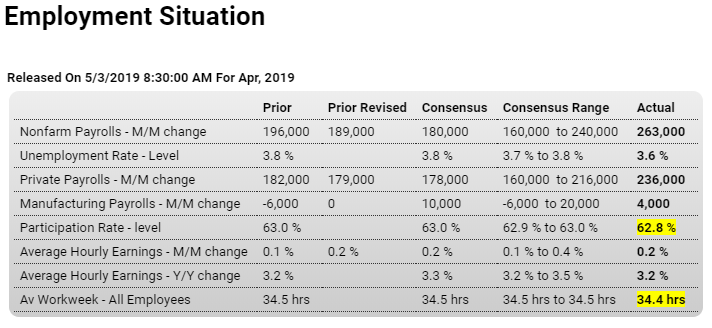

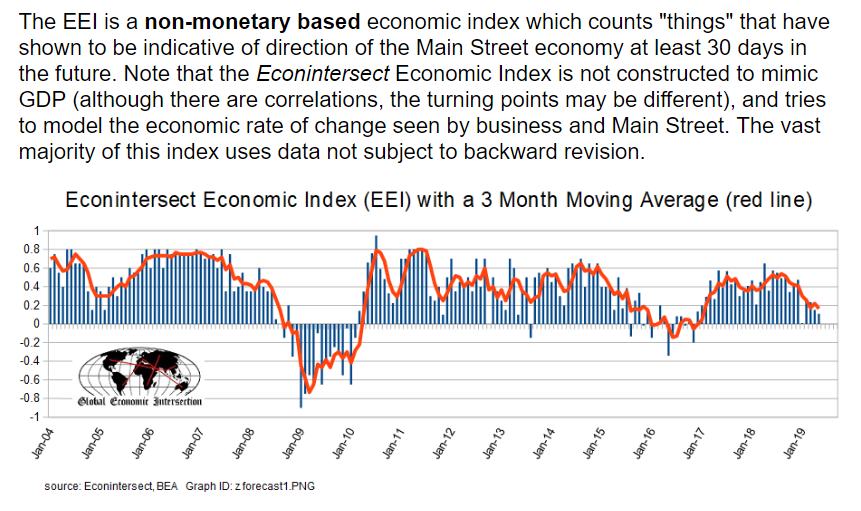

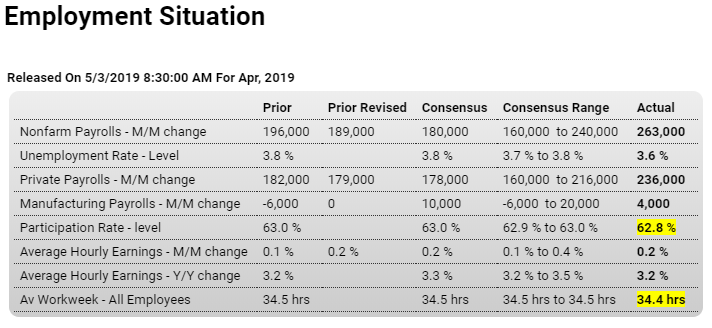

Headline number looks promising. The question is whether employment will lag the other indicators that are decelerating, or provide the support that turns them around. And note the .1 drop in the work week is equivalent to maybe to something over 100,000 jobs:

Highlights

That sound you hear is the economy revving up. Nonfarm payroll growth easily beat expectations at 263,000 in April as did the unemployment rate with an outsized 2 tenths decline to a 49-year low of 3.6 percent. Wages didn’t show any immediate jolt from the strength, coming in as expected for the monthly rate, at 0.2 percent, and 1 tenth under expectations for the year-on-year rate at 3.2 percent.

Tightening conditions are the signal from the pool of available workers which continues to be drained, down nearly 500,000 in the month to 10.9 million. The participation rate, reflecting the decline, fell 2 tenths to a lower-than-expected 62.8 percent.

Payrolls are headed by a second sharp gain for construction, up 33,000 in April after 20,000 in March, for a sector where scarcity of labor especially skilled labor has been an ongoing theme. Perhaps topping construction for April’s payroll highlight is a 76,000 surge in professional & business services that includes an 18,000 jump in temporary help. The strength here, which adds to prior gains, indicates that businesses, in an effort to get the people they need immediately, are turning to contractors to fill slots. Government payrolls are also very strong, up 27,000 in April.

The nation’s unemployment rate sank in April to the lowest rate since December 1969, but the milestone comes with a big caveat: The decline stemmed from more people quitting their search for work.

The jobless rate slipped to 3.6% last month from 3.8% in March, continuing a long downward arc from a 27-year high of 10% in 2009. Yet that doesn’t mean there aren’t some potential trouble spots.

Take the size of the labor force. It contracted in April by nearly half a million people and fell for the fourth straight month.

The last time the labor force fell four months in a row was during the waning stages of the 2007-2009 Great Recession. And before that one has to go back to 1950.

As a result, the so-called labor-force participation rate slipped to 62.8% from a six-year high of 63.2% in January. That is, every 63 of 100 able-bodied Americans 16 or older either have a job or are seeking one.

The shrinking labor force “is the primary factor behind the unexpected decline in the unemployment rate,” noted chief economist Richard Moody of Regions Financial.

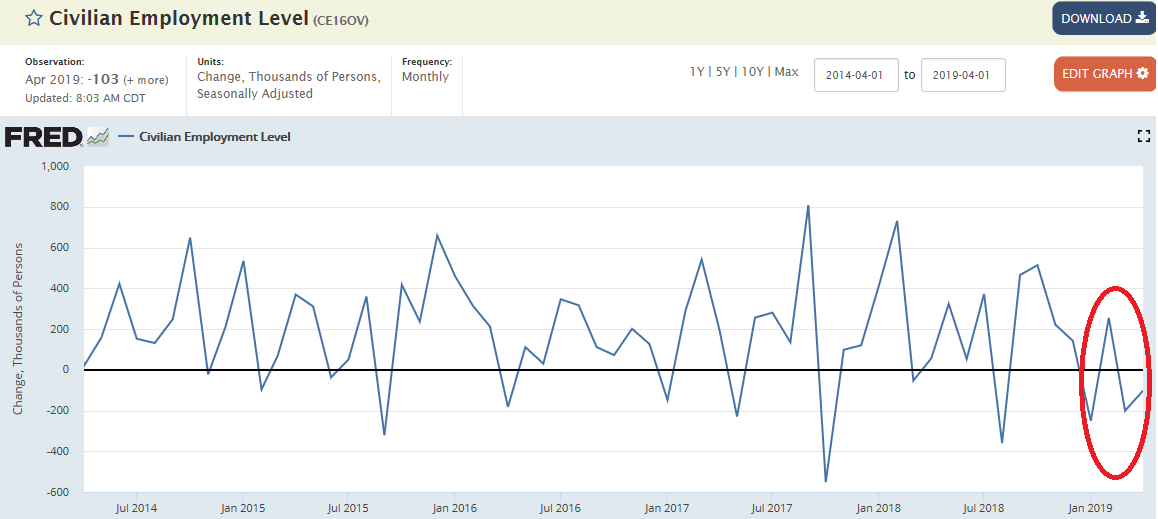

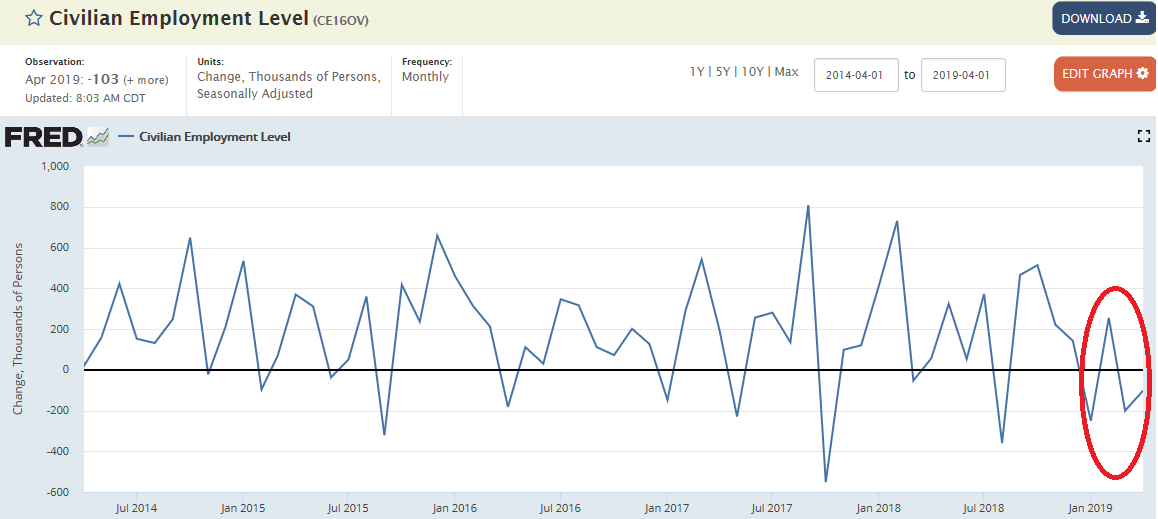

This is from the household survey. The two surveys tend to converge over time, and the payroll survey is much larger and less subjective:

The household survey shows employment is down for the year:

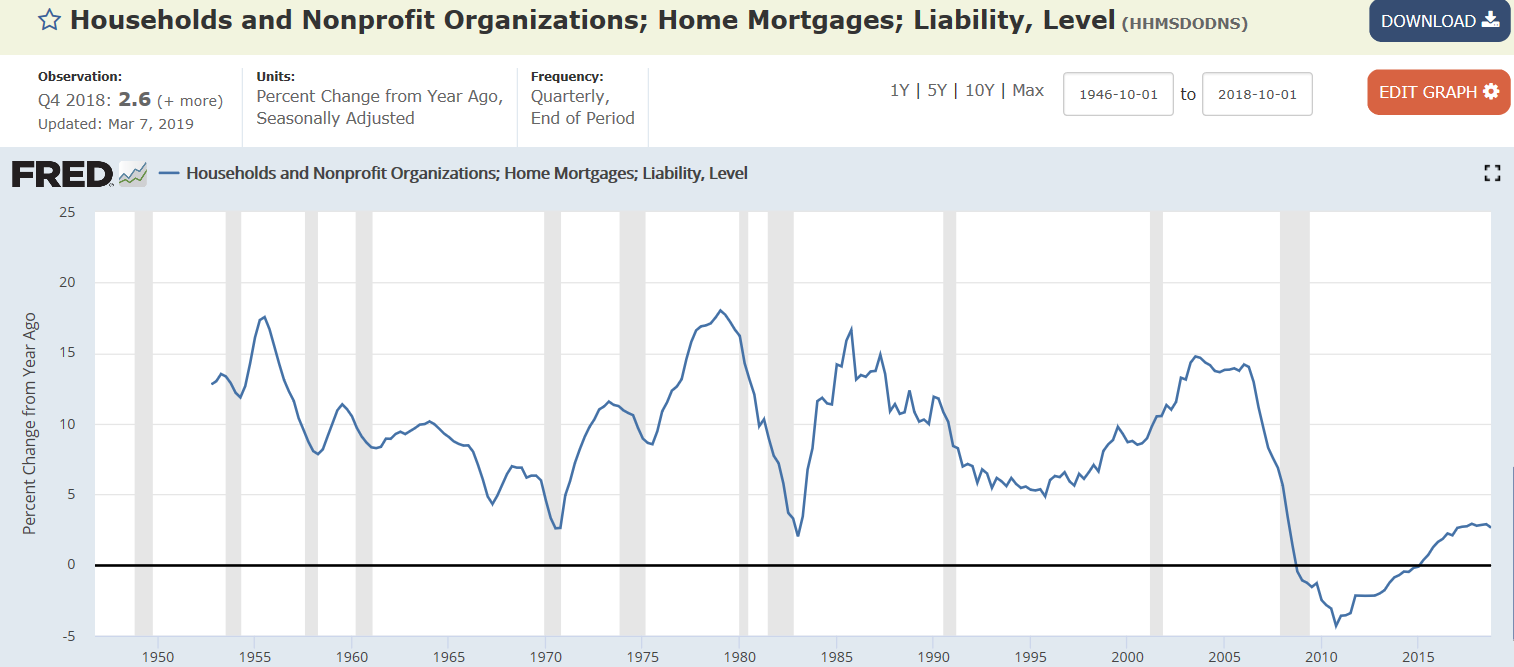

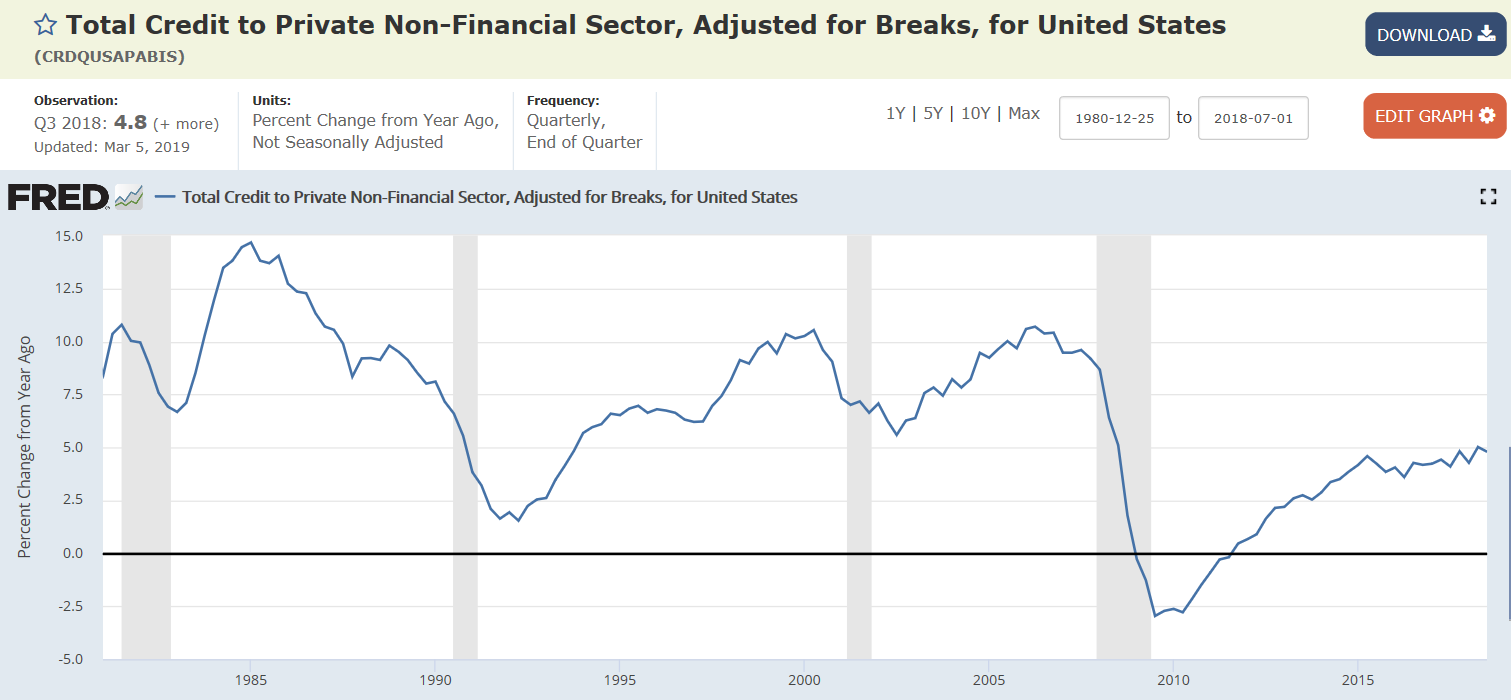

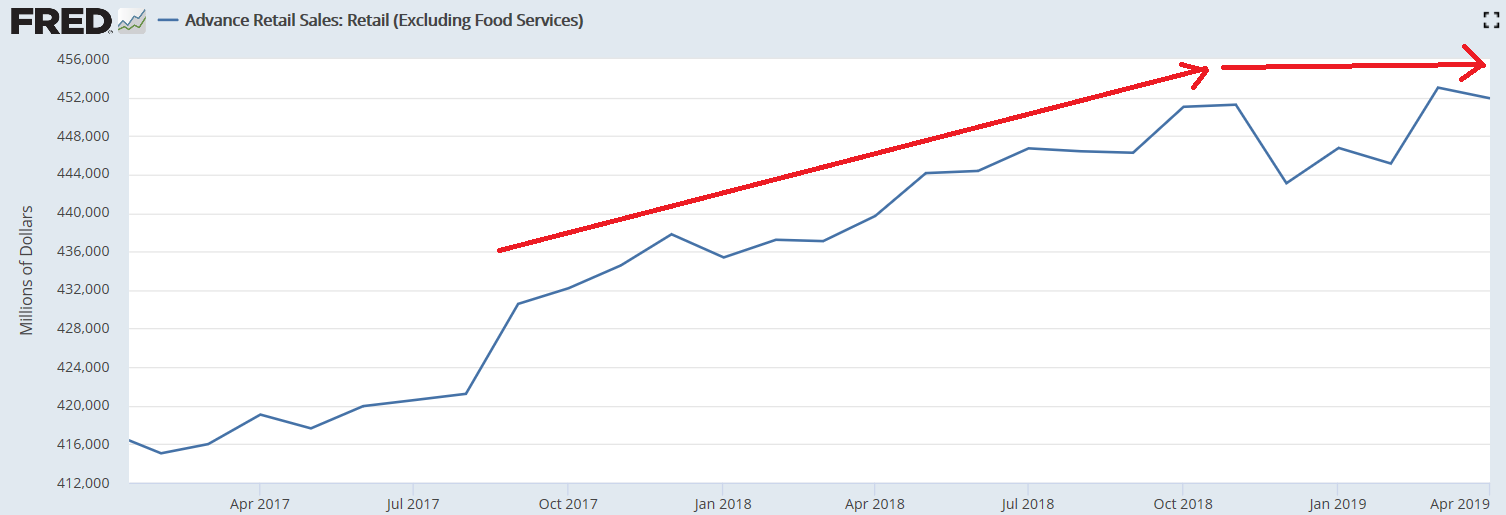

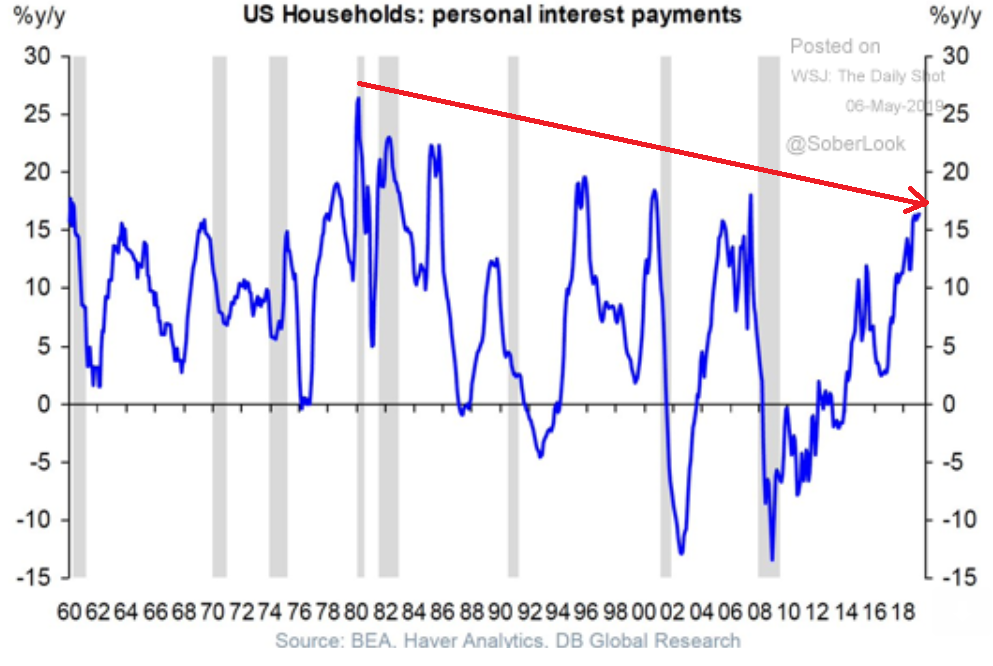

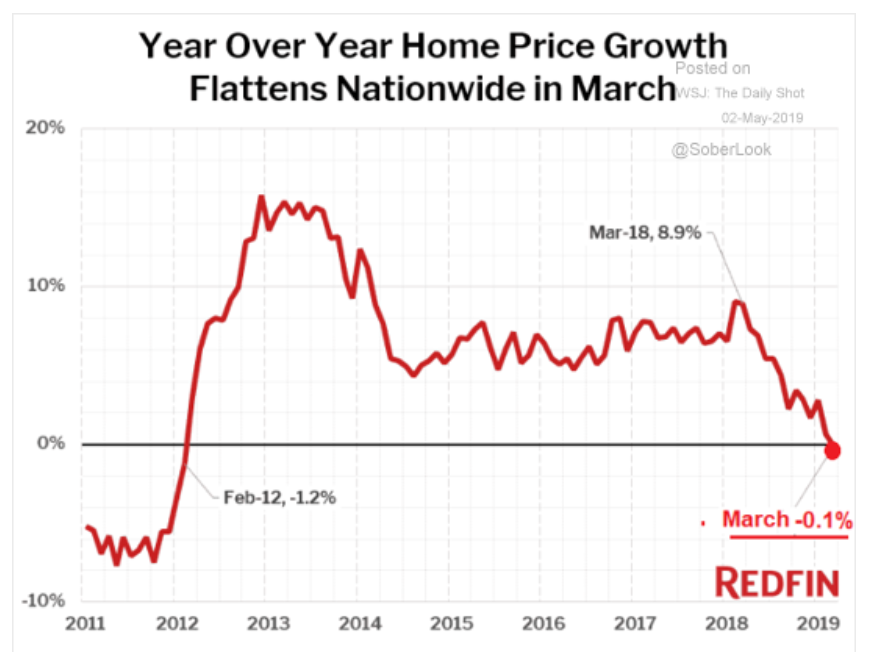

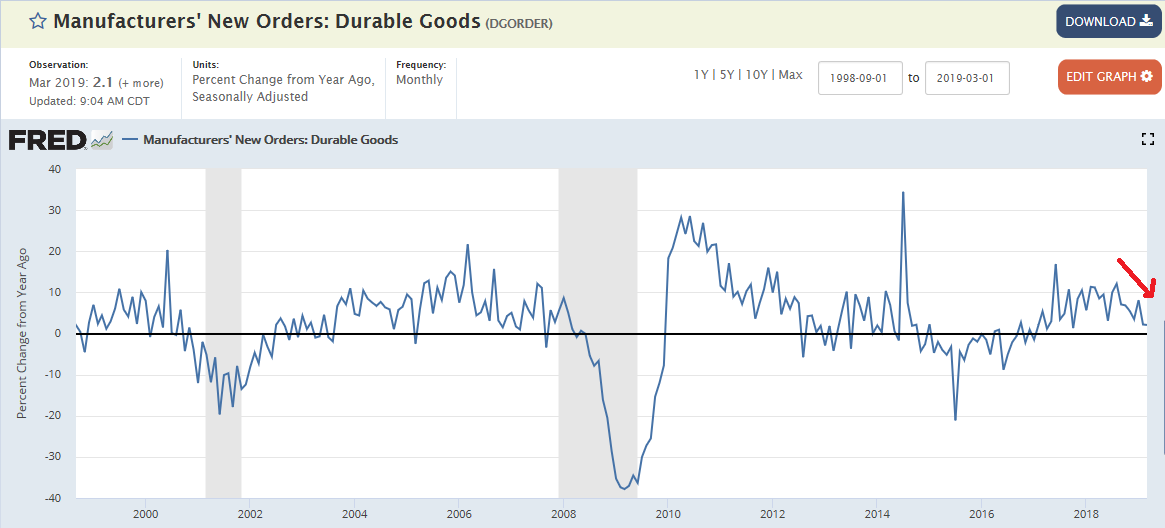

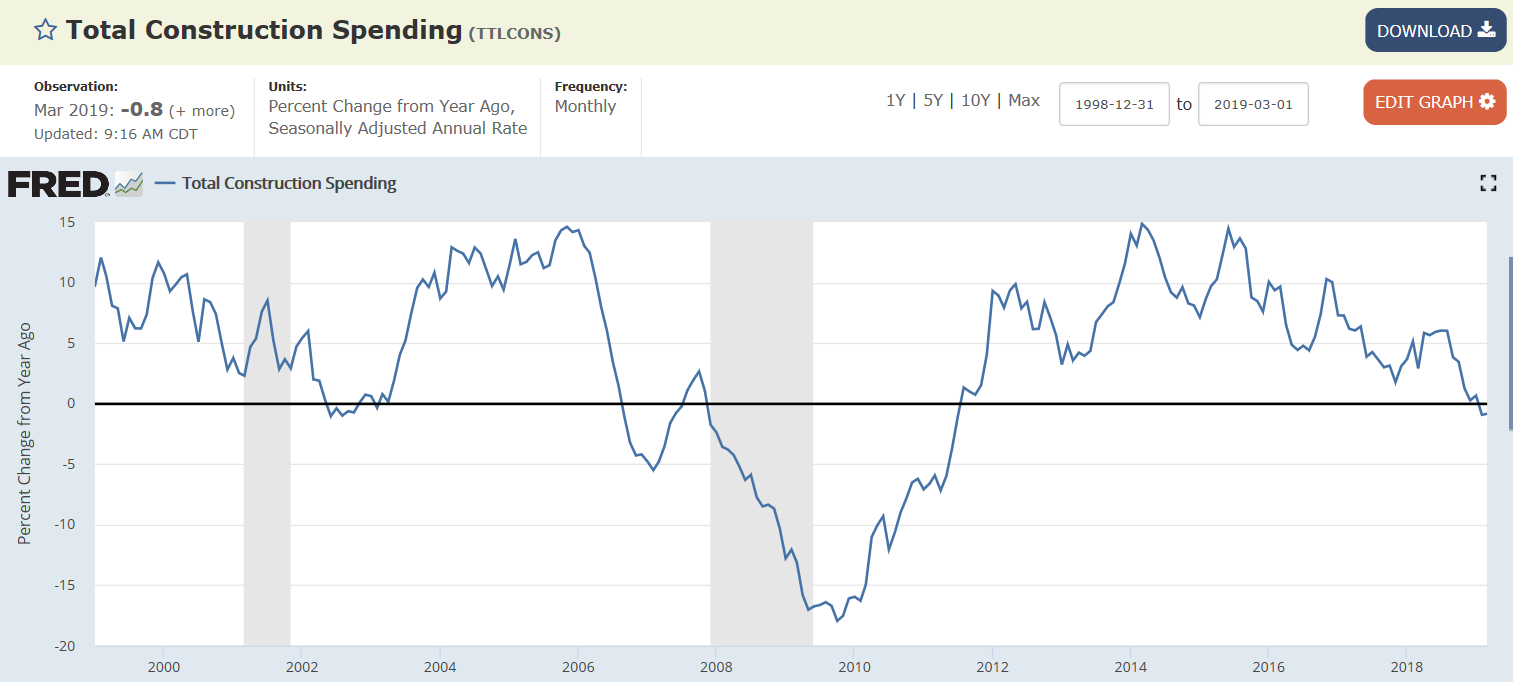

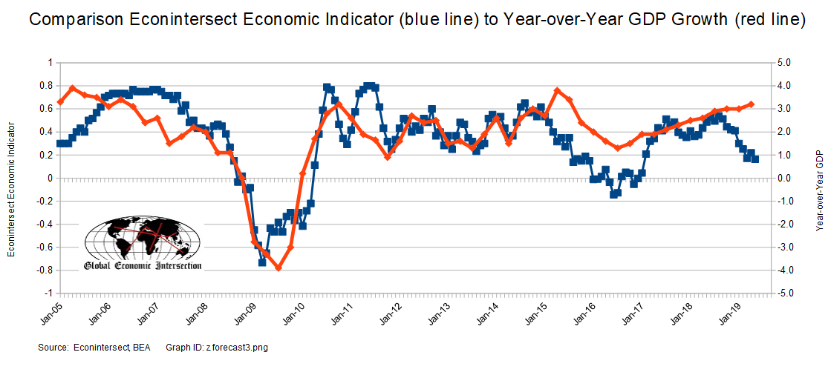

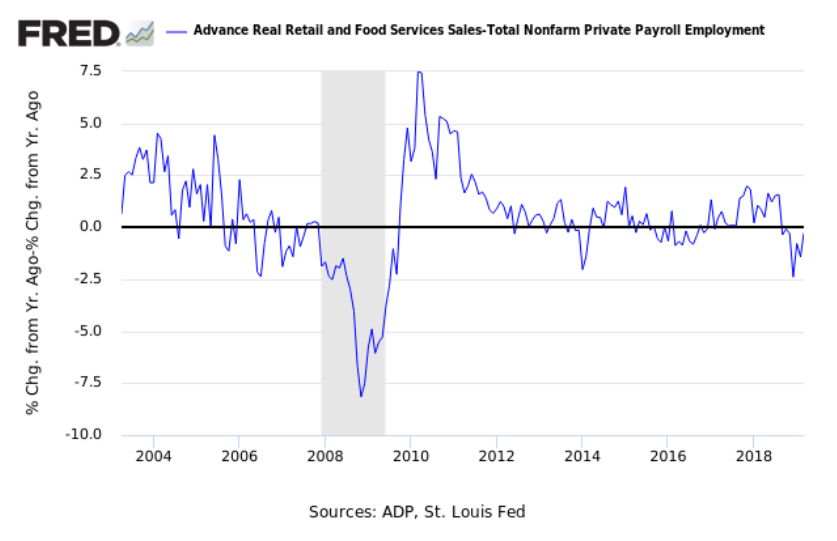

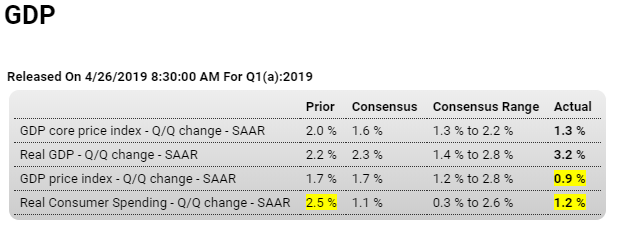

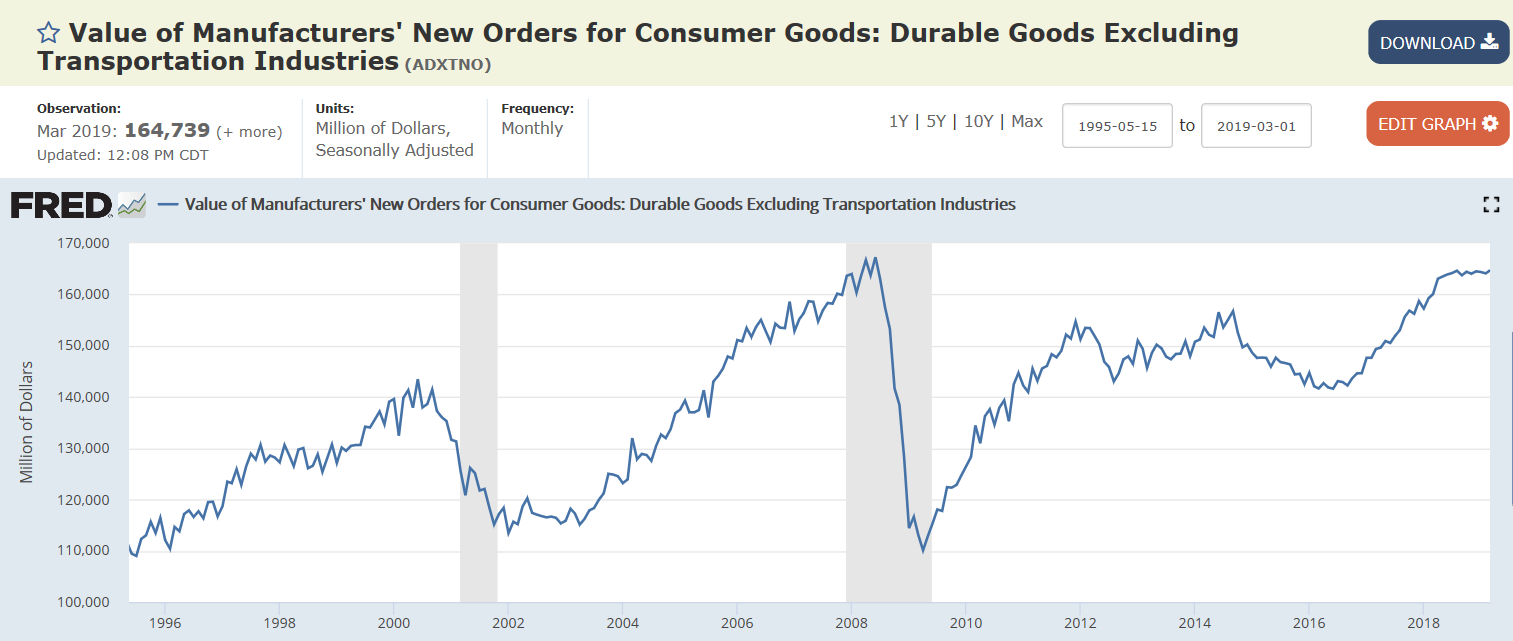

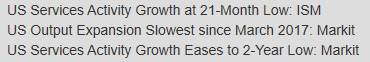

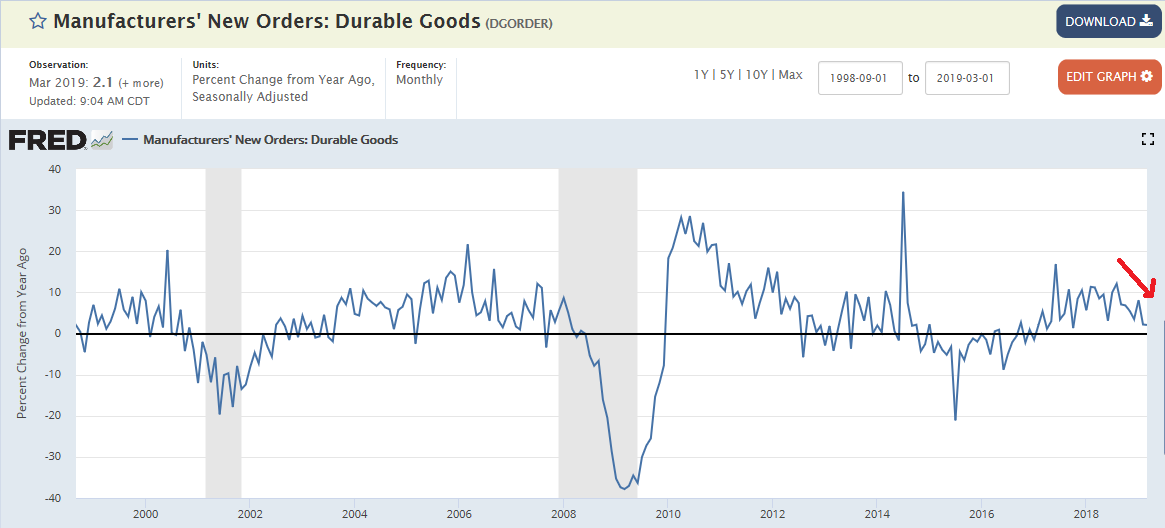

Up nicely for the month, but year over year growth still heading south, as per the chart:

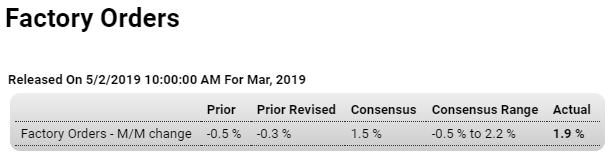

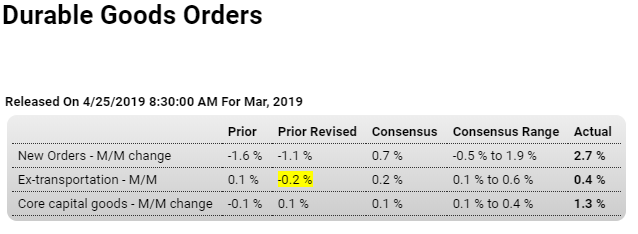

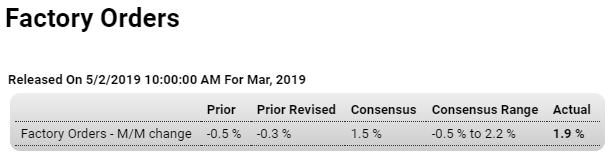

Highlights

Factory orders rose 1.9 percent in a March report that is widely mixed yet fundamentally favorable. The least favorable reading in the report is a modest 0.3 percent rise when excluding transportation durables where however gains for aircraft, especially during the 737 Max grounding, are very welcome as was a strong gain in car and truck orders. The best news in the report is a 1.4 percent surge in orders of core capital goods (nondefense ex-aircraft) that hints strongly at second-quarter acceleration for business investment.

Inventories rose 0.4 percent in the month and though shipments jumped 0.7 percent, the inventory-to-sale ratio held unchanged at 1.36. Unfilled orders rose 0.2 percent and though a modest rate, is nevertheless welcome given what has been a long flat trend for this reading.

The strength of this report was signaled last week by advance data on the durables side of the manufacturing sector, where March orders growth is revised down 1 tenth to a nevertheless very sharp 2.6 percent gain. Nondurables are the fresh information in the report and they rose a strong 1.1 percent in March in a gain tied in part to higher prices for petroleum and related products.

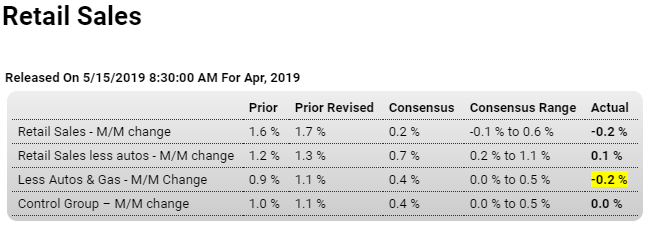

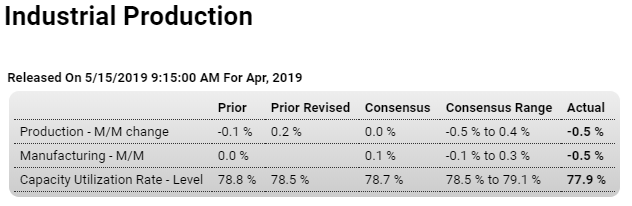

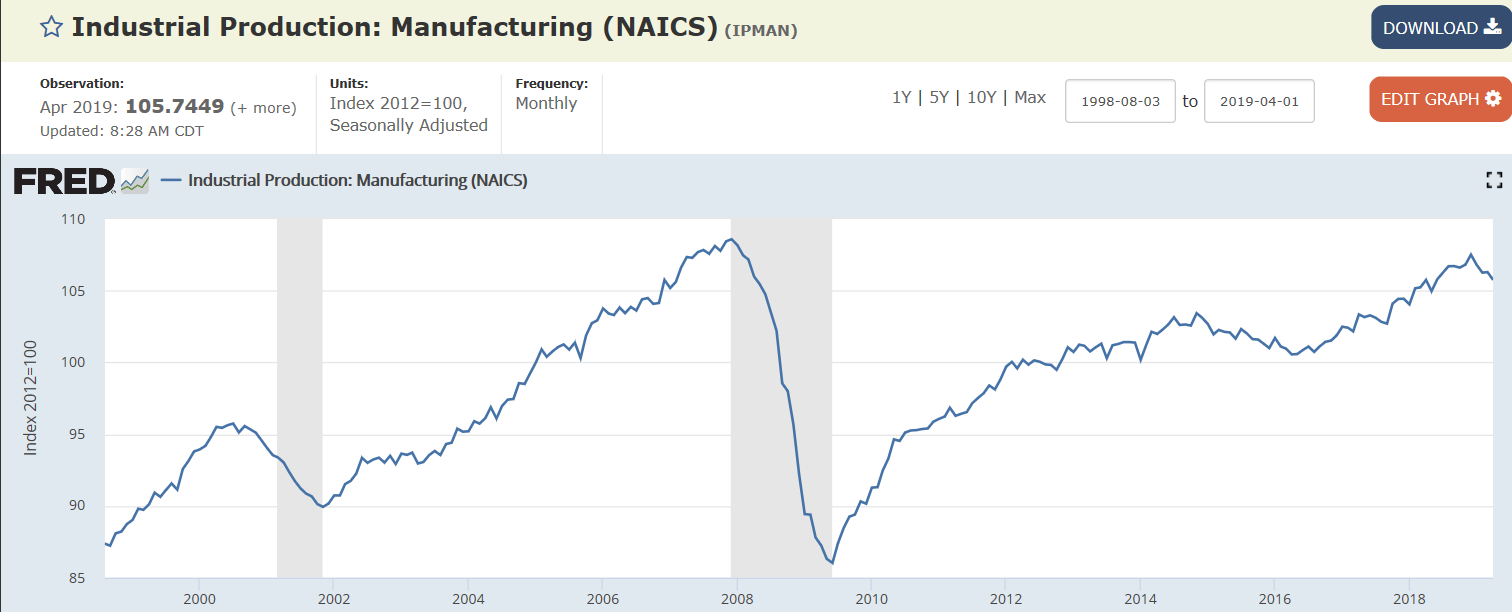

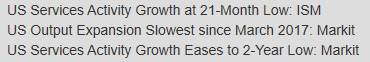

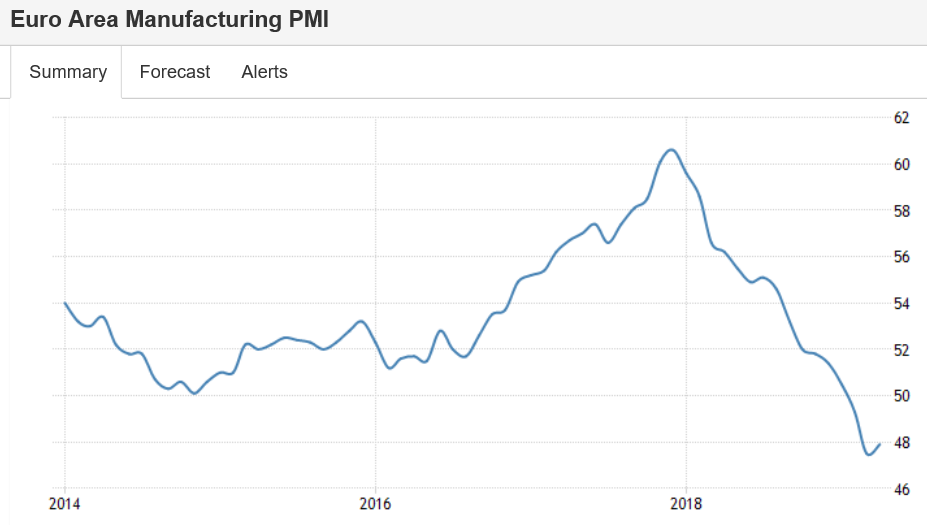

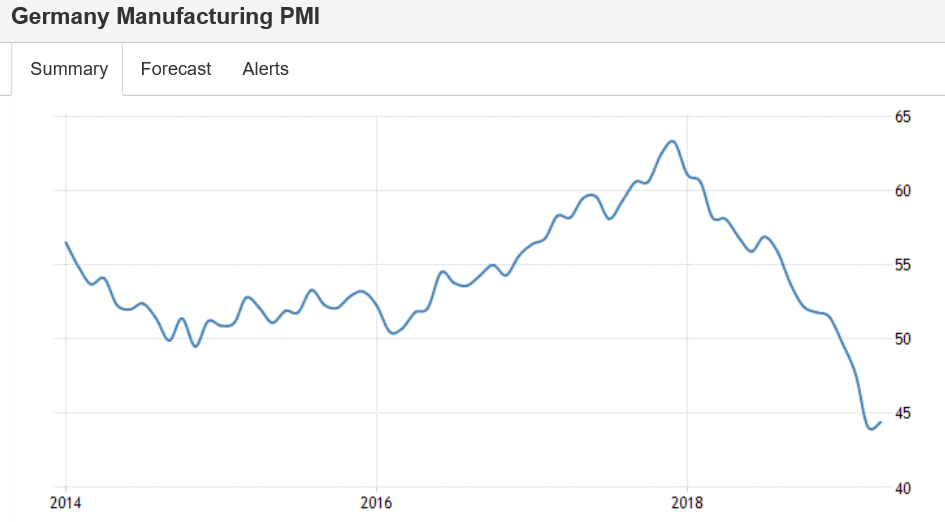

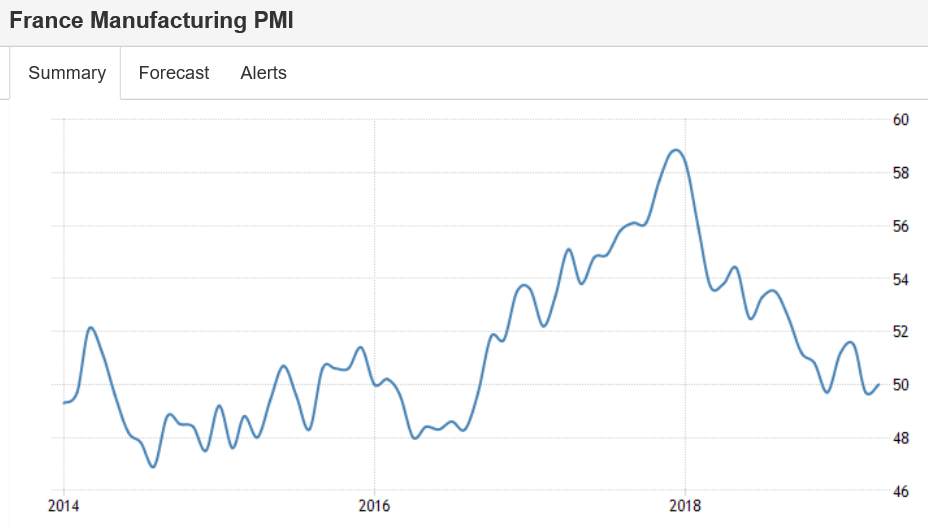

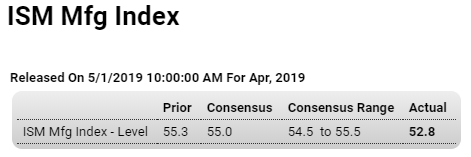

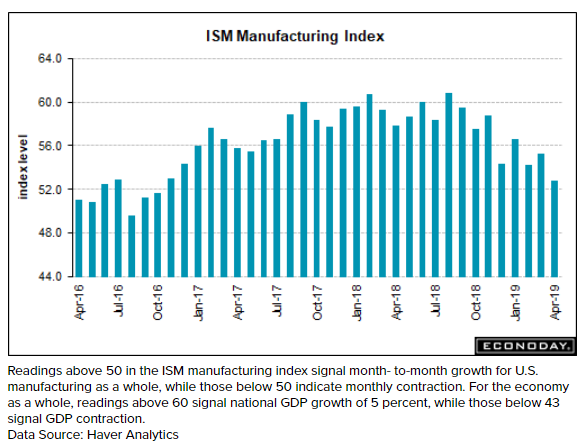

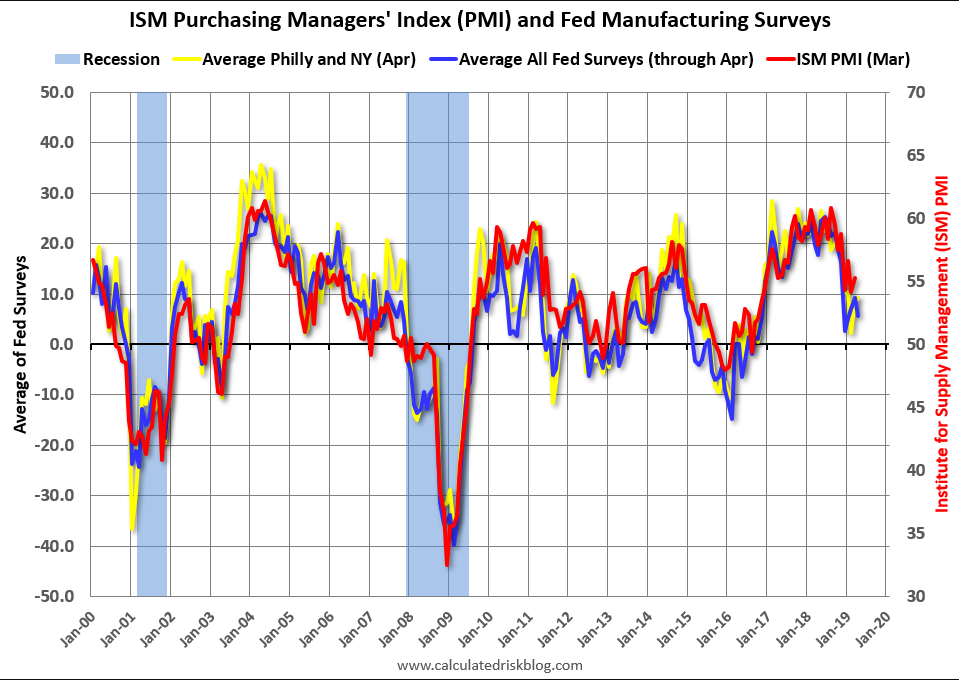

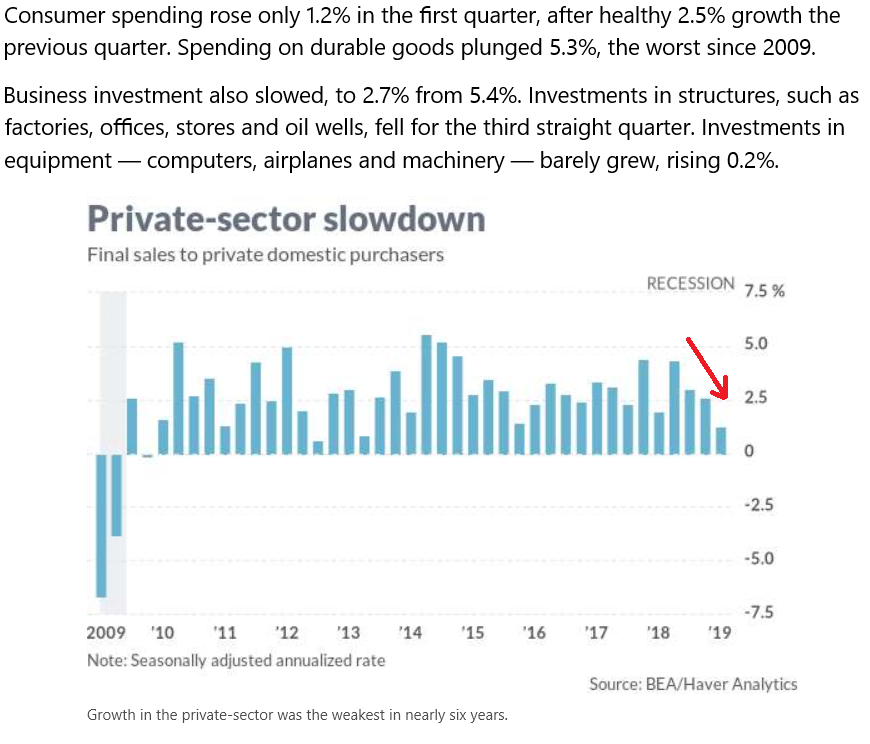

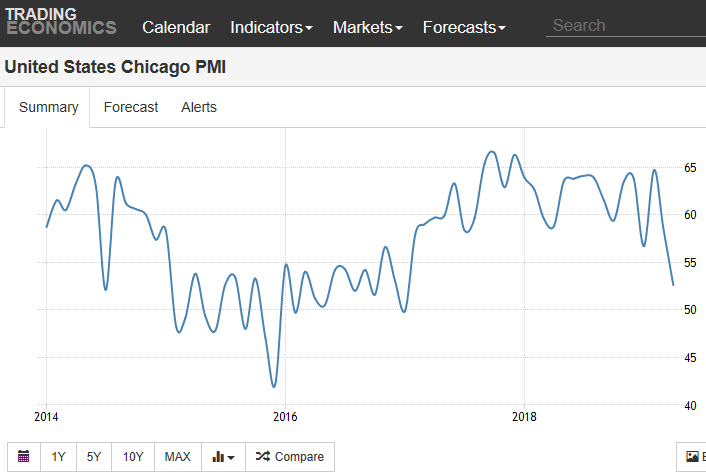

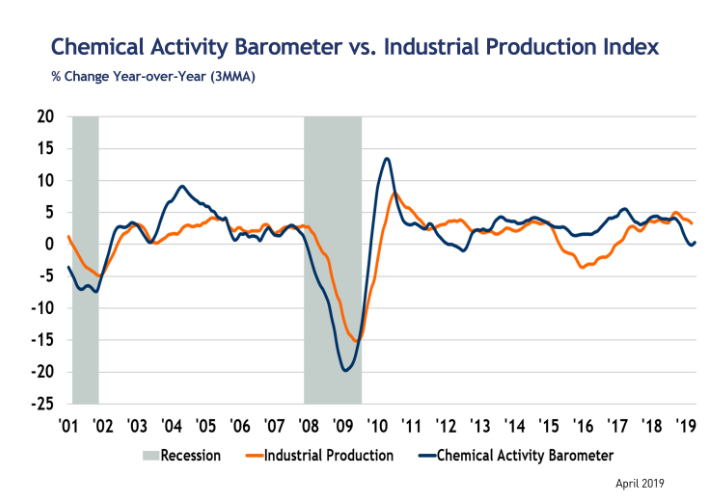

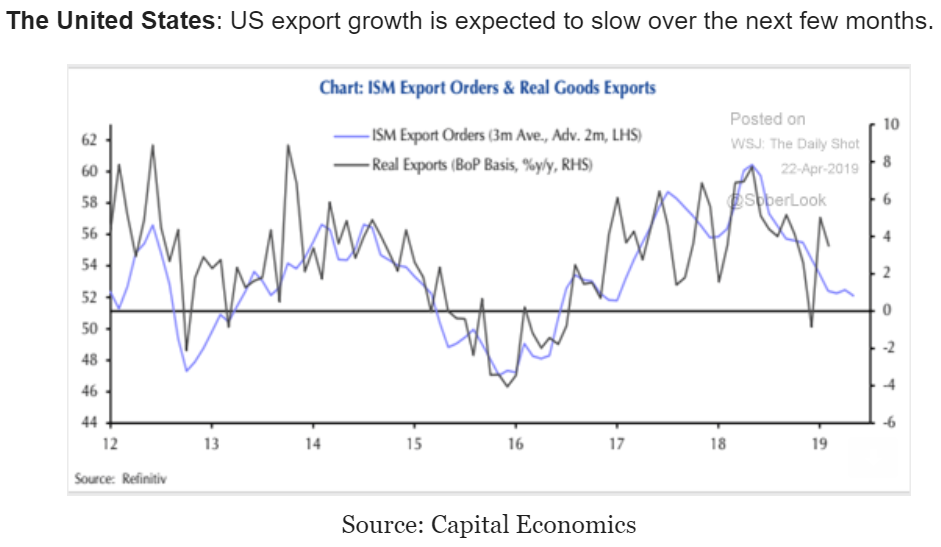

The President’s tariff war initiated to enhance manufacturing seems to instead be undermining it:

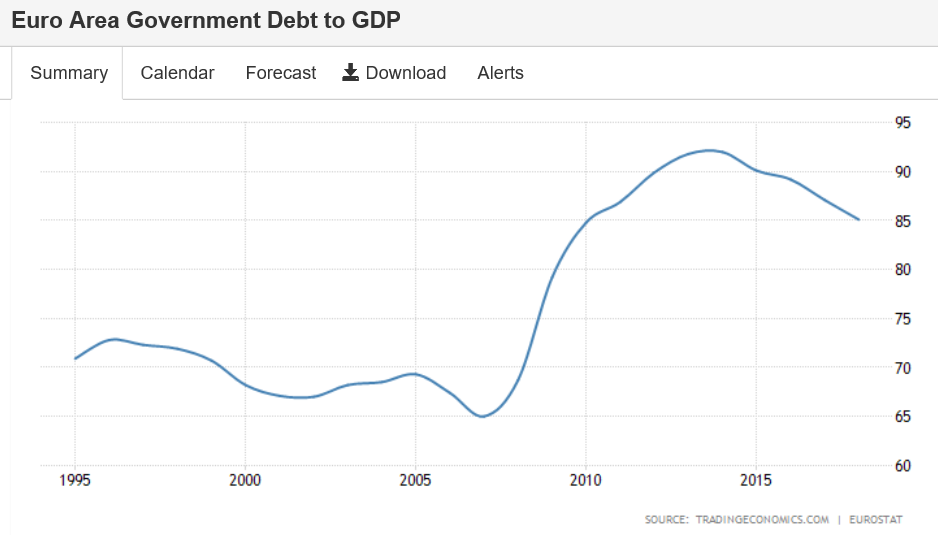

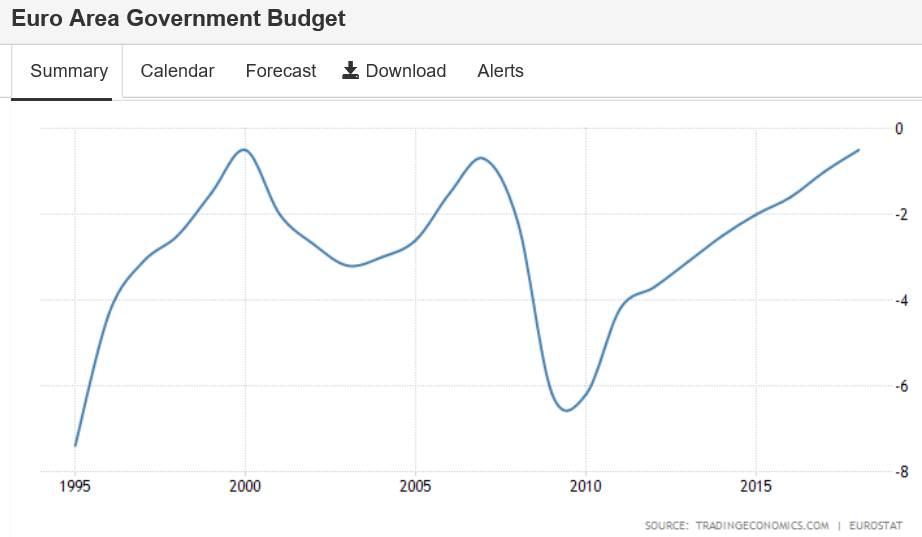

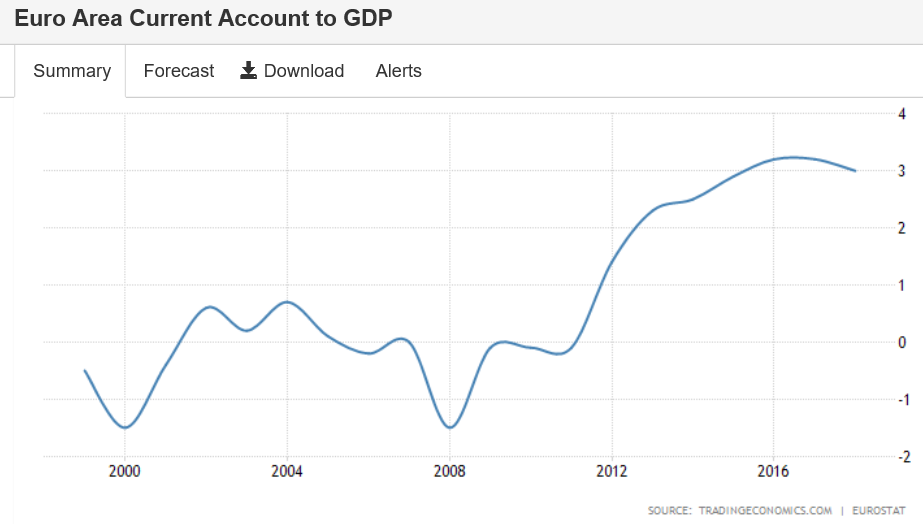

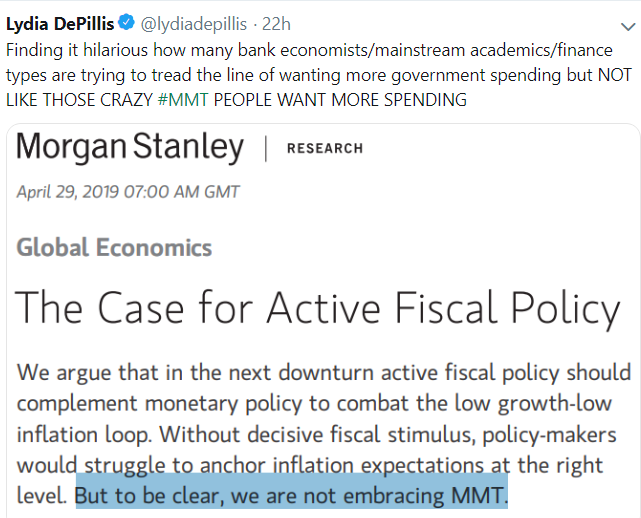

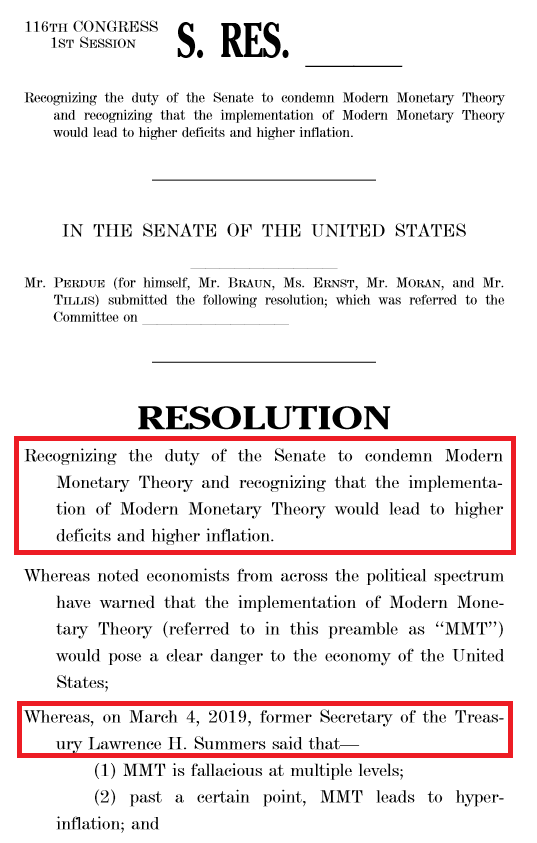

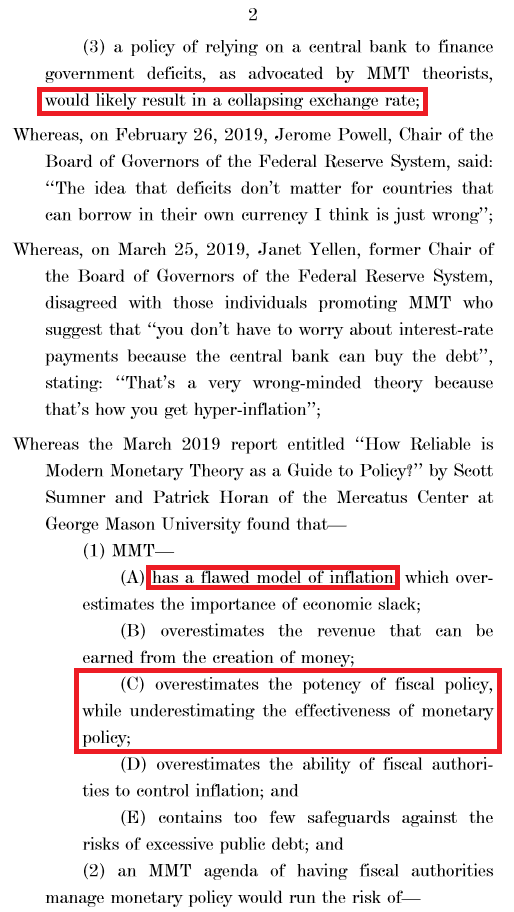

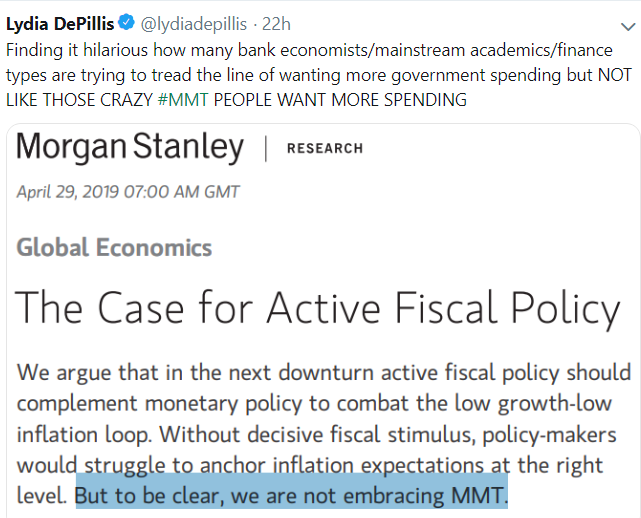

Here we go again. The exporters remain firmly in control, looking to depress domestic consumption and keep wages in check by fear mongering about the public debt has not abated:

(Nikkei) Japan will raise the 8% consumption tax to 10% as scheduled in October, barring a major financial crisis, a top official in the ruling party told Nikkei. “I haven’t heard anyone say that we could see something on the scale of the Lehman shock,” Katsunobu Kato, head of the Liberal Democratic Party’s General Council, said Wednesday. “It’s appropriate for us to proceed as planned.” Prime Minister Shinzo Abe decided to delay planned increases in 2014 and 2016. This time, he has said the government will go through with the increase, barring a disruption on par with the 2008 crisis.

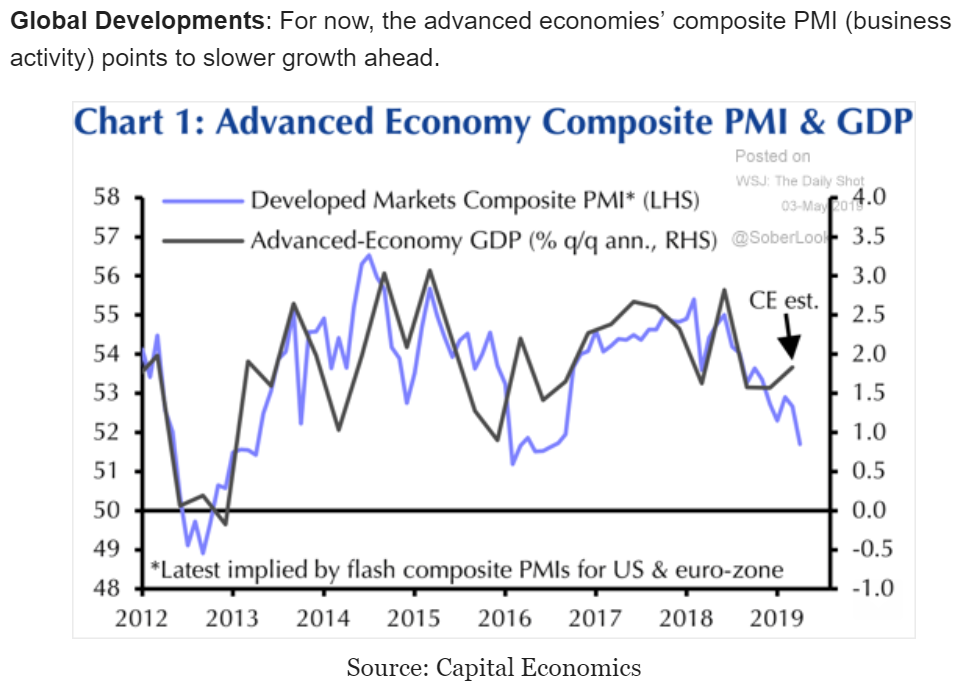

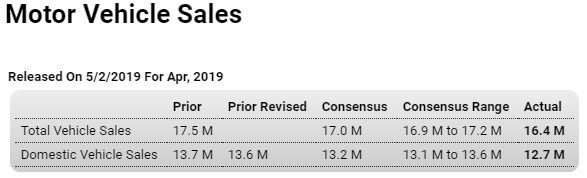

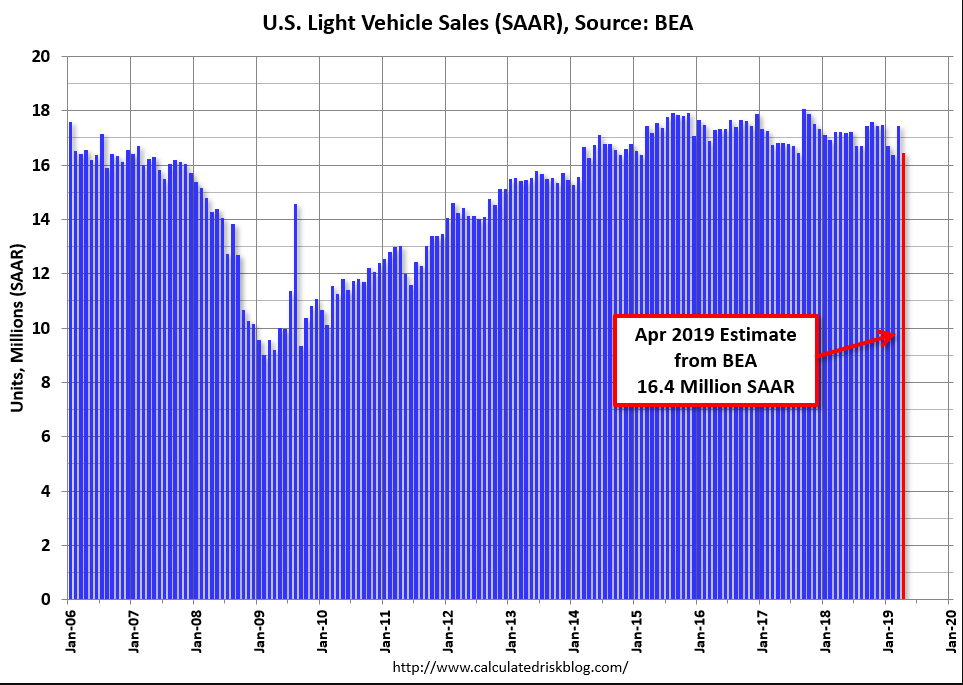

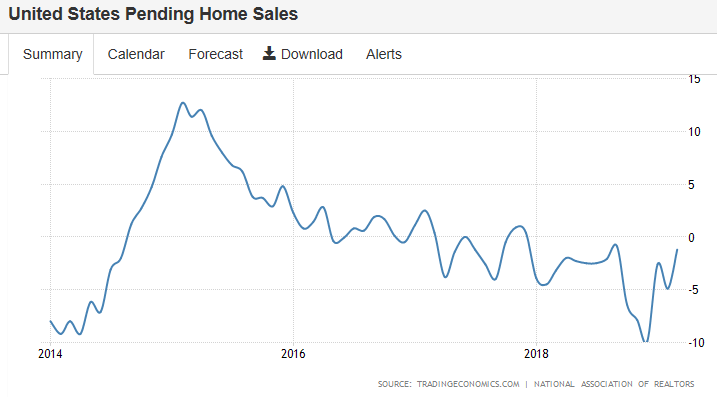

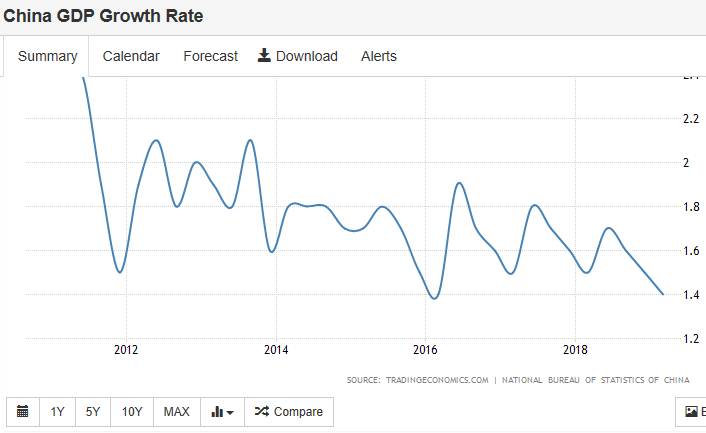

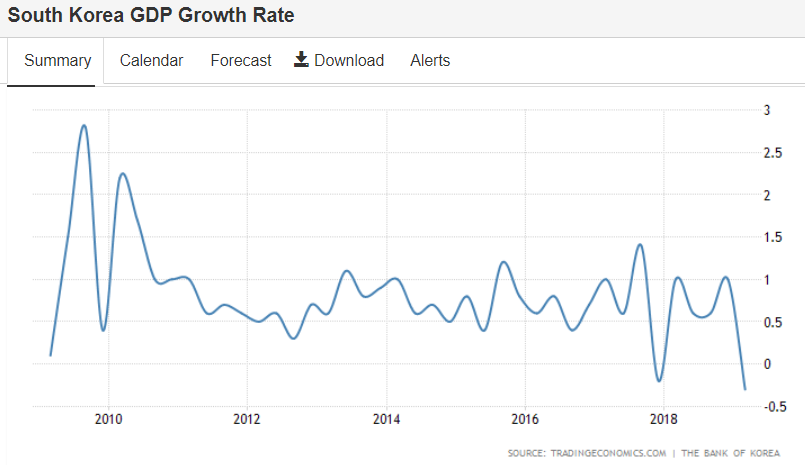

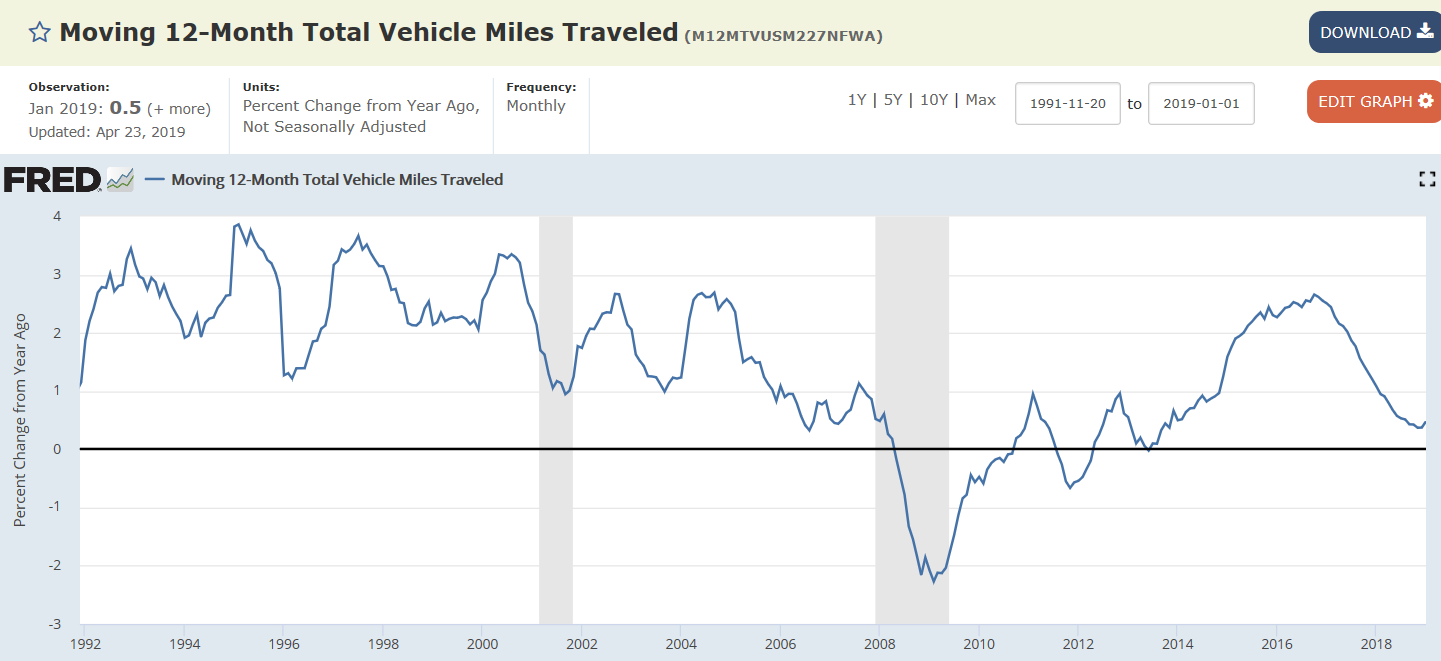

Global trade deceleration:

(Nikkei) Hong Kong’s real gross domestic product rose 0.5% on the year in the January-March quarter. The economy expanded at the slowest rate since July-September 2009, and decelerated markedly from a 1.2% increase reported for the fourth quarter of 2018. Consumption edged up 0.1% on the year last quarter, compared with a 2.7% gain in October-December. Exports of goods fell 4.2%, while imports dropped 4.6%. Rapid growth in January-March 2018, which came to 4.6%, also left less room for improvement, according to the spokesperson.

How about this!!!

https://www.perdue.senate.gov/imo/media/doc/MMT%20Resolution.pdf