Exchange Rate Policy and Full Employment

By Warren Mosler

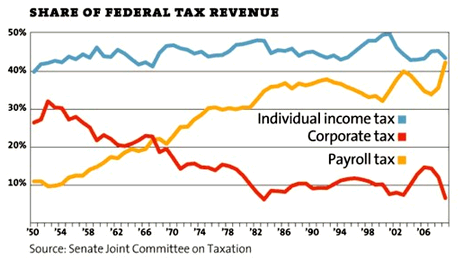

FICA taxes share of Federal tax ‘revenues’

General Theory quote

“gold-mining is the only pretext for digging holes in the ground which has recommended itself to bankers as sound finance” – JM Keynes, 1936

2013 TED Prize Nomination Acknowledgement

>

> (email exchange)

>

> On Fri, Aug 24, 2012 at 6:25 PM, Barry wrote:

>

> FYI.

>

> Cross fingers!

>

Thank you for your 2013 TED Prize Nomination.

Your nomination and nominee will be reviewed over the coming weeks and you will be notified as to the success of your nomination by mid-September.

With best wishes,

The TED Prize team

http://www.tedprize.org

Tweets by TEDPrize

Best,

The TED Prize Team

interesting comment on my blog

Mosler knows!

Thayer knew!

Ruml knew!

Jim Lacey apparently knows, and so did a couple of economists that helped the USA prosecute and win WW2: Robert Nathan and Simon Kuznets.

Keep from All Thoughtful Men: How U.S. Economists Won World War II

I got to page 34.

“Orthodox economic thinking at the beginning of World War II held that taxes should finance wars on a pay-as-you-go basis.”

A fascinating book about what looks to be how MMT won the War. I’m still reading.

And I’m betting that we didn’t need to use all of Great Britain’s gold that they shipped to New York at the start of the war….

MMT in Italy

Translation:

The national launching of the book by W. Mosler – The Seven Deadly Innocent Frauds

MI – Feast of the Southern Italians (Meriondalisti italiani)

MMT Democracy

Modern Monetary Theory

To build an economy that saves lives, saves the state, and saves democracy

A state with sovereign money, legitimized by the citizens, that spends with a positive deficit for the benefits of us 99%, that is the only true democracy.

Daniele Basciu of MMT Democracy – Italy will be at the event in Vasto, CH

The national launching of the book by W. Mosler – The Seven Deadly Innocent Frauds

Fred Thayer

Sadly, looks like Fred passed away about 6 years ago.

I got to know him pretty well working with him on the concepts in the paper, and I picked up a lot of little bits and pieces info on capitalism I still find myself using now and then. One that comes to mind is that one of the costs of capitalism is the scrap heap of failed enterprises, for example, which represents real costs that didn’t work out.

Fred Thayer / Pitt professor and prolific author of letters to the editor

By Joe Smydo

To take a lesson from Fred Thayer, one didn’t have to be his student at the University of Pittsburgh’s Graduate School of Public and International Affairs.

In newspaper op-ed pieces and letters to the editor, Dr. Thayer offered sharply worded commentary on economics, deregulation, unemployment, transportation, the business of professional football and merit pay for elected officials (often peppering his sentences with parenthetical remarks).

The professor wrote to academic journals, elected officials and faculty colleagues, too, cajoling, criticizing and pushing audiences toward what he considered more enlightened thinking and more rational public policy.

“Competitive bidding on government contracts never works well because it cannot work well,” he said in a Nov. 6, 1989, letter to the Pittsburgh Post-Gazette. “When many contractors seek business (the process calls for numerous bids), each bidder knows he must either lie to win (by offering an unreasonably low price), bribe an official or join with other bidders to illegally divide the business. Unfortunately, only bribes and collusion produce high-quality work.”

Dr. Thayer, 82, of Mt. Lebanon, died Saturday at Mercy Hospital following a stroke. His wife, Carolyn Easley Thayer, called him a “very brilliant, simple man.”

Not everyone enjoyed his advice. “But most people took it in good stride,” said a longtime Pitt colleague, Professor Jerome B. McKinney.

Frederick Clifton Thayer Jr. was born Sept. 6, 1924, in Baltimore, the son of Frederick Sr. and Marian Walter Thayer. The family moved to Pittsburgh, and Dr. Thayer graduated from South Hills High School in 1942.

Mrs. Thayer said a last-minute appointment to the U.S. Military Academy at West Point may have been the only way her husband, from a family of modest means, could have gone to college. He graduated in 1945 and spent 25 years in the Army and Air Force, sometimes flying transport planes, other times driving a desk at the Pentagon and the Council on Foreign Relations.

The Thayers met at Ohio State University, when she was a senior and he was working on a master’s degree and teaching in the Reserve Officer Training Corps. They married in October 1952 and had two children, Jeffrey, of Mt. Lebanon, and Sarah Thayer Schneider of Glen Rock, N.J.

Dr. Thayer received his doctorate from the University of Denver in 1963. Jeffrey Thayer recalled his childhood awe at the 750-page document, later published as “Air Transport Policy and National Security.”

“To me, the most important thing about my dad wasn’t what he did but what he said … I just think everything he ever said just made total sense to me,” Mr. Thayer said, recalling the time he was listening to the radio when Steelers broadcaster Myron Cope began discussing a letter the professor sent him.

After retiring a colonel in 1969, Dr. Thayer joined the Pitt faculty and built a reputation as a fiery advocate for what he considered sound public policy. Students, now some of the region’s leaders, loved him; administrators, who considered him a gadfly, didn’t, Professor Donald M. Goldstein said.

“He had a wicked pen, a poison pen,” Dr. Goldstein said. “We used to tangle, too, but in a nice way.”

Dr. Thayer taught at Pitt until about 1990, then took miscellaneous teaching assignments in the United States and overseas.

“He was always what you might call an individual who took a position that encouraged you to think better or more creatively,” Dr. McKinney said. Sometimes, he said, that meant taking an edgy or unorthodox view.

In his November 1989 newspaper letter, Dr. Thayer argued that low bidders must rely on cost overruns, shoddy work and litigation to make a profit on government contracts. “What we need is legal collusion [planning], with government openly dividing the business among available contractors,” he said.

Dr. Thayer at least once skewered a colleague in print but more often sent colleagues two or three typewritten pages to rebut or enhance a point he heard them make. Dr. McKinney said colleagues sometimes wondered how he had time to write the missives he sent “streaming past your desk.”

Think big deficits cause recessions? Think again!

By Frederick C. Thayer

Gold standard thoughts

>

> (email exchange)

>

> On Fri, Aug 24, 2012 at 5:28 AM, Dave wrote:

>

> When you get a chance could you send a quick note out on problems with this type of

> thinking?

>

The reasons nations have gone off the gold standard isn’t because it was working so well and their economies were doing well. The reason they go off, like the US did in 1934, was because it was a disaster.

Historically nations suspend their gold standards in times of war, when they need their economies to function to the max. If a gold standard was so good for an economy, why suspend it when you need max economic performance? Obviously because it is not conducive of maximum real output.

The ideological issue is whether the primary function of the currency is to be an investment/savings vehicle, or a tool for provisioning government and optimizing real economic performance. In a market economy you can’t fix the price of two things without a relative value shift causing you to be buying one of them and running out of the other. Likewise, you can’t sustain full employment and a stable gold price if there is a shift in relative value between the two.

A gold standard is a fixed exchange rate policy, where the govt continuously offers to buy or sell gold at a fixed price.

This means the holder of a dollar, for example, has the option of ‘cashing it in’ for a fixed amount of gold from the govt, and a holder of gold has the option of selling it at a fixed price to the govt.

Therefore a new gold discovery which causes gold to be sold to the govt is inflationary and tends to increase output and employment, and a gold ship sinking in transit or a sudden desire to hoard gold is deflationary and tends to decrease output and employment. And there’s nothing that can be done about these relative value shifts, except to ride them out. The only public purpose served (by definition) is the stable nominal price of gold set by Congress.

With a gold standard, like any fixed fx regime, interest rates are necessarily set by market forces. With the govt’s spending being convertible currency, it is limited to spending only to the extent it has sufficient gold reserves backing the currency it spends. With gold reserves generally pretty much constant and not expandable in the short run, this means govt spending is limited to what it can tax and/or borrow. So when the govt wants to deficit spend, doing so by ‘printing’ new convertible dollars risks those dollars being ‘cashed in’ for gold. Govt borrowing, therefore, functions to remove that risk by delaying conversion privileges until the borrowings mature. This means the govt is competing with the right to convert when the govt borrows. In other words, the holder of the gold certificates has the option of either converting to gold or buying the treasury securities. The interest rate the treasury must pay therefore represents the indifference rate of holders of the convertible currency between cashing in the currency for gold now or earning the interest rate and not being able to convert until maturity. Note that it’s in fixed exchange rate environments that govt borrowing costs have soared to triple digits as govts have competed with their conversion features, and that govts generally lose those fights as the curve goes vertical expressing the fact that at that point there is no interest rate that can keep holders of the currency from wanting to convert.

Note that this also means the nations gold reserves are the net financial equity that supports the entire dollar credit structure, a source of continuous financial fragility and instability.

It’s all here in a paper I did in the late 1990’s.

Hope this helps!

A few more thoughts:

Being on the gold standard doesn’t prevent a financial crisis, but it makes the consequences far more severe.

We were on a gold standard when the roaring 20’s private sector debt boom lead to the crash of 1929 and the depression that followed. 4,000 banks closed before we went off gold in 1934, and it was only getting worse which is why we went off of it.

Gold would not have prevented the pre 2008 sub-prime boom, but it would have made the consequences far more severe. Including no Fed liquidity provision to offset a system wide shortage due to hoarding and banks bidding ever higher for funds that didn’t exist, most all firms losing inventory financing and being forced to liquidate inventories as rates spiked competing for funds that didn’t exist, and no deficit spending for unemployment comp as federal revenues fell from the collapse. In other words, the automatic fiscal stabilizers we rely on can’t be there. Instead it’s a deflationary disaster that only ends when prices fall sufficiently to reflect changes in relative value between gold and everything else.

Note that the recent decade of gold going from under $600 to over $1,600 is viewed as a sign ‘inflationary’ and a 250% ‘dollar devaluation’ as it takes 2.5x as many dollars to buy the same amount of gold. But if we were on a gold standard, and all else equal, and gold had been fixed at $600 back then, the same relative value shift would be manifested as the general price level falling that much in an unthinkable deflationary nightmare.

Republicans Eye Return to Gold Standard

Just when you think it can’t get any worse:

Republicans Eye Return to Gold Standard

By Robin Harding and Anna Fifield

August 23 (FT) — The gold standard has returned to mainstream U.S. politics for the first time in 30 years, with a “gold commission” set to become part of official Republican party policy.

Drafts of the party platform, which it will adopt at a convention in Tampa Bay, Florida, next week, call for an audit of Federal Reserve monetary policy and a commission to look at restoring the link between the dollar and gold.

The move shows how five years of easy monetary policy — and the efforts of congressman Ron Paul — have made the once-fringe idea of returning to gold-as-money a legitimate part of Republican debate.

Marsha Blackburn, a Republican congresswoman from Tennessee and co-chair of the platform committee, said the issues were not adopted merely to placate Paul and the delegates that he picked up during his campaign for the party’s nomination.

“These were adopted because they are things that Republicans agree on,” Blackburn told the Financial Times. “The House recently passed a bill on this, and this is something that we think needs to be done.”

The proposal is reminiscent of the Gold Commission created by former president Ronald Reagan in 1981, 10 years after Richard Nixon broke the link between gold and the dollar during the 1971 oil crisis. That commission ultimately supported the status quo.

“There is a growing recognition within the Republican party and in America more generally that we’re not going to be able to print our way to prosperity,” said Sean Fieler, chairman of the American Principles Project, a conservative group that has pushed for a return to the gold standard.

A commission would have no power except to make recommendations, but Fieler said it would provide a chance to educate politicians and the public about the merits of a return to gold. “We’re not going to go from a standing start to the gold standard,” he said.

The Republican platform in 1980 referred to “restoration of a dependable monetary standard,” while the 1984 platform said that “the gold standard may be a useful mechanism”. More recent platforms did not mention it.

Any commission on a return to the gold standard would have to address a host of theoretical, empirical and practical issues.

Inflation has remained under control in recent years, despite claims that expansion of the Fed’s balance sheet would lead to runaway price rises, while gold has been highly volatile. The price of the metal is up by more than 500 per cent in dollar terms over the past decade.

A return to a fixed money supply would also remove the central bank’s ability to offset demand shocks by varying interest rates. That could mean a more volatile economy and higher average unemployment over time.

BOE Says QE Benefits to Economy Counter Harm Done to Savers

Nice to see they are getting challenged on this.

With govt the net payer of interest to the economy the critics should ultimately win this one. You would need some seriously skewed propensities to spend to overcome the raw interest rate channels.

BOE Says QE Benefits to Economy Counter Harm Done to Savers

By Jennifer Ryan

August 23 (Bloomberg) — The Bank of England defended its quantitative-easing program against criticism that it affected savers, saying these costs must be weighed against the economic benefits and that the plan limited the depth of the slump.

“Without the bank’s asset purchases, most people in the U.K. would have been worse off,” the central bank said in a report published in London today. “This would have had a significant detrimental impact on savers and pensioners along with every other group in our society. All assessments of the effect of asset purchases must be seen in this light.”

The report is a response to a government request that the central bank explain the impact of its bond purchases, which began in March 2009 and will reach 375 billion pounds ($596 billion) in November. It aims to counter a government claim that loose monetary policy penalizes “savers, those with ‘drawdown pensions’ and those retiring now.”

The central bank said QE widened the deficits in defined-benefit pension plans that were already facing a shortfall before the program started, though that burden may fall on employers and future employees rather than those nearing retirement now. The impact on defined contribution plans has been “broadly neutral.”

Asset-Price Impact

The central bank also said that QE helped to boost other asset prices, benefiting returns on pensions and other savings. The comments echo those made by Deputy Governor Charles Bean in February, when he said the impact of QE on assets such as equities provides an “offset to the fall in annuity rates.”

The effect “is thus more complex than it seems at first blush,” Bean said in a speech that month.

“By pushing up a range of asset prices, asset purchases have boosted the value of households’ financial wealth held outside pension funds,” today’s report said. However, those holdings “are heavily skewed, with the top 5 percent of households holding 40 percent of these assets.”

The Bank of England said the biggest factor in the drop in interest income that savers receive from deposits was the reduction in the key interest rate to a record low of 0.5 percent, not asset purchases.

Explaining the widening of deficits in defined benefit pension plans and the fall in the annuity income that can be purchased from other pension funds, it said the “main factor” has been the fall in equity prices relative to gilt prices.

This “was not caused by QE,” the central bank said. “It happened in all the major economies, much of it occurred prior to the start of asset purchases, and stemmed in large part from the reluctance of investors to hold risky assets, such as equities, given the deterioration in the economic outlook. Indeed, by boosting the economy, monetary policy actions in the U.K. and overseas probably dampened this effect.”