This one’s for the bloggers-

Dollar swap lines are functionally unsecured loans to foreign govts. that the Fed can do unilaterally. Congress only finds out well after the fact. Last time around they did $600 billion, including lending (unsecured) to nations Congress never would have approved.

The problem is the Fed Chairman insists they are secured because we get local currency deposits at the foreign central bank as collateral.

That’s like putting up your watch as collateral for a loan but you still wear it.

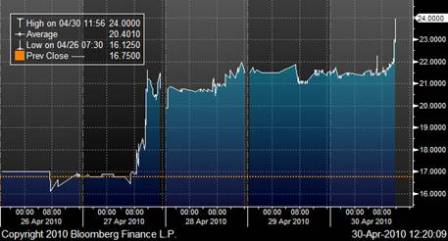

Chatter About the Fed/ECB CCY Swap Line

If reinstituted, it is a basic spot/forward FX trading line.

What this does is to give the ECB the power to lend USD in Europe. It

has 2 potential benefits:

1.Not all banks in Europe who require USD funding has access to the Fed

or the FF market

2.They don’t have to wait until NY opens if panic breaks out in Europe

over USD funding.

There is a third benefit. Politics. It let’s the market know that the

central banks are on the case, and the Fed doesn’t want to see the

FRA-OIS spread spin out of control.