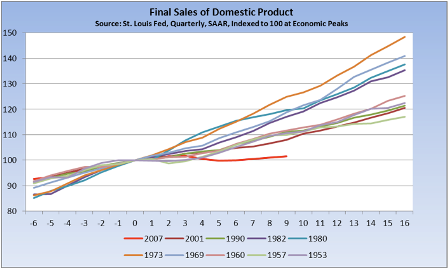

Still feels like modest GDP growth, positive but not enough to make much of a dent in unemployment, until the ‘hand off’ to growth from credit expansion from some other sector, which could be a while.

Risks remain external.

China has been a strong first half weak second half story for a while, and a weak second half after an only ok first half this year can be a problem.

Fiscal tightening around the world can also keep a lid on things.

And I still have that nagging feeling that a 0 rate policy requires higher budget deficits to sustain full employment than a policy of higher rates. That should be a good thing- means taxes can be that much lower- but with a govt that doesn’t understand its own monetary system and keeps fiscal too tight it’s a bad thing.

All seems to point to more of an L shaped, Japan like recovery than a V.

Karim writes:

Constructive data:

* Initial claims down 19k to 457k; Labor dept cited processing issues around Memorial Day holiday for elevated readings past couple of weeks

MKT NEWS:”A Labor analyst said the surge in the previous two weeks was apparently due to technical factors relating to the way new claims were distributed over the holiday and post-holiday weeks and to a pattern that departed from what the seasonal factors were prepared for.”

* Number receiving extended benefits at lowest since last December, suggesting some easing in ability to find a job

Durable goods orders ex-aircraft and defense up 2.1% last month and up 29% past 3mths at an annualized rate; Capex was the sector was the Fed was most upbeat on in their statement yesterday

Shipments ex-aircraft and defense up 1.6% m/m and 16.7% on a 3mth annualized rate