Employment growth has been revised substantially lower. Note that one of the inputs used for estimating monthly employment is data from the weekly jobless claims report, which I had suggested would be misleading due to claims being made substantially harder to get over the last several years.

Employment: Preliminary annual benchmark revision shows downward adjustment of 501,000 jobs

The BLS released the preliminary annual benchmark revision showing 501,000 fewer payroll jobs as of March 2019. The final revision will be published when the January 2019 employment report is released in February 2020. Usually the preliminary estimate is pretty close to the final benchmark estimate.

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For national CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus two-tenths of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates a downward adjustment to March 2019 total nonfarm employment of -501,000 (-0.3 percent).

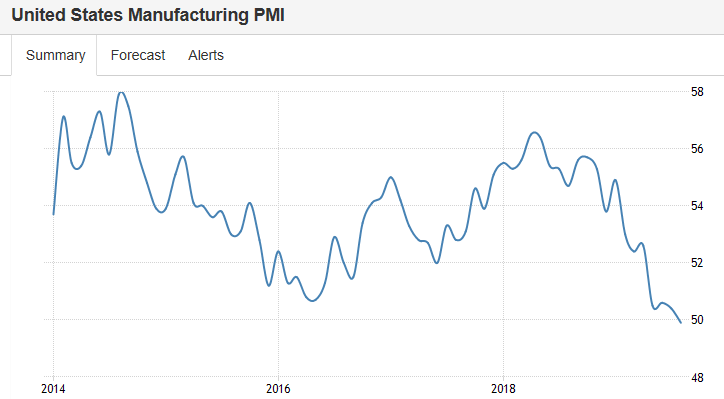

US Factory Activity Contracts for 1st Time in a Decade

The IHS Markit US Manufacturing PMI dropped to 49.9 in August from 50.4 in July and below market expectations of 50.5, a preliminary estimate showed. The latest reading pointed to the first month of contraction in manufacturing since September 2009, as new orders fell the most in 10 years led by the largest decline in exports since August 2009.

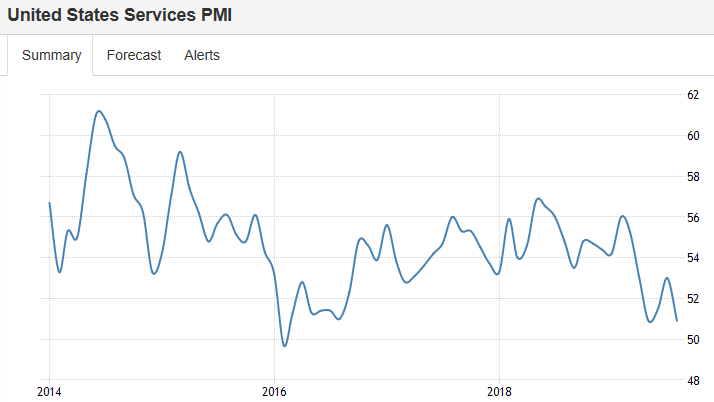

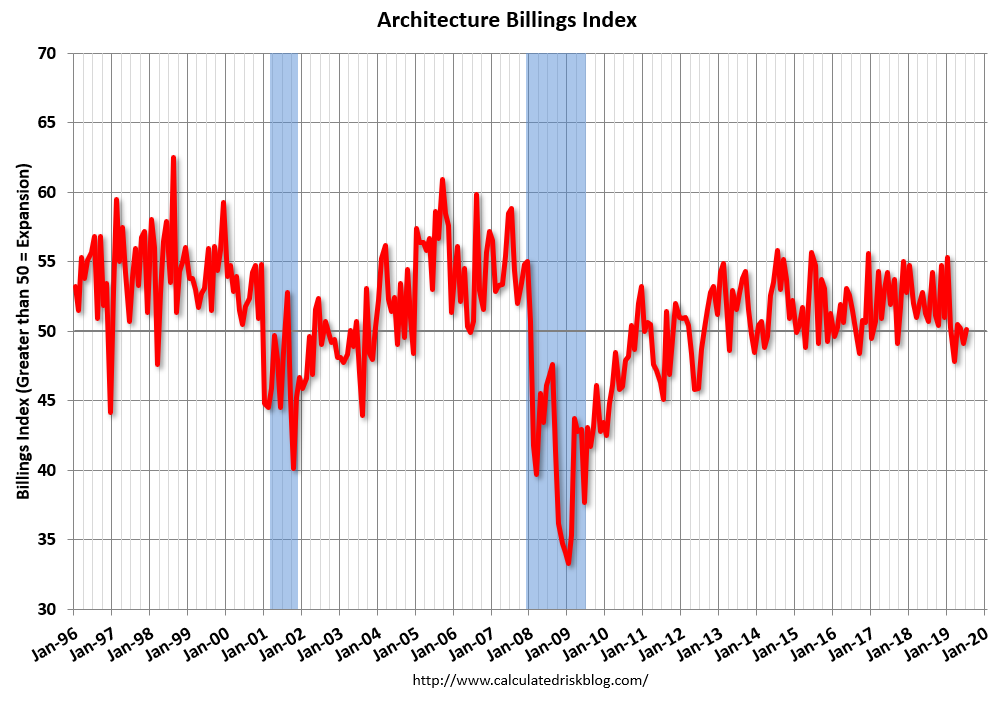

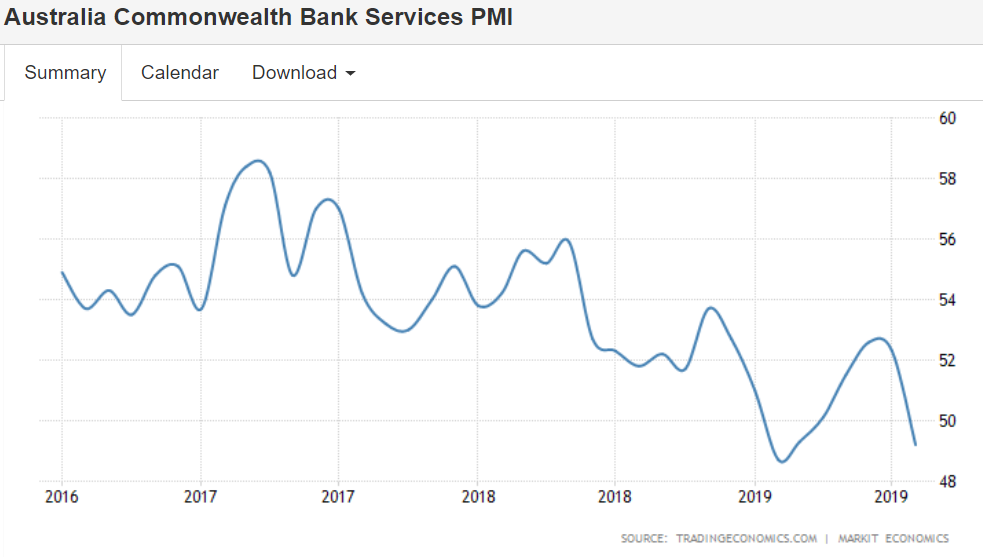

Services decelerating and near contraction:

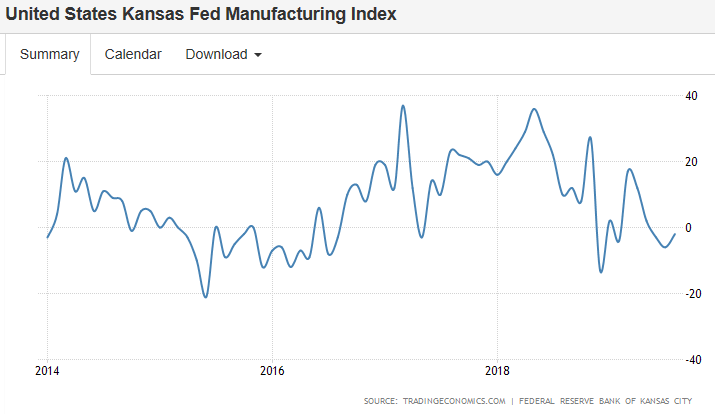

In contraction:

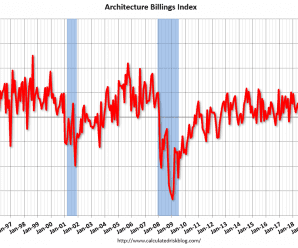

Continued weakness:

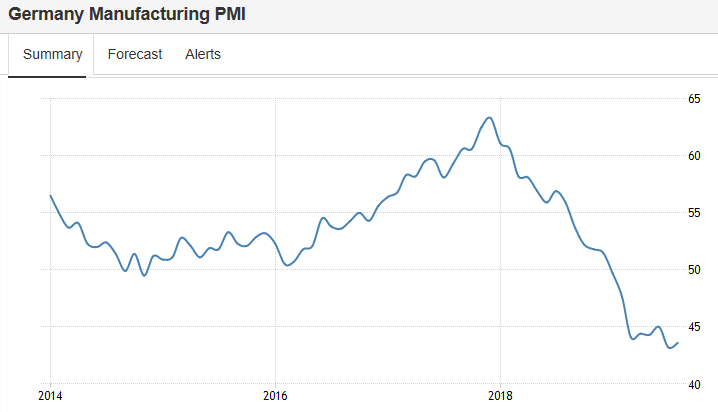

German Manufacturing Contracts for 8th Month

The IHS Markit Germany Manufacturing PMI rose to 43.6 in August 2019 from a seven-year low of 43.2 in the previous month and above market expectations of 43, a preliminary estimate showed. Still, the latest reading pointed to the eight month of contraction in the manufacturing sector, as new orders fell the most since April on the back of weak external demand. In addition, employment contracted the most since July 2012 and outstanding business continued to decline. On the price front, goods producers recorded a further sharp drop in input costs and a subsequent reduction in factory gate charges. Looking ahead, business confidence was the weakest since that series began in mid-2012.

Services in contraction:

Continuous flip flopping as dementia sets in:

President Donald Trump says he’s not currently looking at a payroll tax cut or indexing capital gains to inflation.

The comments follow several days of mixed messaging from his administration about whether or how it will respond to growing recession fears.

Trump says the U.S. does not “need” tax cuts, because of a “strong economy.”

?????

Trump attacks Ford Motor for not backing fuel economy rollback