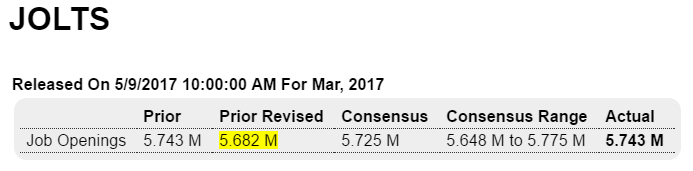

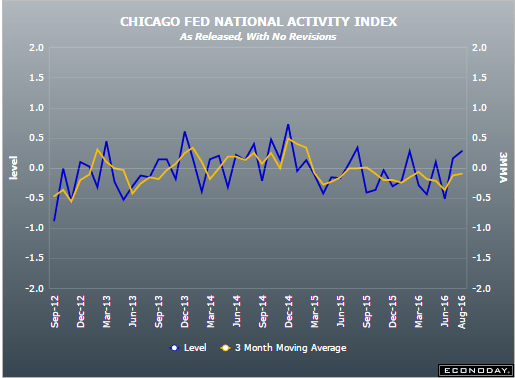

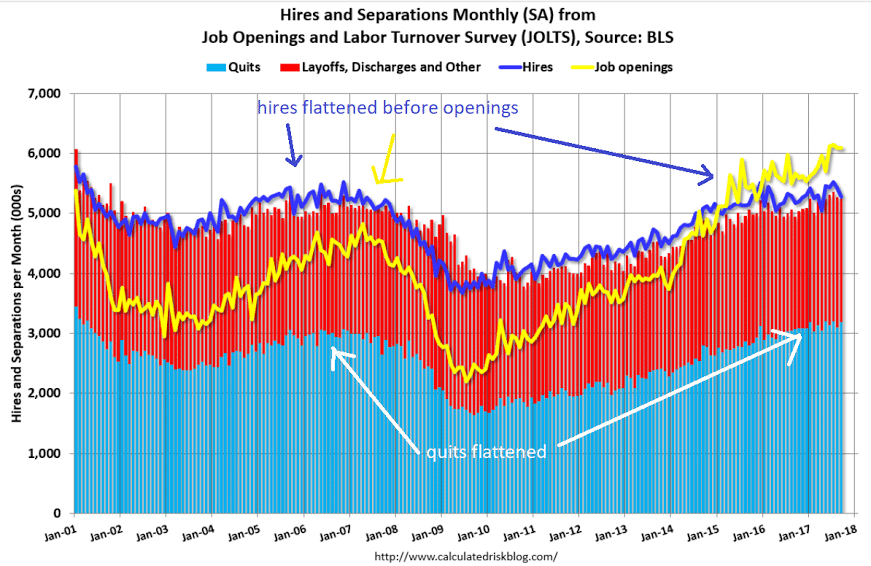

Note that hires and quits have stopped growing, and historically both lead job openings, in yet another indication that this cycle has reversed:

Highlights

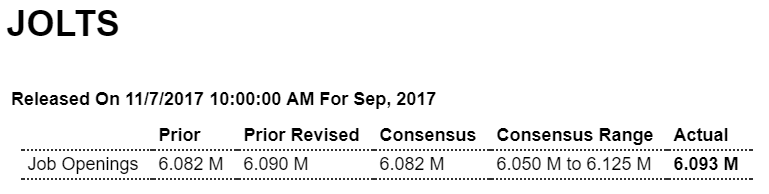

September job openings edged up slightly to a very abundant 6.093 million from a revised 6.090 million in August. Over the month, hires and separations were also little changed at 5.3 million and 5.2 million, respectively. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.2 percent and 1.2 percent, respectively.

Large numbers of hires and separations occur every month throughout the business cycle. Net employment change results from the relationship between hires and separations. When the number of hires exceeds the number of separations, employment rises, even if the hires level is steady or declining. Conversely, when the number of hires is less than the number of separations, employment declines, even if the hires level is steady or rising. These totals include workers who may have been hired and separated more than once during the year.

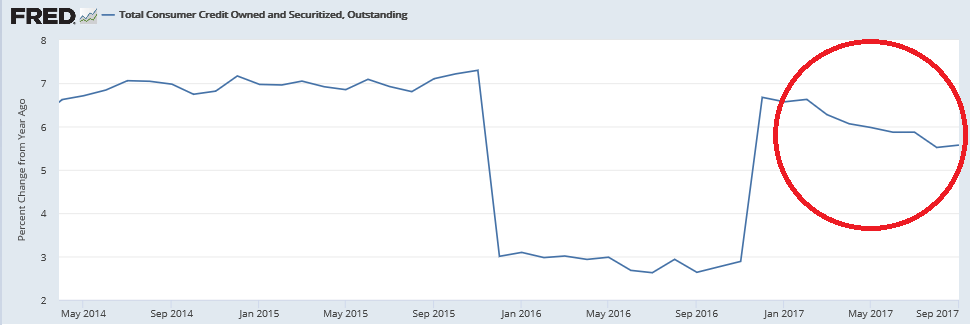

Looks a lot like a one time event to finance vehicles to replace those lost in the hurricane, and maybe some borrowing on credit cards as incomes fell short for the same reason, but in any case the chart shows it’s been decelerating since the election:

Highlights

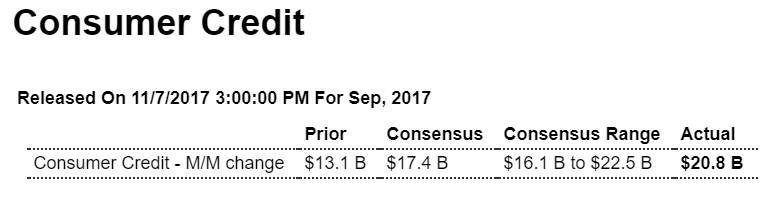

Consumer credit rose a greater-than-expected $20.8 billion in September. Both revolving and non-revolving credit posted sharp gains. Revolving credit which is where credit-card debt is tracked rose a sizable $6.4 billion after increasing $5.5 billion in August. The gain for the non-revolving component, where auto financing and also student loans are tracked, jumped $14.4 billion after $7.6 billion. This report is not about weakness but about strength, at least strength for consumer spending.

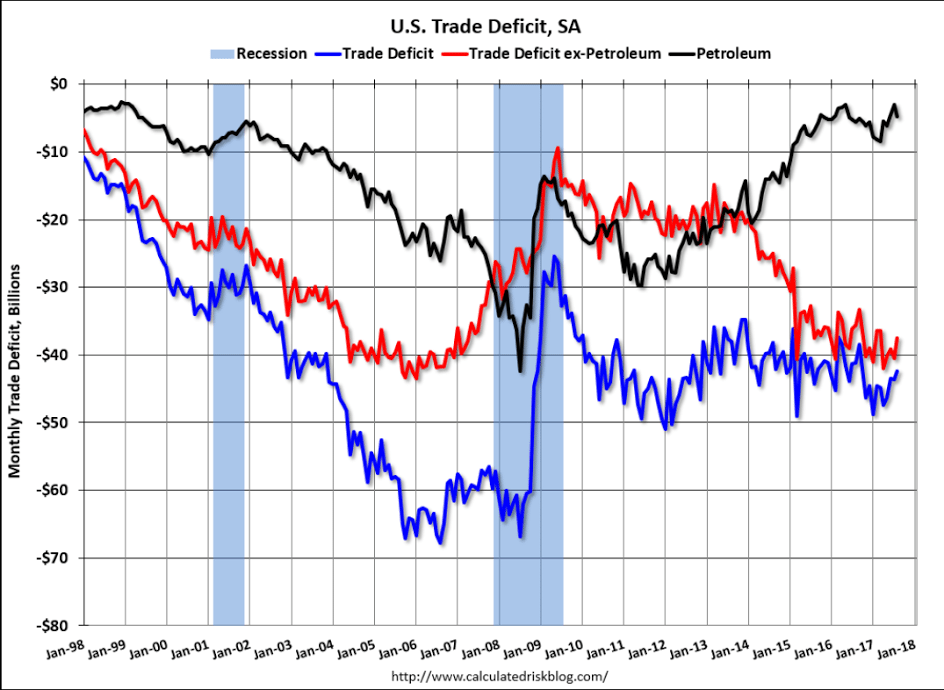

Not that the deficit matters the way they think it does- It’s just the $ spent by govt. that haven’t yet been used to pay taxes and sit as cash, $ in reserve accounts at the Fed and $ in securities accounts at the Fed (aka tsy secs) until used to pay taxes.

But after all this time they’re just now addressing this?

Tax cut-driven economic growth alone won’t wipe out the deficit, top House tax writer Brady admits

“Growth alone, I acknowledge, won’t get us back” to a balanced budget, says the House Ways and Means Committee chairman. Critics say the GOP tax package would add to the deficit. Kevin Brady’s committee is set to begin revising its tax reform plan on Monday to court holdout lawmakers.

GOP tax cuts will not pay for themselves, add ‘significantly’ to US debt: Fitch report

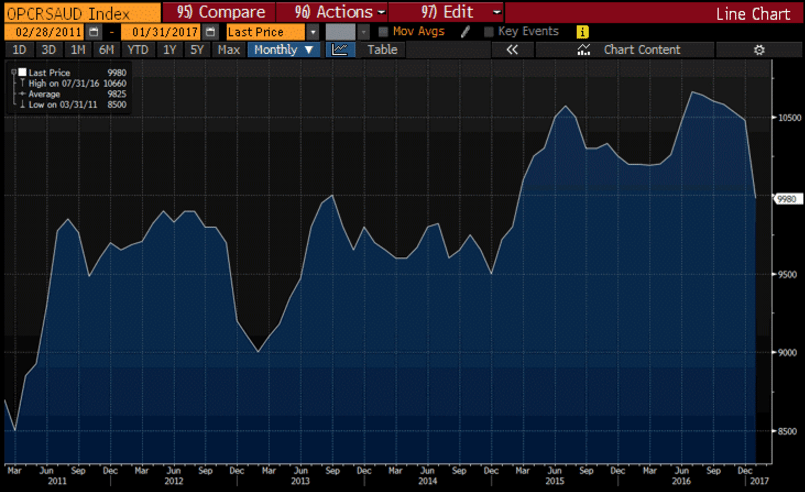

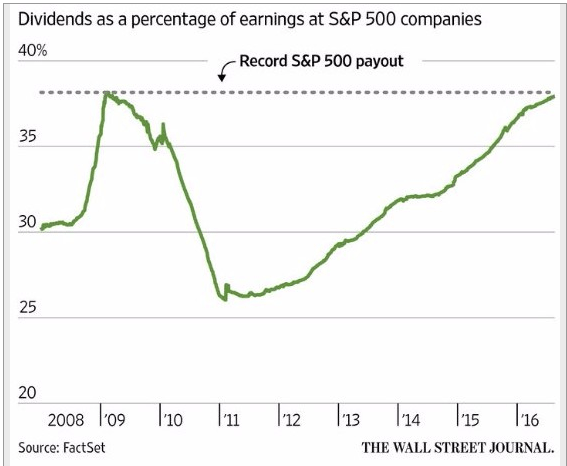

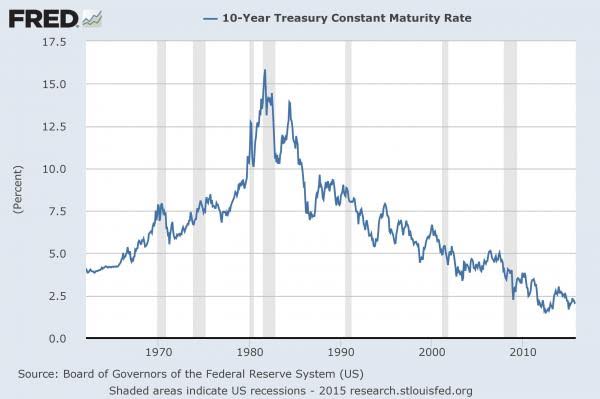

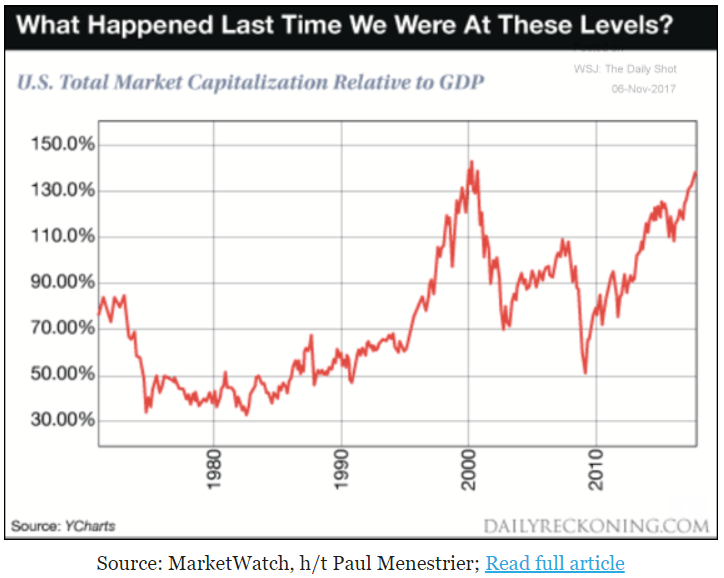

This chart is getting attention again. It isn’t interest rate adjusted, so we’ll see if that matters:

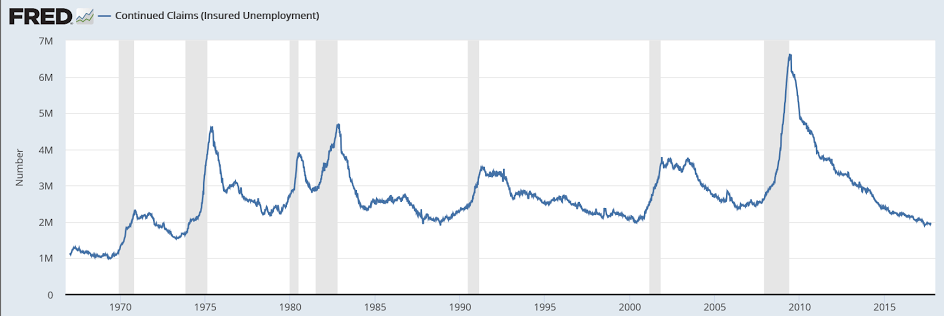

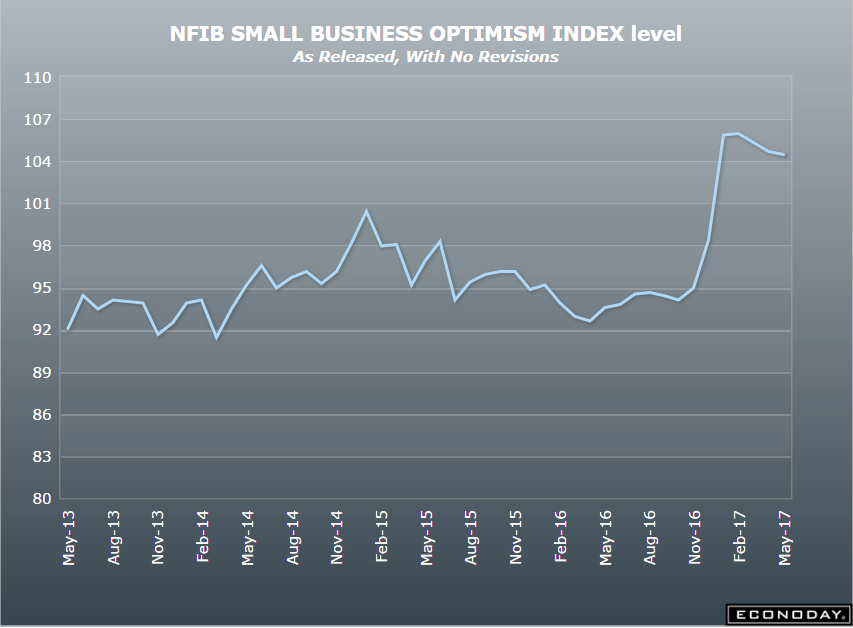

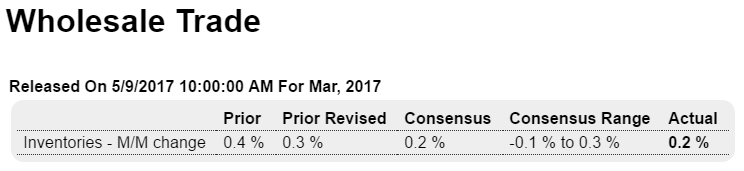

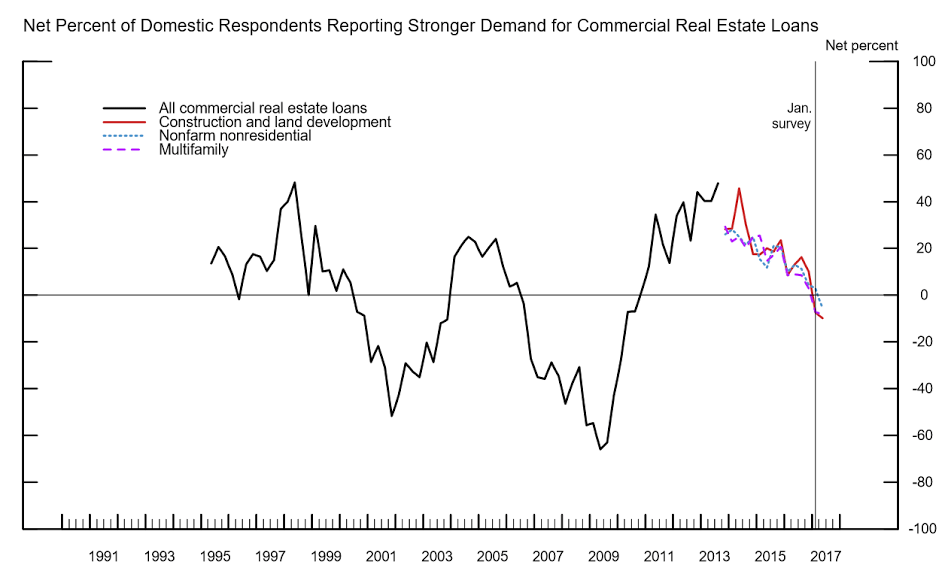

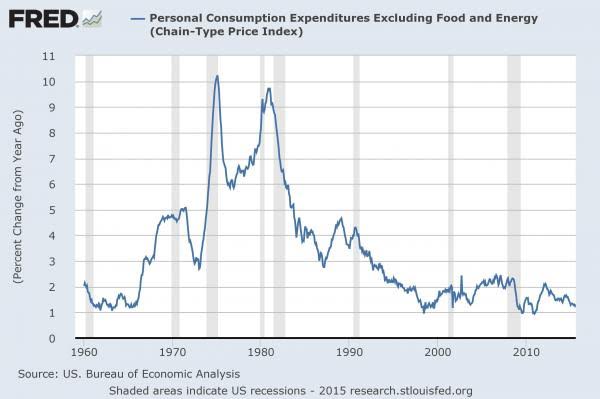

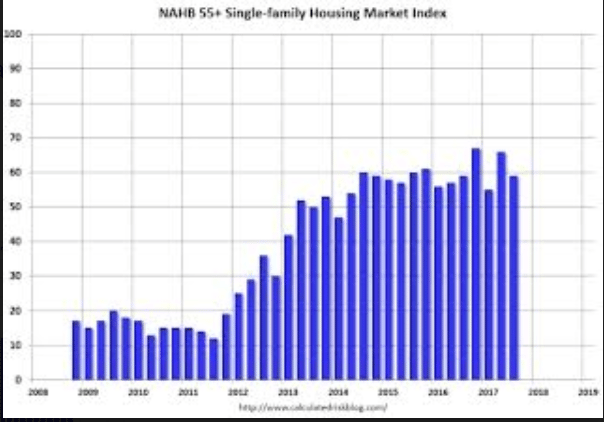

This may have leveled off as well:

MMT conference closing remarks: