The good news is the US budget deficit still looks to be plenty large to support modest top line growth.

And as the deficit continuously adds to incomes and savings, the financial burdens ratios continue to fall, and the stage is set for a ‘borrow to spend’, ‘get a job buy a car’, ‘it’s cheaper to own than to rent’ good old fashioned credit expansion.

But most all of that good news may already be discounted by the higher term structure of interest rates and the latest stock market rally.

And there are troubling near term and medium term risks out there that don’t seem at all priced in.

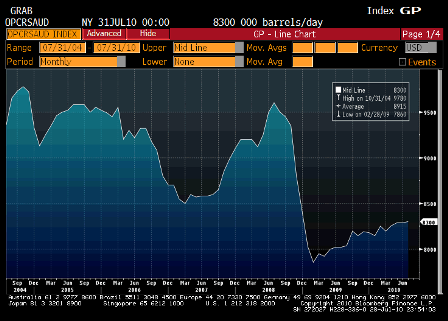

The rise in crude prices is particularly troubling.

Net demand isn’t up, and Saudi production remains relatively low.

So the Saudis are supporting higher prices for another reason. Maybe it’s the wiki leaks, or maybe they just had a bad night in London.

No way to tell, but they are hiking prices, and there’s no way to tell when they will stop.

Crude prices are already up enough to be a substantial tax on US consumers that has probably more than offset whatever aggregate demand might have been added by the latest tax package.

Might explain the weaker than expected holiday retail sales?

Congress will soon have a deficit terrorist majority, with many pledged to a balanced budget amendment.

And the world seems to be leaning towards fiscal tightening pretty much everywhere.

The unemployment benefits program has been extended but benefits still expire after 99 weeks, and less in many states.

Net state spending continues to decline as state and local govs continue to reduce their deficits and capital expenditures.

Catchup in the funding of unfunded pension liabilities will continue to be a drag on demand.

A federal pay freeze has been proposed.

The Fed’s 0 rate policy and qe continue to reduce net interest income earned by the economy.

Bank regulators continue to impose policies that work against small bank lending.

Seems some income has likely been accelerated into this quarter from next year over prior concerns of taxes rising, distorting q4 earnings to the upside and maybe lowering q1 earnings a bit?

Euro zone muddles through with very weak domestic demand, and curves perhaps flattening as markets start to believe the ECB will fund it all indefinitely?

China slows as a result of fighting inflation?

Same with Brazil?

Maybe India as well?

Commodity price slump with demand flattening?

Fed low forever?

Stocks in a long term trading range like Japan?

US term structure of interest rates gradually flattens to Japan like levels?

Relatively weak demand gradually brings on alternatives to over priced crude?

Merry Christmas!!!