Plosser is perhaps the most hawkish Fed president.

Look for a dove to speak soon to soften this stance?

(intro remarks deleted)

The FOMC and Monetary Policy Objectives

In conducting monetary policy, the FOMC seeks to foster financial conditions, including growth of money and credit and a level of

short-term interest rates, consistent with achieving two goals: price stability and maximum sustainable economic growth.

Note this general policy statement:

I believe that the most important contribution the Fed can make to sustained economic growth and employment rests on credibly committing to and achieving long-run price stability. In fact, without a credible commitment to maintaining price stability, the Fed’s ability to promote sustainable growth would be seriously undermined. Moreover, price stability is not only an important element in achieving sustained economic growth, it is also critical in promoting financial stability.

That is the mainstream view, and the view the Fed has presented to Congress over the years regarding how it complies with its dual mandate: get price stability right and markets function to promote optimum long-term growth and employment.

The primary tool for implementing monetary policy is the federal funds rate,

(SNIP)

It is important to recognize that the influence of changes in the FOMC’s targeted funds rate on inflation and economic growth occurs with a lag, so by necessity the FOMC must be forward-looking in setting an appropriate funds rate target. It must forecast future economic growth and inflation based on available economic data and financial conditions, including a particular path for the fed funds rate.

(SNIP)

A change in the economic outlook is what was at work in the last two weeks when the FOMC decided to reduce its target fed funds rate in two steps to its current level of 3 percent.

Let me elaborate on recent economic and financial conditions and my current outlook for the economy and inflation.

The Outlook

Since last August, financial and economic conditions have deteriorated. As that occurred, policymakers revised downward their forecasts for 2008 economic growth. This took place in several steps as new data were released and, in turn, led the FOMC to lower the federal funds rate in a series of steps.

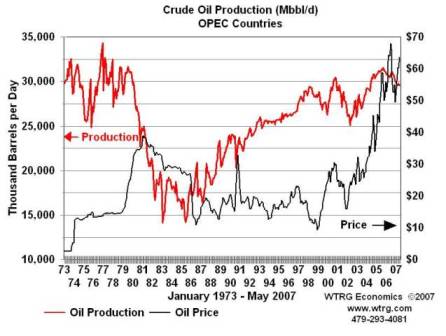

By last September, we had already seen a cumulative deterioration in the housing sector during the earlier part of 2007. In addition, the disruptions in financial markets in August caused by the problems in the subprime mortgage market raised the risk of potential adverse effects on the broader economy from a further tightening of credit conditions. As a result, I lowered my projection of economic growth for the fourth quarter of 2007 and the first half of 2008. In particular, the adjustment to my forecast involved pushing back the turnaround in residential construction, as low demand for homes meant it would take longer than expected for the economy to work off the inventories of new and existing homes for sale. The continuing high prices of oil and other commodities also suggested the potential for some slowing in the pace of economic activity, as well as hinting at increasing inflationary pressures  a point I will return to later. As the outlook changed, the FOMC lowered the fed funds rate target by 50 basis points in September, and then by another 25 basis points in both October and early December.

Since the Committee’s meeting in early December, the economic data have indicated that the deterioration in the housing market has continued unabated. Although that by itself was discouraging, other economic indicators also showed signs of an economy that was weakening. The renewed widening of some credit spreads in financial markets, along with weaker figures for retail sales, manufacturing activity, and job growth in December, led many forecasters in early January to further mark down their forecasts for 2008. The sharp rise in December’s unemployment rate, which was released in early January, also heightened many economists’ concerns about the economy’s health. What’s more, the Philadelphia Reserve Bank’s closely watched manufacturing survey recorded a surprisingly steep decline in industrial activity in January, to a level not seen since the last recession.

Although the economy’s resilience to past shocks makes me cautious about making changes to my outlook based on just one or two pieces of economic news, the string of weaker than anticipated numbers released in late December and in January had a cumulative effect on my own assessment of the 2008 outlook. While I would not be very surprised if the economy bounces back more quickly than many forecasters are now projecting, I am now, nevertheless, anticipating a weaker first half of 2008 than I did in October. This downward revision to the economic outlook is what led me to conclude that a substantially lower level of interest rates was needed to support the process of returning the economy to its trend rate of growth. Consequently, I believe the recent reductions in the federal funds rate were a necessary and appropriate recognition of this changed outlook.

The ongoing housing correction and the volatility and uncertainty in the credit markets are significant near-term drags on the economy and I expect growth in the first half of the year to be quite weak, around 1 percent. As conditions in the housing and financial markets begin to stabilize, I expect growth to improve in the second half of the year and to move back to trend, which I estimate is around 2.7 percent, in 2009. Overall, I am now anticipating economic growth in 2008 of near 2 percent.

Confirming ‘trend’ GDP at 2.7%.

Given the slowdown in economic growth this year, payroll employment will rise more slowly than last year and will remain below trend for much of the year before picking up in 2009. Slower job growth will also lead to an unemployment rate near 5-1/4 percent in 2008, after fluctuating between 4‑1/2 and 5 percent in 2007.

Two adjustments will continue to be needed to help work down the large number of unsold homes: further cuts in construction and declines in housing prices. I expect the decline in housing starts will bottom out in the middle of this year, but starts are likely to then be quite flat through the end of 2009 as the inventory of unsold homes is reduced gradually.

Interesting how long he thinks starts will stay around one million.

Of course, as was the case in 2007, how quickly housing bottoms out remains one of the main uncertainties surrounding any forecast in today’s environment. It seems that ever since last spring, the turnaround in housing was always six months away. Well, nine months later, it is still six months away. Simply having housing stop contracting will help economic growth. In 2007 the decline in residential construction took 1 percentage point off real GDP growth, which turned out to be 2.5 percent for the year (4th quarter to 4th quarter). Once residential construction stops declining, it will cease subtracting from overall growth. But housing is unlikely to make a positive contribution to economic growth until 2009.

Business investment should continue to increase this year, but at a slower pace than in 2007. Outside of autos and housing, there isn’t a large inventory overhang in the economy to be worked off. This is actually good news. Recessions are often preceded by periods of large inventory accumulation and much of the decline in production during recessions reflects a working off of an inventory imbalance. The absence of such an inventory overhang is encouraging.

The biggest component of GDP is consumer spending. With slower growth of employment and personal income in the first half of 2008, and as the decline in the value of homes and equities diminishes households’ net worth, consumer spending is likely to grow more slowly before picking up again in 2009.

One piece of good news has been the growth in exports. The trade sector supported economic growth last year as domestic demand weakened in the U.S. while foreign growth remained strong. The declining dollar also helped fuel a rebound in our exports. The net export component of GDP should continue to improve this year, although more slowly than it did in 2007 because we are likely to see somewhat slower growth among our major trading partners this year.

Inflation

Let me now turn to the outlook for inflation. Unfortunately, I expect little progress to be made in reducing core inflation this year or next, and I am skeptical that slower economic growth will help.

My understanding is the Fed was forecasting weakness that would bring down inflation.

All you have to do is recall the 1970s when we experienced both high unemployment and high inflation to appreciate that slow economic growth and lower inflation do not necessarily go hand in hand. I anticipate that core inflation (which excludes the prices of food and energy) is likely to remain in the 2 to 2‑1/2 percent range in 2008, which is above the range I consider to be consistent with price stability. If oil prices stabilize near their current levels, I expect headline, or total, inflation to decrease to around the 2 to 2‑1/2 percent range in 2008.

That is not a welcome forecast for the FOMC. They don’t want to conduct policy that lets core get that high.

(SNIP)

As the FOMC’s January 30 statement said, it will be necessary to continue to monitor inflation developments carefully. Most measures of inflation, including the core CPI and core PCE price measures, accelerated in the second half of 2007 compared to the first half. With inflation creeping up, we have to be particularly alert for rising inflation expectations. It is important that inflation expectations remain stable. If those expectations become unhinged, they could rapidly fuel inflation.

Again, that is the mainstream view. The expectations operator is key to a relative value story turning into an inflation story, as they say.

Moreover, as we learned from the experience of the 1970s, once the public loses confidence in the Fed’s commitment to price stability, it is very costly to the economy for the Fed to regain that confidence. The painful period of the early 1980s was the price the economy paid to restore the credibility of the Fed’s commitment  we certainly do not wish to go through that process again.

The mainstream often states it this way: ‘The real cost of bringing down inflation once expectations elevate is far higher than the cost of a near term recession.’

Fortunately, so far inflation expectations have not changed very much. But they bear watching because there are some signs that they, too, are edging higher. These may be early warning signs of a weakening of our credibility, and we must be very careful to avoid that.

The Fed is divided here. Most say that if expectations begin to elevate, it could be too late -the inflation cat is out of the bag- so, that much be avoided at all costs. Others say you can let them elevate a little bit, but must then act quickly to bring inflation down.

Monetary Policy Going Forward

(SNIP)

Over the course of the last five months, as forecasts for economic growth have been revised downward, the FOMC has lowered the fed funds rate by 225 basis points  from 5.25 percent to 3 percent. Taking expected inflation into account, the level of the federal funds rate in real terms  what economists call the real rate of interest  is now approaching zero. That is clearly an accommodative level of real interest rates. The last time the level of real interest rates was this low was in 2003-2004. But that was a different time with a different concern  deflation  and we were intentionally seeking to prevent prices from falling. Recently we have had reason to be worried about rising inflation, not declining prices.

This is a very strong statement – real interest rates are near zero, which was maybe appropriate given deflation fears in 2004, but he says not that is not the issue.

The FOMC’s reductions in the federal funds rate have been proactive in responding to evolving economic conditions that led to the deterioration in the outlook for economic growth. My inclination to alter monetary policy depends on whether the accumulation of evidence based on the data between now and our next meeting causes me to revise my forecast further. Weaker than expected data might lead to a downward revision, while stronger than expected data may lead to an upward revision to the forecast.

To make this point concrete, last Friday the Bureau of Labor Statistics reported that the economy lost 17,000 jobs in January. This was not an encouraging number. However, it was consistent with my forecast of weak employment growth in the first quarter of this year. Thus, by itself, it does not lead to a substantive revision to my forecast. We must look at the accumulation of data from a variety of sources to assess how the outlook may have changed relative to what was expected.

The payroll number did not change his forecast.

I also want to note that in early January there was much concern when the BLS reported only 18,000 jobs were created in December. Yet in the employment report last Friday that preliminary number was revised up to 82,000. Thus, we have to realize that economic data are subject to revision, and we have to be very careful not to rely on any one statistic or data series in assessing current economic conditions or our outlook.

Looks like he recognized January may be also revised up as December and August were.

There are those who have expressed the view that in times of economic weakness, the Fed must not worry about inflation and should focus its entire effort on restoring economic growth by dramatically driving interest rates down as far and as rapidly as possible. To borrow a line attributed to that famous, or perhaps infamous, Union Admiral David Farragut at the Battle of Mobile Bay, it is sort of a “damn the torpedoes, full speed ahead” approach to policy. But the Fed has a dual mandate for a reason. Price stability is a necessary component for achieving sustained economic growth. Ignoring price stability during times of economic weakness risks undermining our ability to achieve economic growth over the long run. It fuels higher inflation down the road and risks inappropriate risk taking and recurring boom/bust cycles. This would be counterproductive.

Again, this is the mainstream view.

Although it might be tempting to think that monetary policy is the solution to most, if not all, economic ills, this is not the case. I think it is particularly important, for example, to recognize that monetary policy cannot solve all the problems the economy and financial system now face. It cannot solve the bad debt problems in the mortgage market. It cannot re-price the risks of securities backed by subprime loans. It cannot solve the problems faced by those financial firms at risk of being given lower ratings by rating agencies because some of their assets are now worth much less than previously thought. The markets will have to solve these problems, as indeed they will. But it will take some time. However, the Fed can and should help by offsetting some of the restraint created by tightening credit conditions and the sharp reduction in housing investment. The Fed can and should also promote the orderly functioning of financial markets.

Going forward, then, my approach to making monetary policy decisions will be to look at incoming information and ask whether it is consistent with my outlook and the achievement of the Fed’s dual mandate. My outlook for 2008 already incorporates the fact that we will be receiving quite a few weak economic numbers in the first half of the year. However, to the extent that economic conditions evolve differently than expected, we will need to be prepared to incorporate those changing conditions into our policy decisions in a manner that is consistent with our dual mandate.

He uses the term ‘dual mandate’ to stress the importance of price stability.

Conclusion

In conclusion, my own forecast for economic activity has been revised downward since last October as economic conditions have evolved. I believe the recent reductions in the level of the federal funds rate target will be supportive of the economic adjustment process and a return to trend growth near the end of this year and on into 2009. The Fed has been aggressive in making this adjustment in rates, which will mitigate some, but not all, of the problems the economy and financial markets are facing. Some problems will simply take time for the financial markets to work out.

Seems his opinion is that unless the economy weakens more than currently forecast, the Fed is done.

In taking aggressive action in supporting the economy’s eventual return to its trend growth rate, I continue to believe we must not lose sight of the other part of the Fed’s dual mandate – which is price stability. We cannot be confident that a slow-growing economy in early 2008 will by itself reduce inflation.

The FOMC has been banking on this happening, Plosser is not so sure.

I am also convinced that we need to keep our eye on both headline as well as core inflation in assessing how well we are doing in achieving our goal of price stability.

Going forward, monetary policy decisions will depend on how the economy unfolds and whether further changes in the economic outlook are necessary.

Again, let me thank Philip Jackson and the Rotary Club for inviting me to return to speak here in Birmingham.

♥