The threshold may be high but there is one somewhere up there:

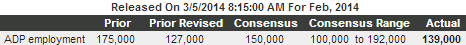

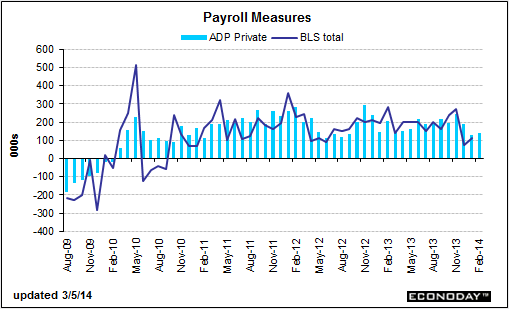

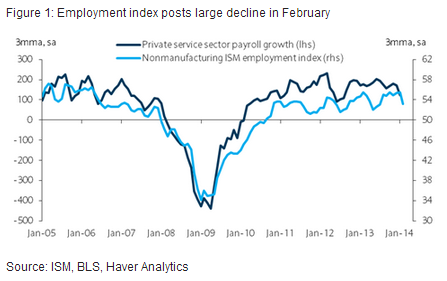

Fed should be ‘very patient’ in cutting stimulus: Rosengren (Reuters) The high number of part-time workers who would rather work full-time, the still-high unemployment rate, and very low inflation suggest significant “slack” in labor markets and “call for a very patient approach to removing monetary policy accommodation, particularly given the softness in recent economic data,” Boston Federal Reserve Bank President Eric Rosengren said. Rosengren said that it has been difficult for economists to determine whether weak employment reports for the past two months have been influenced bad weather or if they reflect an economic slowdown, and predicted that harsh winter weather will make the February jobs report similarly difficult to interpret. “In my view, this uncertainty provides an additional strong rationale for taking a patient approach to removing the monetary policy accommodation that the Federal Reserve has been deploying.”

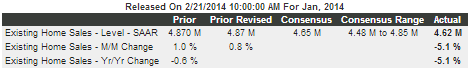

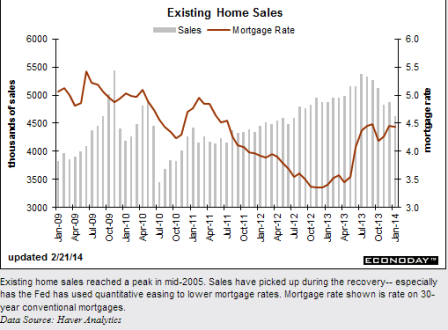

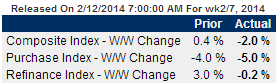

These are closings from contracts signed months earlier:

New home sales hit five-and-a-half year high in January (Reuters) Sales of new U.S. single-family homes jumped 9.6 percent to a seasonally adjusted annual rate of 468,000 units. December’s sales were revised up to a 427,000-unit pace from the previously reported 414,000-unit rate. Sales in the Northeast soared 73.7 percent to a seven-month high, while the South recorded a 10.4 percent rise in transactions to a more than five-year high. Sales tumbled 17.2 percent in the Midwest last month, while rising 11 percent in the West. New home sales rose 2.2 percent compared with January 2013. For all of 2013. Last month, the supply of new houses on the market was unchanged at 184,000 units. The median price of a new home last month rose 3.4 percent to $260,100 from January 2013. At January’s sales pace it would take 4.7 months to clear the supply of houses on the market.

I still suspect some of the q4 activity was ahead of expiring tax credits:

Hope on Horizon for Home-Supply Crunch: Builder Borrowing Picks Up (WSJ) Data released Wednesday by the Federal Deposit Insurance Corp. show that the outstanding balance on loans for land acquisition, development and construction rose in the fourth quarter to $209.9 billion, compared with $206 billion in the third quarter. Last year, the average price of a new U.S. home was $322,100, up 10.2% from 2012. The latest increase in construction lending “is an encouraging signal,” said David Crowe, chief economist for the National Association of Home Builders. But lending remains far from peak, as outstanding land and construction loans topped out at $631.8 billion in the first quarter of 2008. According to the FDIC, outstanding loans solely for construction of homesexcluding development, land acquisition and commercial projectsincreased to $43.7 billion in the fourth quarter, up from a recent low of $40.7 billion in last year’s first quarter.

This helps support prices but doesn’t directly add much to GDP apart from commissions etc. unless it’s new construction:

Foreign appetite for US properties remains strong (FT) Last year the US maintained its position as the top destination for direct commercial property investment by foreigners with $38.7bn pouring into the country, according to a report from brokerage Jones Lang LaSalle. The total was up 44 per cent on 2012. Canadian, Chinese and Australian investors led the charge, with investors targeting top-tier areas such as Manhattan, Los Angeles and Chicago as well as secondary markets including Houston, Dallas and Seattle. Almost half all investments were in office buildings, 16 per cent in apartment blocks, 15 per cent in retail, while hotels, industrial properties and land development made up the rest. Foreign money comprises about 10 per cent of all capital for commercial property investment in the US, which JLL has said could accelerate if international investors expand beyond core assets to riskier deals that deliver higher returns.

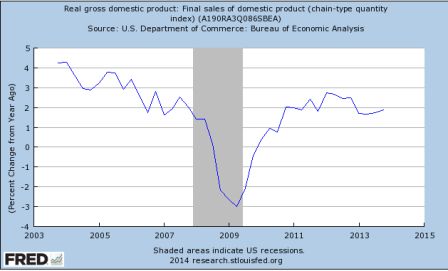

The lack of domestic credit expansion and only very modest export growth leaves only govt. to spend more than its income and they keep pressing the wrong way on that as well:

Euro zone lending contraction compounds ECB headache (Reuters) Loans to the private sector fell by 2.2 percent in January from the same month a year earlier, ECB data released on Thursday showed. That compared to a contraction of 2.3 percent in December. Euro zone M3 money supply grew at an annual pace of 1.2 percent, picking up slightly from 1.0 percent in December. The ECB has set out two scenarios that could trigger fresh policy action: a deterioration in the medium-term inflation outlook and an “unwarranted” tightening of short-term money markets. Before the ECB gets to quantitative easing a cut in interest rates is one option for dealing with low euro zone inflation, or tight money markets. Another option the ECB has discussed is to suspend operations to soak up the money it spent buying sovereign bonds under its now-terminated Securities Markets Programme (SMP) during the euro zone’s debt crisis.

6.8% unemployment considered a successful economy?

whatever…

Lowest number of Germans out of work in Feb since Sept 2012 (Reuters) The number of people out of work in Europe’s largest economy decreased by 14,000 to 2.914 million, data from the Labour Office showed. That meant there were fewer unemployed people in Germany than at any time since September 2012. It was the third consecutive monthly drop in joblessness. Separate data from the Federal Statistics Office on Thursday showed employment climbing to a record high of almost 42 million. Berlin expects private consumption, which boosted growth in 2013, to increase by 1.4 percent as workers benefit from an increase in employment to an expected record of 42.1 million this year and a nominal 2.7 percent jump in earnings. The jobless rate held steady at 6.8 percent, its lowest level since German reunification more than two decades ago.

Germany’s wealth distribution most unequal in euro zone (Reuters) Private wealth is more unevenly distributed in Germany than in any other euro zone state. While the richest one percent of people in Germany have personal wealth of at least 800,000 euros ($1.09 million), over a quarter of adults have either no wealth or negative wealth because of debt, the study by Germany’s DIW think tank showed. According to the study, Germany’s Gini coefficient, a measure of income inequality, was 0.78 in 2012. That compared with 0.68 in France, 0.61 in Italy and 0.45 in Slovakia. A score of 0 indicates minimal inequality and 1.0 maximal inequality. Germans have total net assets worth 6.3 trillion euros, with land and real estate accounting for 5.1 trillion euros, and the average German adult has net assets worth around 83,000 euros, according to DIW. In the study, private wealth includes owned real estate, financial assets, valuables and debt.

French jobless total rises to record in January (Reuters) The number of people out of work in France rose by 8,900 in January to reach a record, as President Francois Hollande’s goal of taming unemployment eluded him yet again. Labour Ministry data showed on Wednesday that the number of people registered as out of work reached 3,316,200 in mainland France, up 0.3 percent over a month and 4.4 percent over a year. Hollande’s popularity has plummeted to record lows. He struggled and ultimately failed to live up to a pledge to get unemployment falling by the end of last year. With that promise in tatters despite at least 2 billion euros ($2.73 billion) spent on subsidized jobs, Labour Minister Michel Sapin said earlier on Wednesday that the jobless total should fall this year. Hollande offered last month to phase out 30 billion euros in payroll charges that companies have to pay, in exchange for committing to targets to create jobs.

Spanish Economic Growth Slower Than Expected (WSJ) Gross domestic product grew by 0.2% in the fourth quarter compared with the third, the country’s national statistics institute INE said Thursday. The figure was lower than the INE’s and the government’s preliminary reading, which had pegged quarterly growth at 0.3%. Public spending fell 3.9% compared with the third quarter. Household consumption was up 0.5% in the same period. Strong export growth helped Spain’s economy emerge from a nine-quarter recession in the second half of 2013, but the recovery has so far been anemic, because households remain highly indebted, unemployment still stands around 26% and the government can’t raise public spending because it is struggling to lower its budget deficit. According to the INE, economic output shrunk by 0.2% in the fourth quarter of 2013 compared with the fourth quarter of a year earlier.

Private rental surge hits benefits bill (FT) Englands housing market is seeing a seismic shift towards private rented property and away from home ownership. Figures from the official English housing survey published on Wednesday show the number of households living in the private rented sector overtook those in social housing for the first time last year. Almost 4m households now live in privately rented homes, and a quarter of the tenants are now subsidised by housing benefit, according to the annual survey. Private renting is now the second-largest tenure in England, behind home ownership. Under two-thirds of households now own their own home down from 71 per cent a decade ago. The number of households in the private rented sector receiving the benefit has risen by two-thirds in the past five years, with 390,000 more households in this category beginning to claim, the English housing survey found.

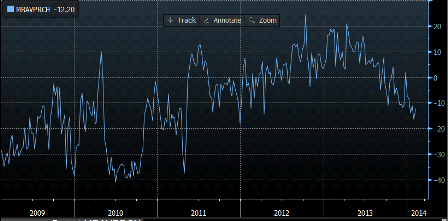

Does China want their currency to adjust to the yen the way other EM currencies have done?

China dismisses concern over sudden renminbi fall (FT) The recent movement of the renminbi exchange rate is the result of market players adjusting their near-term renminbi trading strategies, the State Administration of Foreign Exchange, an agency under the central bank, said. It added that the currencys movement was nothing unusual: The degree of exchange rate volatility is normal by the standards of developed and emerging markets. There is no need to over-interpret it. China faced immense capital inflows at the start of this year, according to data published on Tuesday by the central bank. Banks bought a net $73bn of foreign currency in the onshore market from their clients who wanted renminbi in January, the biggest monthly amount on record. Inflows have been accelerating since the middle of last year when Chinas mountain of foreign exchange reserves grew $500bn to $3.8tn.

China’s Central Bank Engineered Yuan’s Decline (WSJ) China’s central bank engineered the recent decline in the country’s currency to shake out speculators as it prepares to allow a wider trading range for the tightly tethered yuan, according to people familiar with the central bank’s thinking. In the past week, the People’s Bank of China has been guiding the yuan lower against the dollar. It has done so by setting a weaker benchmark against which the yuan can trade. It has also intervened in the currency market by directing state-owned Chinese banks to buy dollars, according to traders. China’s central bank and commercial banks purchased nearly $45 billion worth of foreign exchange in December, the fifth consecutive month of net purchases. The PBOC decided to tamp down expectations for one-way appreciation in the yuan and curb speculative trading during two-day currency-policy meeting that ended on Feb. 18, the people said.