[Skip to the end]

By Paul McCulley, Managing Director, PIMCO

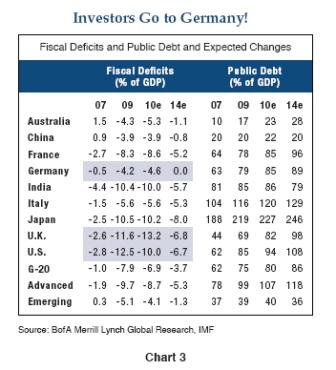

The whole world, it seems, is wrapped around the axle about exit strategies from putatively unsustainable policies: (1) the Fed’s bloated balance sheet, with some $800 billion of excess reserves sloshing ’round the banking system, in the context of an effective zero Fed funds rate; and (2) the Treasury’s huge budget deficit, unprecedented in peace time and set to stay huge, implying a Treasury debt/GDP ratio approaching 100% within a decade’s time.

For some, usually with Monetarist roots, this combination of policies is a classic brew for a major bout of inflation (eventually, it is always stressed). For others, usually with Austrian tendencies, this policy brew is a deflationary force, as it will provoke foreign investors to flee both the dollar and Treasuries, driving up real interest rates, pole axing any revival in risk asset prices, themselves backed by the fruits of bubble-driven mal-investment. And, I’m quite sure, there are some with a foot in both camps.

So it’s not easy to actually define conventional, or consensus, wisdom. In fact, many of my Keynesian brethren seem to be struggling with what to do, arguing against any further near-term fiscal stimulus, or at least unless enacted simultaneously with long-term fiscal restraint. Indeed, I recently publicly uttered something along these lines, though I hedged myself by saying long-term fiscal responsibility rather than restraint (responsibility is in the eye of the beholder, while restraint is more categorical).

In any event, there does not seem to be any serious consensus as to how the policy mix should be adjusted, if at all, despite clear and present evidence of massive unemployment and underemployment, which is putting downward pressure on nominal personal income (the product of fewer jobs, fewer hours and decelerating wages, almost to the zero line).

And rapidly declining interest income as savings rates ‘reset’ to 0, and borrowing rates stay high, with the spread going to lenders with near 0 propensities to consume.

And government net interest payments are flat to down as well even with higher deficits.

This is not the stuff of a self-sustaining revival in aggregate demand. Thus, my tentative conclusion is that maybe the consensus professional economist view is that America should simply accept that it’s going to have its version of Japan’s lost decade, the Calvinist aftermath of the preceding sin of booming growth on the back of ever-increasing leverage and mal-investment.

But if that sobering view is indeed the new consensus, shame on my profession! There is another way. And, irony of ironies, it is not a new way, but rather an old way, one defined by no less than Paul Krugman in 1998 and Ben Bernanke in 2003, when lecturing Japan about what to do. I have enormous respect for the intellectual horsepower of both men, and what they preached back then deserves a re-preaching, even if I’m the humble preacher that must take the pulpit.

Krugman in May 1998

In a delightfully wonkish paper,1 using the enormous horsepower of the IS-LM (investment savings-liquidity preference money supply equilibrium) framework,

Unfortunately that’s a fixed fx/gold standard model with no application to non convertible floating fx currency.

he made a powerful case for what Japan should do to bootstrap itself out of the deflationary swamp. I’ll spare you the wonkish part and cut to his commonsensical conclusion.

In the midst of deflation in the context of a liquidity trap, with the central bank’s policy rate pinned at zero, it is not enough for the central bank to print money,

Right, that’s just an exchange of financial assets, and with lending not reserve constrained has no effect on lending and/or the real economy.

accommodating massive fiscal policy stimulus, he argued. Not that this is not a necessary policy action. It is. But it is not sufficient, Krugman pounded the table, because if the public believes that the central bank will, in the future, un-print the money – in today’s jargon, implement an exit strategy from money printing – then the printed money will simply be hoarded, rather than spent, because deflationary expectations will remain entrenched.

‘Unprinting money’ is simply the CB selling securities which again is an exchange of financial assets and has no effect on lending or the real economy, apart from the resulting interest rates which the CB controls via price in any case.

To get the public to spend the money, Krugman argued, the central bank should make clear that the printed money will remain printed, shifting deflationary expectations to inflationary expectations. In his famous conclusion, actually advice to the Bank of Japan, Krugman declared (his italics, not mine):

“The way to make monetary policy effective is for the central bank to credibly promise to be irresponsible – to make a persuasive case that it will permit inflation to occur, thereby producing the negative real interest rates the economy needs.”

This confirms a lack of understanding of monetary operations. The ‘printing/unprinting of money’ is simply a financial asset exchange that does not add net financial assets to the non govt sectors, and has no influence on lending.

In a follow-up (similarly wonkish) paper2 in 1999, Professor Krugman refined his argument, stressing that the core of his thesis could be implemented through a credible inflation target that was appreciably higher than the prevailing negative inflation rate in Japan. Thus, he was not so much arguing that the Bank of Japan should act irresponsibly, but rather act irresponsibly relative to orthodox, conventional thinking, which itself was irresponsible, in that it emphasized the need for an eventual exit strategy from liquidity trap-motivated money printing.

He is also ‘trapped’ in ‘inflation expectations theory’ that is also the result of not understanding monetary operations, or that taxation is a ‘coercive’ measure that removes the ‘neutrality of money’ from the model.

To get out of the trap, he emphasized, the central bank needed to radically change expectations to the notion that there was no exit strategy, at least until inflation was appreciably higher – not just inflation expectations, but inflation itself. Only then would the commitment to higher inflation be credible, with the central bank not just talking the reflationary talk, but walking the reflationary walk, turning deflationary swamp water into reflationary wine.

As an interesting aside, a little over a year ago the media reported that consumers had pulled back their spending due to inflation and elevated inflation expectations. Not supposed to happen the way expectations theory says they will accelerate purchases. But that’s another story and moot in any case.

Naturally, the Bank of Japan didn’t listen to Krugman at the time; orthodoxy is as orthodoxy does. In March 2001, however, the Bank of Japan did serve up a small beer from the Krugman still, adopting Quantitative Easing (QE), re-enforcing its zero interest rate policy (ZIRP) with an explicit target for massive creation of excess reserves, committing to retaining that policy until the year-over-year core CPI moved above zero on a “stable” basis. A very small beer indeed.

No beer, in fact, as above, as would have been Krugman’s plan, as above.

But to its credit, the Bank of Japan tiptoed the reflationary walk, sticking with QE for five years, exiting in March 2006, after the year-over-year core CPI had turned positive in November 2005. A small beer is better than no beer.

It turned positive after they finally let the deficit get to 8% and not try to cut it with a consumption tax. Also, higher energy and food prices bled through to core through the cost channels some.

Bernanke in May 2003

Professor Bernanke became Fed Governor Bernanke the prior year, making his most famous speech in November 2002, “Making Sure ‘It’ Doesn’t Happen Here,”3 detailing the Fed’s anti-deflationary toolbox. That’s the speech that the markets are using as a roadmap for Chairman Bernanke’s present anti-deflation policy path (it’s actually been quite a good roadmap!). But a speech in May 2003, “Some Thoughts on Monetary Policy in Japan,”4 is equally important, I think, because it provides a roadmap for what the Fed might do if present anti-deflation policies prove to be inadequate to the task.

The speech is not quite as wonkish as Krugman’s May 1998 missive, but is still robustly analytical. Perhaps that’s why my profession and the media do not give it the attention it deserves. But Mr. Bernanke’s speech does have strong Occam’s Razor conclusions, and they are eerily the same as Krugman’s, perhaps even stronger.

No, Mr. Bernanke did not advocate to the Bank of Japan that it credibly commit to acting irresponsibly, Krugman’s clever turn of phrase. In fact, as noted above, Krugman didn’t really, either; he simply wanted the Bank of Japan to act responsibly, which would be deemed irresponsible in the context of orthodox thinking. Both men know how to think outside the proverbial box!

The real problem is their tools don’t do anything in theory or, as repeatedly demonstrated, in practice. It’s not their fault. They don’t have any other tools.

At the time, Mr. Bernanke was a table-thumping advocate for the Fed to adopt an explicit inflation target. But in Japan, he upped that analytical ante by advocating that the Bank of Japan adopt a price level target, not an inflation target.

And there is a huge difference. An inflation target “forgives” past deflation (or below inflation target) sins. In contrast, a price level target does not forgive those sins, but rather demands that the central bank atone for them by explicitly pursuing sufficient inflation to restore the price level to a plateau that would have been achieved if those sins had not been committed. More specifically, he advocated that the Bank of Japan should (his italics, not mine):

“… announce its intention to restore the price level (as measured by some standard index of prices, such as the consumer price index excluding fresh food) to the value it would have reached if, instead of the deflation of the past five years, a moderate inflation of, say, 1 percent per year had occurred. (I choose 1 percent to allow for the measurement bias issue noted above, and because a slightly positive average rate of inflation reduces the risk of future episodes of sustained deflation.) Note that the proposed price-level target is a moving target, equal in the year 2003 to a value approximately 5 percent above the actual price level in 1998 and rising 1 percent per year thereafter. Because deflation implies falling prices while the target price-level rises, the failure to end deflation in a given year has the effect of increasing what I have called the price-level gap. The price-level gap is the difference between the actual price level and the price level that would have obtained if deflation had been avoided and the price stability objective achieved in the first place.

A successful effort to eliminate the price-level gap would proceed, roughly, in two stages. During the first stage, the inflation rate would exceed the long-term desired inflation rate, as the price-level gap was eliminated and the effects of previous deflation undone. Call this the reflationary phase of policy. Second, once the price-level target was reached, or nearly so, the objective for policy would become a conventional inflation target or a price-level target that increases over time at the average desired rate of inflation.”

This is very powerful stuff!

Yes, if there were any tools in the Fed’s tool box that were applicable.

There only tool is setting the term structure of rates, and even then they struggle to figure out how to accomplish that simple task due to their lack of understanding of monetary operations and reserve accounting.

And the problem is, as above, with current institutional arrangements rate cuts have taken income from savers and given it to lenders which has resulted in a net drop in aggregate demand rather than an increase.

Mr. Bernanke knew he was breaking some new ground, at least from the mouth of a sitting policymaker. In actuality, he was drawing on some powerful academic work of Eggertsson and Woodford,5 which laid out the case that a price level target would likely have a more powerful effect on inflation expectations than simply an inflation target above the prevailing level of inflation (or in Japan’s case, deflation). How so? A price level target pegged at the starting point of a period of deflation – or below target inflation – implies that the central bank is explicitly committed to reflation, meaning that in the short-to-intermediate term, the central bank will explicitly aim for an inflation rate that is higher than its long-term “desired” rate.

Unfortunately the fed has no tools that have a transmission mechanism that can make any of that happen.

Mr. Bernanke recognized that such a policy could unmoor long-term inflation expectations, creating a deleterious rise in long-term interest rates.

Yes, the belief in inflations expectations theory leads to those conclusions.

Unfortunately that theory holds no water. It fails to recognize taxation is coercive (as above) which obviates inflation expectations theory as the cause of the price level.

But in his view, this was a risk worth taking, in part because he felt that a central banker with strong communications skills could draw a distinction between (1) a one-time reflation to correct a deflated price level back up to a level that would have been achieved in the absence of deflationary sins and (2) the central bank’s long-term inflation objective. But he acknowledged it would be tricky.

But his case didn’t rest simply on skilled central bank communications. While he felt that generating a positive shock to short-to-intermediate inflation expectations would have the effect of reducing real interest rates (remember, the real rate is the nominal rate minus inflation expectations), he did not think that effect was assured and even if it was, he did not believe it would be sufficient to stimulate private sector aggregate demand robust enough to reduce Japan’s output gap.

Rate cuts did not add to aggregate demand in Japan any more than they have here. They had the same institutional issue- the non government sectors are net savers and rate cuts reduce net interest income.

Bernanke recognized this effect which he called the fiscal channel in his 2004 paper.

Thus, he advocated explicit cooperation between the fiscal authority and the monetary authority, with the latter subordinating itself to the former. And you thought Krugman was radical!

While the passage on this topic6 in Bernanke’s speech is a bit long, it is so powerful that I think it deserves a full hearing. Here it is:

“My thesis here is that cooperation between the monetary and fiscal authorities in Japan could help solve the problems that each policymaker faces on its own. Consider for example a tax cut for households and businesses that is explicitly coupled with incremental BOJ purchases of government debt – so that the tax cut is in effect financed by money creation.

Why would it matter if the BOJ bought the JGB’s or not? Again, all that does is deprive the non government sectors of interest income.

Moreover, assume that the Bank of Japan has made a commitment, by announcing a price-level target, to reflate the economy, so that much or all of the increase in the money stock is viewed as permanent.

That ‘money stock’ is also irrelevant. Reserves are functionally nothing more than one day JGB’s.

Under this plan, the BOJ’s balance sheet is protected by the bond conversion program,7 and the government’s concerns about its outstanding stock of debt are mitigated because increases in its debt are purchased by the BOJ rather than sold to the private sector.

Both those concerns are moot if one understands reserve accounting and monetary operations.

Moreover, consumers and businesses should be willing to spend rather than save the bulk of their tax cut: They have extra cash on hand, but – because the BOJ purchased government debt in the amount of the tax cut – no current or future debt service burden has been created to imply increased future taxes.

Yes.

As taxes function only to reduce aggregate demand and not to ‘fund expenditures’ (with a non convertible currency and floating fx)

Taxes can be reduced to whatever point is necessary to get demand up to desired levels.

Essentially, monetary and fiscal policies together have increased the nominal wealth of the household sector, which will increase nominal spending and hence prices.

The tax cut alone does that. The ‘monetary’ proposal does nothing apart from being part of the process to set interest rates.

The health of the banking sector is irrelevant to this means of transmitting the expansionary effect of monetary policy, addressing the concern of BOJ officials about ‘broken’ channels of monetary transmission. This approach also responds to the reservation of BOJ officials that the Bank “lacks the tools” to reach a price-level or inflation target.

The BOJ did lack the tools. It’s all about fiscal policy.

Isn’t it irresponsible to recommend a tax cut, given the poor state of Japanese public finances?

‘Poor state’ is not applicable to a government with non convertible currency/floating fx. Payment is by crediting member bank accounts at its own central bank. Taxing debits said accounts. The government doesn’t ‘have’ or ‘not have’ ‘money’ at any time. All it does is run its own spread sheet.

To the contrary, from a fiscal perspective, the policy would almost certainly be stabilizing, in the sense of reducing the debt-to-GDP ratio. The BOJ’s purchases would leave the nominal quantity of debt in the hands of the public unchanged, while nominal GDP would rise owing to increased nominal spending. Indeed, nothing would help reduce Japan’s fiscal woes more than healthy growth in nominal GDP and hence in tax revenues.

Debt to GDP is different only because bank reserves aren’t counted as ‘debt’ while JGB’s are even though they are functionally identical apart from maturity.

Nor does debt to GDP matter in any case.

Potential roles for monetary-fiscal cooperation are not limited to BOJ support of tax cuts. BOJ purchases of government debt could also support spending programs, to facilitate industrial restructuring, for example.

As above, these could be done without the BOJ with identical effect.

The BOJ’s purchases would mitigate the effect of the new spending on the burden of debt and future interest payments perceived by households, which should reduce the offset from decreased consumption.

Why is that a concern? Higher propensities for households to save means taxes can be even lower. What’s wrong with an economy with a high savings propensity and lower taxes to sustain demand?

More generally, by replacing interest-bearing debt with money, BOJ purchases of government debt lower current deficits and interest burdens and thus the public’s expectations of future tax obligations.

These ‘interest burdens’ are payments from the government to the non government sectors. With a permanent 0 rate policy there doesn’t have to be any at all. It’s a political choice.

Of course, one can never get something for nothing; from a public finance perspective, increased monetization of government debt simply amounts to replacing other forms of taxes with an inflation tax.

Not if the starting point is an output gap. The output gap is a result of fiscal drag resulting from taxes being too high relative to savings desires. Cutting taxes removes that fiscal drag and allows the economy to return to full employment which is where it would be without that fiscal drag.

More people working and producing output is not getting something for nothing. Only when at full employment can you get ‘no more’ from fiscal adjustments (ex productivity gains).

But, in the context of deflation-ridden Japan, generating a little bit of positive inflation (and the associated increase in nominal spending) would help achieve the goals of promoting economic recovery and putting idle resources back to work,

Yes, the tax cut alone was all that was and still is in order.

which in turn would boost tax revenue and improve the government’s fiscal position.”

And that adds fiscal drag which eventually brings the economy down again.

The idea is to sustain taxes at full employment levels, and not at some revenue target.

Powerful, powerful stuff!

Yes

And Now to the USA at Present

The United States is not presently suffering deflation in goods and services prices, although the core CPI has dipped slightly below the Fed’s putative 2% “target.” So the extreme measures that Krugman and Bernanke advocated for Japan do not translate fully to the United States. But they do translate a lot more than the consensus is even willing to discuss in politically correct circles.

America is in a liquidity trap, driven by private sector deleveraging borne of asset price deflation, meaning that private sector demand for credit is axiomatically flat to negative, despite a Fed funds rate pinned against zero. The only source of credit demand growth in the United States is the Treasury itself.

More simply, the US is suffering from a severe lack of aggregate demand that’s ruining millions of lives.

And until the deleveraging process runs its course, consensus agrees that there is nothing wrong with such bloated Treasury demand for credit: In a recessionary foxhole, Keynesian religion dominates all other economic religions.

So why not an immediate, full, payroll tax holiday and an immediate $500 per capita distribution to the states (per capita is the key to making it ‘fair’ to all)

The payroll tax holiday simply stops taking 20 billion a week from the wages and salaries of people working for a living which is also ‘fair’ and not ‘rewarding bad behavior’ and regressive enough for the democratic majority to be categorically against.

But not all believers are equally devout, as noted at the outset, with many against any further ramping up of Keynesian stimulus, at least without a contemporaneous move to ensure long-term fiscal responsibility, so as to prevent a deleterious increase in long-term Treasury interest rates.

Again, understanding monetary operations and reserve accounting would put those fears to rest.

Best!

Warren

So what should Washington do, if and when – and I stress “if and when”; I’m not making a forecast here! – private sector aggregate (nominal) demand growth looks like it’s going to languish in Japan style for the indefinite future? The answer: Take one cup of Krugman’s advice for Japan and two cups of Bernanke’s advice for Japan – responsibly act irresponsibly relative to orthodoxy.

Yes, as Bernanke intoned, there are no free lunches. But no lunch doesn’t work for me. Or the American people. While it is true, as Keynes intoned, that we are all dead in the long run, I see no reason to die young from orthodoxy-imposed anorexia.

[top]