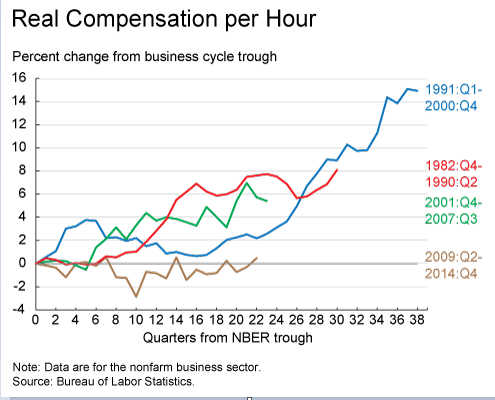

Behind the Slow Pace of Wage Growth

Factory Orders

Highlights

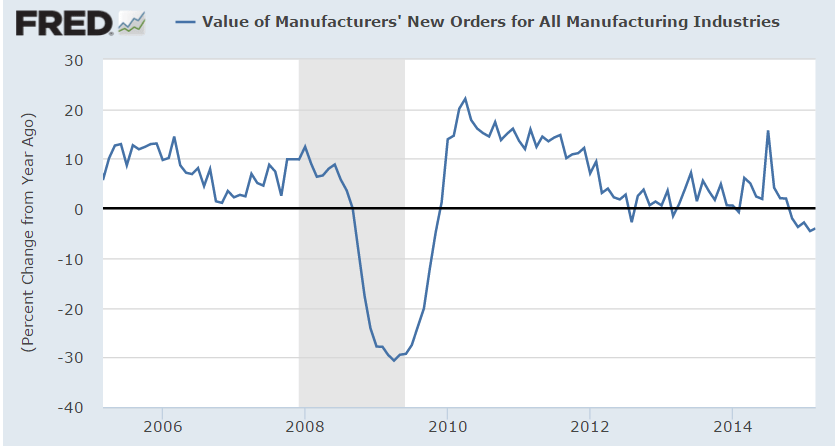

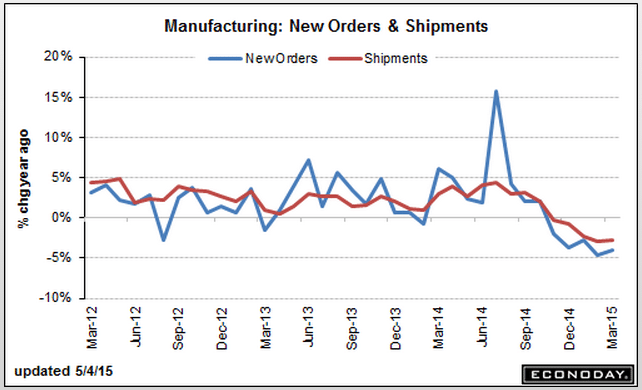

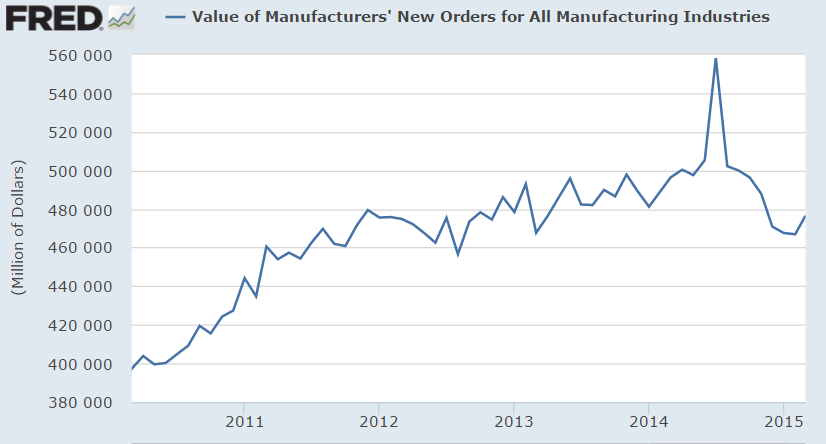

Boosted by aircraft and also by motor vehicles, factory orders rose an as-expected 2.1 percent in March. March’s gain ends what were 7 straight declines as February, which was initially at plus 0.2 percent, is revised now to minus 0.1 percent. The 7 straight declines are the most striking evidence of how hard the manufacturing sector has been hit, by the strong dollar that weakens exports and also specific trouble in the energy sector due to the downturn in oil.

But in March, the sector got a big boost from civilian aircraft, an industry where big monthly swings are normal, but also from motor vehicle & parts where orders rose 6.0 percent in what is one of the very strongest gains of the recovery. Excluding transportation, however, orders were unchanged compared to only a 0.1 percent gain in February, with the latter revised down sharply from an initial reading of plus 0.8 percent.

Energy equipment rebounded 4.8 percent in the month but following a long streak of declines including an 18.5 percent drop in February. Industrial machinery was also down on the month. Other industries on the plus side include computers and defense capital goods.

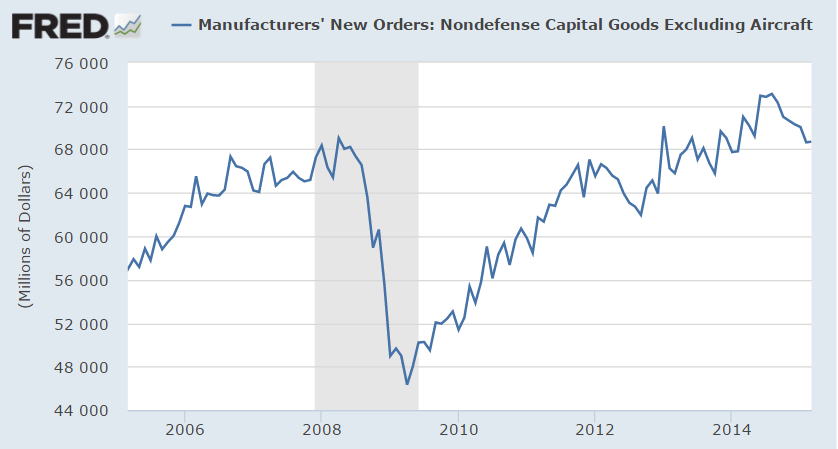

Orders for capital goods in general were mixed, up only 0.1 percent on the core, which excludes aircraft, and extending their downward slope.

Other readings include a sizable 0.5 percent rise in shipments. Another plus is a small rise in unfilled orders which have been especially weak. Inventories held steady relative to sales, with the inventory-to-sales rate unchanged at 1.35.

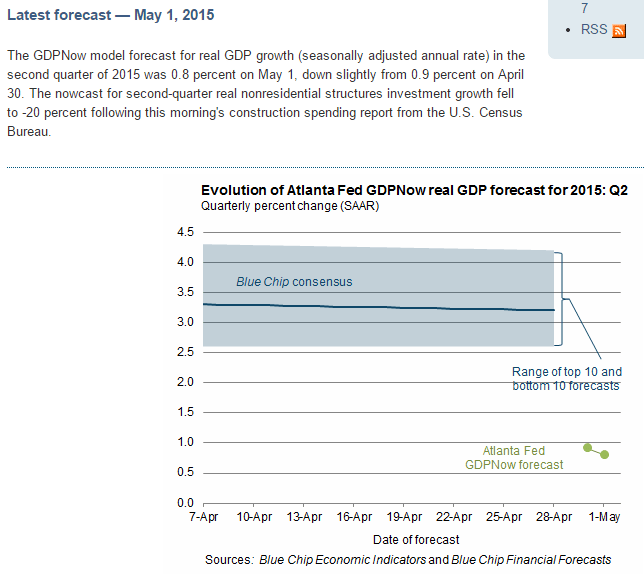

The pop in March ends the first quarter on a positive note but the early indications on the second quarter, despite expectations of an outsized weather boost, have all been soft.

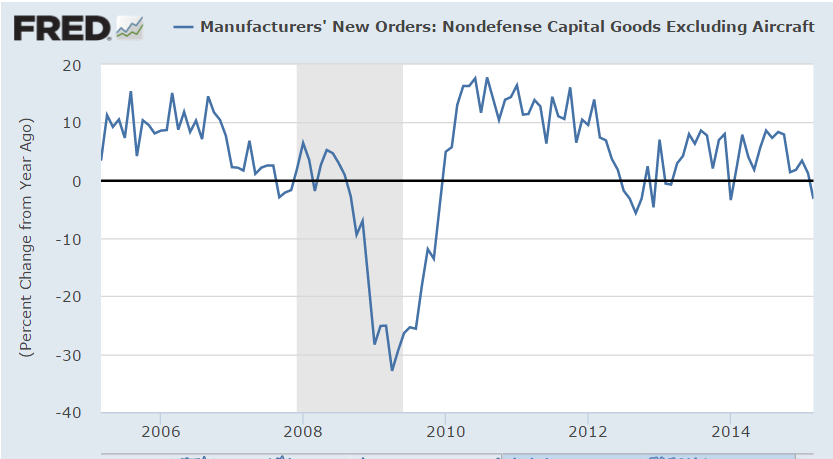

Remember all that cheerleading last year about how NOW capex was going to pick up?

No chance of recession?