Reuters Insider interview here

Category Archives: EU

Broad-based slowdown in Eurozone manufacturing as domestic markets weaken

Broad-based slowdown in Eurozone manufacturing as growth hits 18-month low

(Markit) The final Markit Eurozone Manufacturing PMI fell to a one-and-a-half year low of 52.0 in June, down from 54.6 in May and unchanged from the earlier flash estimate. Incoming new orders fell for the first time since July 2009. Weakening domestic markets – especially at the periphery – was a major factor underlying lower order book inflows. June saw new export orders increase at the slowest pace since September 2009, led down by a decrease at intermediate goods producers. Production continued to rise at a robust pace in the investment goods sector in June, but lower output was seen at consumer and intermediate goods producers. Meanwhile, new order inflows stagnated at consumer and investment goods companies, and dropped at the steepest rate in over two years at intermediate goods producers.

This is not good. The hope is it reverses with lower crude and recovery in Japan.

Risks include China weakening, US austerity, and further austerity induced weakening in Europe.

The Mosler Plan for Greece

The Mosler Plan, as previously posted on this website, is now making the rounds in Europe as an alternative to the French Plan that is currently under serious consideration:

Abstract

The following is an outline for a proposed new Greek government bond issue to provide all required medium term euro funding for Greece on very attractive terms.

The new bond issue includes an addition to the default provisions that eliminates the risk of loss to investors. The language added to the default provisions states that while in default, and only in the case of default, these transferable securities can be used directly, by the bearer on demand, at face value plus accrued interest, for payment of any debts, including taxes, owed to the Greek government.

By eliminating the risk of loss, Greece will be able to independently fund all required financial obligations in the market place for the foreseeable future. The immediate benefits are both reduced interest costs that substantially contribute to deficit reduction, and the elimination of the need for the funding assistance from the European Union and the IMF.

Introduction- Restoring National Sovereignty

Current institutional arrangements have resulted in Greece being faced with escalating interest costs when it attempts to fund itself in the market place, to the point where timely funding is not currently available without external assistance. This requirement for external assistance to avoid default has further resulted in a loss of sovereignty, with the EU and IMF offering funding only on their approval of deficit reduction plans by the Greek government that meet specific requirements. Compliance with these demands from the EU and IMF not only include tax increases, spending cuts, and privatizations, but also include aggressive time lines for achieving their deficit reduction goals. It is also understood by all parties that the immediate near term consequences of these imposed austerity measures will include further slowing of the economy, and rising unemployment.

Greece will restore national sovereignty, and regain control of the process of full compliance with the general EU requirements for all member nations, only when it restores its financial independence. Financial independence will allow Greece to again be master of its own destiny, on an equal basis with the other EU members. And the lower interest rate that result(s) from this proposed bond issue will itself be a substantial down payment on the required deficit reduction, easing the requirements for tax increases, spending cuts, and privatizations.

While this proposal restores Greek national sovereignty, and eases funding burdens, we recognize that it is only the first step in restoring the Greek economy. Even with funding independence and low interest rates the Greek government still faces a monumental task in bringing Greece into full compliance with EU requirements and restoring economic output and employment. However, it should also be recognized that financial independence and low cost funding are the critical first steps to long term success.

The Bond Issue- No Risk of Financial Loss

Market based funding at the lowest possible interest rates requires investors who understand there is no ultimate risk of financial loss, and that the promise to pay principal and interest by the issuer is credible. To be credible, a borrower must have the means to meet all contractual euro obligations on a timely basis. For Greece this has meant investors must have the confidence that Greece can generate sufficient revenues through taxing and borrowing to repay its debts.

The credit worthiness of any loan begins with the default provisions. While there may be unconditional promises to pay, investors nonetheless value what their rights are in the event the borrower does not pay. Corporate debt often includes rights to specific collateral, priorities in specific revenues, and other credit enhancing support.

The new proposed Greek bond issue, with its provision that in the event of default the bonds can be used at face value, plus interest, for the payment of taxes by the bearer on demand, gives the bond holder absolute assurance that full maturity value in euro can always be achieved. And with this absolute assurance that these new securities are necessarily ‘money good’ the ability to refinance is established which dramatically reduces the risk of the default provisions actually being triggered. And, again, should there be a default event, the investor will still get full value for his investment as the entire euro value of the defaulted securities can be used at any time for the payment of Greek taxes. So while this discussion concerns the case of default, the removal of the risk of loss means there will always be demand for them at near risk free market interest rates, and that the default discussion is, for all practical purposes, hypothetical.

These new Greek government bonds will be of particular interest to banks, which, again, encourages bank ownership, which makes default that much more remote a possibility. This is because, in the case of default, a bank holding any of these defaulted securities will be able to use them for payment of taxes on behalf of bank clients (using that bank for payment of their taxes). Under these circumstances, a bank depositor client making payment of euro would, in effect, simultaneously buy the defaulted securities from the bank and use them to pay the Greek government taxes due. Again, the fact that the bank would be fully paid for its defaulted securities in the process of depositors paying their taxes means there will be no default in the first place, as these favorable consequences mean there will be continuous demand for new securities of this type at competitive market interest rates, to facilitate all Greek refinancing requirements.

The new ‘money good’ Greek bonds will be attractive to all global investors, both private and public. This will include international banks, insurance companies, pension funds, and other private investors, as well as sovereign wealth funds and foreign central banks which are accumulating euro reserves.

Fiscal Responsibility

As a member in good standing of the European Union, Greece, like all the member nations, is required to be in full compliance of all EU requirements. Therefore, while this proposal will restore national sovereignty, financial independence, and lower interest rates for Greece, austerity measures will continue to be required to bring Greece into EU compliance. However, Greece will gain substantial flexibility with regard to timing and other specific detail, and will be able to work to achieve its goals in an organized, orderly manner, without the continued pressures of default risk and without the specific terms and conditions currently being demanded by the EU and the IMF. Nor will the ECB be required to buy Greek bonds in the market place, obviating those demands as well.

Global indicators not so good this am

The hope is that the entire soft spot is a temporary consequence of the earthquake, and that China holds together, and that global austerity isn’t sufficient to slow overall growth:

Headlines:

Bank of England warns against quick fix to crisis (AP)

U.K. Services Drop Most Since January 2010 on Extra Holiday (Bloomberg)

U.K. Mortgage Approvals Increased Less Than Forecast in May (Bloomberg)

Bank of England Split on Interest Rate Policy as Consumers Struggle (Telegraph)

PBOC Adviser Sees China ‘Chronic’ Inflation Lasting Decade

Why China’s Heading for a Hard Landing, Part 3: A. Gary Shilling

Sweden: Slowdown After Strong Growth

Europe June Economic Confidence Drops to Lowest in 8 Months

Trichet Urges New Vision of Europe as Greeks Protest Austerity

Up to 15 EU banks to fail stress test

ECB’s Stark Rejects Brady-Bond Solution for Greece, Zeit Reports

French Greek Rollover Plan Depends on No Default Rating

French Output Grew Less Than Estimated on Consumer Spending

Growth of German retail sales maintained in June

French Jobless Claims Increase for First Time in Five Months

Spanish premier proposes new economic measures

Portugal plans tougher austerity measures

Spanish Existing Home Prices Decline 1.8% in Second Quarter

Mortgage Applications Dipped Last Week

CH News – China says willing to help economic growth in Europe

‘So what will you do for us if we buy your bonds instead of US bonds’ said the spider to the fly, as China continues to play us all off against each other.

(And it seems they have gotten ‘assurances’ regarding default risk.)

China says willing to help economic growth in Europe

June 21 (Reuters) — China is willing to help European countries realise stable economic growth, China’s Foreign Ministry said on Tuesday ahead of a visit by Chinese Premier Wen Jiabao to Hungary, Britain and Germany this week.

“The Chinese government has already taken a series of proactive measures to push Sino-Europe trade and economic cooperation, such as buying euro bonds,” ministry spokesman Hong Lei told a regular news briefing when asked about China’s view of the Greek debt crisis.

“China is willing to continue helping European countries realise economic growth in a stable manner through cooperation with relevant countries,” he added, without elaborating.

Wen’s latest visit to Europe from June 24 to 28 will come months after he visited France, Portugal and Spain, and offered to help European economies overcome their debt-driven crises.

The debt crisis afflicting Greece and weighing on the euro is likely to overshadow his visit.

Markets will watch keenly for how Wen handles economic expectations this time, especially with Greece’s woes deepening. Last week, China’s central bank urged European governments to contain debt levels or risk worsening the region’s unfolding debt crisis.

China signalled in April that it could buy more debt from the euro zone’s weaker states. There are no precise figures, but China has said it has bought billions of euros of debt.

Since euro-zone debt worries first rippled through markets last year, China has repeatedly said that it has confidence in the single-currency region and pledged to buy debt issued by some of its troubled member states.

China’s interest in a smooth resolution to the European debt troubles has been clear. Of its $3 trillion or more in foreign exchange reserves, about a quarter are estimated to be invested in euro-denominated assets.

Juncker on the euro crisis

Juncker has to know better than this, he can’t be that sheltered?

From Mike Norman’s blog

“The debt level of the USA is disastrous,” Mr. Juncker said. “The real problem is that no one can explain well why the euro zone is in the epicenter of a global financial challenge at a moment, at which the fundamental indicators of the euro zone are substantially better than those of the U.S. or Japanese economy.”

EU trade deficit widened to 2.9 billion euros ($4.1 billion) from 2.2 billion euros

Note the actual headline and how deep in the article the fact that the trade deficit actually widened is buried.

It’s almost like a US headline that might have reported, for example, the Texas trade surplus grew, when the overall US trade deficit widened and only got a minor mention.

European April Exports Rose on China, Defying Strong Euro

By Gabi Thesing

June 17 (Bloomberg) — European exports rose in April on greater demand from the U.S. and China, shrugging off the effects of a stronger euro.

Exports from the economy of the 17 nations that use the euro rose a seasonally adjusted 0.6 percent from March, when they increased by the same amount, the European Union’s statistics office in Luxembourg said today. Euro-region construction output rose 0.7 percent from the previous month, when it declined 0.1 percent, a separate report showed.

The European Central Bank revised up its growth forecast for this year on June 9, predicting expansion of 1.9 percent after a previous estimate of 1.7 percent on “the ongoing expansion in the world economy.” Even so, the recovery may struggle to maintain momentum as the 15 percent appreciation of the euro against the dollar makes goods manufactured in the euro region more expensive and higher oil prices boost companies’ input prices.

“Exports are particularly driven by Germany, which doesn’t compete solely on price but on highly specialized products,” said Carsten Brzeski, an economist at ING Group in Brussels. “At the same time, the stronger euro will start to bite in the coming months, damping growth, even though it won’t slide back into recession.”

The euro was little changed after the data were released, trading at $1.4168 at 11:03 a.m. in Brussels, down 0.3 percent.

‘Strong Global Demand’

The German economy, the main driver of the European economy, will expand at the fastest pace since the country’s reunification as domestic demand picks up, the RWI economic institute said yesterday.

German carmakers are hiring because of booming demand in China for high-end vehicles. Bayerische Motoren Werke AG Chief Executive Officer Norbert Reithofer said on May 12 that the Munich-based company will hire about 2,000 workers over the course of the year, more than half of them in Germany, “in light of strong global demand for BMW, Mini and Rolls-Royce brand vehicles.”

Euro-area imports rose a seasonally adjusted 1.1 percent in April and the trade deficit widened to 2.9 billion euros ($4.1 billion) from 2.2 billion euros in the previous month, today’s report showed.

Euro-area exports to the U.S. rose 20 percent in the year through March from the year-earlier period, while shipments to the U.K., the euro area’s largest market, increased 14 percent. Exports to China surged 31 percent.

China’s Customs General Administration reported on June 10 that imports from the European Union rose 28.5 percent in April.

China’s ‘vital’ interests at stake over Greek crisis

It’s more than China’s ‘vital interests’ as over their a loss of public funds from a Greek default could mean heads roll- literally- as there is a history of actual execution for failure and disgrace.

And note the past tense- China had helped by buying their debt.

Also, note the anecdotal signs of weakness, highlighted below:

Headlines:

China President Hu: Global Economic Recovery ‘Slow And Fragile’

China’s ‘vital’ interests at stake over Greek crisis

China Yuan Band Widening Would Have ‘Political’ Meaning Only

Consumer Spending Fades in China Economy After ‘Peak Days’

China economy faces over-tightening risk – government economist

China President Hu: Global Economic Recovery ‘Slow And Fragile’

June 17 (Dow Jones) — Chinese President Hu Jintao said Friday that the global economic recovery is still “slow and fragile” and is threatened by a resurgence of protectionism in various forms.

“There still exist some lagging effects of the financial crisis,” he said at a keynote speech at an investment forum in Russia.

Despite failing to agree on a landmark deal for gas supplies from Siberia, Hu was upbeat on the outlook for bilateral trade with Russia, which is rich in other natural resources crucial to China’s economic development.

Hu said he hopes to raise the level of annual bilateral trade between the two countries to $100 billion by 2015, and $200 billion by 2020, compared with $60 billion in 2010.

In 2009, Russia and China agreed in principle to construct two pipelines that would export natural gas from Siberia to China, but a final agreement has been held up due to persistent differences on gas pricing.

Late Thursday, the two sides failed to reach an agreement during last-minute talks at Gazprom headquarters in Moscow.

China’s ‘vital’ interests at stake over Greek crisis

June 17 (Guardian) — China’s “vital” interests are at stake if Europe cannot resolve its debt crisis, the Chinese foreign ministry said on Friday as it voiced concern about the economic problems of its biggest trading partner.

At a media briefing ahead of Chinese premier Wen Jiabao’s visit to Europe next week, vice foreign minister Fu Ying made plain that China had tried to help Europe overcome its troubles by buying more European debt and encouraging bilateral trade.

“Whether the European economy can recover and whether some European economies can overcome their hardships and escape crisis, is vitally important for us,” she said.

“China has consistently been quite concerned with the state of the European economy.”

Wen is due to visit Hungary, Britain and Germany late next week, just months after he visited France, Portugal and Spain and offered to help Europe overcome its debt woes.

With Greece on the verge of a debt default, investors will focus on whether China promises to buy even more debt from beleaguered European nations including Greece, and increase its investment in the region.

China is a natural prospective investor in European assets and government debt because it has $3.05 trillion (£1.9tn) in foreign currency reserves, the world’s largest.

With a quarter of the reserves estimated to be invested in euro-denominated assets, it is clearly in Beijing’s interest to help Europe survive its debt turmoil.

“We have supported other countries, especially European countries, in their efforts to surmount the financial crisis,” Fu said. “We have, for example, increased holdings of euro debt and promoted China-European Union trade.”

Beijing has said in the past that it has bought Greek debt, but has never revealed the size of its investment.

Since eurozone debt worries first rippled through markets last year, China has repeatedly said that it has confidence in the single-currency region.

“We have hoped to help eurozone countries in overcoming the crisis, and this is also a measure that is beneficial to China’s own economic development,” Fu said.

But mirroring deteriorating market confidence on Europe, China’s central bank published a report this week saying the economic bloc risked worsening its problems if it did not contain debt levels.

Greece on the slippery slope

First, I think there isn’t enough political or popular support to leave the euro and go back to the drachma.

As previously discussed, it’s not obvious to the population or the political leadership that there is anything wrong with the euro itself.

Instead, it probably seems obvious the problem is the result of irresponsible leadership, and now they are all paying the price.

So staying with the euro, Greece has two immediate choices:

1. Negotiate the best austerity terms and conditions they can, and continue to muddle through.

2. Don’t accept them and default

Accepting the terms of the austerity package offered means some combination of spending cuts, tax hikes, assets sales, etc. that still leaves a sizable deficit for the next few years, with a glide path to some presumably sustainable level of deficit spending.

Defaulting means no more borrowing at all for most likely a considerable period of time, which means at least for a while they will only be able to spend the actual tax revenue they take in, which means immediately going to a 0 deficit.

What matters to Greece, on a practical level, is how large a deficit they are allowed to run. This makes default a lot more painful than any austerity package that allows for the funding of at least some size deficit.

Therefore it’s makes the most sense for Greece to accept the best package they can negotiate, rather than to refuse and default.

Additionally, the funding Greece will need to keep going is probably funding to pay for goods and services from Germany and some of the other euro member nations.

In other words, if Germany wants to get paid for its stream of exports to Greece it must approve some kind of funding package.

Reminds me of a an old story Woody Allen popularized a while back:

Doctor: So what’s the problem?

Patient: It’s my brother. He thinks he’s a chicken.

Doctor: Have you tried to talk to him about it?

Patient: No

Doctor: Why not?

Patient: Well, we need the eggs

Likewise the euro zone needs the eggs, and so the most likely path continues to be some manner of ECB funding of the banking system and the national govt’s, as needed, last minute, kicking and screaming about how they need an exit strategy, etc. etc. etc. And the unspoken pressure relief valve is inflation, with a falling euro leading the march. It’s unspoken because the ECB has a single mandate of price stability, which is not compatible with a continuously falling euro, and because a strong euro is an important part of the union’s ideology. But a weak euro that adjusts the price level, as a practical matter, is nonetheless the only pressure relief valve they have for their debt issues in general. And, also as previously discussed, it looks like market forces may be conspiring to move it all in that direction.

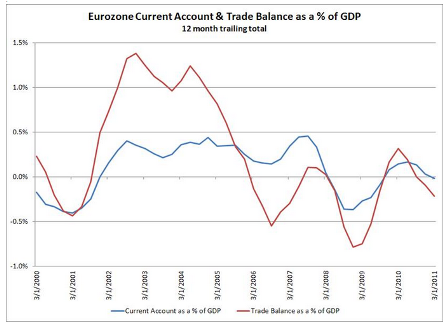

Euro trade data

So looks to me that China shifted to buying more euro just as the trade flows were turning the other way and might have otherwise been weakening the euro.

This means that when they stop buying there could be serious gap down until it gets to where it would have gotten had China not been buying. (Kind of like taking your finger out of the hole in the dam.)

Which is maybe what happened when it peaked a few weeks ago at the time of Bernanke’s first strong dollar speech?

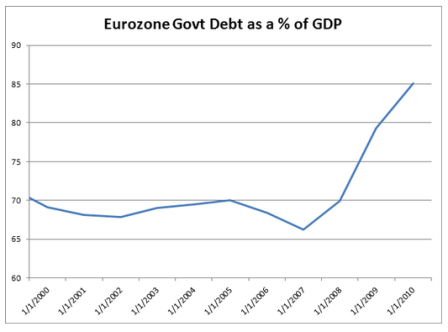

And the rising euro zone debt to GDP ratio (which is only through 2010 on the below chart) though falling some this year with austerity, may now be rising again due to new weakness created by that same austerity.

It’s all starting to look a lot like the beginnings of the traditional banana republic model- high unemployment, high ‘bad’ deficits from weak economies, and a falling currency that keeps debt to gdp ratios capped as ‘inflation’ floods in through the fx window.