Highlights

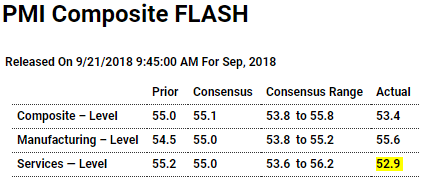

Amid a backdrop of rising inflation pressures, sharp slowing in the services PMI sample pulled down September’s composite flash and masks a strong showing for manufacturing. The PMI composite fell to 53.4 which is well below Econoday’s consensus for 55.1 and also below the low estimate for 53.8. Services fell to 52.9 vs a consensus for 55.0 while manufacturing, however, rose to 55.6 vs expectations for 55.0.

Weakness in services is centered in the year-ahead outlook which fell to its lowest level of 2018 reflecting concerns over cost pressures as input prices rose sharply and selling prices surged to a record high in survey data going back 10 years. Respondents to the service sample cited the need to pass through higher labor costs and increased input costs sourced from overseas. Cost concerns overshadow a rise in new orders, a build in backlogs, and a jump in hiring to a 3-1/2 year high.

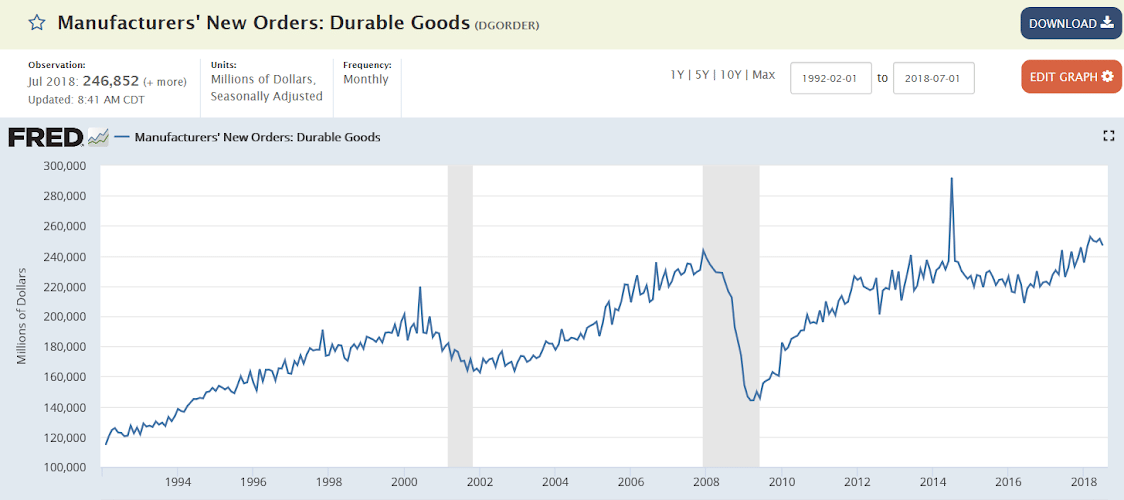

The year-ahead outlook on the manufacturing side is also weak, slipping to a 2-1/2 year low as this sample cited higher costs tied to metal tariffs and the related need for forward purchasing. Some of these respondents said strong order levels are allowing them to push up selling prices. Yet other details, much like the service side of the report, are positive including rising orders and production. Another negative, however, is the slowest rate of hiring over the past year.

The service sector dwarfs manufacturing in size which explains its much greater impact on the composite. But though a fraction of the size of services, manufacturing is considered, however, a leading barometer for future economic change which is the silver lining in today’s report. Yet not a silver lining at all is the inflation theme of the report, one that is certain to gain the attention of Federal Reserve policy makers who look to raise rates next week to defend against the risk of economic overheating.

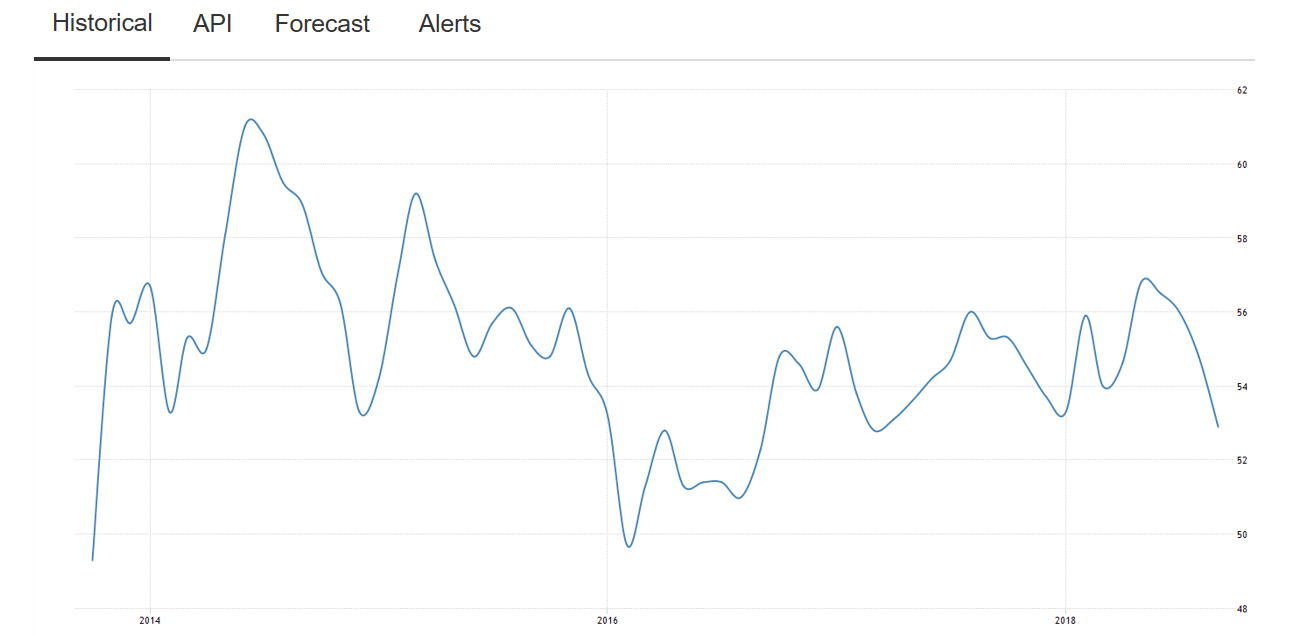

Services pmi:

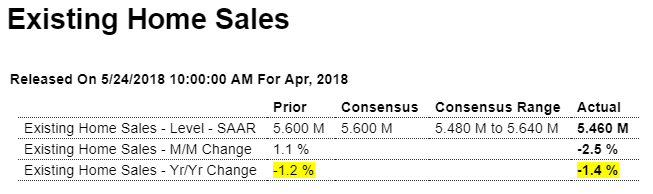

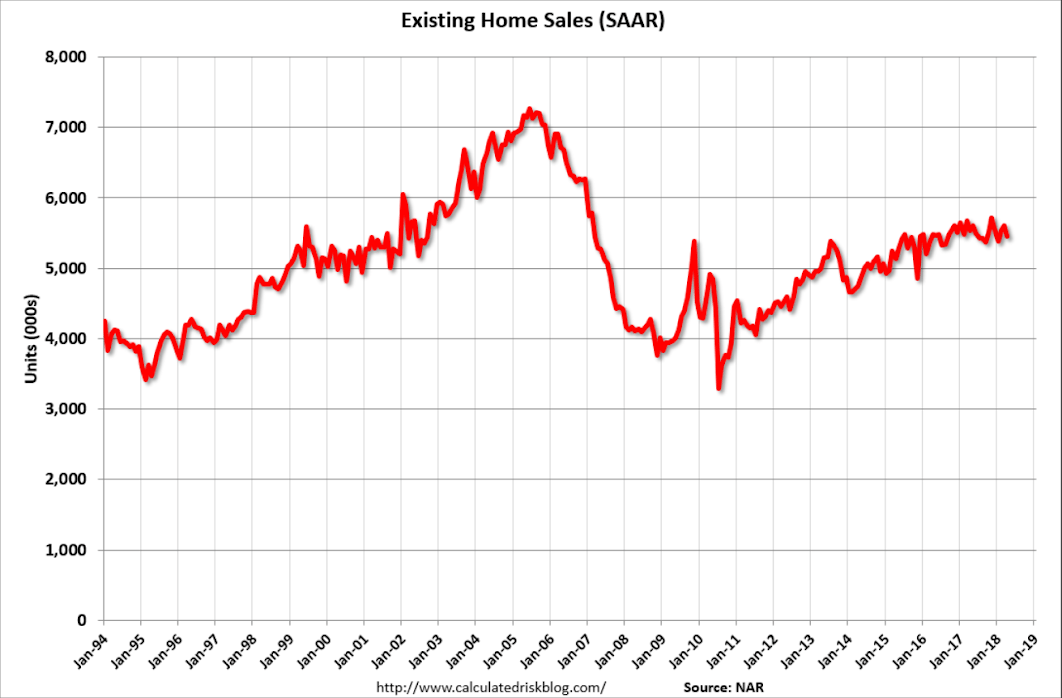

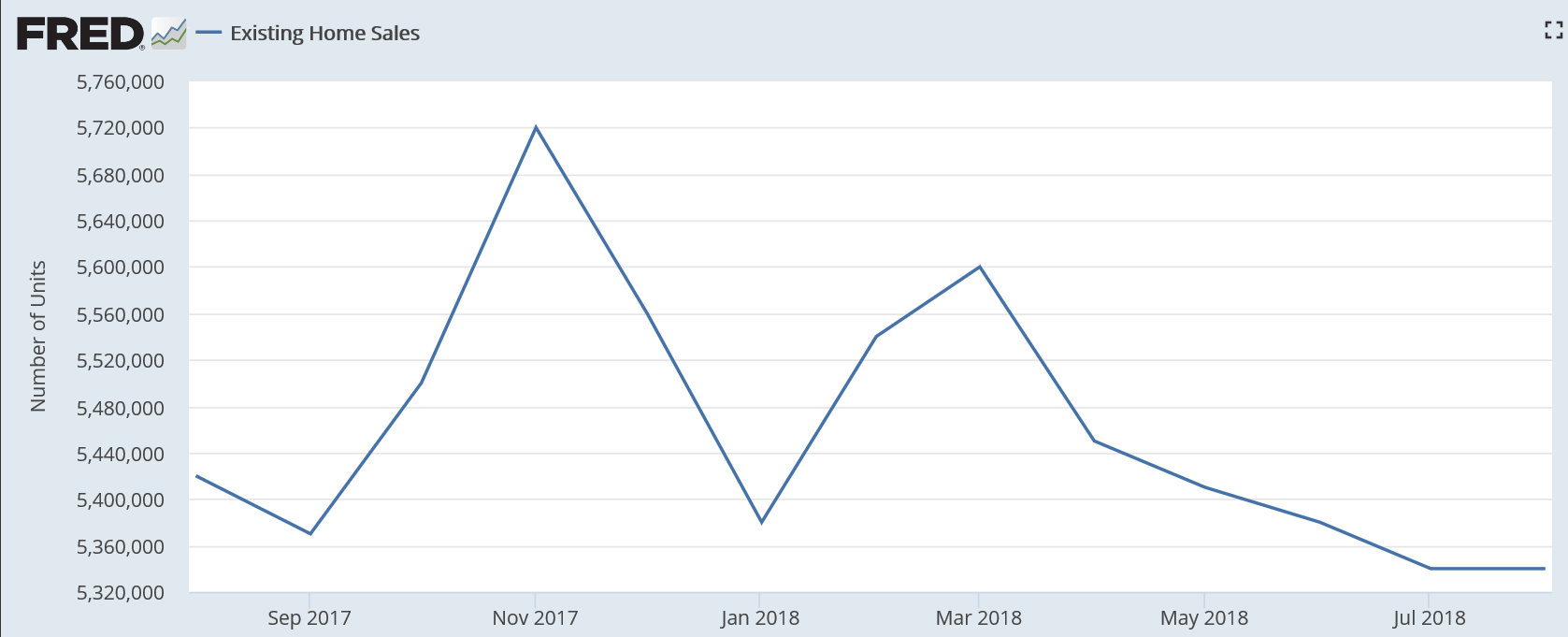

August 2018 Headline Existing Home Sales Continue In Contraction Year-over-Year

The headline existing home sales growth was unchanged with the authors saying “With inventory stabilizing and modestly rising, buyers appear ready to step back into the market”. Our analysis shows home sales three month rolling average is in contraction year-over-year.

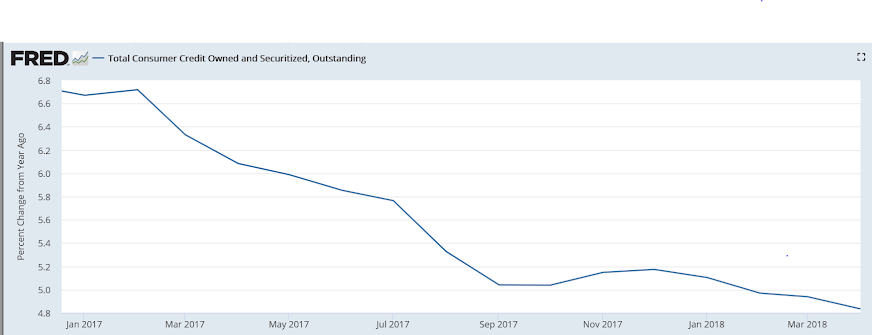

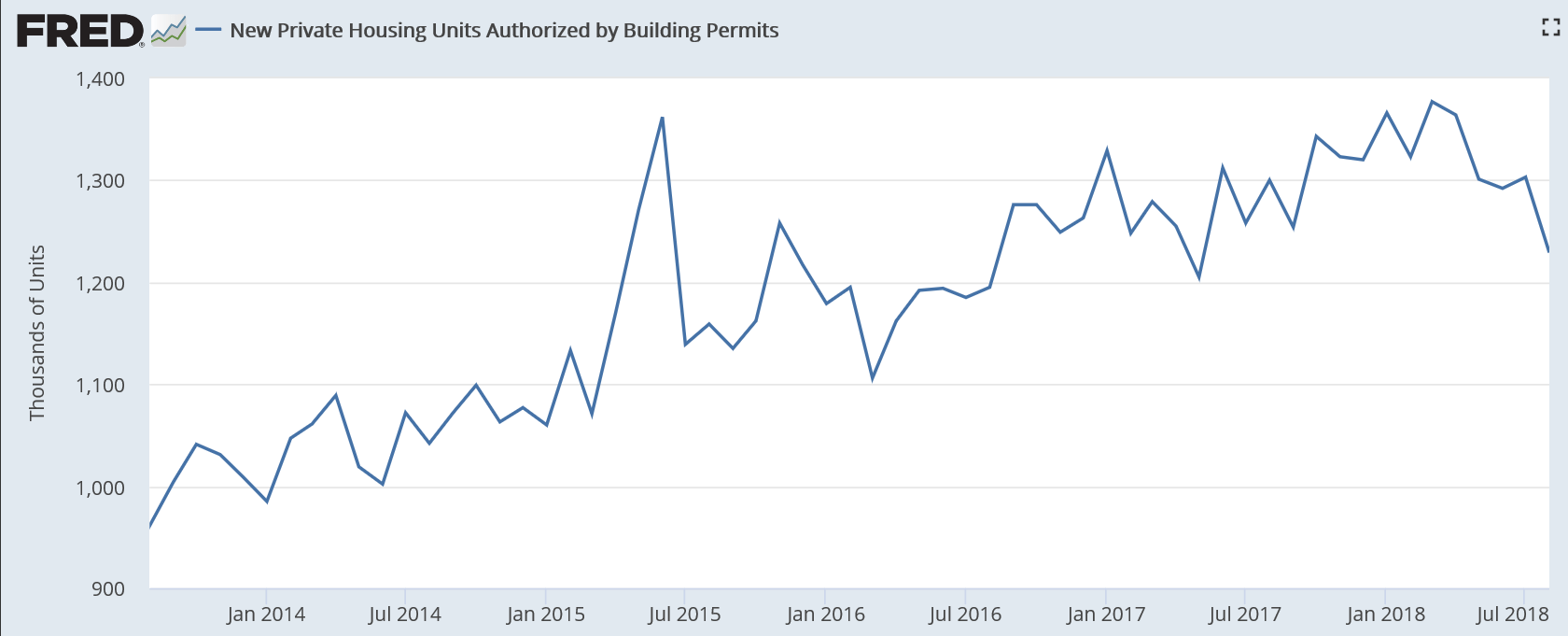

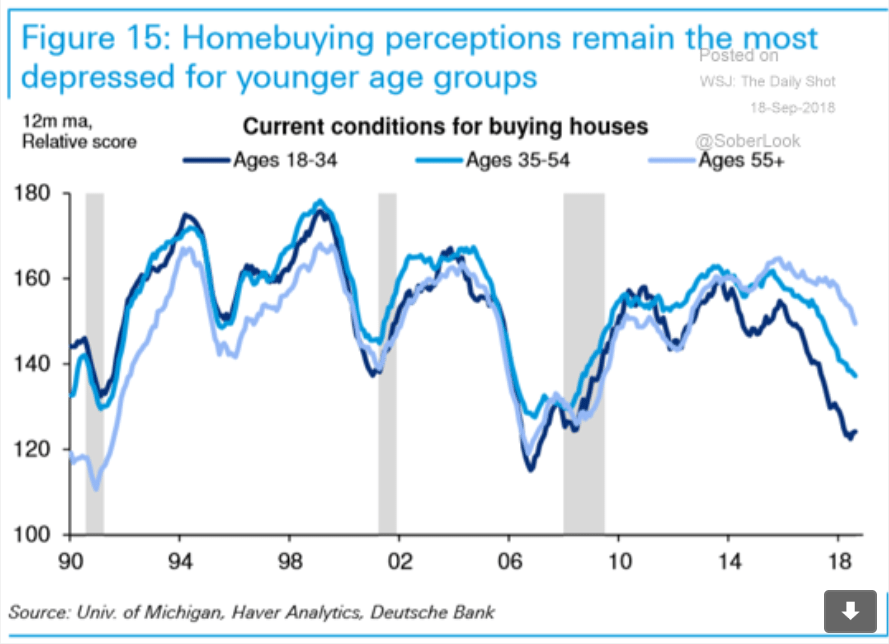

Slowing here as well:

Chicago Fed “Index Points to Steady Economic Growth in August”

Fed’s Beige Book “This report was prepared at the Federal Reserve Bank of New York based on information collected on or before August 31, 2018”

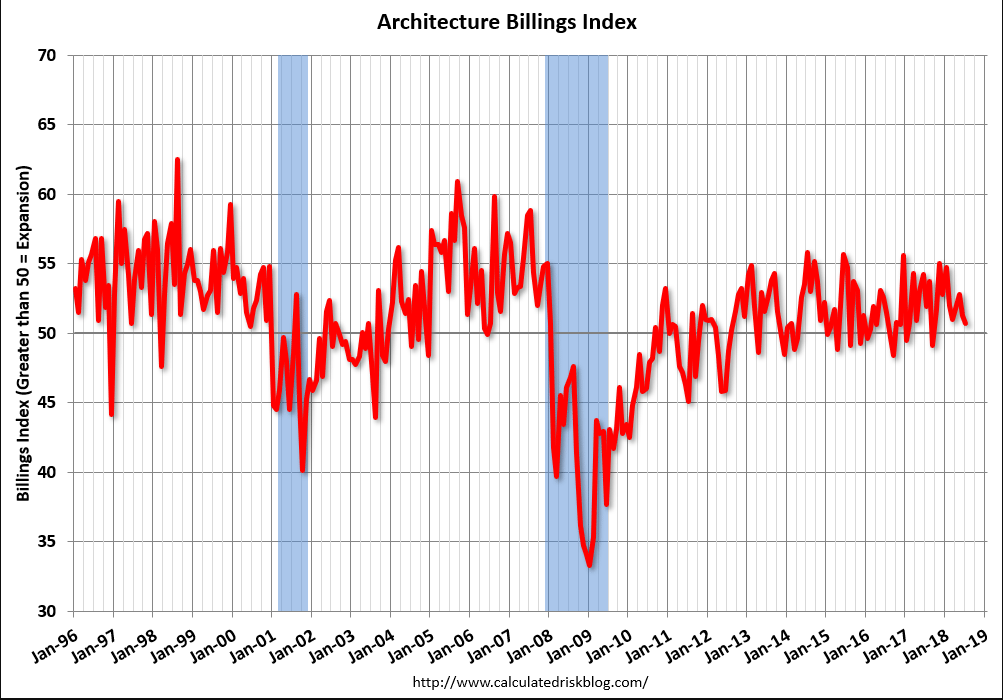

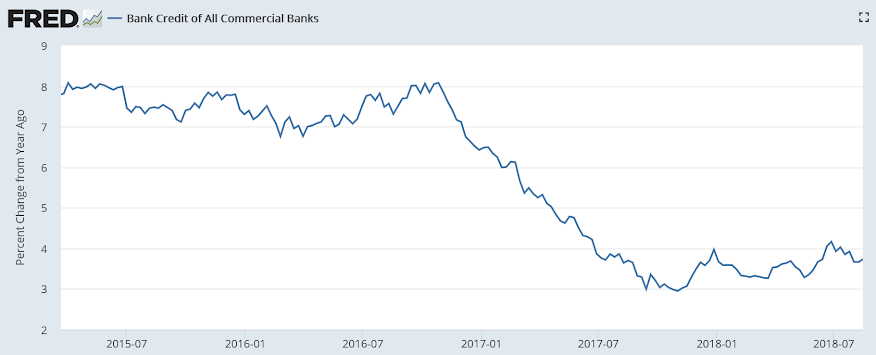

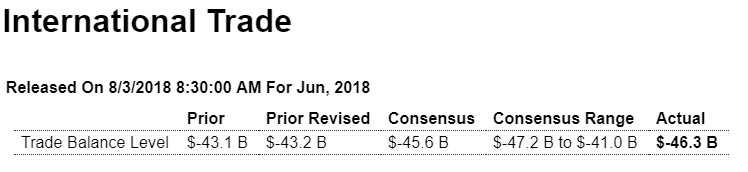

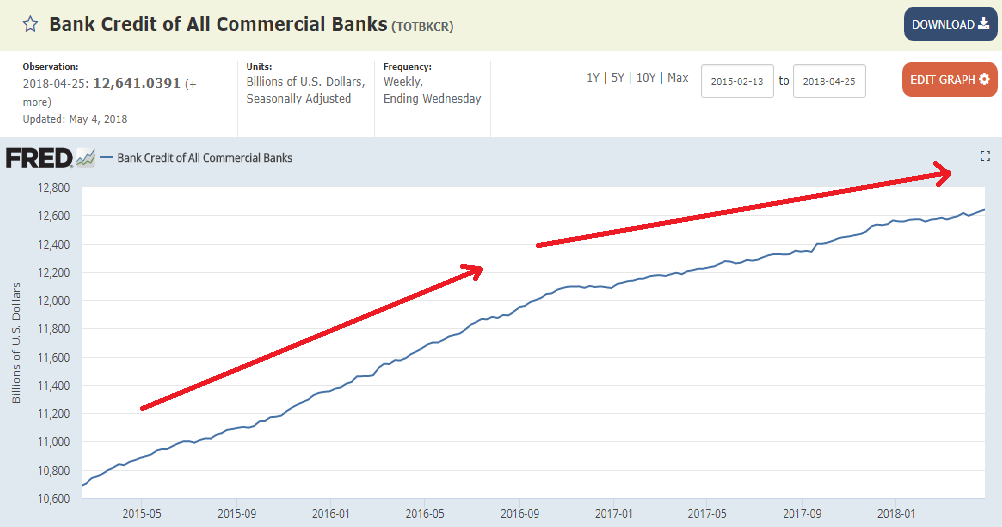

Reports from the Federal Reserve Districts suggested that the economy expanded at a moderate pace through the end of August. Dallas reported relatively brisk growth, while Philadelphia, St. Louis, and Kansas City indicated somewhat below average growth. Consumer spending continued to grow at a modest pace since the last report, and tourism activity expanded, to varying degrees, across the nation. Manufacturing activity grew at a moderate rate in most Districts, though St. Louis described business as little changed and Richmond reported a decline in activity. Transportation activity expanded, with a few Districts characterizing growth as robust. Home construction activity was mixed but up modestly, on balance. However, home sales were somewhat softer, on balance–in some cases due to reduced demand, in others due more to low inventories. Commercial real estate construction was also mixed, while both sales and leasing activity expanded modestly. Lending activity grew throughout the nation. Some Districts noted weakness in agricultural conditions. Businesses generally remained optimistic about the near-term outlook, though most Districts noted concern and uncertainty about trade tensions–particularly though not only among manufacturers. A number of Districts noted that such concerns had prompted some businesses to scale back or postpone capital investment due to worries about the trade outlook.

China Auto Sales Slump on Trade Tensions, Economic Jitters

We’ll see if this ‘eventuates’:

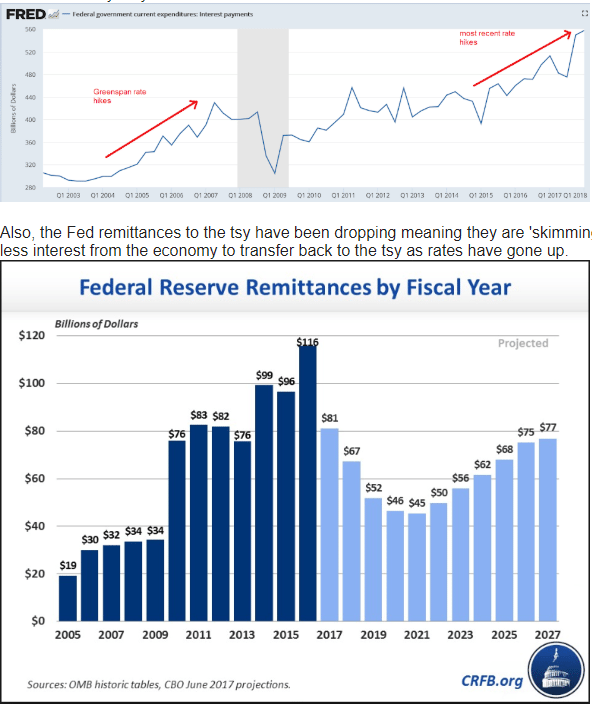

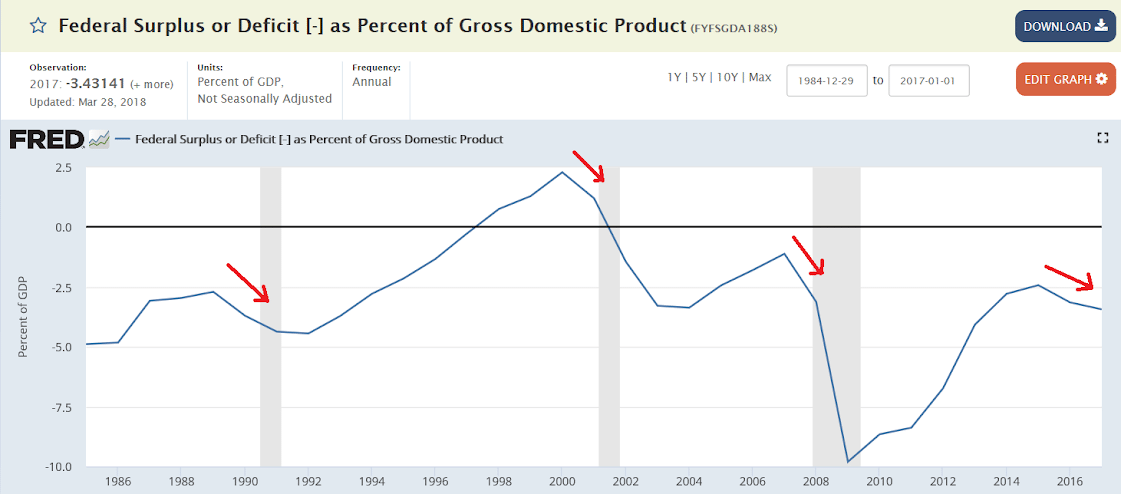

Trump adviser eyes entitlement cuts to plug U.S. budget gaps

(Reuters) “We have to be tougher on spending,” White House economic adviser Larry Kudlow said in remarks to the Economic Club of New York, adding that government spending was the reason for the wider budget deficits, not the Republican-led tax cuts activated this year. “We’re going to run deficits of about 4 to 5 percent of GDP for the next year or two, OK. I’d rather they were lower but it’s not a catastrophe,” Kudlow said. “Going down the road, of course we’d like to slim that down as much as possible and we’ll work at it.”