The data continues to support the narrative:

Proactive deficit reduction, aka ‘austerity’, slows an economy and can throw it into reverse if some other agent’s deficit spending/savings reduction doesn’t rise to the occasion.

And add to that the growing headwind of the now highly aggressive ‘automatic fiscal stabilizers’ with a deficit now probably running at a pace well under 3% of GDP.

As you know I’ve been looking for any sign of credit expansion and so far I see nothing but deceleration. Mortgage credit outstanding continues to contract, housing starts have gone sideways, and most recently mtg apps have actually turned down. Unemployment claims seem to have bottomed earlier this year and the 3 month moving average has turned up as well. Year over year consumer credit growth is flat, and bank lending in general remains only very modestly positive, with no sign of a recent increase needed to fill the ‘spending gap’ left by a retreating govt sector.

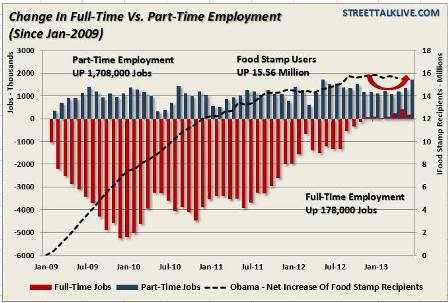

Furthermore, GDP has been revised down to be consistent with my narrative, with Q1 now down to 1.8% and Q2 estimates in the 1%- 1.5% range. And, as discussed yesterday, with long term productivity somewhere around that level, jobs should go from up 200,000 to flat, with a lag of course. In other words, the upturn in claims that leads jobs is offering more support for that narrative.

Additionally, the risk of it all going into reverse is mounting as well. This happens when the deficit- the net financial equity of the economy- isn’t sufficient to support the credit structure that’s supporting growth. And the way the deficit gets higher is via the automatic fiscal stabilizers going into reverse- the slowing economy increases transfer payments and reduces revenues.

Also note the evidence of global disinflation including commodity prices, a general fade of the emerging market sector, and Europe at best getting modestly less worse. Only Japan has had some growth, but none of it is about growing imports, so it’s no help to anyone else, and their 25% real wage pay cut and increased exports/lower prices is reducing domestic demand abroad and deflating prices and margins abroad.

For more data, scroll down through www.moslereconomics.com where I’ve been posting charts with the data releases. Hint: they all show a general deceleration.

Conclusion- we are in the midst of a global, broad based fiscally induced set of contractionary/deflationary forces.

Supporting optimism is the notion that ‘yes the fiscal drag from the tax hikes is subtracting from growth, but when it ends growth will return as the underlying private sector is growing at over 3%”

Yes, that’s possible, but again, it means private sector credit growth has to be there offering ever increasing support to offset the ‘demand leakages’ and to overcome the fiscal headwinds of the automatic fiscal stabilizers. And note that the automatic fiscal stabilizers are just that. They work to reverse declines by automatically increasing the deficit, and work to end expansions by automatically decreasing the deficit. So they will end the up leg in any case, and pro active deficit reduction only hastens that outcome in any case.

So after the tax hikes and sequesters have ratcheted down growth and lowered the deficit as well, the question is whether the economy will grow from that point.

I agree it’s not theoretically impossible, but it takes ever expanding private sector credit expansion, which is asking a lot from our current institutional structure.

And, of course, the portfolio shifting in reaction to the QE placebo is it’s own can of worms…

US Jobless Claims Jump Above Forecasts; Prices Still Tame

The number of Americans filing new claims for unemployment benefits rose last week, although the level still appeared to point to healing in the nation’s job market. Meanwhile, prices for U.S. imports and exports fell in June for the fourth straight month.

Initial claims for state unemployment benefits increased by 16,000 to a seasonally adjusted 360,000, the Labor Department said on Thursday.