Lehman cuts oil demand forecast

by Richard Valdmanis

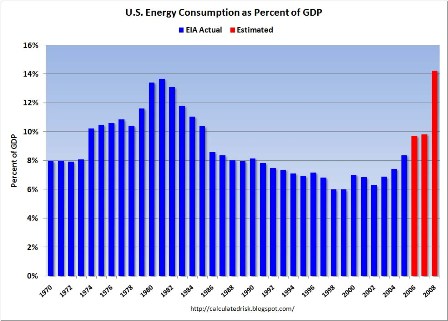

(Reuters) Investment bank Lehman Brothers (LEH.N: Quote, Profile, Research, Stock Buzz) said Wednesday it slashed its forecast for 2008 world oil demand growth due to a steeper-than-expected slowdown in energy consumption in the United States and other OECD countries.

Lehman added it believes the oil market is “approaching a tipping point” with prices expected to decline to an average of $90 a barrel in the first quarter of 2009.

“We now forecast annual oil demand for 2008 at 86.3 million barrels per day, a growth of 790,000 bpd from 2007. The growth has been revised down from projections of 1.5 million bpd in December,” Lehman said in a research note titled ‘Demand Demolition’.

If true, and non-Saudi supply remains about flat, Saudi production might fall to about 9 million bpd and the price would still remain wherever the Saudis set it.

There has been some talk that the Saudis may have agreed to lower prices after the last round of meetings with US officials. Could be, but with their output running within a million or two bpd of their total capacity, it seems doubtful they would do anything to increase demand before they have the excess capacity to meet it. But there could be other factors (including the US 7th fleet and concerns about a united Iran/Iraq threatening them) that might be influencing their decision. Only time and prices will tell. Should be more clear in a week or so.

[top]