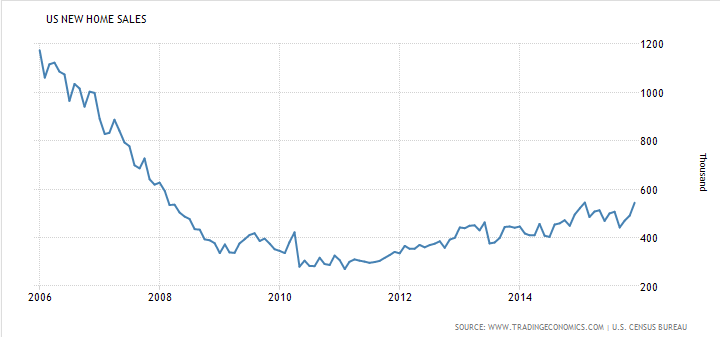

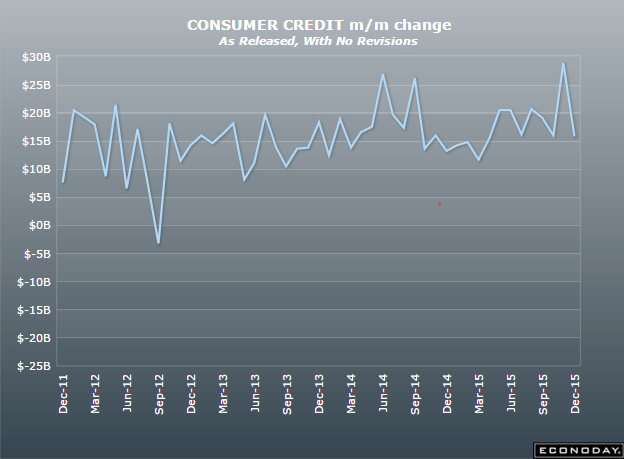

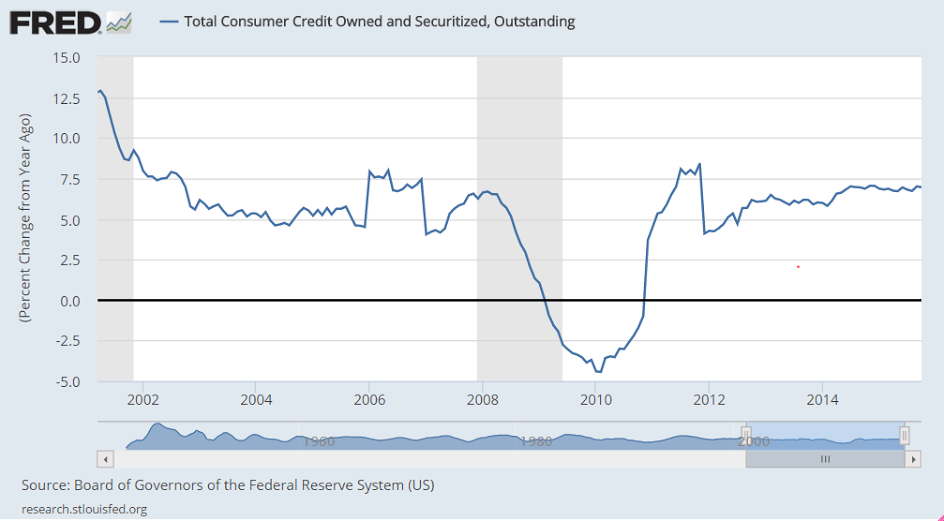

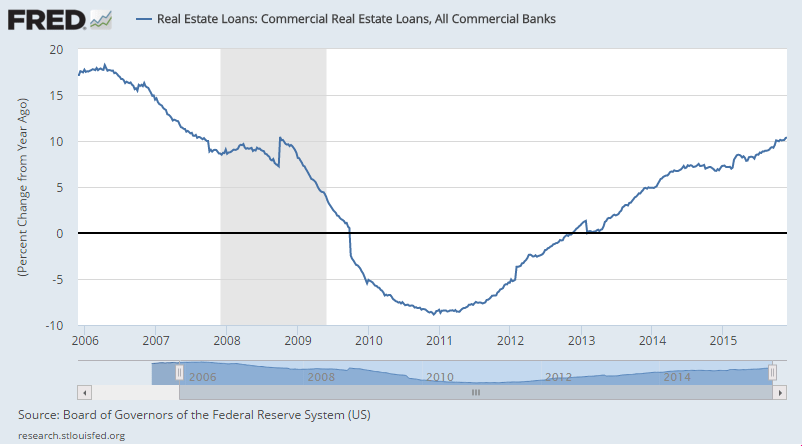

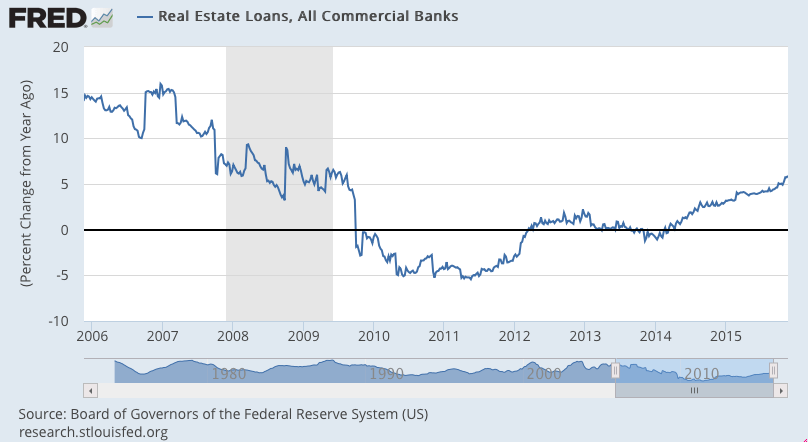

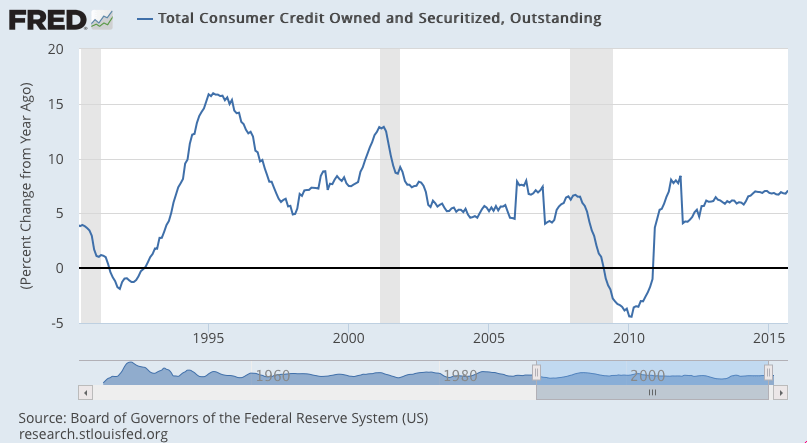

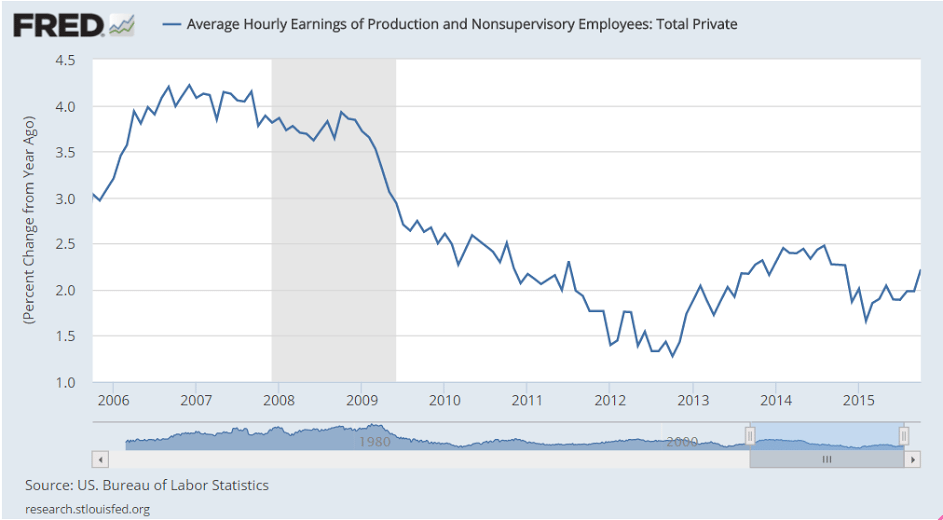

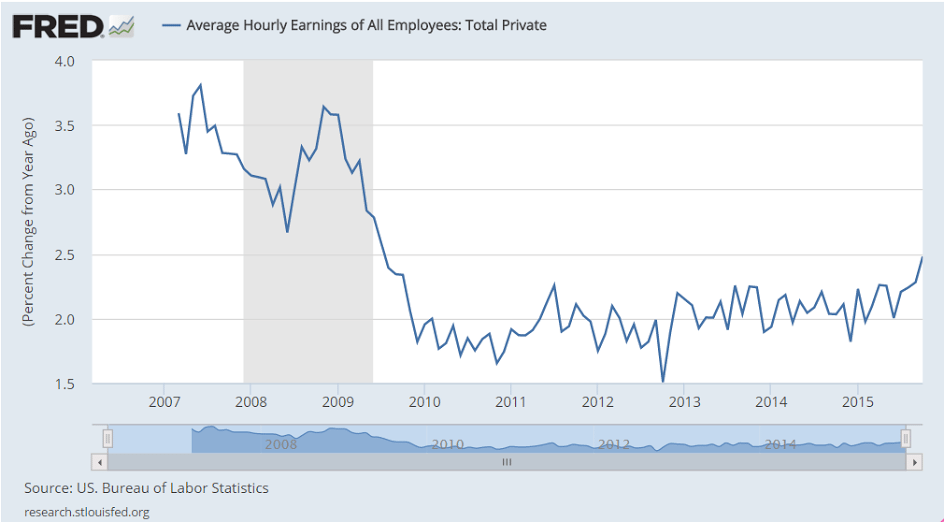

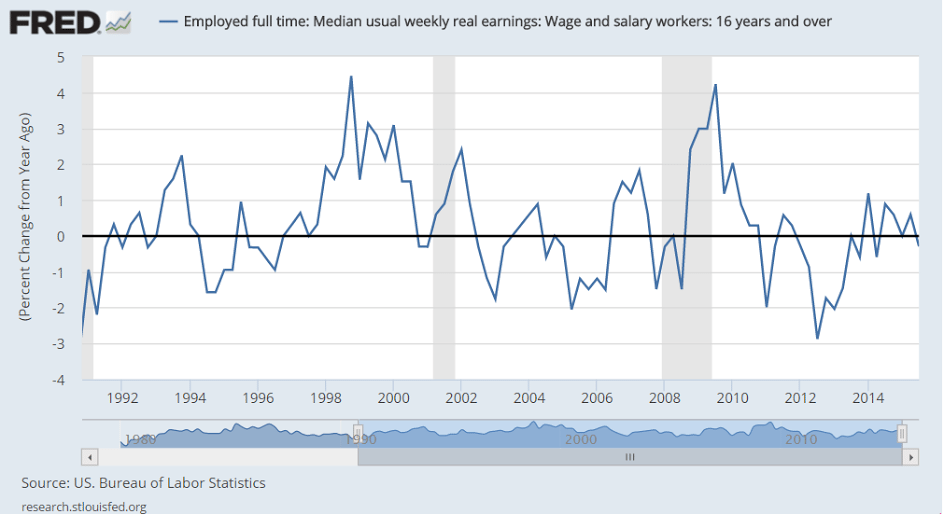

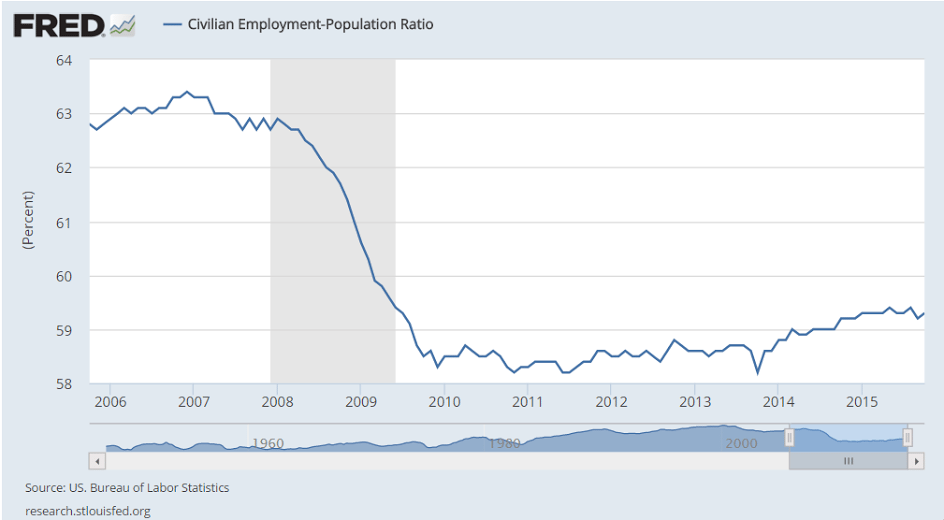

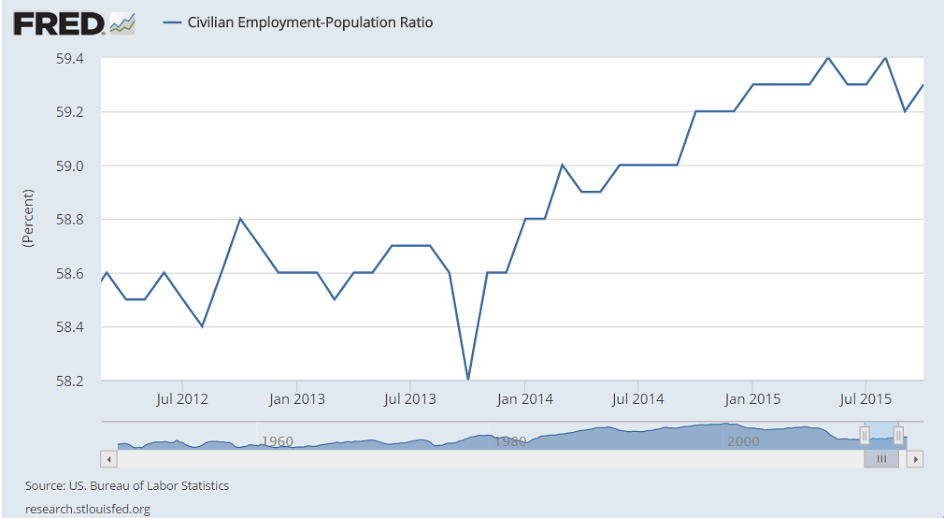

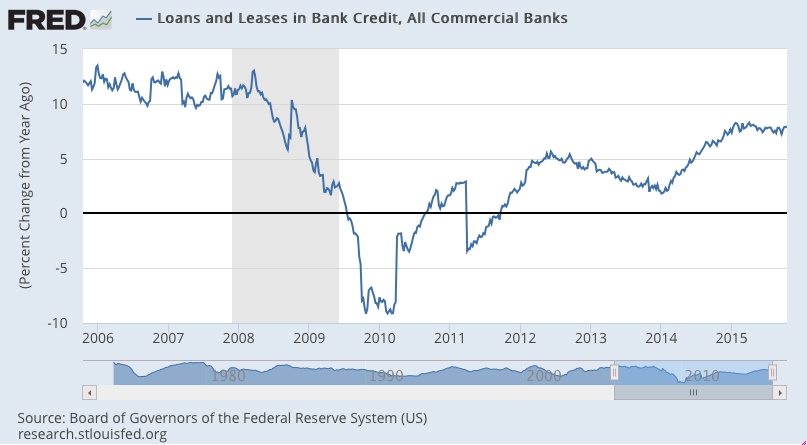

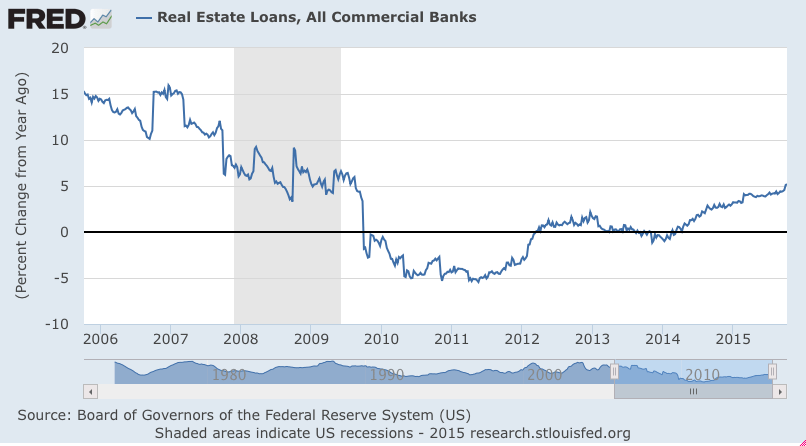

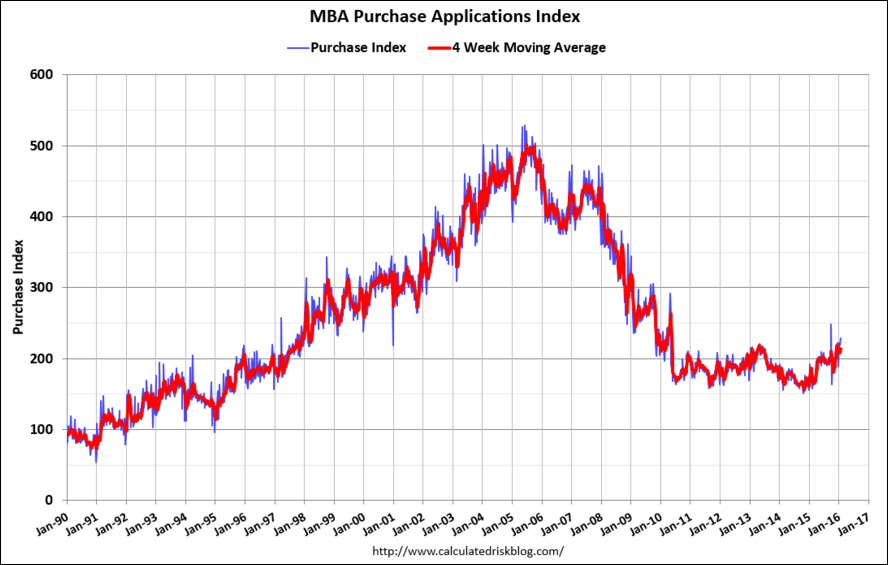

Inching up a bit but still seriously depressed:

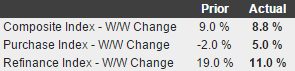

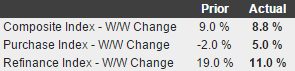

MBA Mortgage Applications

Highlights

Weekly mortgage applications have been very volatile so far this year but mostly to the upside. Purchase applications jumped 5.0 percent in the January 22 week with refinancing applications up 11.0 percent. Low mortgage rates are driving the activity, down 4 basis points in the week to an average 4.02 percent for 30-year conforming loans ($417,000 or less).

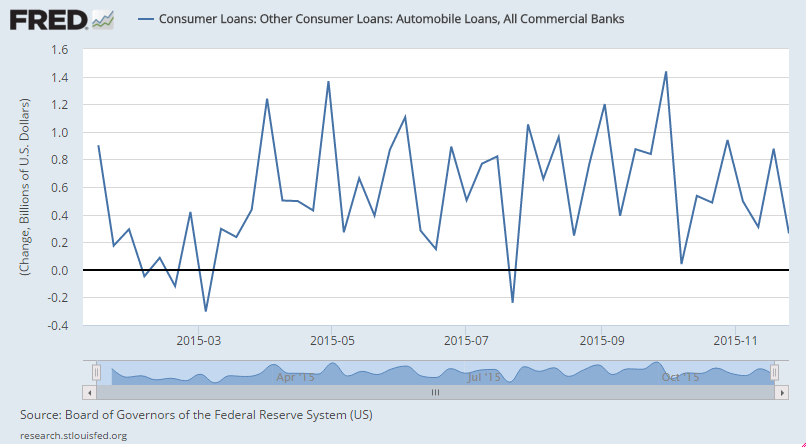

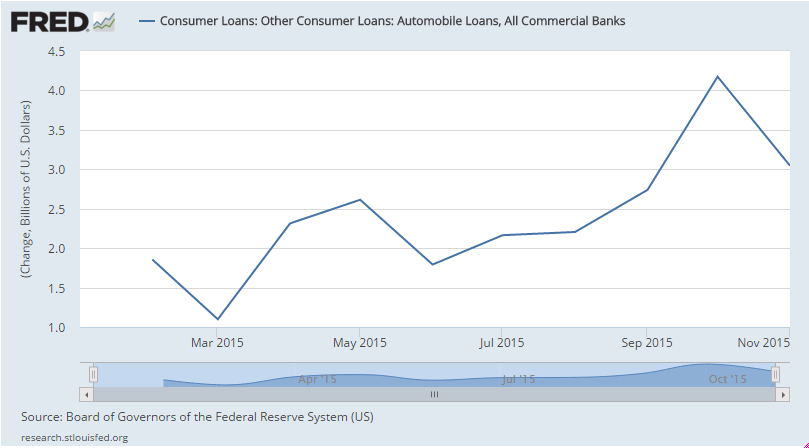

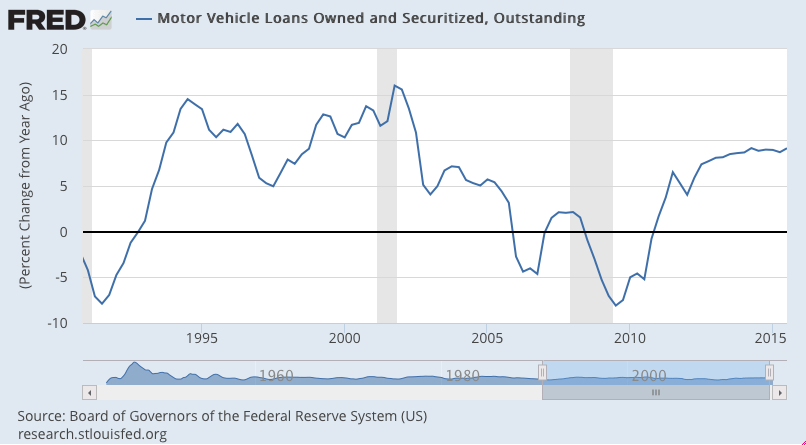

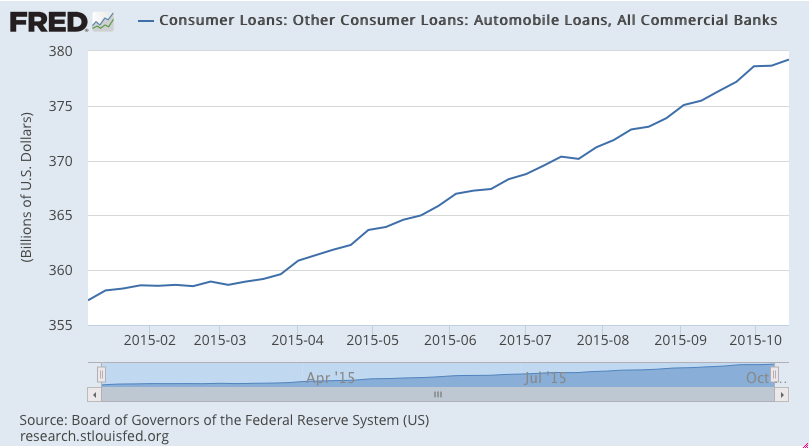

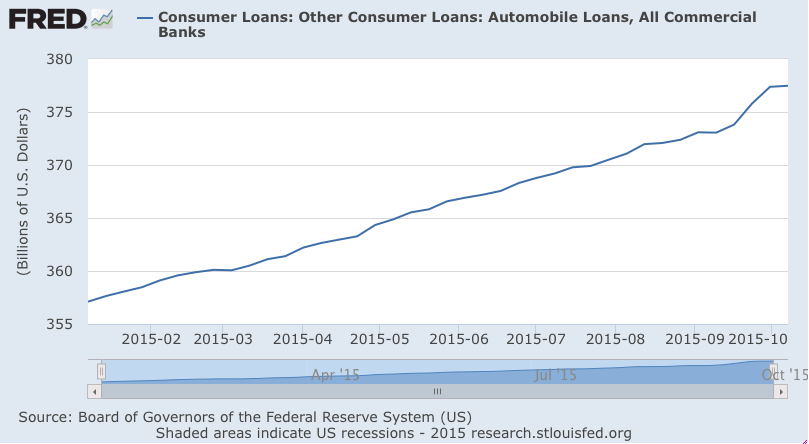

Looks like Wards is forecasting no improvement in the annual selling rate that has been decelerating from over 18 million per year for the last several months:

A WardsAuto forecast calls for U.S. automakers to deliver 1.13 million light vehicles in January.

The resulting daily sales rate (DSR) of 47,126 units, a 10-year high for the month, over 24 days represents a 6.8% improvement from like-2015 (26 days) and a 19.2% month-to-month decline from December (28 days).

The 5-year average December-to-January decline is 26%, but the traditional pull-ahead of sales in December was not as strong as expected this time. Lighter deliveries allowed dealers to remain well-stocked with vehicles highest in demand going into January.

The report puts the seasonally adjusted annual rate of sales for the month at 17.3 million units, compared with a year-ago’s 16.6 million and December’s 17.2 million.

Three major U.S. shale oil companies have slashed their 2016 capital spending plans more than expected in a bid to survive $30 a barrel oil prices, with one of them saying prices would need to rise more than 20 percent just to turn a profit.

The cuts on Monday from Hess Corp, Continental Resources and Noble Energy ranged from 40 percent to 66 percent. This marks the second straight year of pullbacks by a trio of companies normally seen as among the most resilient shale oil producers.

The cuts were steeper than expected. Analysts at Bernstein Energy had forecast an average 2016 spending cut for the sector of 38 percent.

The reductions show budgets may shrink more this year than they did last year, when spending fell between 20 percent and 50 percent. Output at some companies may fall for the first time ever.

“It’s very rare to have spending decline two years in a row,” said Mike Breard, oil company analyst with Hodges Capital Management in Dallas. “Any budget you see published now is going to be much lower than last year.”

But last year many operators managed to lift output as they devised new ways to coax more oil from rock, a feat that seems unlikely to be repeated.

In a sign that a reckoning has come, Continental admitted it will pump about 10 percent less oil this year as it can no longer afford or innovate and sell more oil at depressed prices.

The U.S. government projects domestic crude output to fall by about 700,000 barrels per day (bpd) by the end of this year to around 8.5 million bpd.

Depressed spending typically means fewer drilling rigs. All three companies said they would cut the number of rigs boring new wells in U.S. shale oil fields across Texas, North Dakota and elsewhere.

“If you cut your budget 60 percent, you may drill 40 percent fewer wells and your production is going to drop a considerable amount,” said Breard.

Continental, North Dakota’s second-largest oil producer, said it would slash its 2016 capital budget by 66 percent. The company made the risky move of getting rid of hedges in the fall of 2014. [L2N15A2MB] Led by billionaire wildcatter Harold Hamm, Continental plans to spend $920 million this year, down from $2.7 billion in 2015.

Oklahoma City-based Continental said it will not become profitable until oil prices return to $37 per barrel. U.S. oil prices closed Tuesday at $31.45 per barrel.

Meanwhile, New York-based Hess plans to spend $2.4 billion in 2016, down 40 percent from $4 billion last year.

Noble cut its quarterly dividend 44 percent and said it will cut spending about 50 percent this year.

On the other end of the spectrum, Pioneer Natural Resources, known for its aggressive hedging program, said this month it would spend between $2.4 billion and $2.6 billion this year.

Though Pioneer will fund its 2016 budget in part from a $500 million asset sale, the modest increase from $2.2 billion in 2015 makes the company a relative outlier at a time when most companies are trimming capex by amounts similar to last year’s drastic cutbacks.

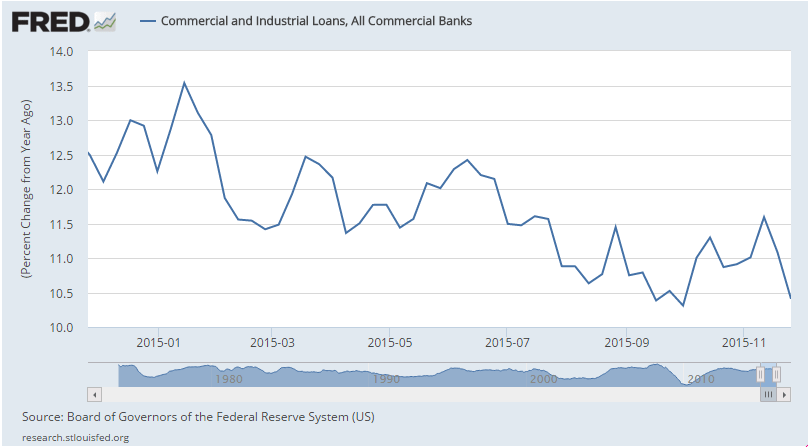

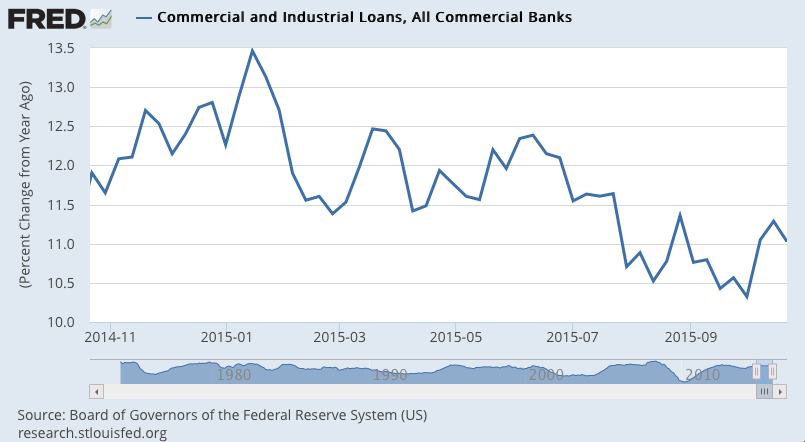

Borrowing by U.S. companies to spend on capital investment declined 5 percent in December, trade association Equipment Leasing and Finance Association (ELFA) said.

Companies signed up for $12.5 billion in new loans, leases and lines of credit last month, less than a year earlier, but more than double from November, ELFA said.

Cumulative new business volume inched up 0.4 percent for 2015, relatively flat with 2014, ELFA said

Caterpillar saw retail sales of machinery fall 16 percent worldwide for the three-month period ended in December, the construction and mining equipment company said on Wednesday.

Caterpillar, which is due to report earnings on Thursday, has been pressured by the global slowdown in the energy and mining industries.

The company said retail sales to resource industries worldwide fell 38 percent over the three-month period, while retail sales to the energy industries fell 32 percent.

The pace of declines is also increasing, the company noted in an SEC filing. The worldwide decline in retail sales of machines had been 11 percent for the three months ended in November.

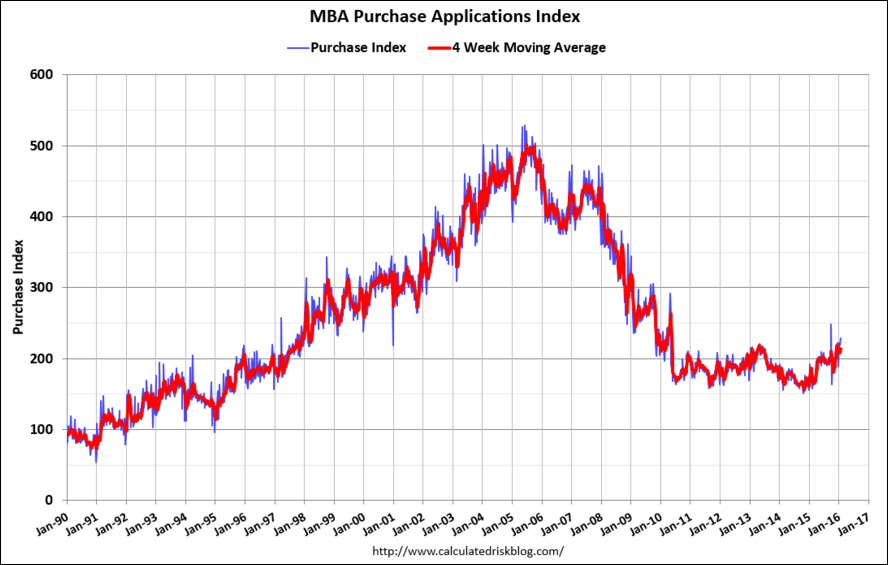

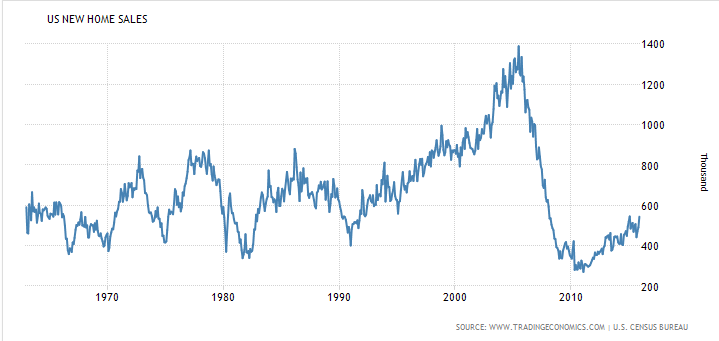

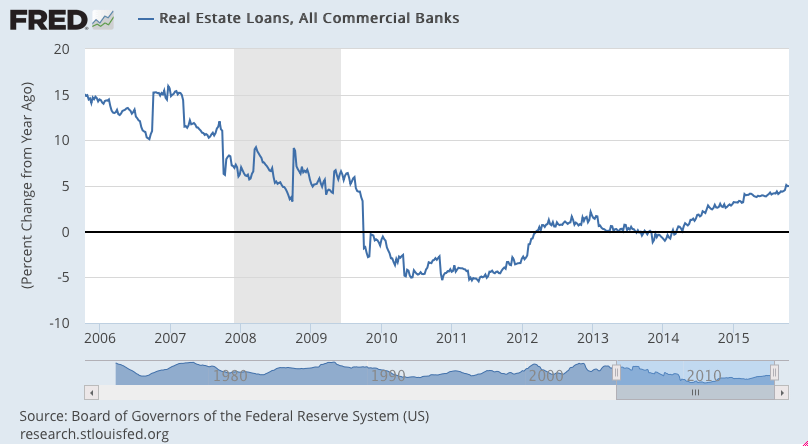

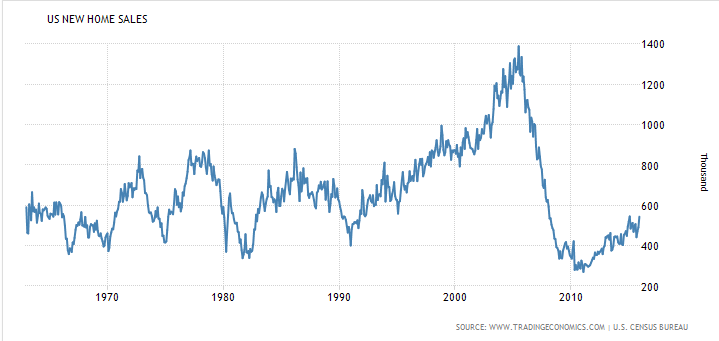

New home sales better than expected, but still near the lows of prior recessions all the way back to the 1960’s when the population was about 60% of what it is now:

New Home Sales

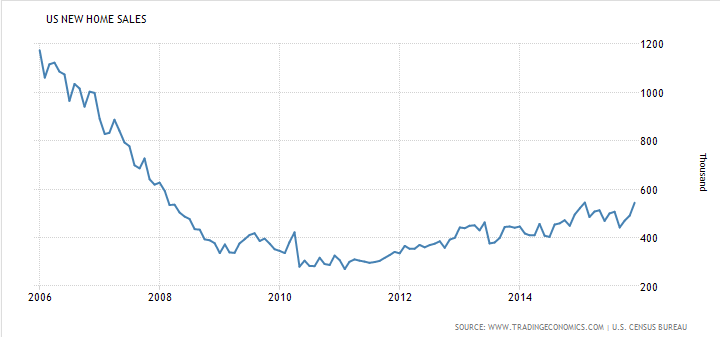

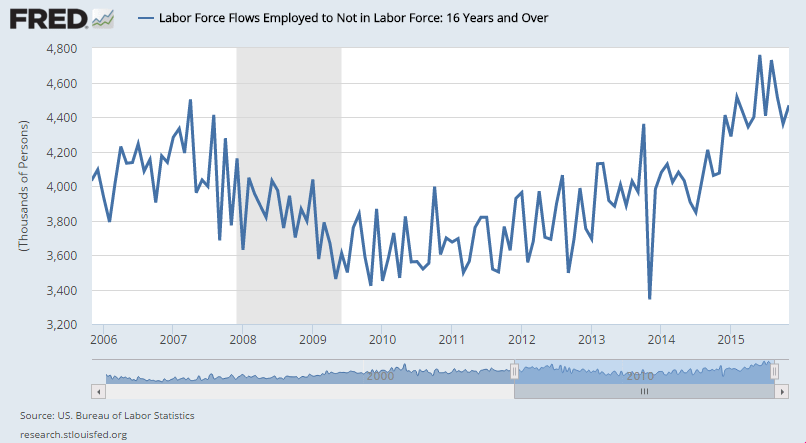

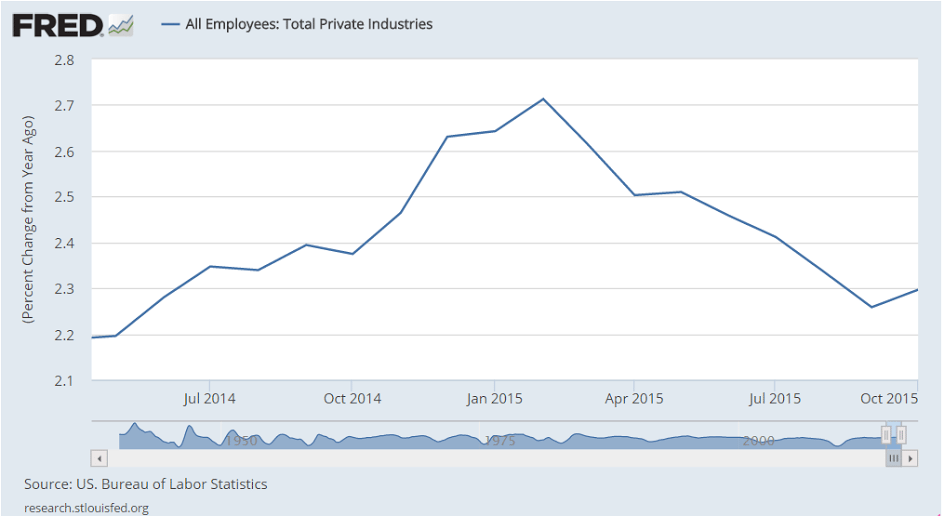

This is just the last 10 years: