This is the current thinking, but the pieces don’t add up?

Hoping I’m being too negative here…

Comments below:

By Christopher S. Rugaber

April 29 (AP) — This year got off to a sour start for U.S. workers: Their pay, already gasping to keep pace with inflation, was suddenly shrunk by a Social Security tax increase.

Which raised a worrisome question: Would consumers stop spending and further slow the economy? Nope. Not yet, anyway.

On Friday, the government said consumers spent 3.2 percent more on an annual basis in the January-March quarter than in the previous quarter the biggest jump in two years. It highlighted a broader improvement in Americans’ financial health that is blunting the impact of the tax increase and raising hopes for more sustainable growth.

Yes, but the ‘slope’ has been negative, with March way down.

Consumers have shed debt. Gasoline has gotten cheaper. Rising home values and record stock prices have restored household wealth to its pre-recession high. And employers are steadily adding jobs, which means more people have money to spend.

Sort of. There have been new jobs, but often at lower pay, and the participation rate has continued to fall. Rising home values are from very low, foreclosure depressed levels, and reports show substantial negative equity remains. And it seems that while total household wealth may be back to the highs, the ‘1%’ has benefited disproportionately.

“No one should write off the consumer simply because of the 2 percentage-point increase in payroll taxes,” says Bernard Baumohl, chief economist at the Economic Outlook Group. “Overall household finances are in the best shape in more than five years.”

Yes, better than 08 after the crash, but still marginal. Debt is down, but take home pay vs the cost of living isn’t doing all that well.

Certainly, spending weakened toward the end of the January-March quarter. Spending at retailers fell in March by 0.4 percent, the worst showing in nine months. And more spending on utilities accounted for up to one-fourth of the increase in consumer spending in the January-March quarter, according to JPMorgan Chase economist Michael Feroli, because of colder weather.

Higher spending on utilities isn’t a barometer of consumer confidence the way spending on household goods, such as new appliances or furniture, would be.

Right. Not good and the slope is negative.

Americans also saved less in the first quarter, lowering the savings rate to 2.6 percent from 3.9 percent in 2012. Economists say that was likely a temporary response to the higher Social Security tax, and most expect the savings rate to rise back to last year’s level. That could limit spending.

‘Saving less’ generally takes the form of ‘borrowing more’, in this case to pay utility bills and make up for the income lost to the tax hike, which is not sustainable.

But several longer-term trends are likely to push in the other direction, economists say, and help sustain consumer spending. Among those trends:

Wealth is up

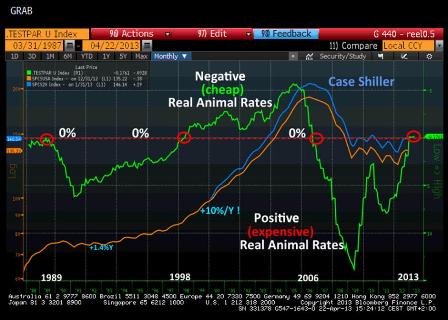

Home prices rose more than 10 percent in the 12 months that ended in February. And both the Dow Jones industrial average and Standard & Poor’s 500 stock indexes reached record highs in the first quarter. As a result, Americans have recovered the $16 trillion in wealth that was wiped out by the Great Recession.

Again, skewed to the higher income groups who’s ‘consumer spending’ wasn’t all that sensitive to income in any case.

Economists estimate that each dollar of additional wealth adds roughly 3 cents to spending.

Or is it every 3 cents in spending adds a dollar of additional wealth?

That means last year’s $5.5 trillion run-up in wealth could spur about $165 billion in additional consumer spending this year. That’s much more than the $120 billion cost of the higher Social Security taxes.

Or the 120 billion tax hike will reduce wealth by $5.5 trillion from where it would have been otherwise?

‘The wealth’ has to ‘come from’ somewhere. In this case, so sustain spending, non govt debt would have to climb that much more just to make up for the tax hike. It’s possible, but working against that happening is the lower after tax income makes it harder to qualify for new debt, even if you wanted to.

Debt is down

Household debt now equals 102 percent of after-tax income, down from a peak of 126 percent in 2007. That’s almost back to its long-term trend, according to economists at Deutsche Bank.

And so why should it grow faster than the long term trend? The burst last time around was from the sub prime fraud. Before that the .com nonsense and the Y2K scare. Before that the expansion phase of the S&L fraud. And it won’t happen this time if we’re careful to not allow a credit expansion we’ll later regret…

And households are paying less interest on their debts, largely because of the Federal Reserve’s efforts to keep borrowing rates at record lows.

And earning less on their savings. Households are net savers.

The percentage of after-tax income that Americans spent on interest and debt payments dropped to 10.4 percent in the October-December quarter last year. That’s the lowest such figure in the 32 years that the Federal Reserve has tracked the data.

And personal income from interest has likewise dropped, and probably more so.

Jobs are up

Employers have added an average of 188,000 jobs a month in the past six months, up from 130,000 in the previous six. Job gains slowed in March to only 88,000.

Yes, negative slope again. And not even beginning to close the output gap.

But most economists expect at least a modest rebound in coming months. And layoffs sank to a record low in January. Fewer layoffs tend to make people feel more secure in their jobs and more willing to spend.

Gas prices are down

Gasoline prices have fallen in the past year and are likely to stay low. Nationwide, the average price of a gallon of gas has dropped 28 cents since this year’s peak of $3.79 on Feb. 27. Analysts expect gas to drop an additional 20 cents over the next two months. Each 10 cent drop over a full year translates into roughly $13 billion in savings for consumers.

Yes, that helps, except gas prices have been going back up most recently.

Loan costs are down

Lower interest rates have enabled millions of Americans to save money by refinancing their mortgages. Mortgage giant Freddie Mac estimates that in the fourth quarter of 2012, homeowners who refinanced cut their interest rate by one-third, the biggest reduction in 27 years the agency has tracked the data. On a $200,000 loan, that means $3,600 in savings over the next 12 months.

And savers are losing that much.

Some economists note that the Social Security tax cut didn’t spur much more spending when it first took effect at the start of 2011. The tax cut gave someone earning $50,000 about $1,000 more to spend each year. A household with two high-paid workers had up to $4,500 more.

Despite the tax cut, Baumohl notes that consumer spending rose only 2.5 percent in 2011 and 1.9 percent in 2012. In the 10 years before the recession began in December 2007, the average annual spending increase was 3.4 percent.

And a study by the Federal Reserve Bank of New York found that consumers spent only 36 percent of the increased income that resulted from the tax cut. The rest went to paying down debt or to savings.

Ok, so the question is whether with the tax hike they will cut spending or consume from borrowing and dipping into savings. Initially that’s what happened, but seems by March the increasing consumption had started to fade?

And the sequesters hadn’t even begun.

Since the tax cut didn’t boost spending that much, its expiration may not drag it down much, either. Economists say temporary tax cuts are often ineffective because many consumers assume that the tax breaks will eventually disappear. So they don’t ramp up spending in response.

As just discussed. It’s not necessarily symmetrical.

Scott Loehrke, 25, hasn’t cut back spending this year. Loehrke went ahead in March with some car repairs that could have been delayed. And he still plans to vacation in May in Mexico with his wife, Jackie.

The couple, who live just outside Cleveland, feel secure in their jobs. Loehrke is a salesman for a company that makes T-shirts, cups, key chains and other promotional products. Business has picked up in the past year as the economy has improved. His wife is a pharmacist.

“Everything that we’ve planned to do we’re still doing,” Loehrke says.

That proves their case!!!

:(

The Loehrkes both have heavy student debt and so are focused on keeping their expenses in check. They both drive used cars. That’s enabled them to build up some savings and made it easier to absorb the tax increase.

New threats have emerged. Across-the-board government spending cuts kicked in March 1. The spending cuts have triggered government furloughs and could lead private companies that do business with the government to cut staff. And the cuts are expected to shave a half-point from economic growth this year.

And that’s just the first order effect.

Even so, most economists are relieved that consumers have proved so resilient so far.

“It’s very encouraging that consumers and thus the broader economy have been able to weather that storm as well as they have,” says Mark Zandi, an economist at Moody’s Analytics.

‘The beatings will continue until morale improves’