: When the housing bubble burst, all that AAA-rated paper turned into sludge. So investors scurried back into the haven provided by the debt of the United States and a few other major economies. In the process they drove interest rates on that debt way down.

Rates went down in anticipation of future rate setting by the fed.

What investors did was reprice financial assets. Investors can’t change total financial assets. The total only changes with new issues and redemptions/maturities.

And those low interest rates, Mr. Kocherlakota declares, are a problem. When interest rates on government debt are very low even when the economy is strong, there’s not much room to cut them when the economy is weak, making it much harder to fight recessions.

True, but cutting rates doesn’t fight recessions. In fact low rates reduce interest income paid by govt to the economy, thereby weakening it.

There may also be consequences for financial stability: Very low returns on safe assets may push investors into too much risk-taking — or for that matter encourage another round of destructive Wall Street hocus-pocus.

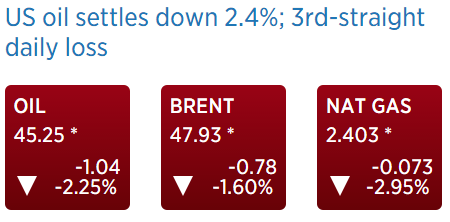

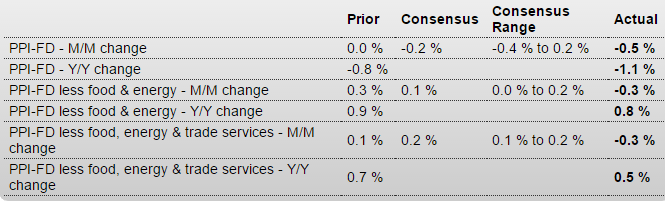

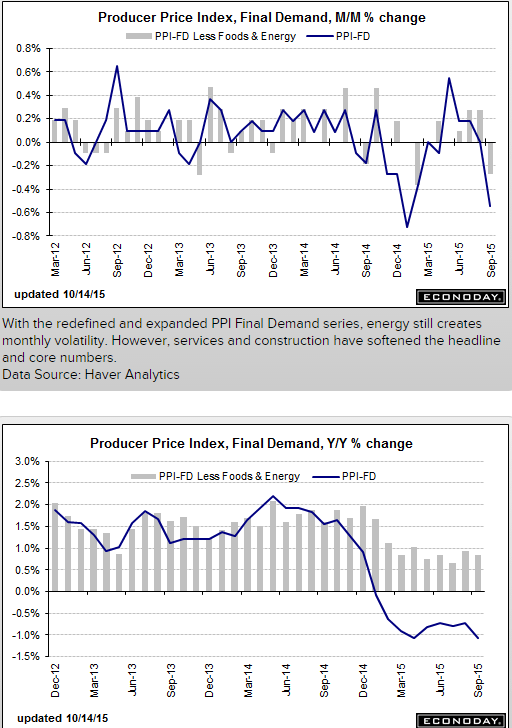

That would be evidenced by an increase in the issuance of higher risk securities, but there has been no evidence of that. In fact, it was $100 oil that at the margin drove the credit expansion that supported GDP growth, as evidenced by the collapse when prices fell.

What can be done? Simply raising interest rates, as some financial types keep demanding (with an eye on their own bottom lines), would undermine our still-fragile recovery.

It would more likely very modestly strengthen it from the increase in the govt deficit due to the increased interest income paid by govt to the economy. However, I’d prefer a tax cut and/or spending increase to support GDP, rather than an interest rate increase. But that’s just me…

What we need are policies that would permit higher rates in good times without causing a slump. And one such policy, Mr. Kocherlakota argues, would be targeting a higher level of debt.

Mr. K isn’t wrong, but again I’d rather just have a larger tax cut to get to the same point, but, again, that’s just me…

In other words, the great debt panic that warped the U.S. political scene from 2010 to 2012, and still dominates economic discussion in Britain and the eurozone, was even more wrongheaded than those of us in the anti-austerity camp realized.

True, and this author…

Not only were governments that listened to the fiscal scolds kicking the economy when it was down, prolonging the slump; not only were they slashing public investment at the very moment bond investors were practically pleading with them to spend more; they may have been setting us up for future crises.

True but for differing reasons. It’s never about investors pleading. It’s always about the public purpose behind the policies.

And the ironic thing is that these foolish policies, and all the human suffering they created, were sold with appeals to prudence and fiscal responsibility.

The larger problem with this editorial is that the wrong reasons it gives for what’s largely the right policy are out of paradigm reasons that the opposition routinely shoots down and shouts down, easily convincing the electorate that they are correct and the ‘headline left’ is wrong.

Feel free to distribute