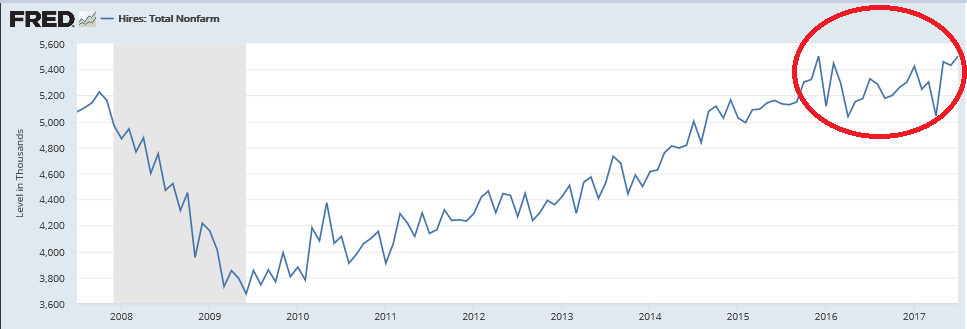

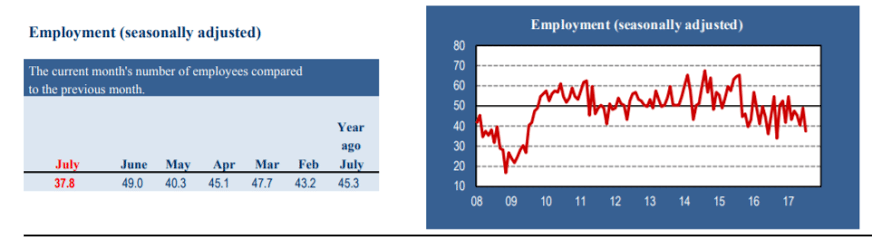

More than the entire gain in civilian employment seems to have been via part time work:

Highlights

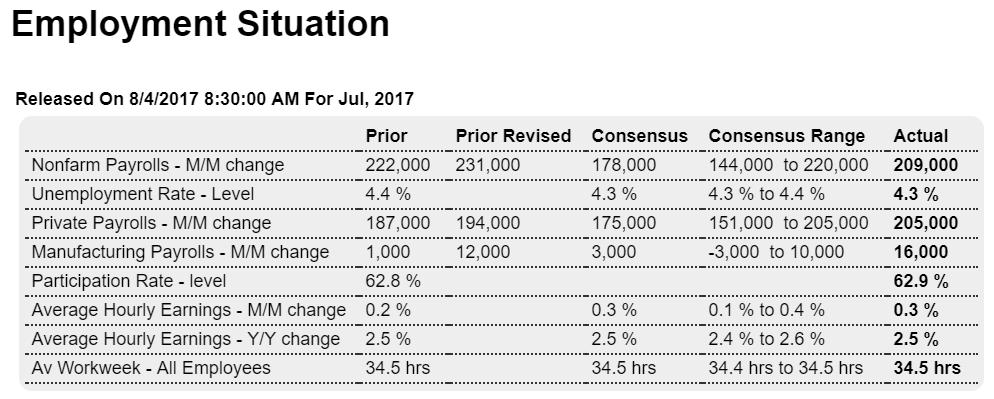

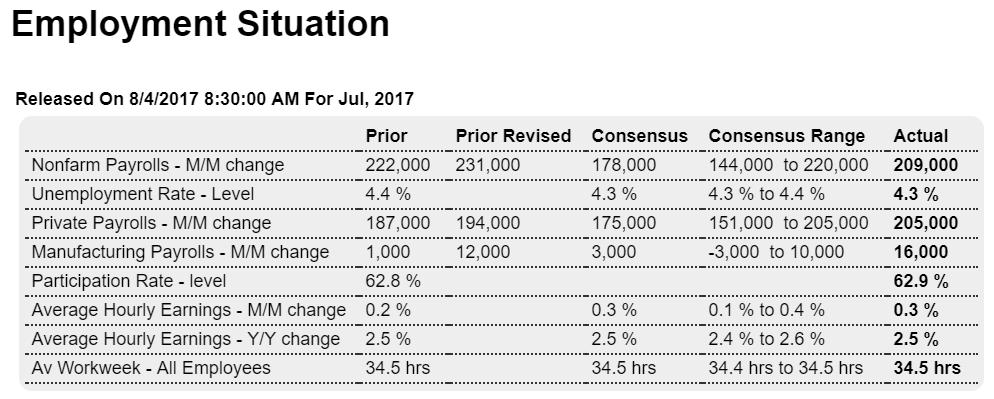

The second half of the year opens on a strong note as nonfarm payrolls rose 209,000 in July, far above Econoday’s consensus for 178,000. The unemployment rate moved 1 tenth lower to 4.3 percent while the participation rate rose 1 tenth to 62.9 percent, both solid positives. And a very strong positive is a 0.3 percent rise in average hourly earnings though the year-on-year rate, at 2.5 percent, failed to move higher. The workweek held steady at 34.5 hours.

Factory payrolls are coming alive, up 16,000 in July following a 12,000 increase in June. This points to second-half momentum for manufacturing and is a positive wildcard for the economy in general. A similar standout is professional & business services, up 49,000, and within this temporary help services which rose 15,000. Gains here suggest that employers, pressed to find permanent staff, are turning to contractors to keep up with production. Government was a big factor in June, up 37,000, but was quiet in July at a gain of 4,000. Total revisions are a wash with nonfarm payrolls revised 9,000 higher in June and 7,000 lower in May.

Employment has by far been the strongest factor in the economy and the strength in today’s report will firm conviction among Federal Reserve policy makers that increasing wage gains, and with this increasing inflation, are more likely to hit sooner than later.

From the household survey:

If there was a blemish in the month’s numbers, it came from the distribution of jobs to lower-income sectors. Job creation was strongly titled to part-time, which gained 393,000 positions, while full-time fell by 54,000.

https://www.cnbc.com/2017/08/04/us-nonfarm-payrolls-july-2017.html

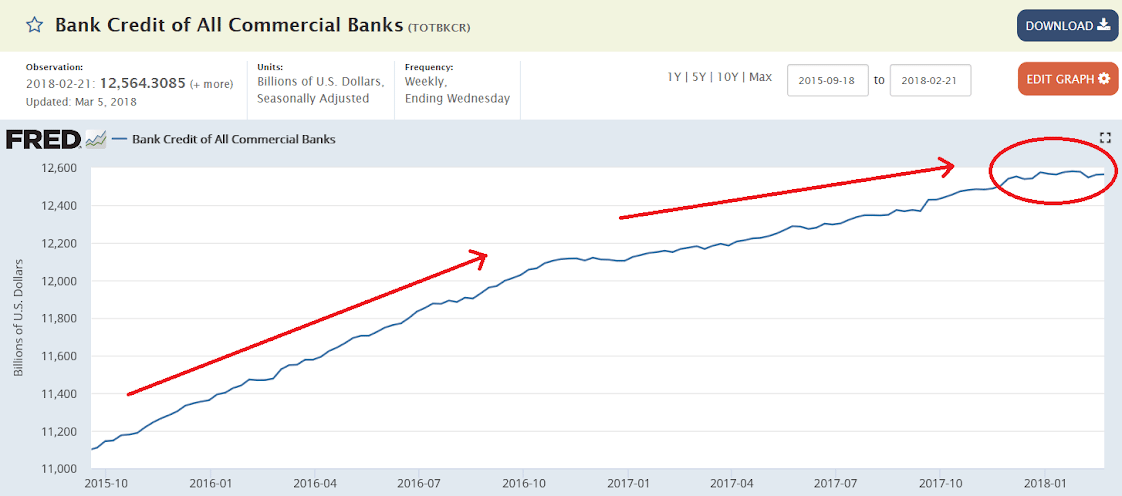

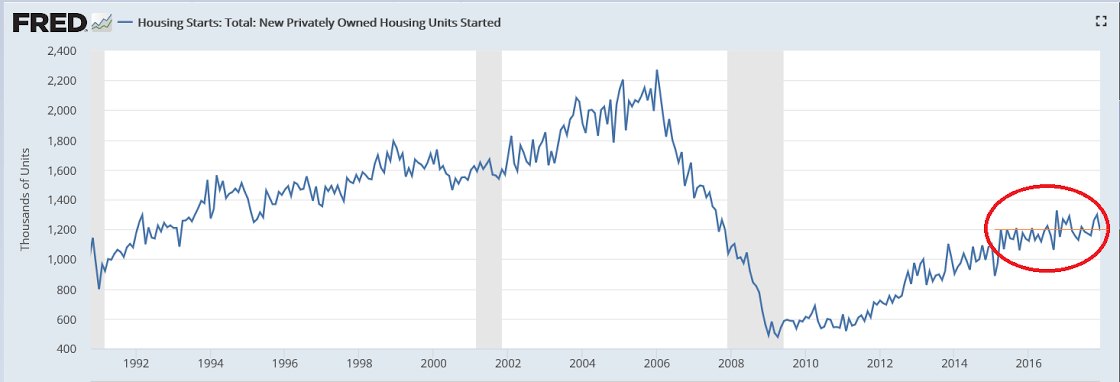

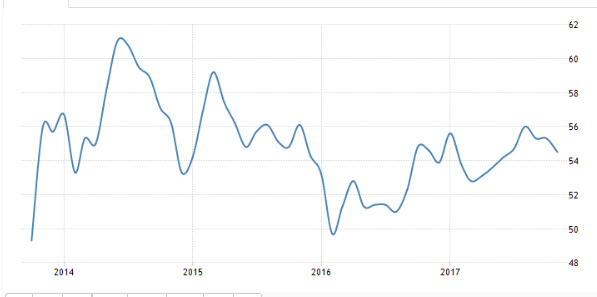

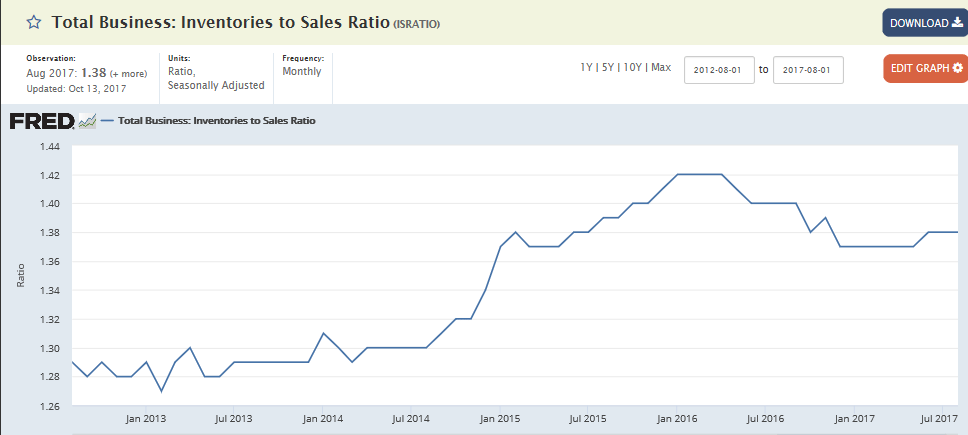

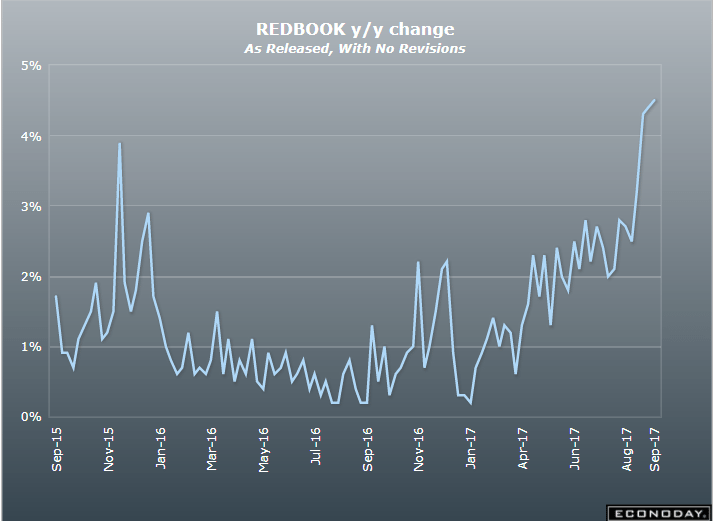

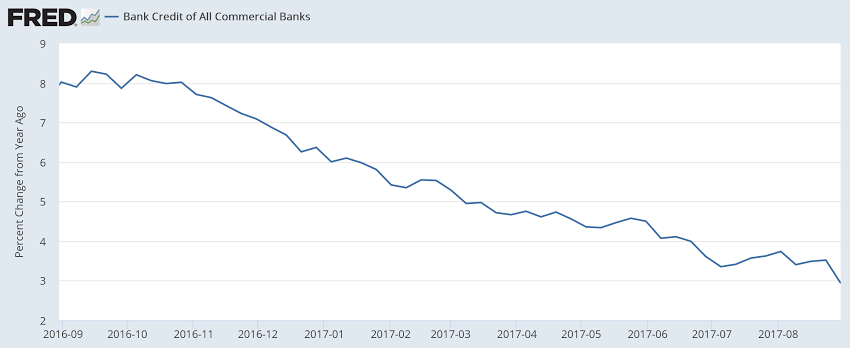

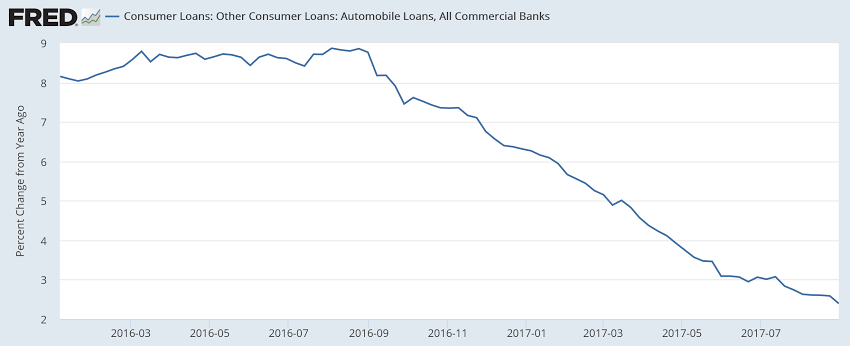

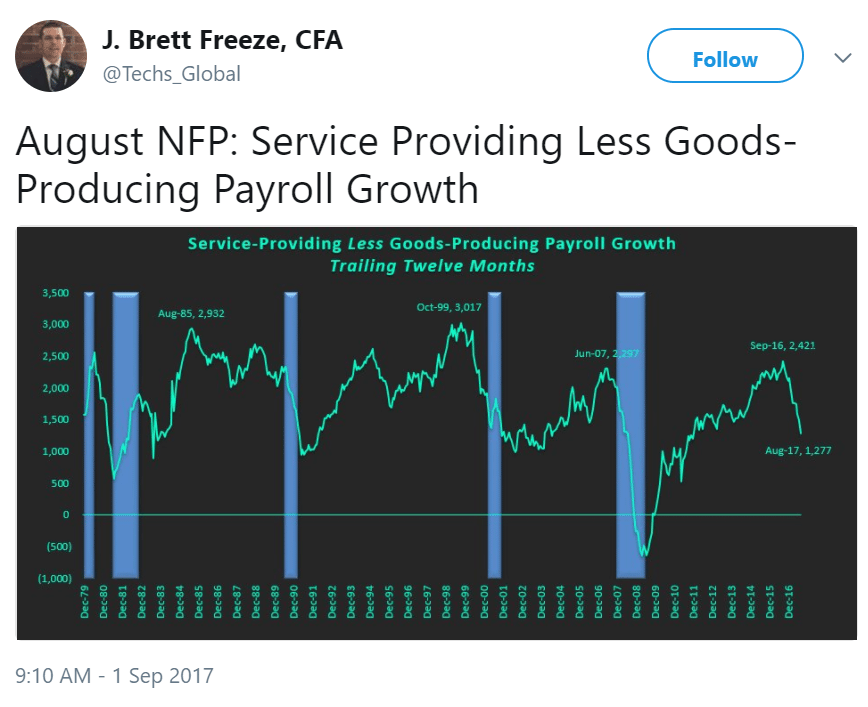

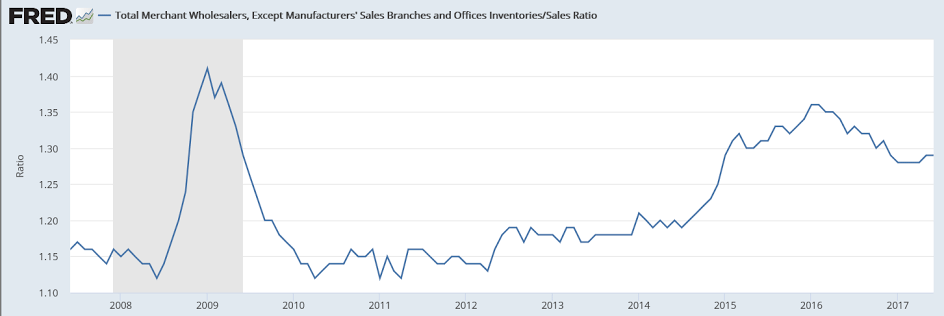

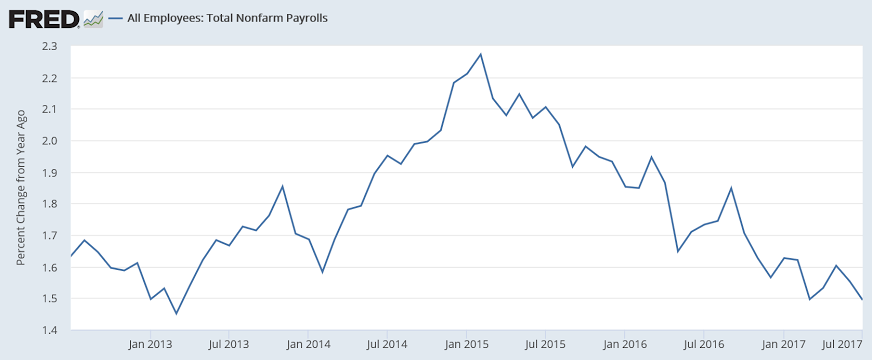

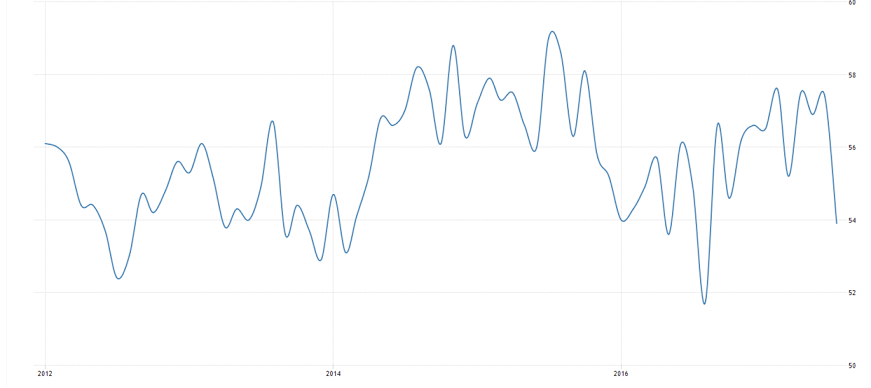

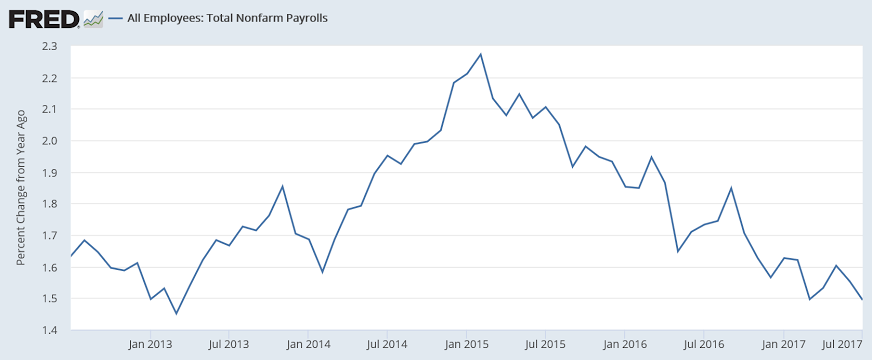

No hint yet of this trend reversing:

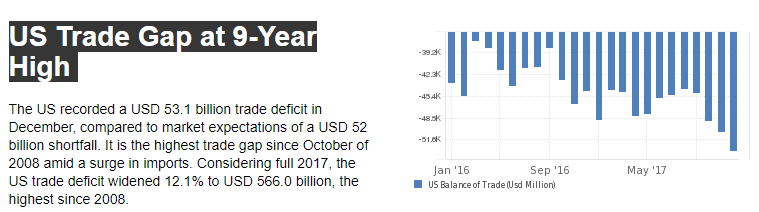

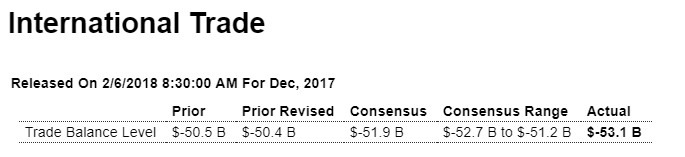

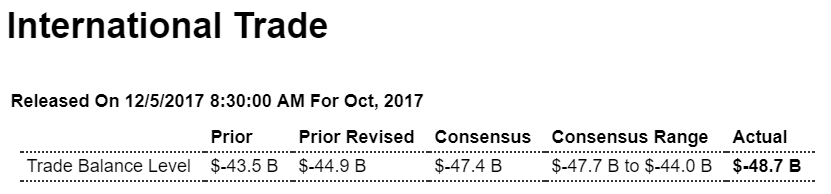

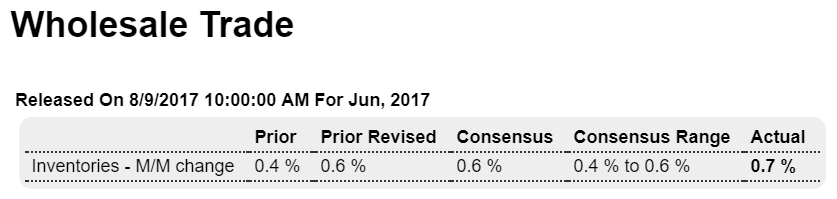

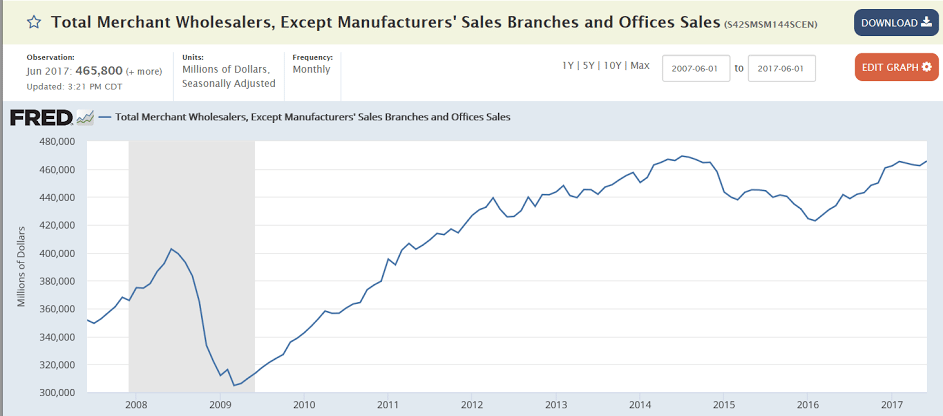

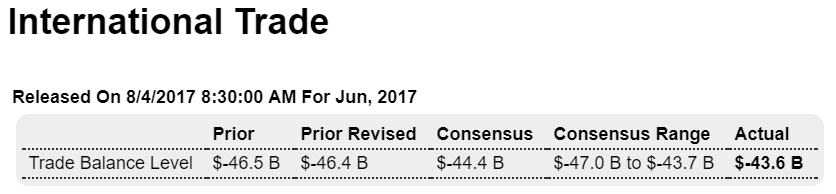

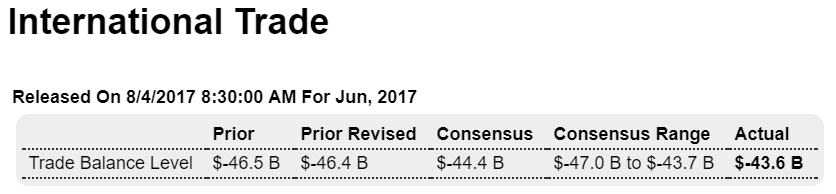

Highlights

At $43.6 billion, the nation’s trade deficit came in below Econoday’s consensus for $44.4 billion which will prove a plus for second-quarter GDP revisions. The goods gap fell 3.2 percent to $65.3 billion (vs the advance reading of $63.9 billion) while the services surplus, which is the economy’s special strength, rose 2.9 percent to $21.6 billion.

Exports show a bounce higher for capital goods despite a dip in aircraft. Exports of cars and food were also strong offsetting a decline for consumer goods. Imports of industrial supplies and within this crude oil fell as did imports of consumer goods. This helped offset a sharp rise in car imports. Imports of capital goods were flat.

The trade gap with China widened nearly $1 billion in June to $32.6 billion and narrowed slightly with the EU to $12.5 billion. The gap with Japan also narrowed slightly, to $5.6 billion, and narrowed sharply with Mexico, by $1.3 billion to $6.0 billion. The gap with Canada also narrowed, to $0.6 billion.

Except for the widening with China and weakness in consumer-goods exports, this is a positive report showing that cross-border trade ended the quarter with solid improvement.

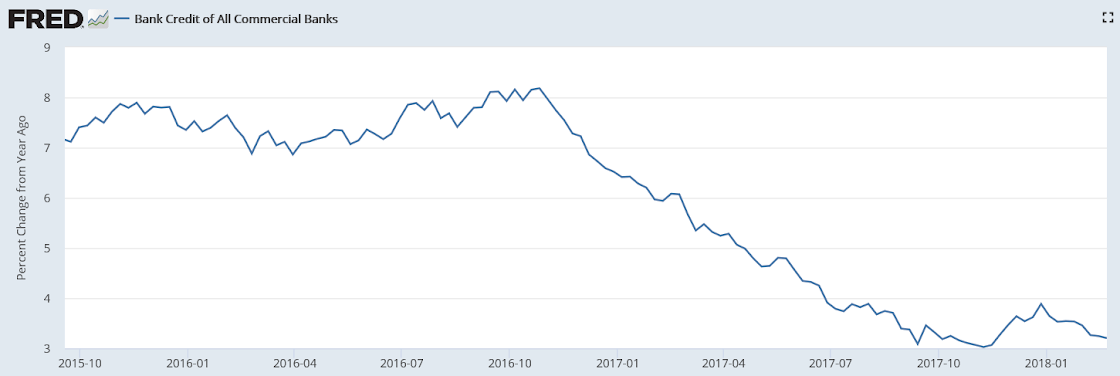

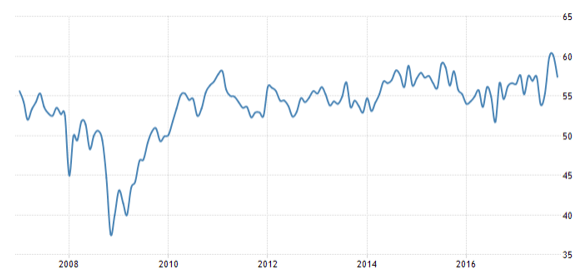

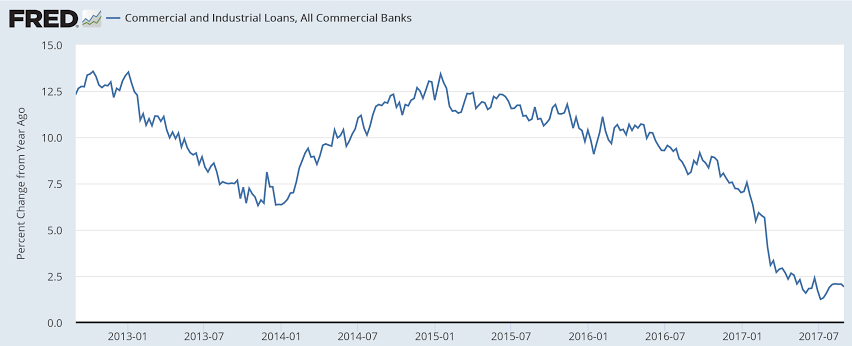

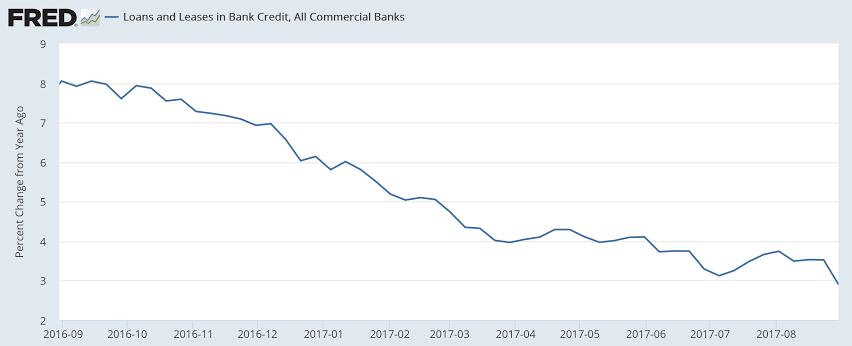

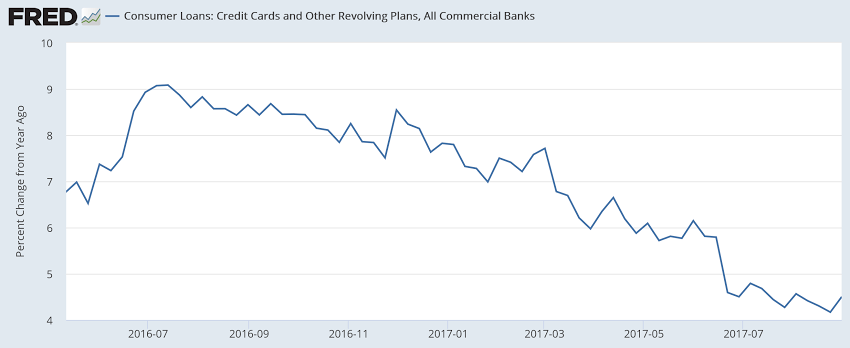

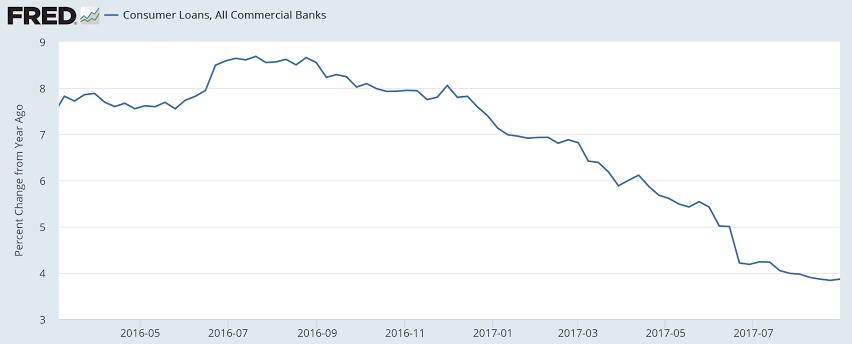

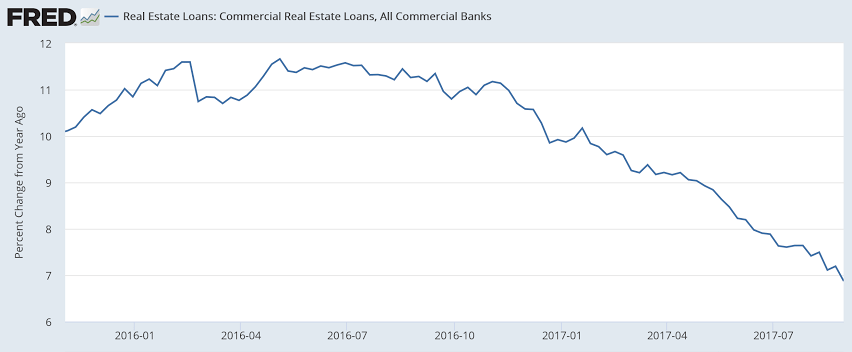

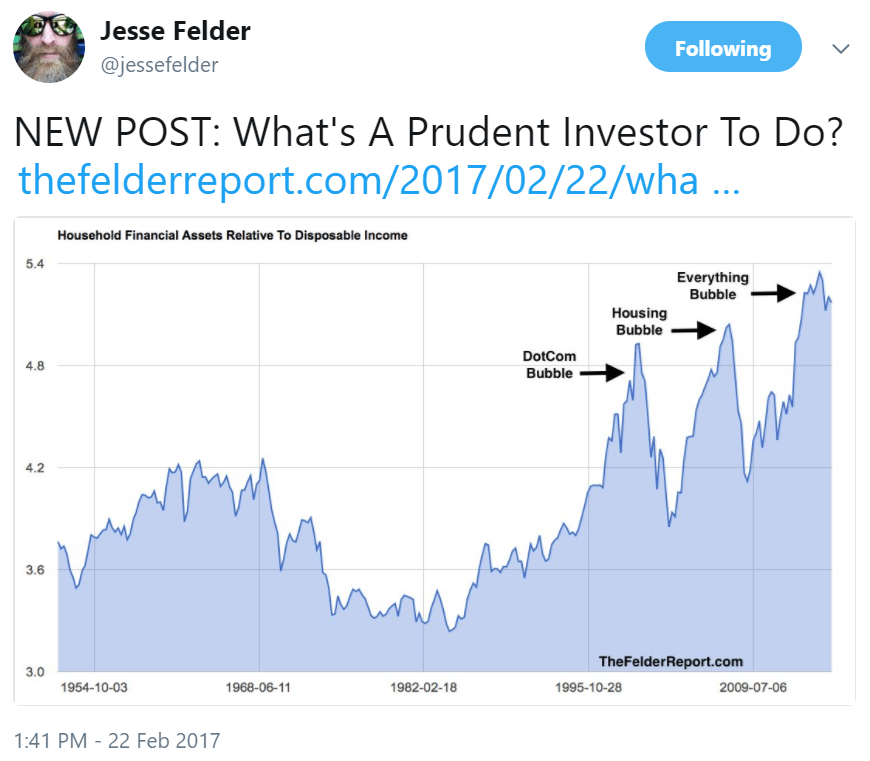

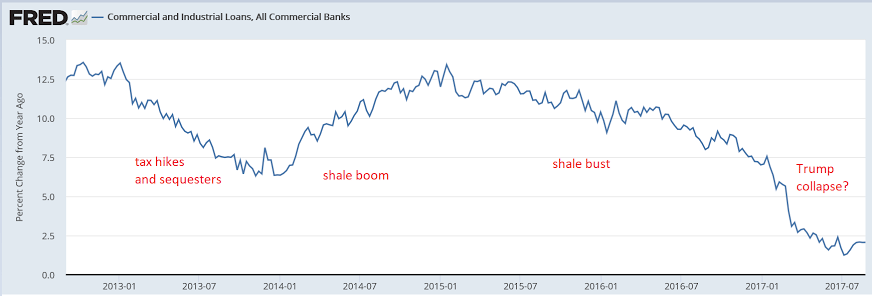

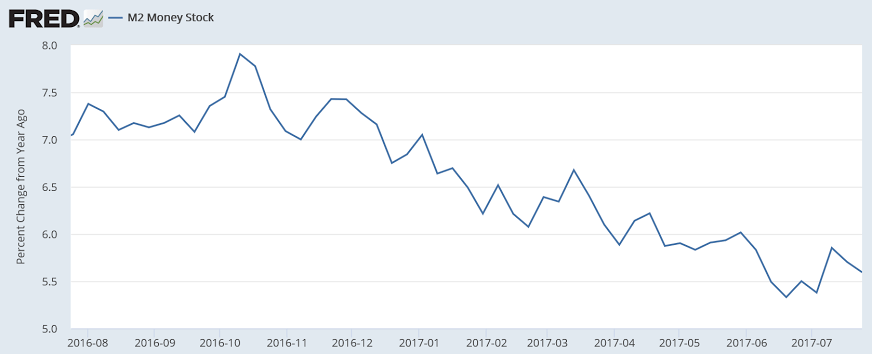

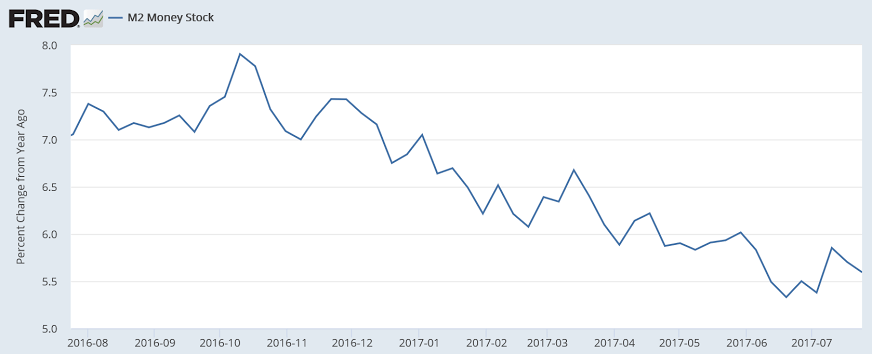

M2 includes bank deposits at the Fed and commercial banks, and as loans create deposits, it’s a proxy for bank loan growth. And while it is ‘distorted’ by QE most recently the Fed’s portfolio has be relatively constant. So note the same pattern of deceleration as with bank lending:

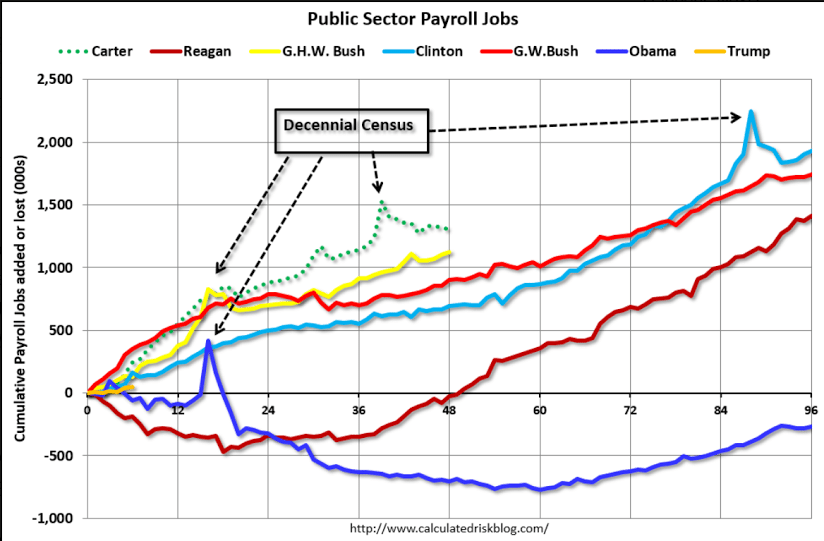

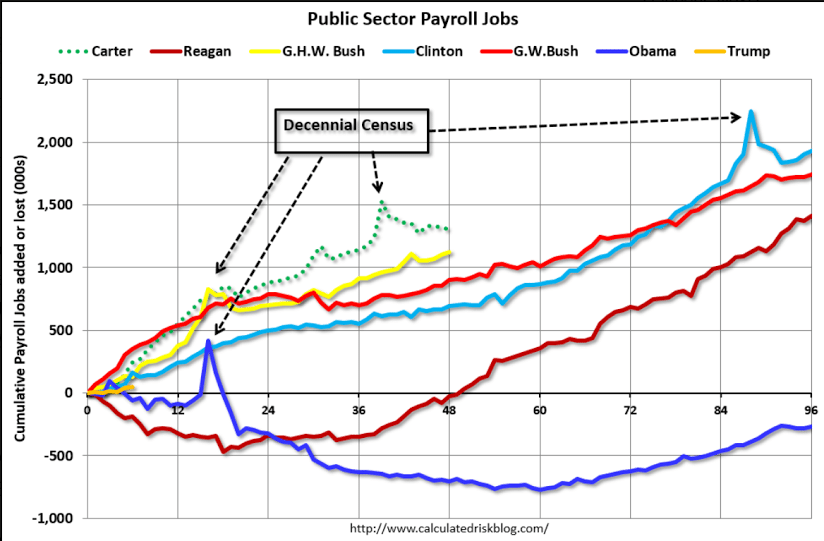

So Trump is winning on this one- more new public sector workers than Obama! ;)

The public sector grew during Mr. Carter’s term (up 1,304,000), during Mr. Reagan’s terms (up 1,414,000), during Mr. G.H.W. Bush’s term (up 1,127,000), during Mr. Clinton’s terms (up 1,934,000), and during Mr. G.W. Bush’s terms (up 1,744,000 jobs).

However the public sector declined significantly while Mr. Obama was in office (down 268,000 jobs).

During the first six months of Mr. Trump’s term, the economy has gained 47,000 public sector jobs.

Read more at http://www.calculatedriskblog.com/#bXBCMVBXZXBLuHDB.99

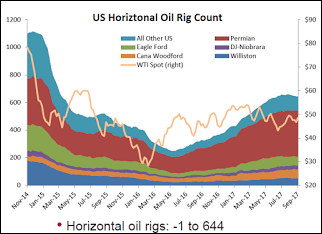

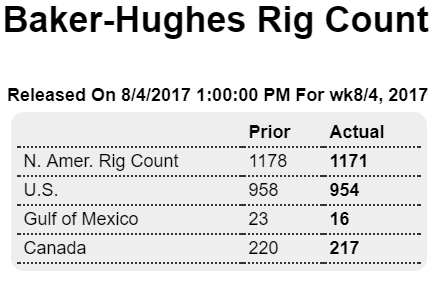

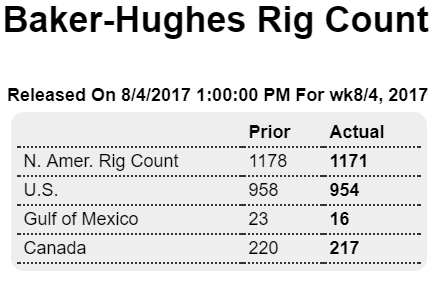

Rig counts seem to have leveled off at current prices. Yes, a bit more is being spent on drilling, and output is up, but oil related capital spending is nowhere near the 2014 growth in oil related spending that was subsequently lost:

Highlights

The Baker Hughes North American rig count is down 7 rigs in the August 4 week to 1,171, interrupting its upward climb for only the second time in the last 14 weeks. The U.S. count is down 4 rigs to 954 but is up 490 rigs from the same period last year. The Canadian count is down 3 rigs to 217 but is up 95 rigs from last year.

For the U.S. count, rigs classified as drilling for oil are down 1 rig to 765 and gas rigs down 3 to 189. For the Canadian count, oil rigs are down 5 rigs to 124 but gas rigs are up 2 to 93.