Taken from ‘Soft Currency Economics’, 1993

That was 20 years ago and the same error persists!!!

:(

How the Government Spends and Borrows as Much as it Does Without Causing Hyperinflation

Most people are accustomed to viewing savings from their own individual point of view. It can be difficult to think of savings on the national level. Putting

part of one’s salary into a savings account means only that an individual has not spent all of his income. The effect of not spending as such is to reduce the demand for consumption below what would have been if the income which is saved had been spent. The act of saving will reduce effective demand for current production without necessarily bringing about any compensating increase in the demand for investment. In fact, a decrease in effective demand most likely reduces employment and income. Attempts to increase individual savings may actually cause a decrease in national income, a reduction in investment, and a decrease in total national savings. One person’s savings can become another’s pay cut. Savings equals investment. If investment doesn’t change, one person’s savings will necessarily be matched by another’s’ dissaving’s. Every credit has an offsetting debit.

As one firm’s expenses are another person’s income, spending equal to a firm’s expenses is necessary to purchase its output. A shortfall of consumption results in an increase of unsold inventories. When business inventories accumulate because of poor sales: 1) businesses may lower their production and employment and 2) business may invest in less new capital. Businesses often invest in order to increase their productive capacity and meet greater demand for their goods. Chronically low demand for consumer goods and services may depress investment and leaves businesses with over capacity and reduce investment expenditures. Low spending can put the economy in the doldrums: low sales, low income, low investment, and low savings. When demand is strong and sales are high businesses normally respond by increasing output. They may also invest in additional capital equipment. Investment in new capacity is automatically an increase in savings. Savings rises because workers are paid to produce capital goods they cannot buy and consume. The only other choice left is for individuals to “invest” in capital goods, either directly or through an intermediary. An increase in investment for whatever reason is an increase in savings; a decrease in individual spending, however, does not cause an increase in overall investment. Savings equals investment, but the act of investment must occur to have real savings.

The structural situation in the U. S. is one in which individuals are given powerful incentives not to spend. This has allowed the government, in a sense, to spend people’s money for them. The reason that government deficit spending has not resulted in more inflation is that it has offset a structurally reduced rate of private spending. A large portion of personal income consists of IRA contributions, Keoghs, life insurance reserves, pension fund income, and other money that compounds continuously and is not spent. Similarly, a significant portion of business income is also low velocity; it accumulates in corporate savings accounts of various types. Dollars earned by foreign central banks are also not likely to be spent.

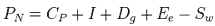

The root of this paradox is the mistaken notion that savings is needed to provide money for investment. This is not true. In the banking system, loans, including those for business investments, create equal deposits, obviating the need for savings as a source of money. Investment creates its own money. Once we recognize that savings does not cause investment it follows that the solution to high unemployment and low capacity utilization is not necessarily to encourage more savings. In fact, taxed advantaged savings has probably caused the private sector to desire to be a NET saver. This condition requires the public sector to run a deficit, or face deflation.