[Skip to the end]

I like this not so much for his suggestion as for his assessment of the Fed.

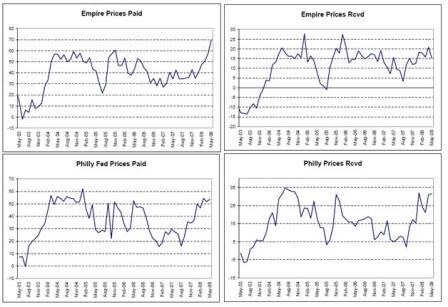

This both expresses the market view of the Fed and the Fed’s own expressed concern that their previous actions could contribute to elevated inflation expectations.

“I think they should put interest rates up and worry about inflation. What do I think they’ll do? I think they’ll delay,” says Allan Meltzer, a professor of political economy at Carnegie Mellon and noted Fed watcher. “The Fed is spineless in response to pressures from Congress and pressures from Wall Street.”

In contrast, my best guess is the Fed is ready to act quickly to restore a ‘real rate’ ASAP as ‘market functioning’ risk subsides, no matter how weak the economy my get.

IMHO, it was blind fear of 1907/1930/gold standard deflationary tail risk that caused the Fed to cut rates into a triple negative supply shock, not a lack of resolve vs. inflation that pushed their ‘balance of risks’ towards ’emergency’ cuts with much talk of being ‘nimble’ regarding ‘taking them back’.

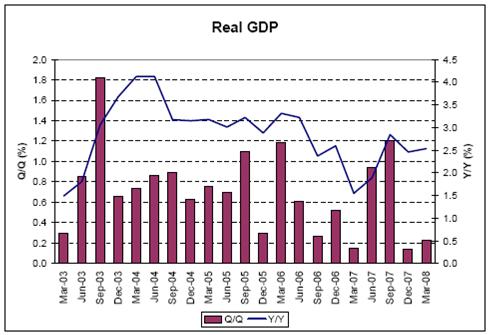

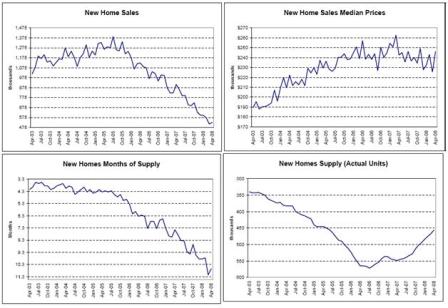

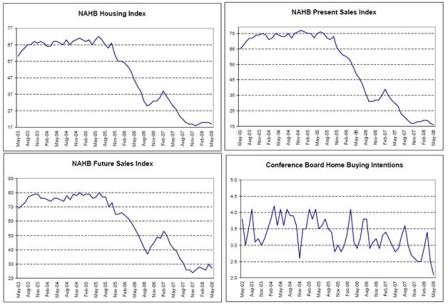

The immediate deflation risk was seen to be coming from the housing collapse.

While housing remains weak, it is no longer perceived to pose the same broad-based deflationary risk. Instead, it is showing signs of leveling off, and with GDP and personal income muddling through, housing looks to be muddling through at current levels as well.

NOTE: In August, the Fed didn’t cut because inflation was deemed too high, and it’s a lot higher now.

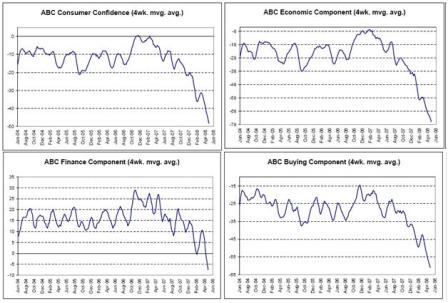

I don’t expect ‘ordinary’ recession risks to keep them from moving to put a brake on what they see as elevating inflation expectations.

Even Yellen the Dove is ready to hike. They all believe low inflation is a necessary condition for optimal long-term growth and employment, and inflation is now by far the greatest risk to long-term growth and employment.

And they all agree the cost of slow growth now to reign in inflation is far less then the cost of bringing down inflation later should it continue to get worse. In the ‘balance of risks’, inflation is a risk because it is perceived as a crucial risk to long-term growth.

They also agree that their dual mandate is, therefore, met by keeping inflation low, which automatically optimizes long-term growth and employment.

The remaining dove position is that inflation isn’t a problem, as evidenced by low core reports and well-anchored wage demands, and that the current output gap is sufficient to keep inflation expectations from elevating and bring inflation down to desired levels over the next few years.

That position is quickly losing support as evidenced by two actual dissenting votes and a growing movement to the hawk side as perceived deflationary tail risk subsides, inflation expectations show signs of elevating and food/crude/import prices remain firm as they are further supported by the fiscal package.

[top]