December dip reversed:

Full size image

Solid Recovery in the January Credit Managers’ Index

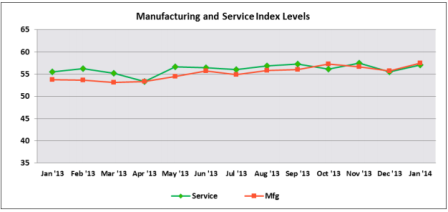

National Association of Credit Managements CMI report for January encourages, rebounds to 57.3. Main indices improved and all sub-indices are now out of contraction territory, indicating December was the likely the anomaly.

January 30 — Januarys reading for the Credit Managers Index (CMI) from the National Association of Credit Management (NACM) rebounded to 57.3, the highest point reached in over a year and even more robust than the 57.1 notched in November. This now begs the question, which of the last three months is signaling the real trend? The November CMI hit a two-year high followed by a December low that took the index back to summer levels and now the January is back to highs not seen in two years. In December, there was a palpable gloom falling over the economy where the data was concerned. The December CMI recorded a low not seen since July and it looked as if all the gains that started to accumulate in the third and fourth quarters were evaporating. The January data dispels that mood a little.

The factors comprising the CMI provide more insight. All of the favorable factors improved in January. Sales regained some of its former momentum and climbed back into the 60s to 61.5 after falling to 58.7 last month. Granted, this is still on the low end of the 60s, but is trending in a more positive direction. New credit applications rose from 57.2 to 58.2, with the biggest improvement occurring in dollar collections, which jumped from 58.7 to 60.9, its first time over 60 since October. There was also a very significant jump in amount of credit extended from 62.6 to 65.4, marking its first time cresting over 65 since May. Finally, amount of credit extended hasnt been this high in almost three years and shows that credit is far more accessible now than it has been in some time. The favorable factor index regained a little of its luster and is back in the 60s with a fairly comfortable margin of 61.5 compared to Decembers 59.3.

The unfavorable factor index also provided some good news. The majority of the factors showed improvement and some truly regained the momentum that had been building in the months prior to December. Rejections of credit applications remained stable, moving up from 54.5 to 54.6, which is certainly better than the stagnant course recorded in the last few months. The reading hit the bottom of a downward trend in May at 50.8 and barely budged from June on. Accounts placed for collection improved quite a bit from 53.4 to 55.2, suggesting the little slump recorded at the end of the year did not force many companies into a state of distress. There was similar improvement in disputes from 50.7 to 52.2, which washed away end-of-year worries that struggling companies would be pushed over the edge and would start to become a challenge from a collection point of view. Dollar amount beyond terms was one of the big gainers, jumping out of contraction territory from Decembers 49.7 to Januarys 52.8. Finally, dollar amount of customer deductions stayed almost the same, improving very slightly from 51.5 to 51.6 and filings for bankruptcies posted a nice improvement from 59.0 to 60.5. Overall, the unfavorable factor index steadied more than many had expected with its bump from 53.1 to 54.5.

The numbers posted in the December CMI were anything but inspiring and seemed to match a general lack of enthusiasm in the economy, said NACM Economist Chris Kuehl, PhD. It was suggested that the low reading was likely an anomaly and, with the rebound in January, it now appears this is the case. The next set of data will attract a lot of attention as analysts seek to determine whether there is a clear trend back to more positive readings and if this will occur on a more consistent basis.