Rising inflation hits German confidence

by Matt Moore

Same theme: ‘inflation’ hurting buying plans.

Expectations theory says ‘inflation’ expectations will accelerate purchases.

Different kinds of ‘inflation’ at work…

Rising inflation hits German confidence

by Matt Moore

Same theme: ‘inflation’ hurting buying plans.

Expectations theory says ‘inflation’ expectations will accelerate purchases.

Different kinds of ‘inflation’ at work…

Highlights:

| U.K. Hometrack House Prices Fall the Most Since 2001 |

| Brown Says He Won’t Turn to ’70s Agenda After Defeat |

| Darling Considers Expanding Mortgage Bond-Swap Scheme, FT Says |

U.K. Hometrack House Prices Fall the Most Since 2001

by Brian Swint

(Bloomberg) The average cost of a residential property in England and Wales slipped 4.4 % in July from a year earlier to 168,500 pounds ($336,000), Hometrack Ltd. said. Prices fell 1.2 % from June. “With no immediate end in sight to the current uncertainty, activity levels are likely to remain suppressed with prices remaining under pressure into the autumn,” said Richard Donnell, director of research at Hometrack. Prices “are now back to levels last seen in October 2006.” Demand for housing has declined 20 % in the past three months, Hometrack said.

Note how much higher prices are vs the US.

It’s another case of going up very fast and now working its way down towards a more historically normal trend line.

But as in the US, they never come down quite that far before turning up on a new path from a higher base as much of past ‘inflation’ remains indefinitely.

[top]

A touch higher last week, but still seems to be working its way lower.

[top]

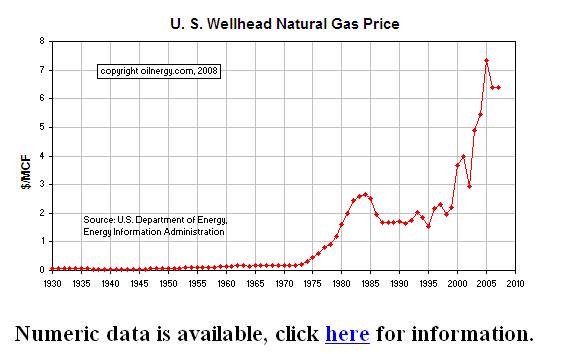

It was deregulated back in the 1970s, which brought out vast supplies causing utilities to substitute gas for oil and eventually break OPEC.

I don’t see that kind of supply response lurking today.

The Natural Gas Policy Act of 1978

In November of 1978, at the peak of the natural gas supply shortages, Congress enacted legislation known as the Natural Gas Policy Act (NGPA), as part of broader legislation known as the National Energy Act (NEA). Realizing that those price controls that had been put in place to protect consumers from potential monopoly pricing had now come full circle to hurt consumers in the form of natural gas shortages, the federal government sought through the NGPA to revise the federal regulation of the sale of natural gas. Essentially, this act had three main goals:

- Creating a single national natural gas market

- Equalizing supply with demand

- Allowing market forces to establish the wellhead price of natural gas

[top]

Government spending kicking in with 2007 spending that was delayed to 2008:

Topical article: The GOP’s December Surprise by James K. Galbraith

Durable Goods Orders Rise Unexpectedly

by Michael M. Grynbaum

A separate report showed that orders for big-ticket items rose last month, beating economists’ expectations. A surge in export orders and *investment in military-related products* sent durable goods orders up 0.8 percent in June from a revised 0.1 percent in May, the Commerce Department said. Excluding orders for military-related goods, orders were up only 0.1 percent.

[top]

from Dave:

Japan core CPI last night came out at 1.9% as expected

Petrol products were up +23.9% y/y

Non fresh food products were up +3.5% y/y

Core-Core CPI (ex energy and ex fresh food) rose +0.1% vs -0.1% in the previous month indicating some signs of higher energy and food prices filtering through the economy to other products and services

Price pressures continue to grow at the corporate level (see graph of Corporate Services Price Index CSPI and Corporate Goods Price Index CGPI)

Expectations from many dealers and BOJ’s Mizuno is that CPI could reach as high as 2.5% by the fall

[top]

His monetary analysis is ridiculous but we agree on this point:

The Media Are Missing the Housing Bottom

by Larry Kudlow

Media reports painted a pessimistic picture of today’s release on existing home sales, which fell 15 percent from a year ago and recorded higher inventories. But inside the report was an awful lot of very good new news, which appear to be pointing to a bottom in the housing problem; in fact, maybe the tiniest beginnings of a recovery.

For example, the median existing home price has increased four consecutive months and is up 10 percent since February. Yes, it’s down 6 percent over the past year. But the monthly numbers show a gradual rebound. Actually, this median home price is $215,000 in June, compared to $196,000 last winter.

And there’s more. One of the hardest hit regions is the West, including California, Arizona, and Nevada. The other two bad states are Florida and Michigan. However, existing home sales in the western region are up four straight months, and are 17 percent above the low in October. At the same time, prices in the West have increased three straight months.

Meanwhile, overall national existing home sales are basically stabilizing at just under five million. And in the first and second quarters of 2008, these sales dropped slightly by 3 percent in each case, which is a whole lot better than the roughly 30 percent sales drops of the prior three quarters.

It’s a pity the mainstream media keeps searching for more and more pessimism. The reality is a possible upturn in the housing trend, and at the very least we are getting a bottom. Stocks sold off 165 points largely on media reports of terrible home sales and prices. But I am hoping the market comes to its senses and realizes the data are a whole lot better.

related content

Senate Set to Vote Saturday On Housing Rescue Bill

Existing Home Sales: A Look At Numbers That Weren’t There

And on top of all that, just as housing may be on the mend, Congress is about to ratify a huge FHA-based bailout that could total $42 billion. Congressional solons are putting up $300 billion to refinance and insure distressed loans through the Federal Housing Administration. But this dubious government agency, with a whole history of bad portfolio management, may wind up taking in the very worst loans on the books.

[top]

I hadn’t noticed this back then, but Vince got it right: The Fed purchased the $30 billion of securities from JPM/Bear Stearns, with JPM agreeing that if there were any net losses it would be responsible for the first $1 billion.

It’s very odd that the Fed would call this a non-recourse loan, as they cut a better deal than that.

Unlike a non-recourse loan, if the securities turn out to be profitable, the Fed gets those funds.

So why would the Fed use language that implies the transaction was worse for the Fed than it actually was?

Perhaps there was a legal or some other restriction that prevented the Fed from purchasing the securities?

Seem there is a lot more to the story than has been revealed?

Press Release

Summary of Terms and Conditions Regarding the JPMorgan Chase Facility

March 24, 2008

The Federal Reserve Bank of New York (“New York Fed”) has agreed to lend $29 billion in connection with the acquisition of The Bear Stearns Companies Inc. by JPMorgan Chase & Co.

The loan will be against a portfolio of $30 billion in assets of Bear Stearns, based on the value of the portfolio as marked to market by Bear Stearns on March 14, 2008.

JPMorgan Chase has agreed to provide $1 billion in funding in the form of a note that will be subordinated to the Federal Reserve note. The JPMorgan Chase note will be the first to absorb losses, if any, on the liquidation of the portfolio of assets.

The New York Fed loan and the JPMorgan Chase subordinated note will be made to a Delaware limited liability company (“LLC”) established for the purpose of holding the Bear Stearns assets. Using a single entity (the LLC) will ease administration of the portfolio and will remove constraints on the money manager that might arise from retaining the assets on the books of Bear Stearns.

The loan from the New York Fed and the subordinated note from JPMorgan Chase will each be for a term of 10 years, renewable by the New York Fed.

The rate due on the loan from the New York Fed is the primary credit rate, which currently is 2.5 percent and fluctuates with the discount rate. The rate on the subordinated note from JPMorgan Chase is the primary credit rate plus 450* basis points (currently, a total of 7 percent).

BlackRock Financial Management Inc. has been retained by the New York Fed to manage and liquidate the assets.

The Federal Reserve loan is being provided under the authority granted by section 13(3) of the Federal Reserve Act. The Board authorized the New York Fed to enter into this loan and made the findings required by section 13(3) at a meeting on Sunday, March 16, 2008.

Repayment of the loans will begin on the second anniversary of the loan, unless the Reserve Bank determines to begin payments earlier. Payments from the liquidation of the assets in the LLC will be made in the following order (each category must be fully paid before proceeding to the next lower category):

- to pay the necessary operating expenses of the LLC incurred in managing and liquidating the assets as of the repayment date;

- to repay the entire $29 billion principal due to the New York Fed;

- to pay all interest due to the New York Fed on its loan;

- to repay the entire $1 billion subordinated note due to JPMorgan Chase;

- to pay all interest due to JPMorgan Chase on its subordinated note;

- to pay any other non-operating expenses of the LLC, if any.

Any remaining funds resulting from the liquidation of the assets will be paid to the New York Fed.

Where No Fed Has Gone Before

Why the Federal Reserve’s ‘loan’ for the Bear Stearns deal looks like an investmentâ€â€Âand faces serious scrutiny

March 26, 2008

by Peter Coy

The Federal Reserve has stretched its mandate up, down, and sideways to prevent a financial market deluge. Now it appears to be stretching the English language a bit as well. What the Fed is calling a $29 billion “loan” to help finance JPMorgan Chase’s (JPM) purchase of Bear Stearns (BSC) looks much more like a $29 billion investment in securities owned by Bear. Although the Fed insists that it isn’t technically buying any assets, in practical terms it’s doing exactly that. All this adds up to a big and unacknowledged step up in the central bank’s financial intervention with Wall Street investment banks.

The Fed, of course, is the only part of government with the speed, power, and flexibility to arrest a bout of market panic. By rapidly intervening in mid-March to keep Bear from filing for bankruptcy, it may well have prevented a series of cascading failures that could have severely damaged the financial system and the economy. Many economists and analysts are happy that the Fed stepped into the breach. Nevertheless, now that things have quieted down a bit, the Fed is likely to face some tough questions about the precise nature of its actions as well as the legal justification for them.

The second-guessing has already begun. On Mar. 26, Senate Banking, Housing, and Urban Affairs Chairman Christopher Dodd (D-Conn.) announced an Apr. 3 hearing to explore the “unprecedented arrangement” between the Fed, JPMorgan, and Bear. Top officials from the Fed and other regulators, as well as Bear Stearns CEO Alan Schwartz and JPMorgan CEO Jamie Dimon, will likely be grilled about the details.

“That Looks Like Equity”

Meanwhile, Treasury Secretary Henry Paulson gave the Fed a gentle prod on Mar. 26 in a speech to the Chamber of Commerce. While saying he fully supported the Fed’s recent actions, Paulson stressed that “the process for obtaining funds by nonbanks must continue to be as transparent as possible.” He also urged the Fed to continue to work with other agencies to get the information necessary for “making informed lending decisions.”

So far, few people have focused on what exactly the Fed is getting in exchange for supplying $29 billion to JPMorgan Chase. That’s a bit surprising because whatever the deal is, it’s far from a standard loan. The strangest twist is that even though the money goes to JPMorgan, that firm isn’t the borrower. So the Fed can’t demand repayment from JPMorgan if the Bear assets turn out to be worth less than promised.

What’s also odd is that if there’s money left after loans are paid off, the Fed gets to keep the residual value for itself. That’s what one would expect if the Fed were buying the assets, not just treating them as collateral for a loan. Vincent R. Reinhart, a former director of the Fed’s Division of Monetary Affairs and now a resident scholar at the American Enterprise Institute, said in an interview on Mar. 26: “The New York Fed is the residual claimant. That doesn’t look to me like a loan. That looks like equity.”

[top]

Looks like they buckled quickly to get the rest of the bill through ASAP.

Pension fund provisions out of House bill

by Doug Halonen

A bill in the House Agriculture Committee that would deal with commodity speculation was dramatically revised today to delete provisions in a previous draft that would have barred pension funds from investing in agricultural and energy commodities and engaging in equity and interest rate swaps, a committee aide said.

“(The) pension provisions are out of the bill,” the aide, who asked not to be identified, wrote in an e-mail response to a P&I Daily inquiry. The aide could not say why the provisions were removed.

Pension industry advocates said that the threat of the bans  included in the draft bill that was being circulated Wednesday  was met by significant opposition from pension fund representatives.

The draft and the revised bill were both sponsored by Rep. Collin Peterson, D-Minn. The committee will vote on the bill this afternoon, according to the committee.

“It’s going to be a pretty innocuous bill,” said one pension industry lobbyist, who asked not to be identified by name. “We’re not sweating it for sure.”

[top]

| Survey | -0.3% |

| Actual | 0.8% |

| Prior | 0.0% |

| Revised | 0.1% |

Better than expected, partially because fiscal and government is kicking in harder than expected.

| Survey | n/a |

| Actual | -1.3% |

| Prior | -2.7% |

| Revised | n/a |

Still has turned up in a meaningful way, but moving away from recession levels.

When car sales normalize we’ll see a further boost.

| Survey | -0.2% |

| Actual | 2.0% |

| Prior | -0.8% |

| Revised | -0.5% |

Headline numbers being held down by car sales.

Durables better than expected, likely due to companies taking advantage of new accelerated depreciation allowance

Small appliances up as well. Seems some rebate checks went for down payments on appliances and home improvements.

Electronics and consumer goods down.

| Survey | 56.4 |

| Actual | 61.2 |

| Prior | 56.6 |

| Revised | n/a |

Better than expected and a possible bottom from a very low level.

Gas prices ‘stabilizing’ likely lead to the modest improvement in the Michigan survey and the ebbing of inflation expectations:

Don’t underestimate the fiscal package!

One year steady at 5.1%.

| Survey | n/a |

| Actual | 5.1% |

| Prior | 5.1% |

| Revised | n/a |

Two months over 5% is very troubling for the Fed. They see this as a direct cause of inflation.

| Survey | n/a |

| Actual | 3.2% |

| Prior | 3.4% |

| Revised | n/a |

Down some but still way too high.

The Fed wants this back to their long term target of something under 2.5%.

| Survey | 503K |

| Actual | 530K |

| Prior | 512K |

| Revised | 533K |

Better than expected and last month revised up as well.

| Survey | n/a |

| Actual | 425K |

| Prior | 448K |

| Revised | n/a |

Sales can quickly be stifled by dwindling actual inventories.

| Survey | -1.8% |

| Actual | -0.6% |

| Prior | -2.5% |

| Revised | -1.7% |

Better than expected and from an upwardly revised May number.

| Survey | n/a |

| Actual | -33.2% |

| Prior | -37.8% |

| Revised | n/a |

| Survey | n/a |

| Actual | 230.9 |

| Prior | 227.7 |

| Revised | n/a |

The decline may be about over.

Median prices are already rising from the lows.

Watch for a shortage of new homes.

The three month average has turned higher.

But higher than expected at 530,000, and down from May because May was revised up to 533,000 from 512,000.

Also, inventories down and prices up, and prices getting very close to being up year over year:

New home sales fall but stronger than expected

by Mark Felsenthal

Sales of newly constructed U.S. single-family homes were stronger than expected in June, falling 0.6 percent to a 530,000 annual pace, a government report showed on Friday, providing a glimmer of hope for the beaten-down housing market.

Economists polled by Reuters were expecting sales to slow to a 500,000 seasonally adjusted annual sales rate from a previously reported 512,000 pace in May. May’s sales rate was revised up to 533,000, the Commerce Department said.

The inventory of homes available for sale shrank 5.3 percent to 426,000, the lowest since December 2004. The June sales pace put the supply of homes available for sale at 10 months’ worth.

The median sales price rose to $230,900 from $227,700 from May, but was down 2 percent from a year earlier, the government said.

[top]