Looks to me like the central bankers are worried the outcome will be inflationary, or worse. Seems when gold goes up it turns out it was central bank buying of one sort or another.

For all practical purposes they have an unlimited budget to buy gold. It falls under what I call off balance sheet deficit spending. The central bankers buy in their own currency, paying for it with a credit to the account of the seller’s bank they enter on their own books. The gold is accounted for as the asset and the (new) funds credited the liability, no questions asked, no budget rules involved.

Category Archives: Inflation

Jackson Hole speech

The Chairman seems to be well aware of the upturn in housing, which he mentioned twice. But he was careful to not reveal an upbeat attitude that he knows would cause rates to spike in expectation of the Fed ‘normalizing’ policy with ‘neutral’ being a Fed funds rate maybe 1% over the inflation rate, or something like that.

In other words, he wants longer term rates, and mtg rates in particular, to stay down for now, which causes him to guard any optimism he may have, and then some.

It falls under ‘managing expectations’ and my best guess is he’s waiting for unemployment to fall below 8% before he publicly becomes more optimistic.

“Key sectors such as manufacturing, housing, and international trade have strengthened, firms’ investment in equipment and software has rebounded, and conditions in financial and credit markets have improved.”

“Rather than attributing the slow recovery to longer-term structural factors, I see growth being held back currently by a number of headwinds. First, although the housing sector has shown signs of improvement, housing activity remains at low levels and is contributing much less to the recovery than would normally be expected at this stage of the cycle.”

Gold standard thoughts

>

> (email exchange)

>

> On Fri, Aug 24, 2012 at 5:28 AM, Dave wrote:

>

> When you get a chance could you send a quick note out on problems with this type of

> thinking?

>

The reasons nations have gone off the gold standard isn’t because it was working so well and their economies were doing well. The reason they go off, like the US did in 1934, was because it was a disaster.

Historically nations suspend their gold standards in times of war, when they need their economies to function to the max. If a gold standard was so good for an economy, why suspend it when you need max economic performance? Obviously because it is not conducive of maximum real output.

The ideological issue is whether the primary function of the currency is to be an investment/savings vehicle, or a tool for provisioning government and optimizing real economic performance. In a market economy you can’t fix the price of two things without a relative value shift causing you to be buying one of them and running out of the other. Likewise, you can’t sustain full employment and a stable gold price if there is a shift in relative value between the two.

A gold standard is a fixed exchange rate policy, where the govt continuously offers to buy or sell gold at a fixed price.

This means the holder of a dollar, for example, has the option of ‘cashing it in’ for a fixed amount of gold from the govt, and a holder of gold has the option of selling it at a fixed price to the govt.

Therefore a new gold discovery which causes gold to be sold to the govt is inflationary and tends to increase output and employment, and a gold ship sinking in transit or a sudden desire to hoard gold is deflationary and tends to decrease output and employment. And there’s nothing that can be done about these relative value shifts, except to ride them out. The only public purpose served (by definition) is the stable nominal price of gold set by Congress.

With a gold standard, like any fixed fx regime, interest rates are necessarily set by market forces. With the govt’s spending being convertible currency, it is limited to spending only to the extent it has sufficient gold reserves backing the currency it spends. With gold reserves generally pretty much constant and not expandable in the short run, this means govt spending is limited to what it can tax and/or borrow. So when the govt wants to deficit spend, doing so by ‘printing’ new convertible dollars risks those dollars being ‘cashed in’ for gold. Govt borrowing, therefore, functions to remove that risk by delaying conversion privileges until the borrowings mature. This means the govt is competing with the right to convert when the govt borrows. In other words, the holder of the gold certificates has the option of either converting to gold or buying the treasury securities. The interest rate the treasury must pay therefore represents the indifference rate of holders of the convertible currency between cashing in the currency for gold now or earning the interest rate and not being able to convert until maturity. Note that it’s in fixed exchange rate environments that govt borrowing costs have soared to triple digits as govts have competed with their conversion features, and that govts generally lose those fights as the curve goes vertical expressing the fact that at that point there is no interest rate that can keep holders of the currency from wanting to convert.

Note that this also means the nations gold reserves are the net financial equity that supports the entire dollar credit structure, a source of continuous financial fragility and instability.

It’s all here in a paper I did in the late 1990’s.

Hope this helps!

A few more thoughts:

Being on the gold standard doesn’t prevent a financial crisis, but it makes the consequences far more severe.

We were on a gold standard when the roaring 20’s private sector debt boom lead to the crash of 1929 and the depression that followed. 4,000 banks closed before we went off gold in 1934, and it was only getting worse which is why we went off of it.

Gold would not have prevented the pre 2008 sub-prime boom, but it would have made the consequences far more severe. Including no Fed liquidity provision to offset a system wide shortage due to hoarding and banks bidding ever higher for funds that didn’t exist, most all firms losing inventory financing and being forced to liquidate inventories as rates spiked competing for funds that didn’t exist, and no deficit spending for unemployment comp as federal revenues fell from the collapse. In other words, the automatic fiscal stabilizers we rely on can’t be there. Instead it’s a deflationary disaster that only ends when prices fall sufficiently to reflect changes in relative value between gold and everything else.

Note that the recent decade of gold going from under $600 to over $1,600 is viewed as a sign ‘inflationary’ and a 250% ‘dollar devaluation’ as it takes 2.5x as many dollars to buy the same amount of gold. But if we were on a gold standard, and all else equal, and gold had been fixed at $600 back then, the same relative value shift would be manifested as the general price level falling that much in an unthinkable deflationary nightmare.

Republicans Eye Return to Gold Standard

Just when you think it can’t get any worse:

Republicans Eye Return to Gold Standard

By Robin Harding and Anna Fifield

August 23 (FT) — The gold standard has returned to mainstream U.S. politics for the first time in 30 years, with a “gold commission” set to become part of official Republican party policy.

Drafts of the party platform, which it will adopt at a convention in Tampa Bay, Florida, next week, call for an audit of Federal Reserve monetary policy and a commission to look at restoring the link between the dollar and gold.

The move shows how five years of easy monetary policy — and the efforts of congressman Ron Paul — have made the once-fringe idea of returning to gold-as-money a legitimate part of Republican debate.

Marsha Blackburn, a Republican congresswoman from Tennessee and co-chair of the platform committee, said the issues were not adopted merely to placate Paul and the delegates that he picked up during his campaign for the party’s nomination.

“These were adopted because they are things that Republicans agree on,” Blackburn told the Financial Times. “The House recently passed a bill on this, and this is something that we think needs to be done.”

The proposal is reminiscent of the Gold Commission created by former president Ronald Reagan in 1981, 10 years after Richard Nixon broke the link between gold and the dollar during the 1971 oil crisis. That commission ultimately supported the status quo.

“There is a growing recognition within the Republican party and in America more generally that we’re not going to be able to print our way to prosperity,” said Sean Fieler, chairman of the American Principles Project, a conservative group that has pushed for a return to the gold standard.

A commission would have no power except to make recommendations, but Fieler said it would provide a chance to educate politicians and the public about the merits of a return to gold. “We’re not going to go from a standing start to the gold standard,” he said.

The Republican platform in 1980 referred to “restoration of a dependable monetary standard,” while the 1984 platform said that “the gold standard may be a useful mechanism”. More recent platforms did not mention it.

Any commission on a return to the gold standard would have to address a host of theoretical, empirical and practical issues.

Inflation has remained under control in recent years, despite claims that expansion of the Fed’s balance sheet would lead to runaway price rises, while gold has been highly volatile. The price of the metal is up by more than 500 per cent in dollar terms over the past decade.

A return to a fixed money supply would also remove the central bank’s ability to offset demand shocks by varying interest rates. That could mean a more volatile economy and higher average unemployment over time.

Asmussen statement

>

> (email exchange)

>

> On Wed, Aug 22, 2012 at 3:02 AM, wrote:

>

> You are totally right about him, I sent you a word doc with his exact words

> (emphasis mine)

>

Repeat: Asmussen: ECB Wants To Eliminate Doubts About Euro

2012-08-20 05:36:05.371 GMT

–First Ran On Mainwire At 2257 GMT/1857 ET Sunday

FRANKFURT (MNI) – The European Central Bank wants to remove any doubt about the permanence of the common currency, ECB Executive Board member Joerg Asmussen said in a newspaper interview published in Monday’s edition of the German daily Frankfurter Rundschau.

The German board member told the paper that financial market certainty regarding the continued existence of the euro was a necessary condition for the currency’s stability.

The ECB’s planned new bond-buying program is superior to its predecessor, the Securities Market Program, and the Governing Council will work on details at its next meeting, Asmussen said.

Noting the high risk premia for some sovereign bonds in the euro area, which he said were in part due to concerns about the reversibility of the euro, Asmussen said that such an exchange rate risk was theoretically not admissible in a currency union and was leading to the incomplete transmission of ECB monetary policy to some euro area economies.

“Our measures attempt to repair this defect in the monetary policy transmission mechanism,” he said. The worries about the euro’s permanence are no wonder, he added, given “how carelessly” the currency is talked about in Europe.

“It is precisely these concerns about the continued existence of the euro that we want to rid market participants of,” he said.

Asmussen asserted that the ECB is acting within its mandate, adding that “a currency can only be stable if there is no doubt about its existence.”

The new bond-buying program meant to address this issue “will be better conceived” than the SMP, he said, repeating that the ECB will only act in tandem with the EFSF or ESM and that interested countries must submit a request and satisfy “comprehensive economic policy conditions.”

The ECB’s Governing Council “will decide in complete independence whether, when and how bonds are purchased on the secondary market,” he added.

What happened last summer with Italy, which failed to use the time bought by ECB bond purchases to make necessary adjustments, cannot be allowed to happen again, he said.

Moreover, in the new program the ECB will deal with the problem of senior status, which interferes with affected countries’ return to capital markets because private investors fear being disadvantaged vis-a-vis the ECB, he said.

Asked if the new program could be successful because it will be unlimited in time and scope, Asmussen confirmed that ECB President Mario Draghi had said as much.

“But wait and see,” he said. “We are working on the design of the new program and will occupy ourselves with these questions in our next meeting.”

Credit and money growth in the euro area are “moderate,” and “inflation expectations in the entire Eurozone are firmly anchored to our target,” he said. “We are monitoring price developments very closely and have all the necessary instruments to fight possible inflationary dangers effectively and in a timely manner.”

Mike Norman MMT video

Professor Bill Mitchell on full employment and the aging population

Bill on top of his game here:

MMT primer on the net

This Could Change Everything

By Dick Wagner

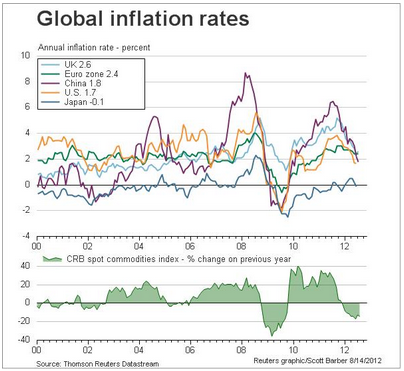

Global inflation rates

Interesting chart.

The way we define ‘inflation’ seems to be largely based on ‘cost plus’ pricing, seems?

Romney and Ryan’s Disastrous Economic Plan – Forbes

Romney and Ryan’s Disastrous Economic Plan

By John T. Harvey