The euro remains under the cross currents of deflation driven further by the austerity measures that make it stronger.

And portfolio shifting out of euro mainly into dollars and gold out of fears of disintegration and restructuring that are making it weaker.

The latter is currently the stronger force as evidenced by the falling euro and rising price of gold, especially when priced in euro.

It may even be a case of allowing ‘insiders’ to get out and leave the public institutions like banks holding the bag at the point of restructuring at the expense of the remaining shareholders.

The deflation forces are evident in the falling commodity prices, declining equity values, and declining term structures of rates outside of the euro zone, where the politics of fiscal austerity also seem to be getting the upper hand as the world goes the way of Japan.

And each passing day provides more evidence that ultra low overnight rates from central banks are in fact deflationary, probably through the income and cost channels, which allows governments to have a much lower level of taxation for a given level of government spending (higher deficits) to sustain optimal levels of output and employment.

Unfortunately they firmly believe the opposite and continue with their deflationary, overly tight fiscal policies.

And talk coming out of China about ‘monetary easing’ tells me they see reason to be very concerned about their growth as well.

So it looks like the two external threats to the US economy, the euro zone and China, are indeed happening as feared.

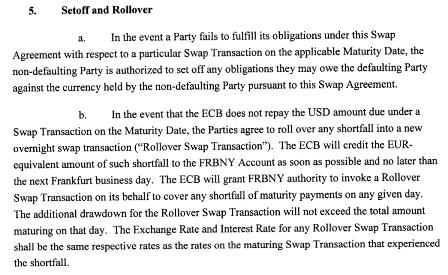

Last, on a reread and after discussion, the new Fed swap lines look to be both unsecured and containing rollover language that reads as the foreign central banks being able to roll over their loans in perpetuity meaning they are not loans but one way fiscal transfers from the US to foreign central banks, as repayment is strictly voluntary.

EU Daily

Zapatero Said Sarkozy Threatened to Leave Euro, El Pais Says

ECB’s Trichet Dismisses Inflation Fears

ECB’s Tumpel Says Inflation to Be Fought ‘Without Compromise’

Volcker Sees Euro ‘Disintegration’ Risk From Greece

Trichet Says ECB Plans Time Deposits to Sterilize Buys

ECB Will Give ‘Sterilization’ Details Next Week

Quaden Says Market Reaction to Greece Was Excessive

German Cities’ Deficits to Hit Record in 2010, Rundschau Says

ECB Pares Spanish, Italian Bond Purchases, AFME Says

Constancio Says ECB Will Give Details on Sterilization Soon

Spain’s Core Inflation Turns Negative for First Time