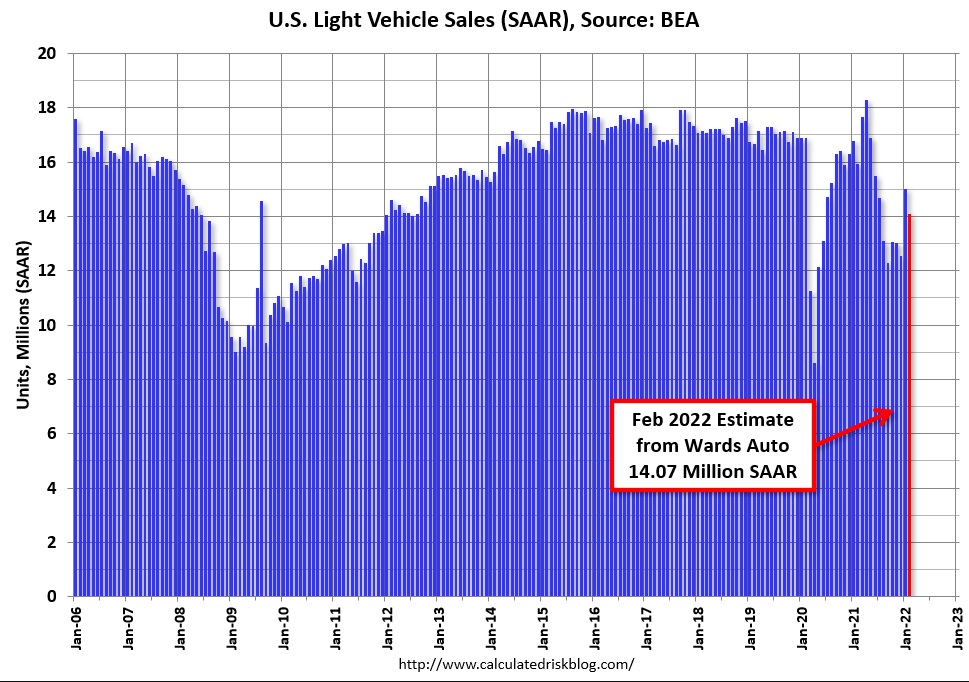

Low and slipping:

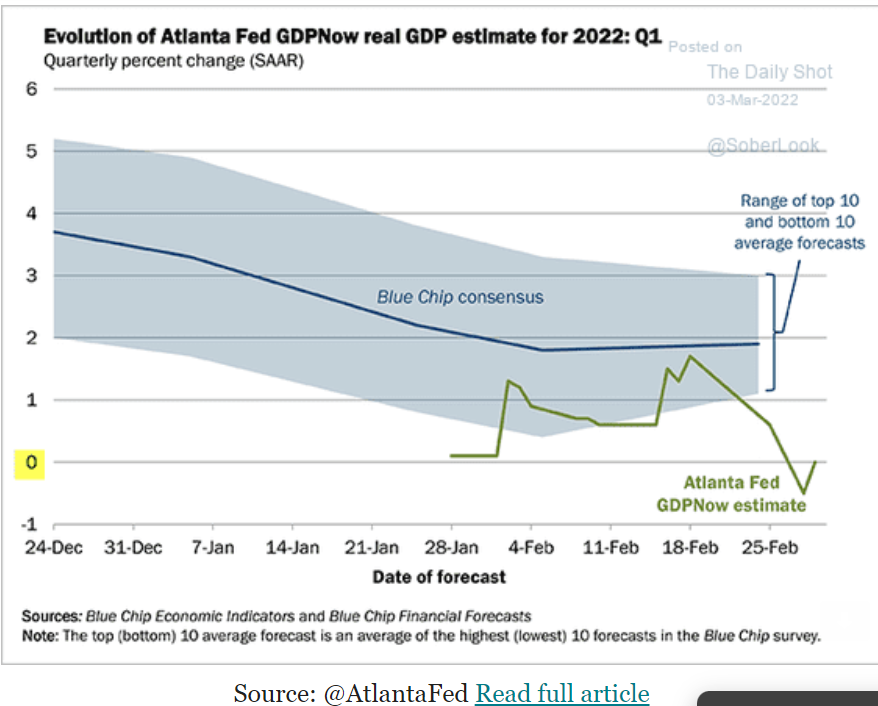

GDP tracking at 0:

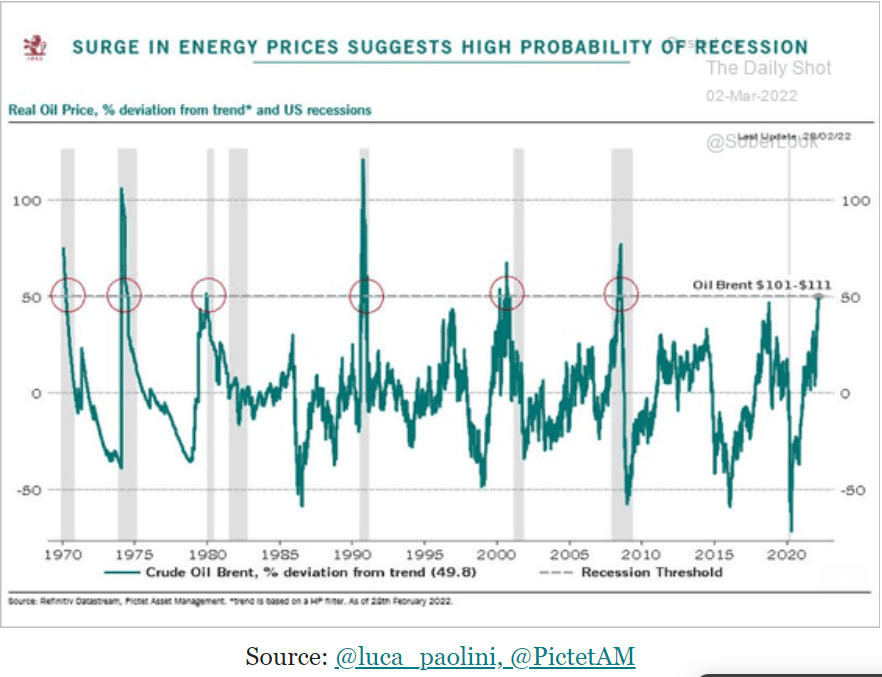

Very yen friendly!

Japan Nears Switching on Reactors After Tepco’s Meltdown: EnergyBy Jacob Adelman & Yuji Okada

July 3 (Bloomberg) — A countdown is starting in Japan for restarting some of the 48 nuclear reactors that were idled after the 2011 Fukushima meltdowns caused the worst atomic accident since Chernobyl.

The nation’s Nuclear Regulation Authority will receive applications for switching on plants starting July 8, and more than five utilities plan to seek permits. Tokyo Electric Power Co., operator of the wrecked Dai-Ichi plant that spread radiation in the Fukushima area, said yesterday it will seek permission to start its Kashiwazaki-Kariwa nuclear plant as soon as possible. Its shares jumped 19 percent yesterday.

Interesting!

US Energy Revolution Gathers Pace

By Ed Crooks, Jonathan Soble and Guy Chazan

May 18 (FT) — The growing role of the U.S. in world energy markets was underlined on Friday as the Obama administration approved wider exports of liquefied natural gas and international companies committed billions of dollars for new infrastructure.

The developments were both consequences of the shale revolution in the U.S., in which improvements in the techniques of horizontal drilling and hydraulic fracturing, or “fracking,” have unlocked new supplies of oil and gas, and raised the prospect that the US will be an increasingly important supplier of energy to the rest of the world.

The Department of Energy on Friday authorized the Freeport LNG project in Texas to export to countries that do not have a trade agreement with the US, including Japan and the members of the EU. It was the first such approval to be granted for two years and only the second ever.

President Barack Obama had been expected to approve worldwide sales from the Freeport project, as the administration sees rising energy exports as providing economic benefits and strengthening the global influence of the U.S.

However, a vocal lobby of companies in industries such as chemicals and steel has urged restrictions on gas exports to ensure U.S. manufacturers continue to derive a competitive advantage from cheap energy.

Freeport has signed deals to sell its gas to Osaka Gas and Chubu Electric of Japan, and BP of the U.K. The export project is owned by a consortium including Osaka Gas and Michael Smith, Freeport’s founder and chief executive.

Separately, Japanese and European companies said they would invest billions of dollars in another proposed gas export project, the $10 billion Cameron LNG plant in Louisiana.

>

> (email exchange)

>

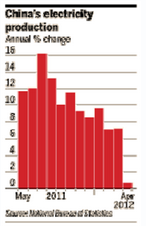

> Attached is an interesting article from the FT discussing the investment slowdown in China.

> While the official picture remains one of a gradual slowdown, more anecdotal data on

> electricity production and bank loans suggests that the slowdown is much more severe – this

> is likely to negatively impact the EM and the Asian suppliers to China such as Australia and

> Korea.

>

Full article: China Investment Boom Starts to Unravel

My proposals remain:

1. A full FICA suspension:

The suspension of FICA paid by employees restores spending which supports output and employment.

The suspension of FICA paid by business helps keep costs down which in a competitive environment lowers prices for consumers.

2. $150 billion one time distribution by the federal govt to the states on a per capita basis to get them over the hump.

3. An $8/hr federally funded transition job for anyone willing and able to work to assist in the transition from unemployment to private sector employment.

Call me an inflation hawk if you want. But when the fiscal drag is removed with the FICA suspension and funds for the states I see risk of what will be seen as ‘unwelcome inflation’ causing Congress to put on the brakes long before unemployment gets below 5% without the $8/hr transition job in place, even with the help of the FICA suspension in lowering costs for business.

It’s my take that in an expansion the ’employed labor buffer stock’ created by the $8/hr job offer will prove a superior price anchor to the current practice of using the current unemployment based buffer stock as our price anchor.

The federal government caused this mess for allowing changing credit conditions to cause its resulting over taxation to unemploy a lot more people than the government wanted to employ. So now the corrective policy is to suspend the FICA taxes, give the states the one time assistance they need to get over the hump the federal government policy created, and provide the transition job to help get those people that federal policy is causing to be unemployed back into private sector employment in a more orderly, more ‘non inflationary’ manner.

I’ve noticed the criticism the $8/hr proposal- aka the ‘Job Guarantee’- has been getting in the blogosphere, and it continues to be the case that none of it seems logically consistent to me, as seen from an MMT perspective. It seems the critics haven’t fully grasped the ramifications of the recognition of the currency as a (simple) public monopoly as outlined in Full Employment AND Price Stability and the other mandatory readings.

So yes, we can simply restore aggregate demand with the FICA suspension and funds for the states, but if I were running things I’d include the $8 transition job to improve the odds of both higher levels of real output and lower ‘inflation pressures’.

Also, this is not to say that I don’t support the funding of public infrastructure (broadly defined) for public purpose. In fact, I see that as THE reason for government in the first place, and it should be determined and fully funded as needed. I call that the ‘right size’ government, and, in general, it’s not the place for cyclical adjustments.

4. An energy policy to help keep energy consumption down as we expand GDP, particularly with regard to crude oil products.

Here my presumption is there’s more to life than burning our way to prosperity, with ‘whoever burns the most fuel wins.’

Perhaps more important than what happens if these proposals are followed is what happens if they are not, which is more likely going to be the case.

First, given current credit conditions, world demand, and the 0 rate policy and QE, it looks to me like the current federal deficit isn’t going to be large enough to allow anything better than muddling through we’ve seen over the last few years.

Second, potential volatility is as high as it’s ever been. Europe could muddle through with the ECB doing what it takes at the last minute to prevent a collapse, or doing what it takes proactively, or it could miss a beat and let it all unravel. Oil prices could double near term if Iran cuts production faster than the Saudis can replace it, or prices could collapse in time as production comes online from Iraq, the US, and other places forcing the Saudis to cut to levels where they can’t cut any more, and lose control of prices on the downside.

In other words, the risk of disruption and the range of outcomes remains elevated.

It’s good to be China’s coal mine.

Though it does make Australia one of the world’s largest contributors to the increasingly unpopular emissions issues.

Australia Has Record Trade Surplus on China Coal, Iron Demand

Australia Has Record Trade Surplus on China Coal, Iron DemandBy Jacob Greber

Aug. 4 (Bloomberg) — Australia’s trade surplus unexpectedly

reached a record in June as Chinese demand spurred exports of

coal and iron ore, while imports stagnated amid a slowdown in

domestic spending.

The excess of exports over imports reached A$3.54 billion

($3.2 billion), almost double the median forecast in a Bloomberg

News survey, a Bureau of Statistics report showed in Sydney

today. A separate report showed house-price gains decelerated in

the second quarter, underscoring the impact of the central

bank’s six interest-rate increases since early October.

I tend to agree with Karim and Fed Chairman Bernanke.

Modestly improving GDP growth with unemployment coming down very gradually until a consumer credit expansion takes hold.

Good for stocks, not so good for most of the people still struggling to survive, as the Obama administration continues to preside over what might be the largest transfer of wealth from bottom to top in the history of the world.

And no credible energy policy. We are completely at the mercy of the Saudis who can unilaterally hike prices any time they feel like it.

Karim writes:

| July | June | |

| Index | 55.5 | 56.2 |

| Prices paid | 57.5 | 57.0 |

| Production | 57.0 | 61.4 |

| New Orders | 53.5 | 58.5 |

| Inventories | 50.2 | 45.8 |

| Customer inventories | 39.0 | 38.0 |

| Employment | 58.6 | 57.8 |

| New export orders | 56.5 | 56.0 |

| Imports | 52.5 | 56.5 |

Bernanke

While the support to economic activity from stimulative fiscal policies and firms’ restocking of their inventories will diminish over time, rising demand from households and businesses should help sustain growth. In particular, in the household sector, growth in real consumer spending seems likely to pick up in coming quarters from its recent modest pace, supported by gains in income and improving credit conditions. In the business sector, investment in equipment and software has been increasing rapidly, in part as a result of the deferral of capital outlays during the downturn and the need of many businesses to replace aging equipment. At the same time, rising U.S. exports, reflecting the expansion of the global economy and the recovery of world trade, have helped foster growth in the U.S. manufacturing sector.

To be sure, notable restraints on the recovery persist. The housing market has remained weak, with the overhang of vacant or foreclosed houses weighing on home prices and new construction. Similarly, poor economic fundamentals and tight credit are holding back investment in nonresidential structures, such as office buildings, hotels, and shopping malls.

This chart shows demand for gasoline is still down year over year, even with substantially lower prices.

It is also another indication of the ‘soft spot’ in demand that may have hit a couple of months ago.

[top]

Looks like it, unless there is another side of this story we don’t know about, but seems highly doubtful

The only legal place you can store mercury is in your mouth, by the way.

Mercury Found in Every Fish Tested, Scientists Say

By Cornelia Dean

August 19 (NYT) — When government scientists went looking for mercury contamination in fish in 291 streams around the nation, they found it in every fish they tested, the Interior Department said, even in isolated rural waterways. In a statement, the department said that some of the streams tested were affected by mining operations, which can be a source of mercury pollution, so the findings, by scientists at the United States Geological Survey, do not necessarily reflect contamination levels nationwide. But Interior Secretary Ken Salazar said the findings underlined the need to act against mercury pollution. Emissions from coal-fired power plants are the largest source of mercury contamination in the United States. A quarter of the fish studied had mercury levels above safety levels set by the Environmental Protection Agency for people who eat the fish regularly, the Interior Department said.

[top]