They even tried to spin this positively:

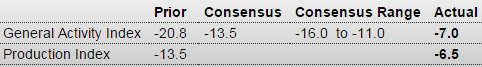

United States : Dallas Fed Mfg Survey

Highlights

The Texas manufacturing sector is still falling but not falling as fast as prior months. The general activity index improved but to a still very weak minus 7.0 from a deeply negative minus 20.8 percent in May. The production index improved to minus 6.5 from minus 13.5 percent in the May report.

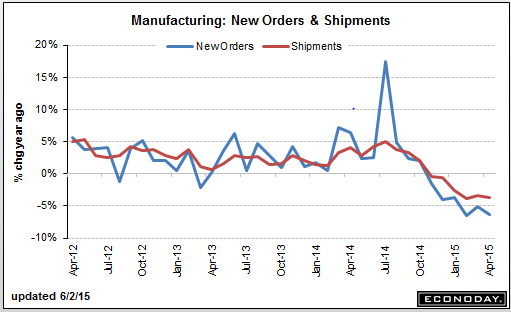

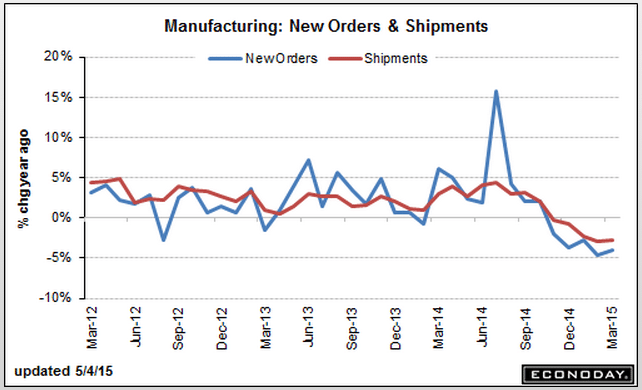

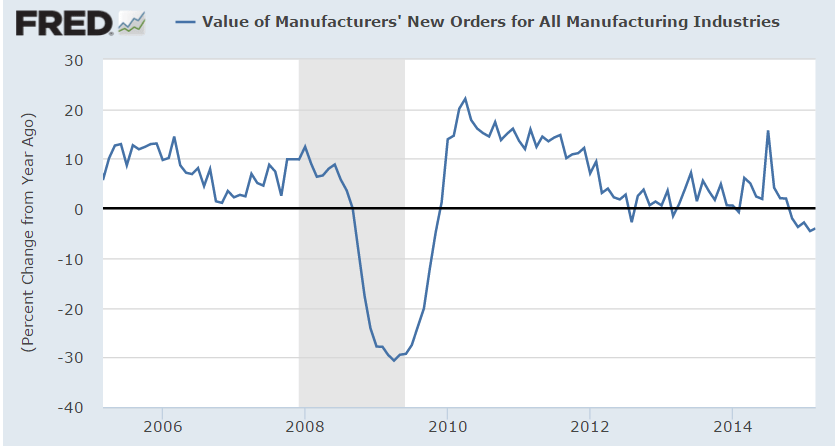

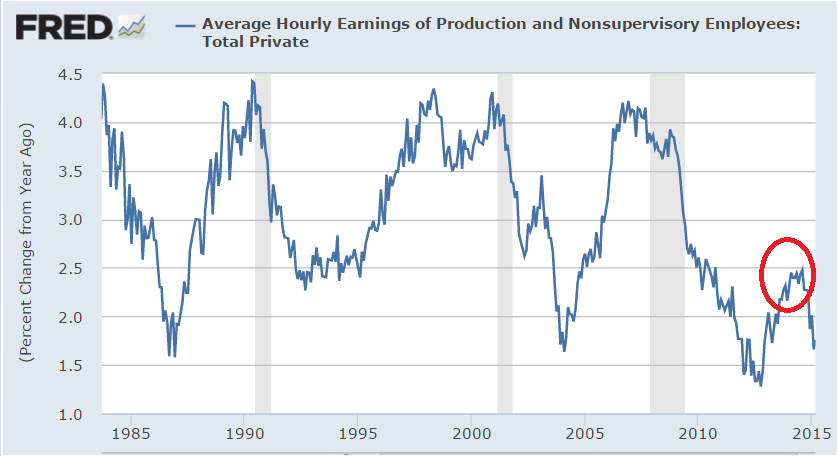

New orders, however, remain very weak, still in the double-digit negative column at minus 10.3. Shipments are in the high single-digit negative column at minus 8.8. Nearing the plus column, however, is employment, at minus 1.2 vs May’s minus 8.2. Price data show upward pressure for inputs, moderating downward pressure for finished goods, and steady upward pressure for wages.

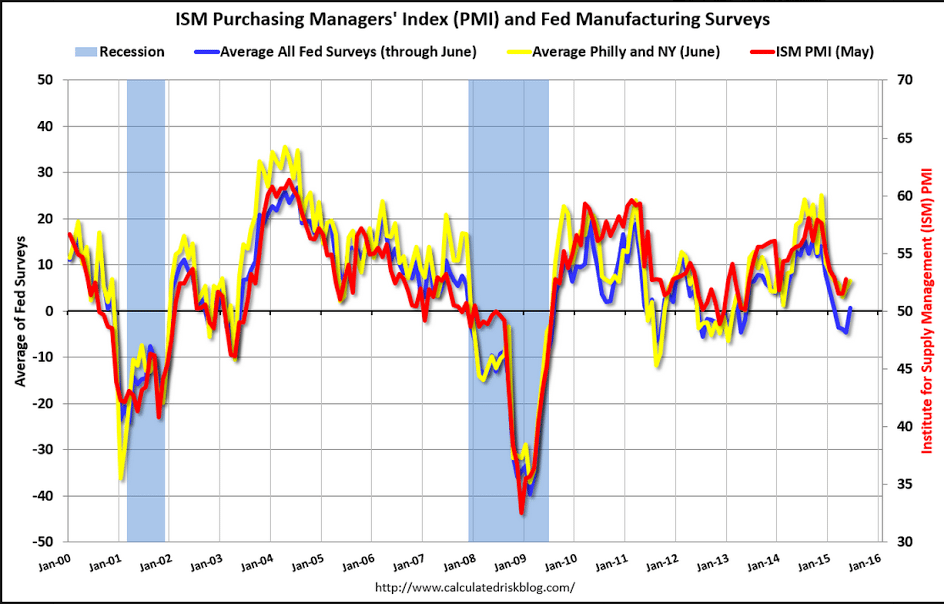

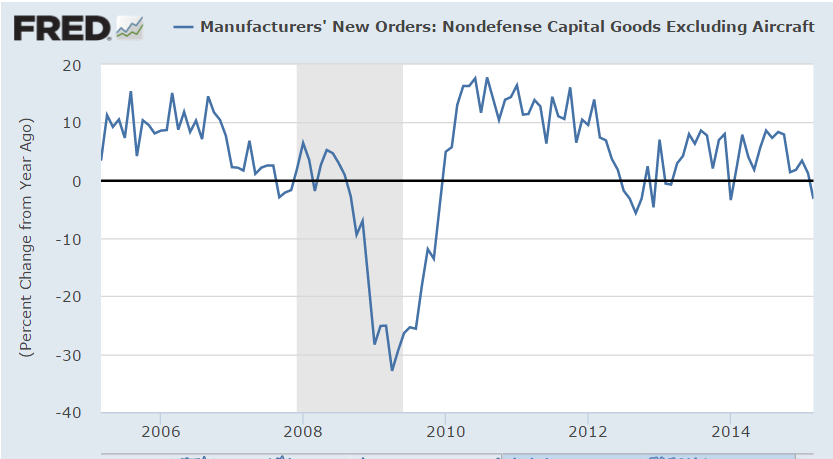

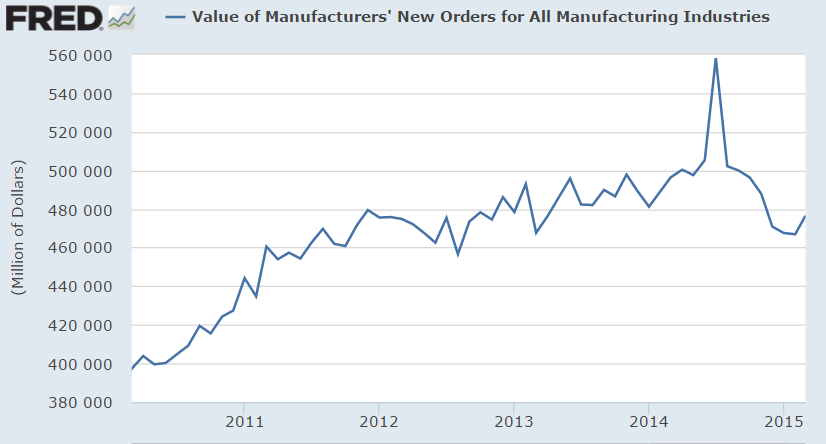

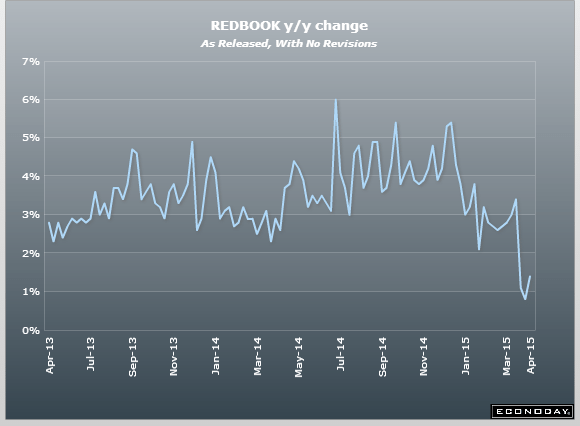

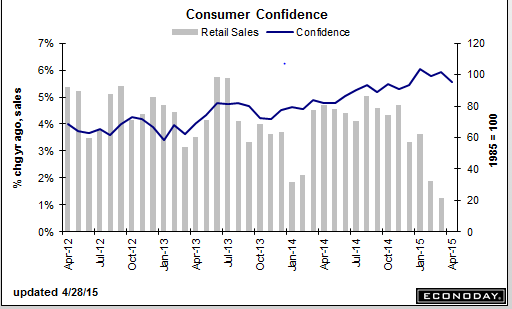

This is the last of the regional manufacturing surveys from the Fed and the bulk, with the exception of the Philly Fed, pointing to another month of weakness for the sector which continues to get hit with a one-two punch: weakness in exports and also, as especially evidenced in this report, weakness in energy equipment.

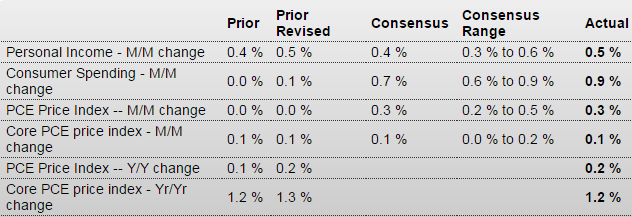

Check out the individual indicators, where only the ‘activity index’ was up:

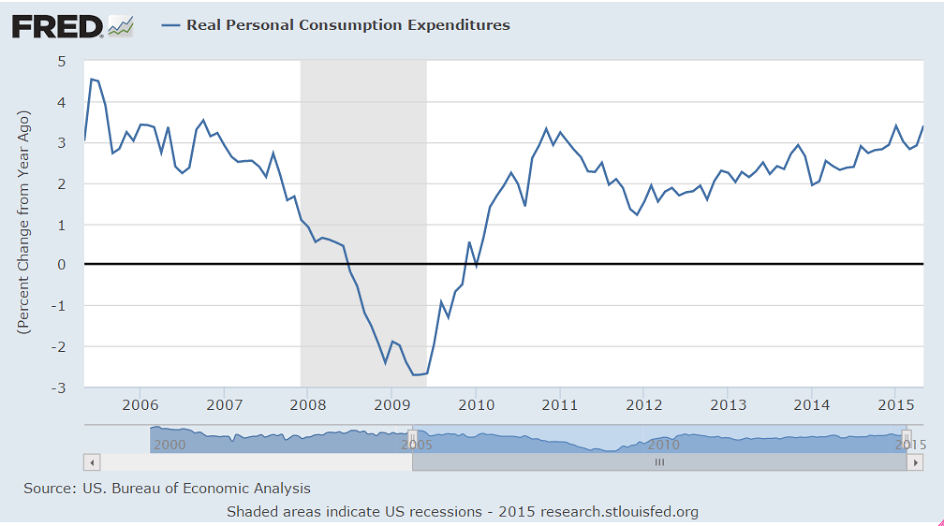

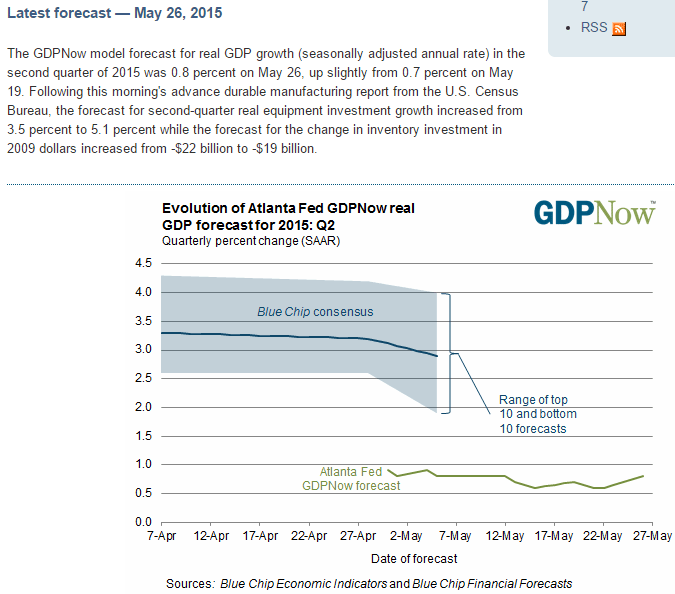

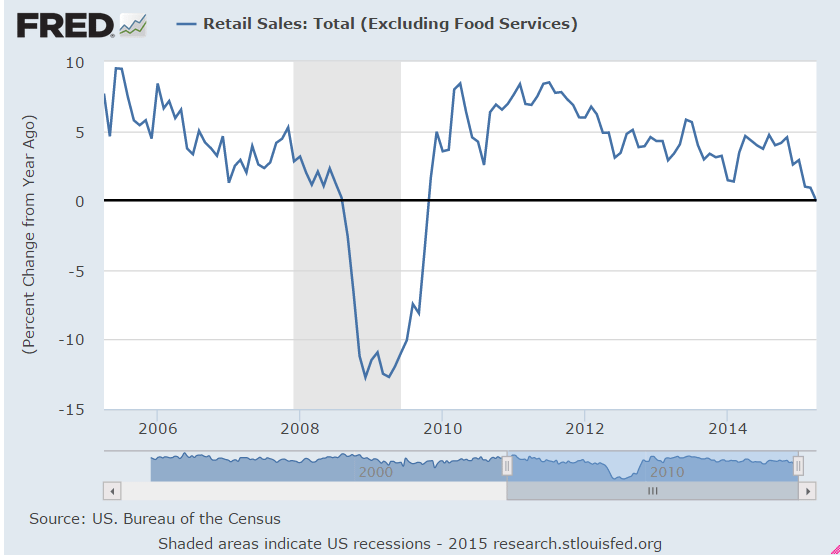

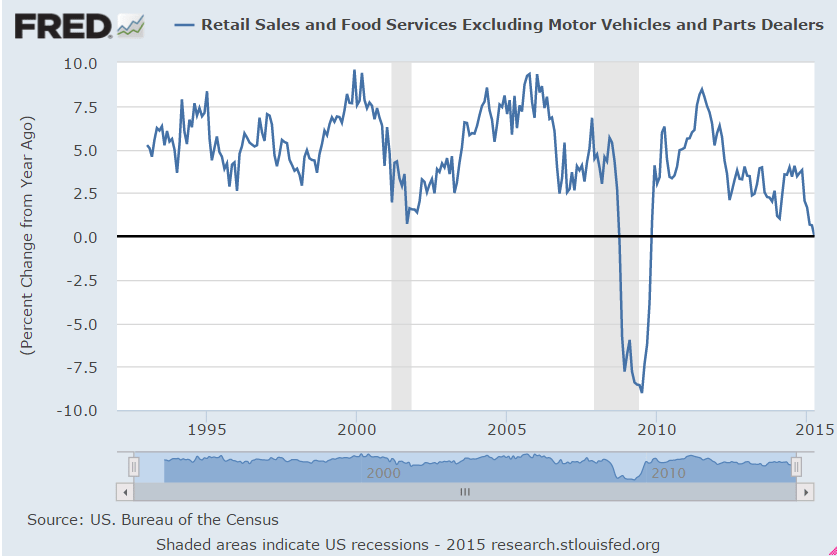

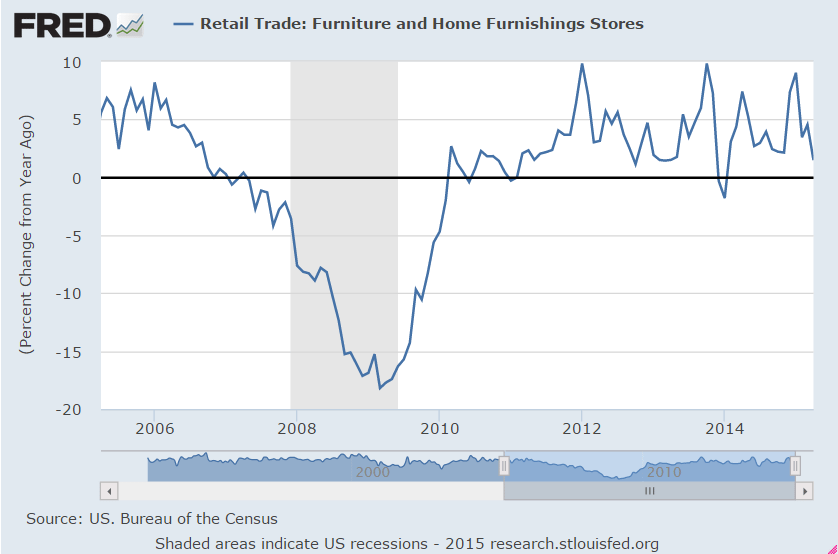

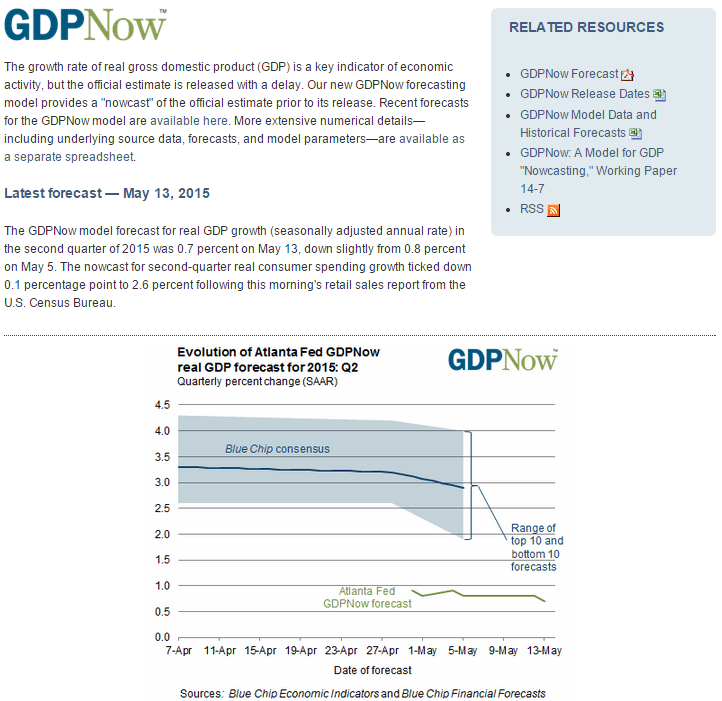

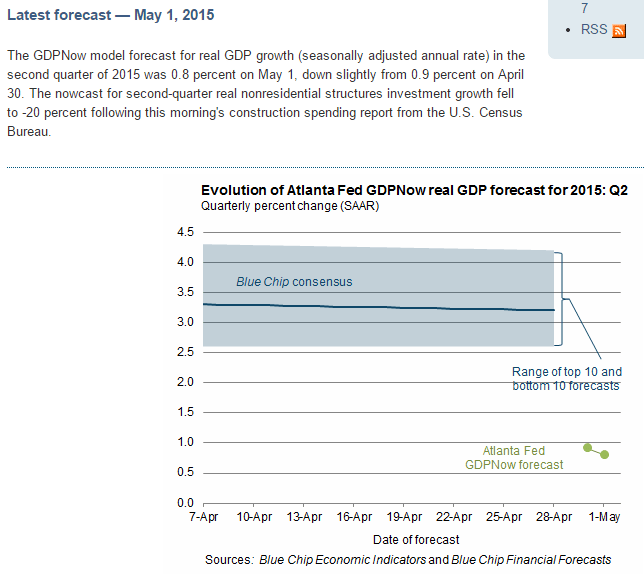

And none of this indicates Q2 improved from Q1, just maybe got worse less fast: