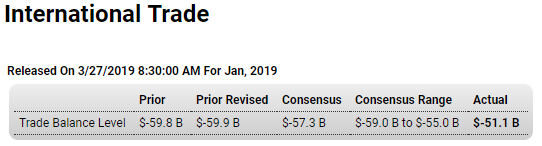

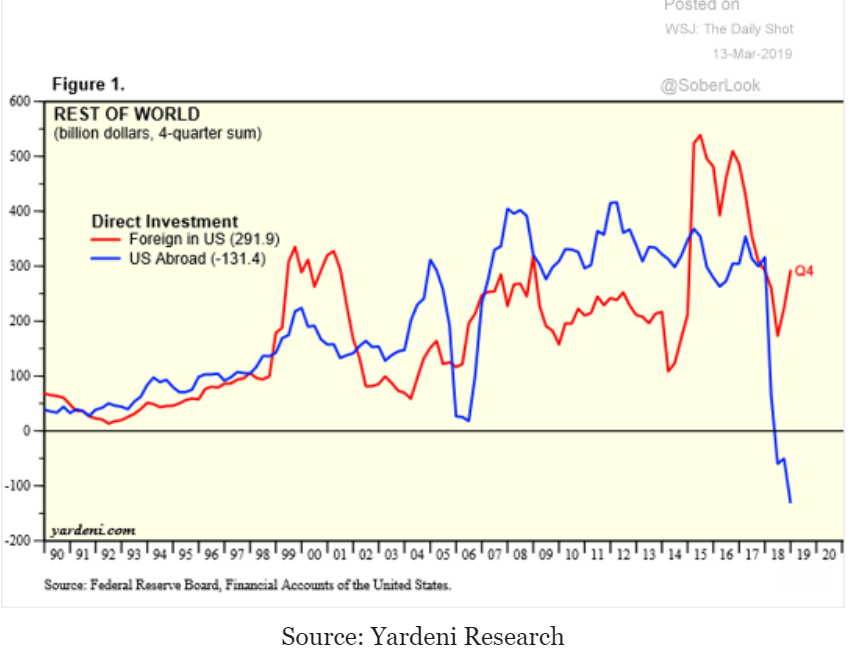

Decelerating global trade hitting home:

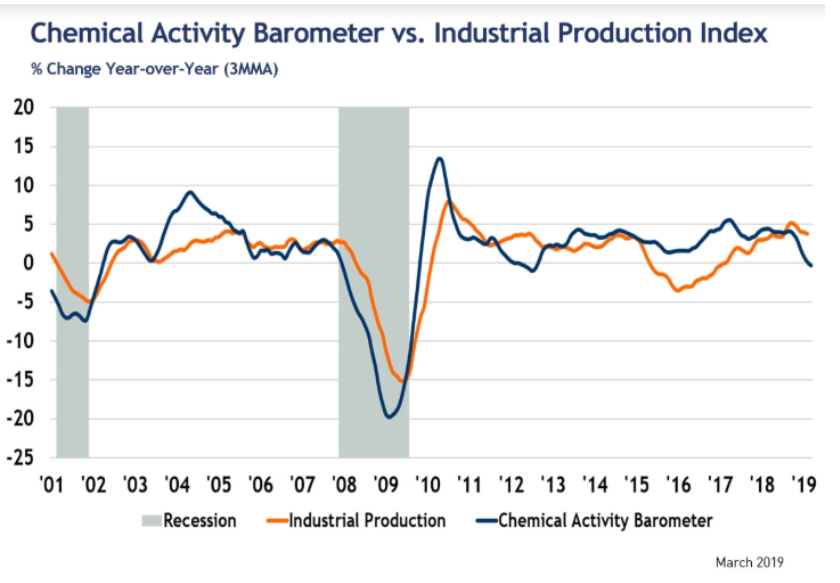

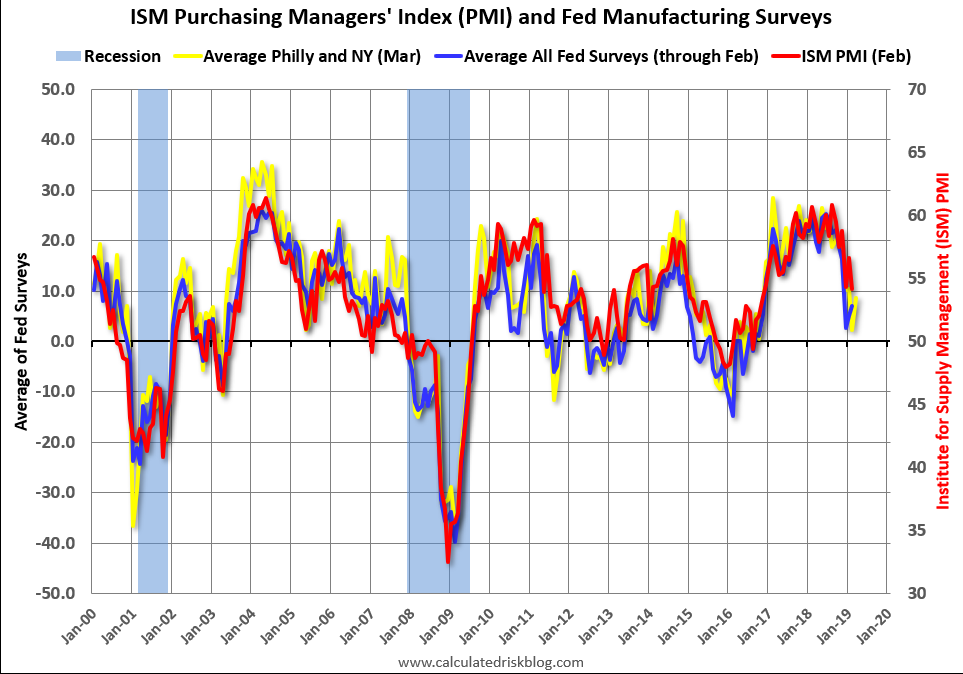

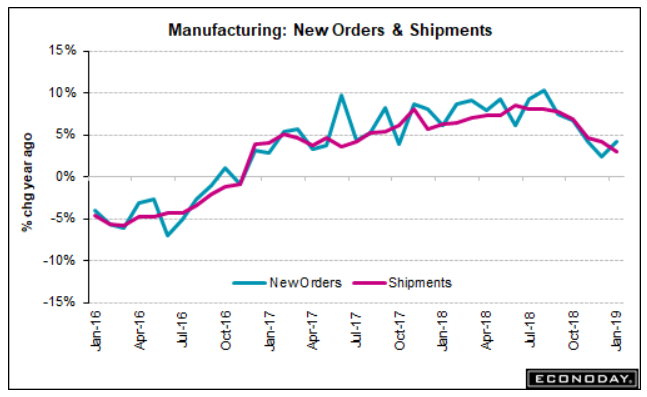

(Reuters) The Fed said manufacturing production dropped 0.4 percent last month. January was revised up to show output falling 0.5 percent instead of slumping 0.9 percent. Production at factories increased 1.0 percent in February from a year ago. Motor vehicles and parts output slipped 0.1 percent last month after tumbling 7.6 percent in January. Excluding motor vehicles and parts, manufacturing output fell 0.4 percent last month. Capacity utilization for the manufacturing sector fell to a nine-month low of 75.4 percent in February from 75.8 percent in January.

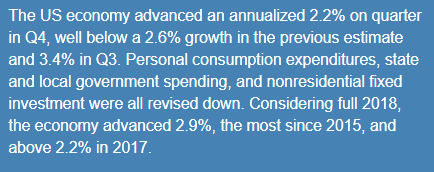

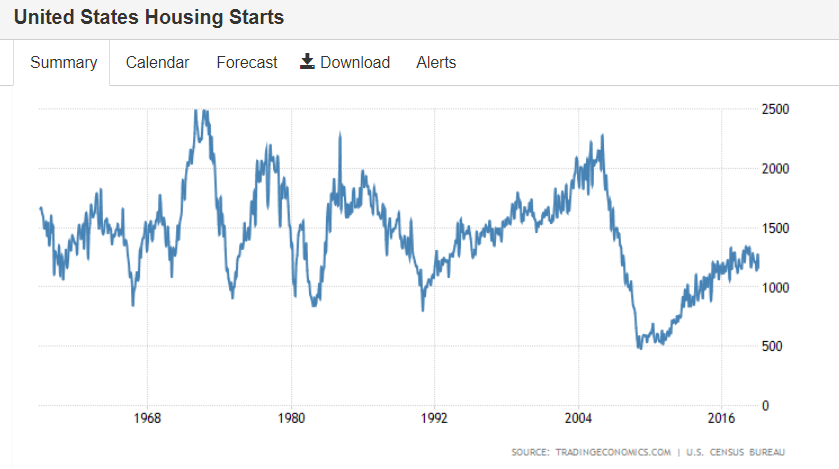

(WSJ) Private-sector economic forecasters surveyed in recent days expect U.S. economic output to grow, on average, at a 1.3% pace in the first quarter. That is a sharp drop from the last survey, in early February, when they predicted a 2% growth rate for the January-to-March period. 84.2% said they saw a greater risk that the economy would grow more slowly than that it would grow more quickly over the next 12 months. When asked about the biggest downside risk to their forecasts, 46.8% mentioned trade policy or China.

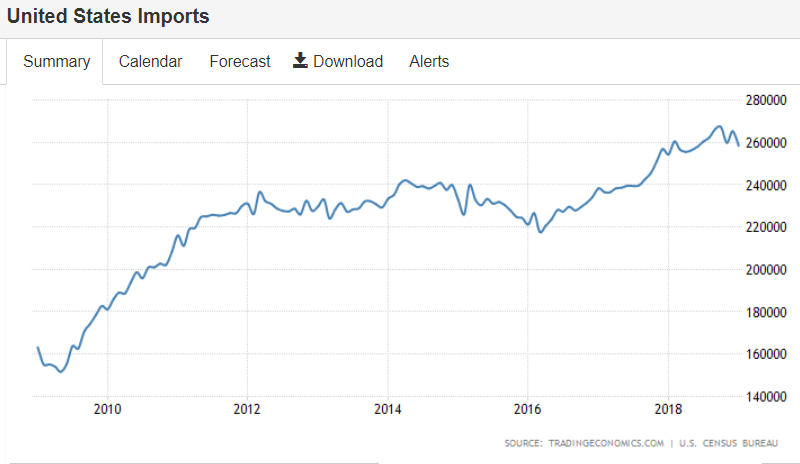

Container traffic gives us an idea about the volume of goods being exported and imported – and usually some hints about the trade report since LA area ports handle about 40% of the nation’s container port traffic.

On a rolling 12 month basis, inbound traffic was down 0.8% in February compared to the rolling 12 months ending in January. Outbound traffic was down 1.2% compared to the rolling 12 months ending the previous month.

Exports and imports fading:

(Kyodo) Exports fell for the third straight month in February, slipping 1.2 percent to 6.38 trillion yen. Imports declined 6.7 percent to 6.05 trillion yen. China-bound exports increased 5.5 percent from a year prior, but that failed to make up for a 17.4 percent plunge in January. Japan’s trade surplus against the United States shrank to 624.9 billion yen as a 4.9 percent rise in imports such as aircraft outpaced a 2.0 percent increase in exports. With the European Union, Japan had a trade surplus of 58.2 billion yen as exports grew 2.5 percent while imports edged up 0.5 percent.

(Nikkei) “The Chinese economy is decelerating,” Gov. Haruhiko Kuroda said. But “stimulus steps are already being taken by the government. Their effects will show up in due course. Many believe that will be in the latter half of this year,” he added. “There are risks to the global economy. They need to be monitored carefully. But continued gradual growth remains our main scenario.” The BOJ downgraded its view of exports and output, saying they have been showing weakness recently. Previously, the central bank described export and output conditions as being “on an expanding trend.”

(WSJ) Private-sector economic forecasters surveyed in recent days expect U.S. economic output to grow, on average, at a 1.3% pace in the first quarter. That is a sharp drop from the last survey, in early February, when they predicted a 2% growth rate for the January-to-March period. 84.2% said they saw a greater risk that the economy would grow more slowly than that it would grow more quickly over the next 12 months. When asked about the biggest downside risk to their forecasts, 46.8% mentioned trade policy or China.