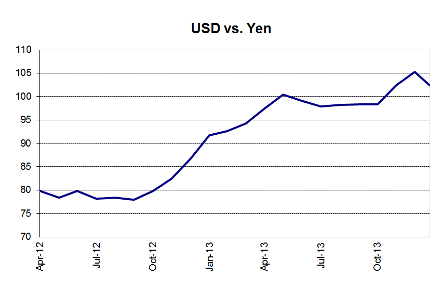

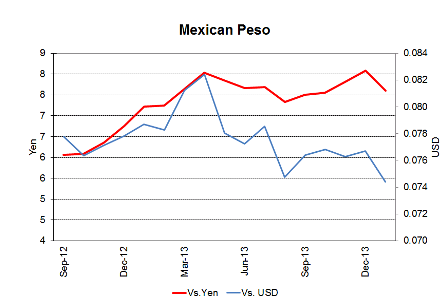

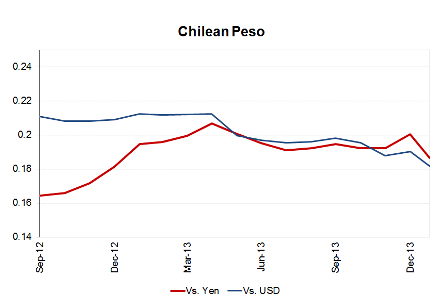

Seems no one is pointing out how this is all looking a lot like ‘catch up’ vs last year’s yen move?

As previously discussed, the proactive yen move from under 80 to over 100 vs the dollar- a 30% or so pay cut for domestic workers in terms of prices of imports- was an internationally deflationary impulse.

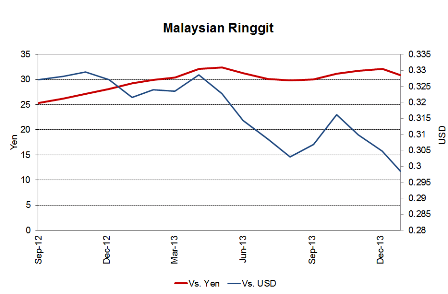

It’s called ‘currency wars’ with the exporters pushing hard on their govts to do whatever it takes to keep them ‘competitive’. And all, at least to me, shamelessly thinly disguised as anything but. And, in fact, it’s not ‘wrong’ to call it ‘dollar appreciation’ rather than EM currency depreciation given the deflationary bias of US (and EU) fiscal and monetary (rate cuts/QE reduce interest income for the economy) policy.

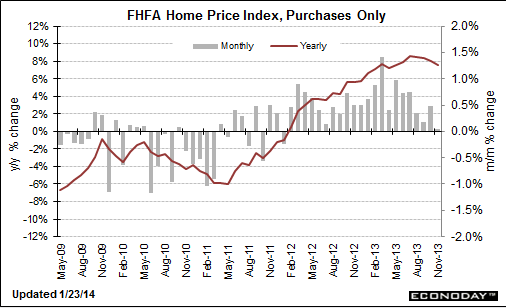

This is a highly deflationary force for the US (and EU) via import prices and lost export pricing power, also hurting earnings translations and, in general weakening US domestic demand, as increased domestic oil output doesn’t reduce net imports as much as would otherwise be the case.

And while I’m not saying energy independence is a ‘bad thing’ note that the UK has been largely ‘energy independent’ for quite a while, so there’s obviously more to it.

The optimal policy move for the US is fiscal relaxation- like my proposed FICA suspension- to get us back to full employment and optimize our real terms of trade. (and not to forget the federally funded transition job for anyone willing and able to work to facilitate the transition from unemployment to private sector employment as the economy booms).

But unfortunately Congress is going the other way and making it all that much worse.

By Katrina Bishop

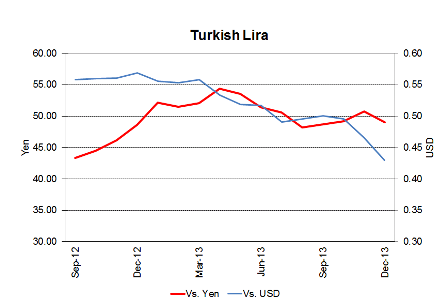

January 24 (CNBC) — Emerging market currencies continued to take a beating on Friday — with Turkey’s lira hitting a new record low against the dollar yet again — amid growing concerns about the U.S. Federal Reserve’s monetary guidance.

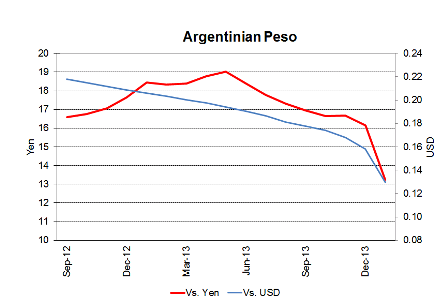

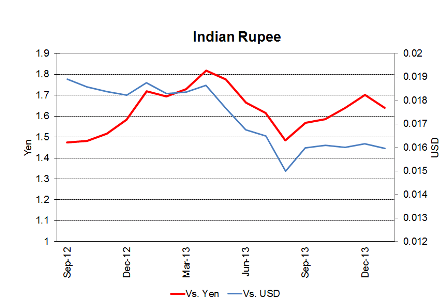

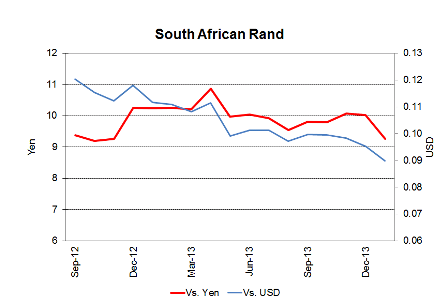

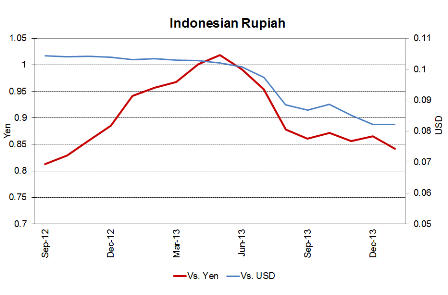

On Friday, the dollar strengthened to 2.3084 against Turkey’s currency. Investors also piled out of the South African rand and Argentina’s peso, and both the Indian rupee and the Indonesian rupiah fell to two-week lows against the dollar. Meanwhile, the Australian dollar fell to $0.8681 – its lowest level in three-and-a-half years.

“The market is in panic mode. We have huge psychological fear that is going to emerging markets, despite a global environment that hasn’t changed that much,” Benoit Anne, head of global emerging market strategy at Societe Generale, told CNBC.

“My bias at this stage — although it’s a bold one — is that this is all about the credibility of the Fed with respect to its forward guidance. This fear that the Fed is going to tighten quicker than expected is translating into emerging markets.”

The U.S. central bank has promised that it will not raise interest rates until unemployment hits 6.5 percent – but some analysts are concerned that rate hikes could come sooner than expected.

U.S. monetary policy has always had a significant on emerging markets, and the Fed’s bond-buying program boosted risk sentiment, causing investors to turn their back on so-called “safe havens” and pile into assets seen as riskier – such as emerging market currencies.

Speculation of Fed tapering in 2013 hit emerging markets hard, with currencies including India, Turkey, Russia and Brazil coming under intense pressure in 2013.

But Anne added these recent moves were likely to be more temporary.

“It’s a matter of weeks rather than the whole year 2014 as a total write off for emerging markets,” he said. “Although it will take the Fed re-establishing its credibility towards forward guidance before we see respite in emerging markets.”