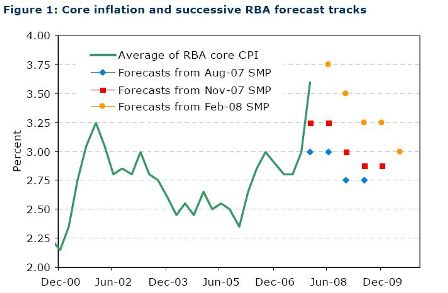

Interesting in that it totally ignores inflation when predicting CB moves.

Maybe not only the Fed but the rest of the world’s CB’s don’t care about inflation:

Into the valley

One of the characteristics of a recession is a sudden drop off in activity, the point at which a slowdown turns into something more serious. Economists term this a discontinuity or a break in the data and it is this pattern which makes recessions so difficult to spot from simply tracking the daily data releases. There is evidence that we have hit such a point in the US with several indicators taking a tumble over the past month.

True, but these indicators aren’t yet sufficient:

For example, the service sector ISM fell to its lowest level since the last recession in 2001,

The first move of this indicator is very unreliable, and these types of drops have a recent history of getting reversed. The next update will be more meaningful.

consumer confidence reached a 16 year low

Yes, but again, this is not a reliable indicator

and we saw the first fall in payrolls for 4 years as firms trimmed jobs in construction and manufacturing.

Yes, but how quickly they forget the same was said when the August number came out negative, only to be revised to a very respectable positive number a month later.

And the December number was also revised up to a reasonable number from a weak initial report. The February number and revised January number will be out a week from Friday.

Meanwhile, activity in the housing sector remained weak and consumer spending has levelled off. The economy lost momentum at the end of last year with GDP rising just 0.6% at an annualised rate in the fourth quarter.

This could also be revised up soon as exports were higher than anticipated.

It is quite possible that this tipped over into a negative quarter in Q1 this year.

Yes, it’s possible, but this is biased analysis that simply cherry picked the worst possible data.

The Fed has not been slow to respond and cut rates by a further 50 basis points to 3% at its last meeting to bring the cumulative easing to 225 bps in this cycle. Fed chairman Ben Bernanke has shown that he will adopt an activist stance in the face of downside risks to activity, a departure from the gradualist approach of his predecessor Alan Greenspan. Bernanke is a student of the Great Depression in the US

Yes, and he has also expressed risks that existed only due to the gold standard of the time and don’t apply to current floating fx policy.

and so is well aware of the dangers of allowing confidence to slide and the economy falling into a liquidity trap. Sometimes described as pushing on a string, this was also the situation in Japan during the 1990s, where lower interest rates failed to stimulate activity.

Yes, that can happen due to tight fiscal policy. The difference between now/Japan and the gold standard days is that now there are no quantitative supply side constraints on lending. In the US today as with Japan credit is infinitely available to credit worthy borrowers. Today’s constraints come with bank perceptions of credit worthiness, as well as ‘regulatory over reach’ where bank regulators restrict lending. And, for another example, today the treasury can issue unlimited numbers of treasury securities (as did Japan) as rates at or below the CB’s target rates. On a gold standard, treasury borrowing drives up rates as it competes for funds with the private sector, and those funds are limited by the gold standard.

The current situation is not as severe as in these episodes, but does share the essential characteristic that the transmission mechanism from central bank rate cuts to the real economy is impaired and not functioning normally.

Confused as above.

This, of course, is the credit crunch where banks are tightening or withdrawing credit from the economy even as interest rates fall. Evidence of this is found in the continued tightening of lending conditions apparent in the Fed’s senior loan officer survey despite the fall in policy rates (see chart on front page).

Again, very different from gold standard constraints and easily overcome if understood, where the gold standard constraints are only overcome by going off it, as the US did domestically in 1934.

True, however, that employment, growth, and inflation are not functions of interest rates, as is nearly always the case.

It is this headwind which policy makers not just in the US, but also in the Eurozone and UK need to overcome. The problem extends into the markets for securitised debt which have in many cases dried up. In response to this and the weaker near term performance of the economy, we have reduced our forecast for the Fed funds target rate to 2% by May (previously 2.5%).

Regardless of inflation!

These inflation concerns have weighted more heavily in Europe than the US where the Bank of England and ECB continue to voice concern about second round effects from higher commodity prices into wages. Nonetheless, we still see scope for a further easing of policy from both central banks along with the Federal Reserve in coming months as activity weakens (see below for more on the UK and Eurozone).

More generally, our baseline view remains one where global growth slows in 2008 and quells inflation fears in the second half of the year. Our forecasts will be reviewed next month and although we already have a weak profile for US GDP growth we will trim our baseline projections. It is more than likely that the US is now in recession. However, we will still look for a modest recovery in the second half of the year as the housing market stabilises and the economy begins to experience some of the effects of looser fiscal and monetary policy. Nonetheless, growth is expected to remain below trend throughout 2008, so it will feel more like a stabilisation than a recovery. More of an “L” shaped recovery than a “V”.