[Skip to the end]

Wonderful, we contrive policy to drive up unemployment and foreclose vast numbers of people out of their homes at firesale prices so others can move in with subsidized down payments to buy them.

The lower prices could be a sign of bid hitting rather than offer lifting.

By Shobhana Chandra

Nov. 23 (Bloomberg) — Sales of existing U.S. homes jumped 10 percent in October to the highest level since February 2007 as Americans rushed to take advantage of a tax credit, cheaper properties and lower mortgage rates.

Purchases rose more than forecast to a 6.1 million annual rate from a 5.54 million pace in September, the National Association of Realtors said today in Washington. The median sales price decreased 7.1 percent from October 2008.

Stocks extended gains on signs the industry at the center of the deepest recession since the 1930s may contribute to a recovery. The extension of a tax credit originally due to expire Nov. 30 and its expansion beyond first-time buyers may fuel further gains in home sales, helping to overcome the drag from rising foreclosures and unemployment.

Existing home sales were forecast to rise to a 5.7 million annual rate, according to the median estimate of 66 economists in a Bloomberg News survey. Estimates ranged from 5.2 million to 6 million, after an initially reported 5.57 million rate in September.

Condos, Co-ops

Sales of existing single-family homes rose 9.7 percent, the biggest gain since 1983, to an annual rate of 5.33 million. Sales of condos and co-ops increased 13.2 percent to a 770,000 rate.

The share of homes sold as foreclosures or otherwise distressed properties rose to 30 percent from 29 percent in September, NAR chief economist Lawrence Yun said in a press conference today.

A “similarly robust†sales gain may occur this month, he said. “With such a sales spike, a measurable decline should be anticipated in December and early next year before another surge in spring and early summer,†Yun said.

The number of previously owned unsold homes on the market fell 3.7 percent to 3.57 million. At the current sales pace, it would take 7 months to sell those houses, compared with 8 months at the end of the prior month. The months’ supply is the lowest since February 2007.

New-Home Sales

Sales of previously owned homes, which make up more than 90 percent of the market, are compiled from contract closings and may reflect purchases agreed upon weeks or months earlier. Many economists consider new-home sales, recorded when a contract is signed, a more timely barometer.

The Commerce Department may report on Nov. 25 that new home sales rebounded to a 405,000 annual rate in October, according to the Bloomberg survey.

Home construction seized up last month as builders waited to find out if the first-time homebuyer tax credit would end, a Commerce Department report showed last week. Builders in October broke ground on the fewest houses since April’s record low annual pace.

Sales and construction may get another boost after President Barack Obama on Nov. 6 extended the incentive until April 30. Earlier, buyers had to close the transaction by Nov. 30 to be eligible. The government also expanded the program to include some current owners.

Debt Purchases

Mortgage rates held down by Federal Reserve purchases of housing debt are also spurring a recovery in the housing market. The average rate on a 30-year fixed mortgage fell last week to 4.83 percent, the lowest since May, according to Freddie Mac.

Borrowing costs may remain low as the Fed has signaled it will keep the benchmark interest rate near zero for an “extended period.â€

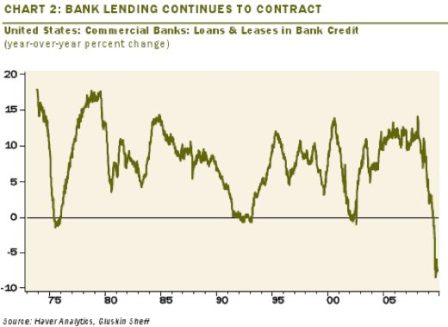

“Activity in the housing sector has increased over recent months,†Fed policy makers said in their Nov. 4 statement. “Household spending appears to be expanding but remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit.â€

The labor market remains a risk for housing. The unemployment rate, which rose to a 26-year high of 10.2 percent last month, will stay above 10 percent through the first half of 2010, a Bloomberg survey showed.

Foreclosure Filings

Foreclosure filings surpassed 300,000 for an eighth straight month in October as rising joblessness made it tougher for homeowners to pay bills, according to RealtyTrac Inc. data.

Some companies see a potential for stronger demand. Hovnanian Enterprises Inc., New Jersey’s largest homebuilder, has signed contracts or options to buy 4,000 land lots in preparation for a market recovery, said Chief Executive Officer Ara K. Hovnanian. The Red Bank, New Jersey-based builder had reduced its land holdings during the recession.

“Prices are ridiculously low in some markets,†he said at a conference in New York on Nov. 17. “That’s not going to stay.â€

Sales of existing homes were led by a 14.4 percent jump in the Midwest, today’s report showed. Purchases rose 12.7 percent in the South, 11.6 percent in the Northeast and 1.6 percent in the West.

Sales had reached a 4.49 million pace in January, their lowest level since comparable records began in 1999.

Purchases of existing homes rose 23.5 percent in October compared with a year earlier. The median price fell 7.1 percent from a year earlier, to $173,100.

[top]