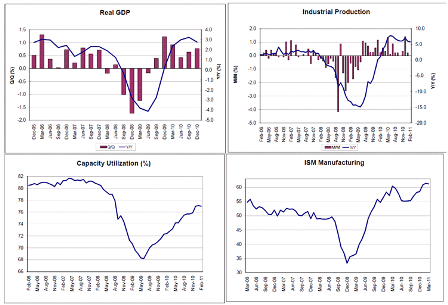

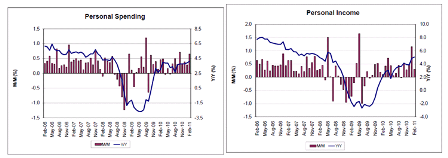

This is a good sign top line growth was continuing it’s modest growth in March.

Federal deficit spending continues to work to add the income and savings that allows consumers to both reduce their credit card debt and expand their consumption.

Deficit spending continues to be sufficient to support the modest GDP growth and employment growth we’ve been experiencing.

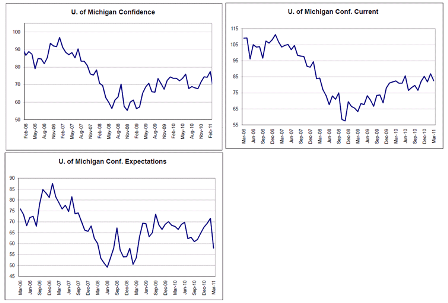

However, the risks remain as discussed at year end:

US deficit reduction efforts, with both sides agreeing that the deficit is THE problem, with some of the proposed cuts more than sufficient to trigger negative GDP growth and rising unemployment.

China’s fight against inflation leading to a hard landing.

UK and euro zone austerity measures passing the tipping point where further austerity measures slow growth sufficiently to increase national govt deficits.

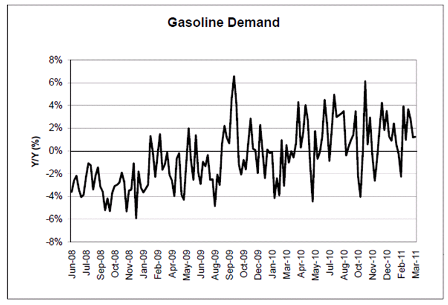

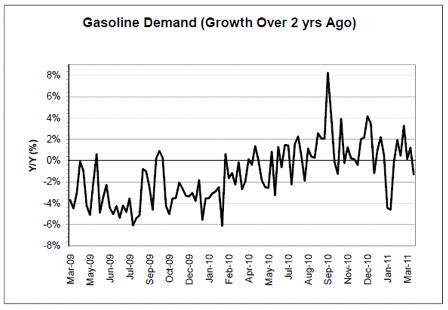

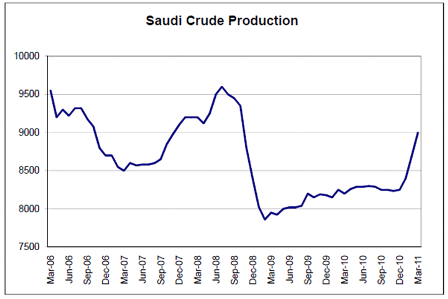

Saudi crude oil price hikes both slowing world demand and triggering anti inflation responses that remove demand.

Additionally, world growth should slow by an unknown amount due to supply disruptions form the earthquake in Japan.

Consumers borrow more for student loans, new cars

April 7 (AP) — U.S. consumers borrowed more money in February to buy new cars and attend school, but they cut back on using their credit cards to make purchases. Borrowing increased by $7.6 billion, or 3.8 percent, in February. It was the fifth consecutive monthly gain. The category that includes car loans and student loans increased 7.7 percent. Borrowing in the category that covers credit cards fell 4.1 percent. That has risen only once in the more than two years since the 2008 financial crisis peaked. The gains pushed total borrowing up to a seasonally adjusted annual rate of $2.42 trillion in February. That’s 1 percent from the three-year low hit in September.