Real final sales slowing, and business equipment growth negative:

From the NY Fed, reads like credit growth slowing:

Total Household Debt Rises for 19th Straight Quarter, Now Nearly $1 Trillion Above Previous Peak

The report includes a one-page summary of key takeaways and their supporting data points. Overarching trends from the Report’s summary include:

Housing Debt

Mortgage balances rose by $120 billion, to $9.2 trillion. Mortgage originations declined to $344 billion from $401 billion, the lowest level seen since the third quarter of 2014. Mortgage delinquencies improved slightly, with 1.0% of mortgage balances 90 or more days delinquent, down from 1.1% in the fourth quarter of 2018. Non-Housing Debt

Outstanding student loan debt increased by $29 billion, to $1.49 trillion. Newly originated auto loans totaled $139 billion, continuing a long-running growth trend. Credit card balances fell slightly, to $848 billion from $870 billion.

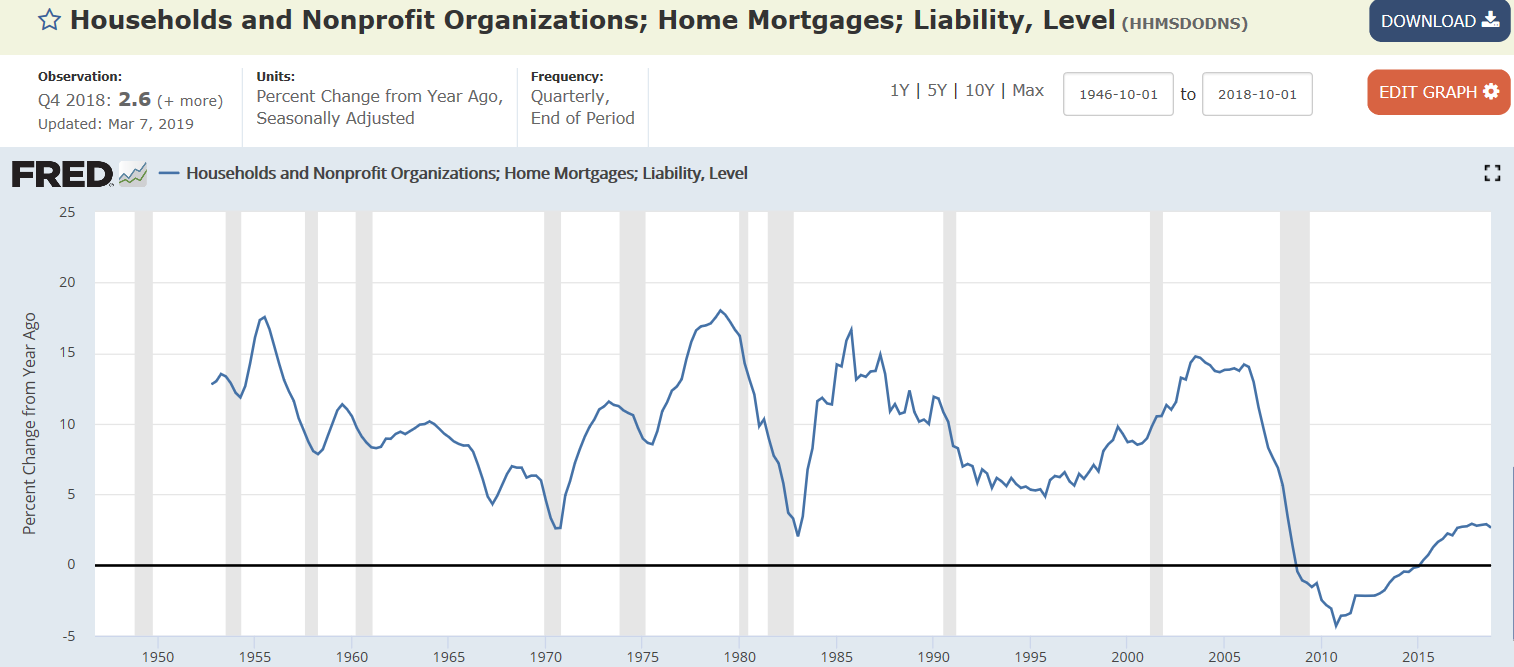

Through year end- credit growth low and slowing:

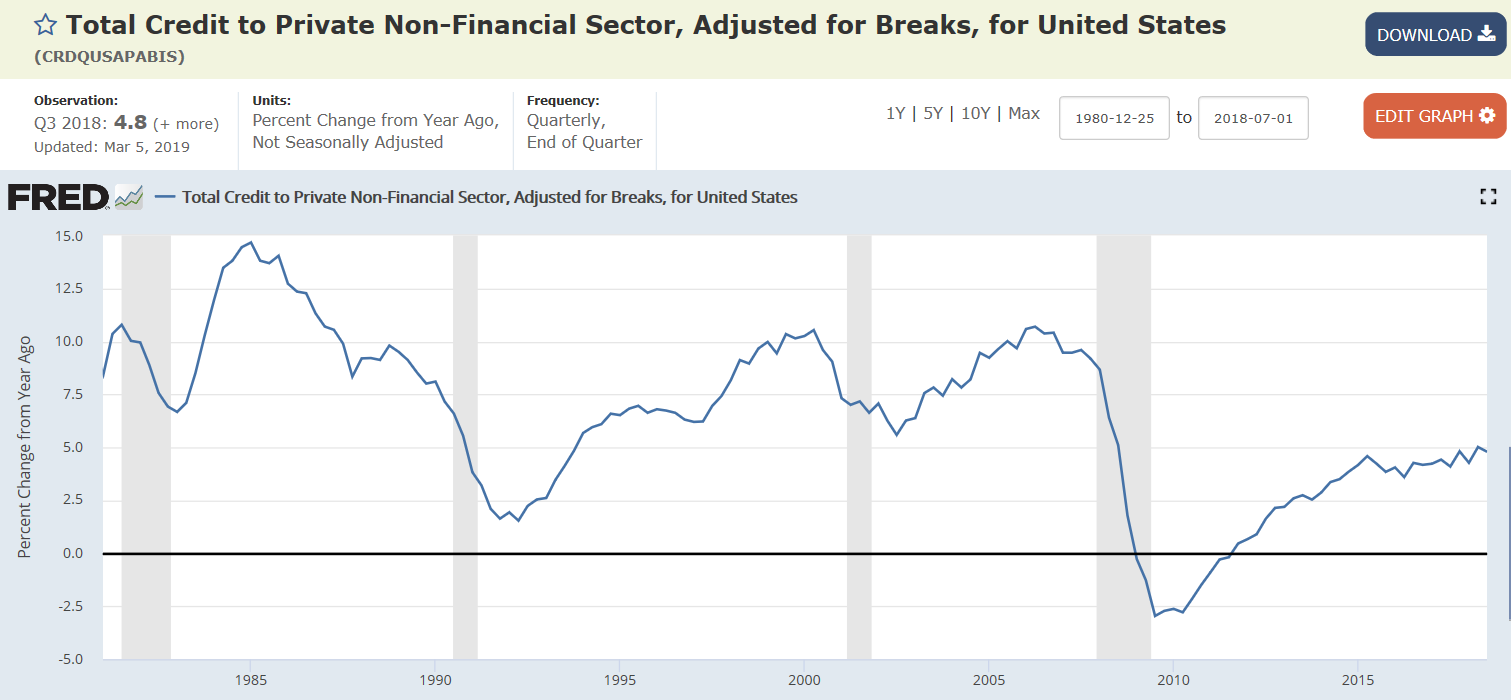

Only through q3 available:

As of year end:

Rolled over?