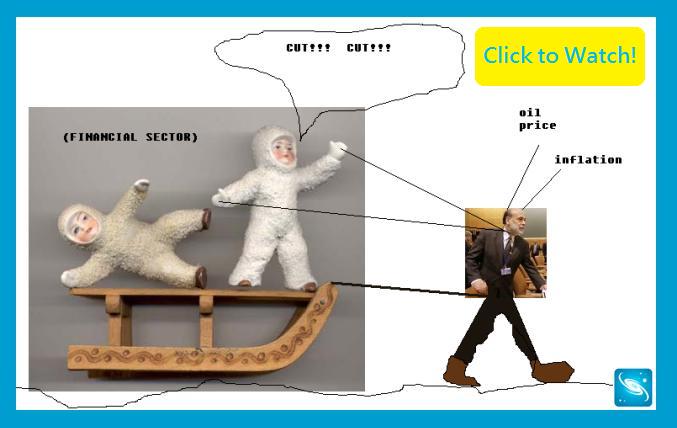

Karim Basta:

- Further cut to gwth outlook

- Financial conditions tighter and housing getting worse

- Inflation receives greater concern than prior statement

- Conclusion: downside risks predominant and ‘timely’ means another intermeeting cut on the table.

Agreed, further comments below:

Release Date: March 18, 2008

For immediate release

The Federal Open Market Committee decided today to lower its target for the federal funds rate 75 basis points to 2-1/4 percent.

Could have been 100 as anticipated by the markets. Fed shaded its cut to the low side of the priced in expectations.

Recent information indicates that the outlook for economic activity has weakened further. Growth in consumer spending has slowed

Implies there is still some growth, not negative yet.

and labor markets have softened.

Looking unrevised February payroll number, not the lower unemployment rate. In January they looked at the higher unemployment rate. Unemployment has subsequently gone from 5.0% to 4.9% to 4.8% (rounded).

Financial markets remain under considerable stress,

They went a long way to relieve stress over the weekend.

and the tightening of credit conditions and the deepening of the housing contraction are likely to weigh on economic growth over the next few quarters.

Housing starts were revised up, and other indicators indicate it may have bottomed.

Inflation has been elevated, and some indicators of inflation expectations have risen.

This was noted in several Fed intermeeting speeches.

The Committee expects inflation to moderate in coming quarters, reflecting a projected leveling-out of energy and other commodity prices and an easing of pressures on resource utilization.

They continue to make this projection even after being completely wrong for many meetings.

Still, uncertainty about the inflation outlook has increased.

That’s why – their forecasts have proven unreliable, and crude/food continues to rise as the USD continues to fall.

It will be necessary to continue to monitor inflation developments carefully.

Only ‘monitor’? No action planned.

Today’s policy action, combined with those taken earlier, including measures to foster market liquidity, should help to promote moderate growth over time and to mitigate the risks to economic activity. However, downside risks to growth remain. The Committee will act in a timely manner as needed to promote sustainable economic growth and price stability.

Intermeeting action is on the table, for both growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Gary H. Stern; and Kevin M. Warsh. Voting against were Richard W. Fisher and Charles I. Plosser, who preferred less aggressive action at this meeting.

Wonder how much less aggressive?

In a related action, the Board of Governors unanimously approved a 75-basis-point decrease in the discount rate to 2-1/2 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, and San Francisco.