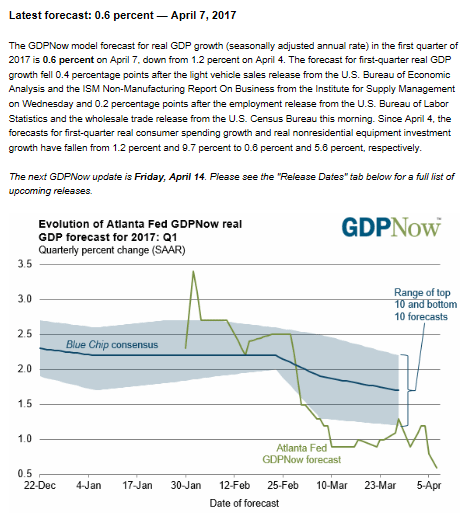

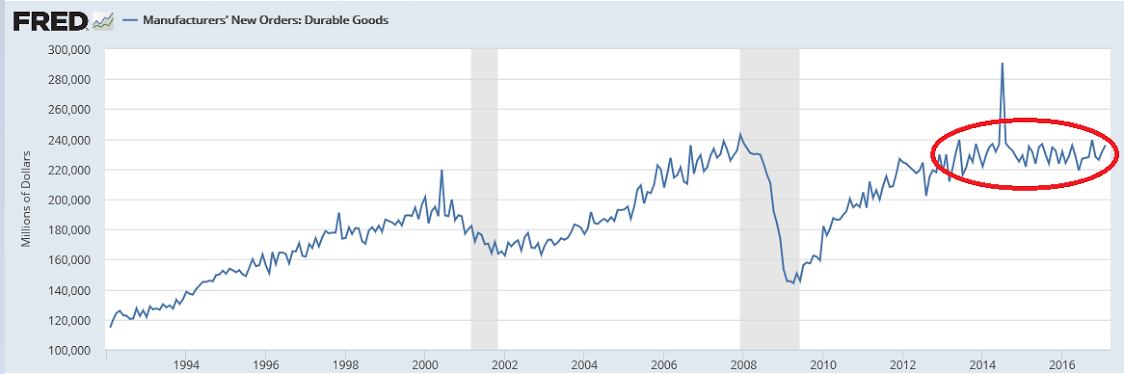

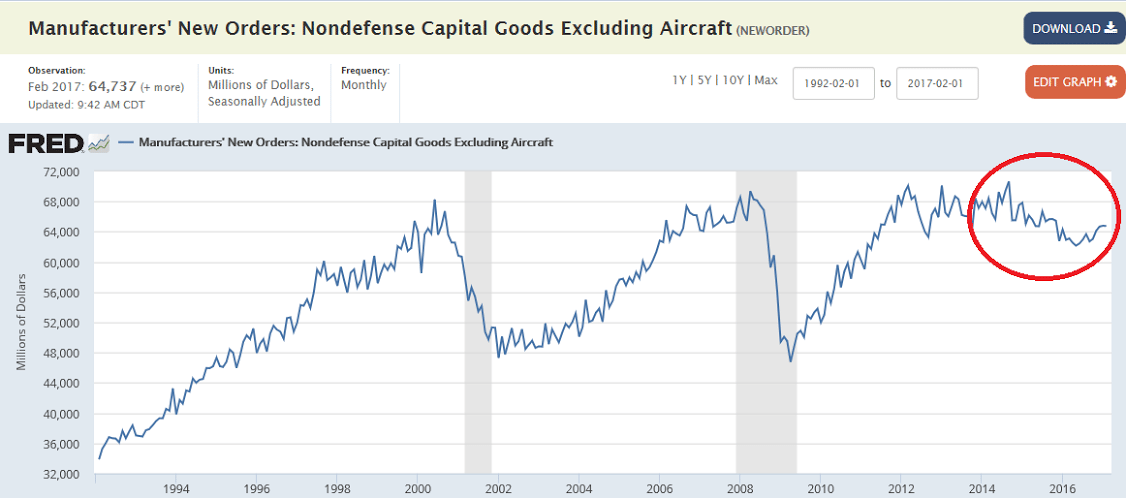

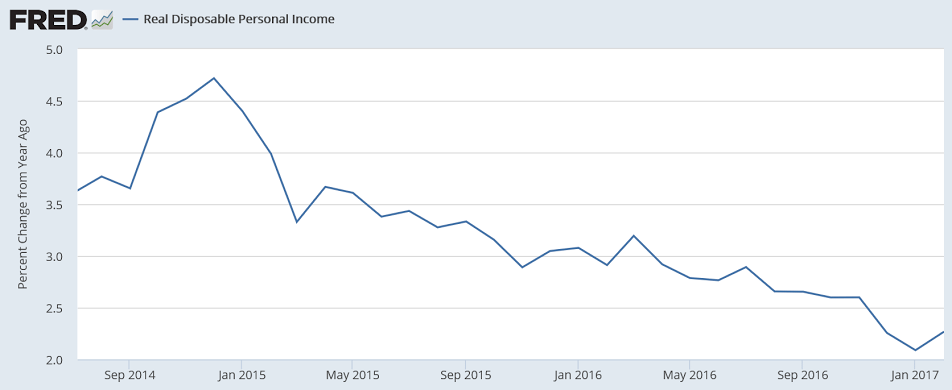

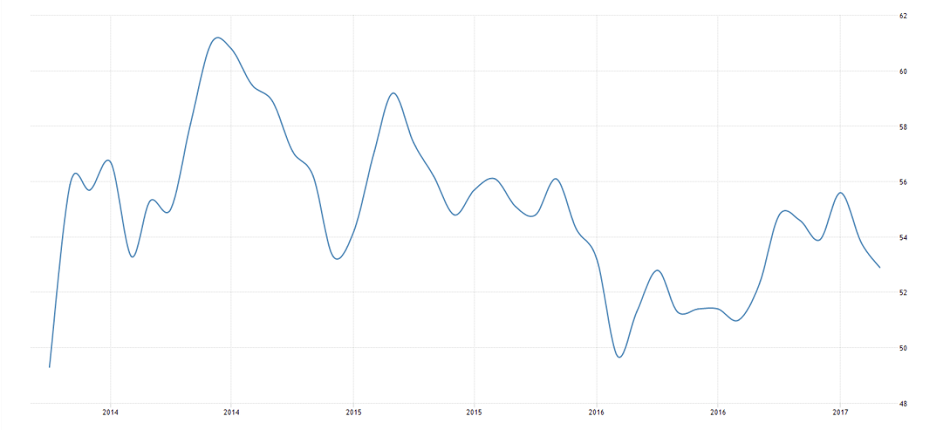

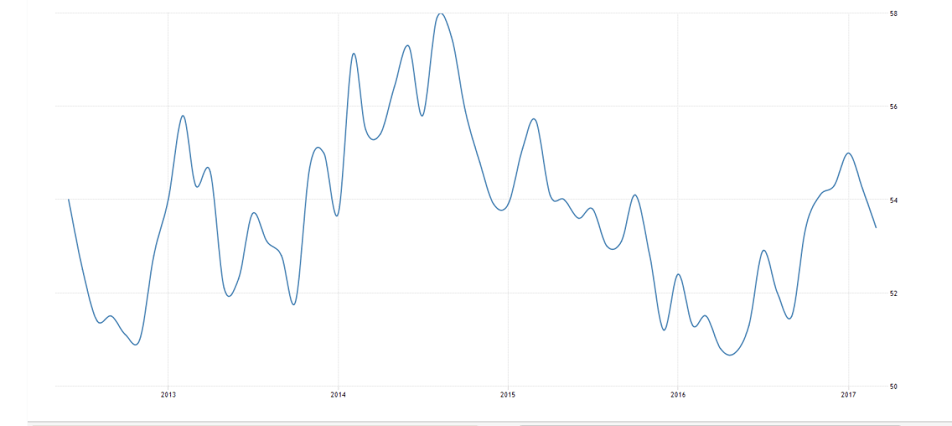

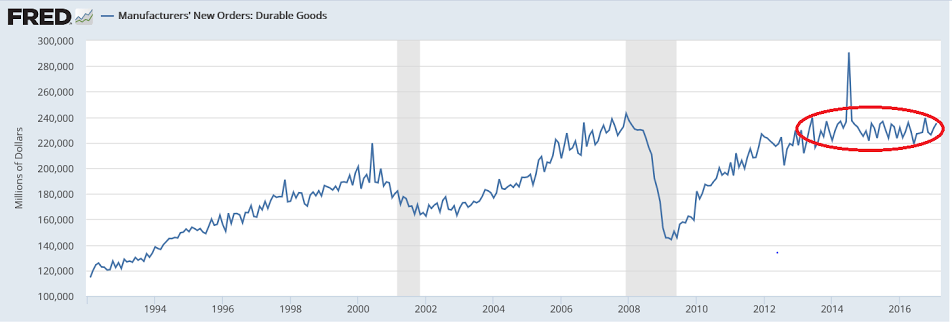

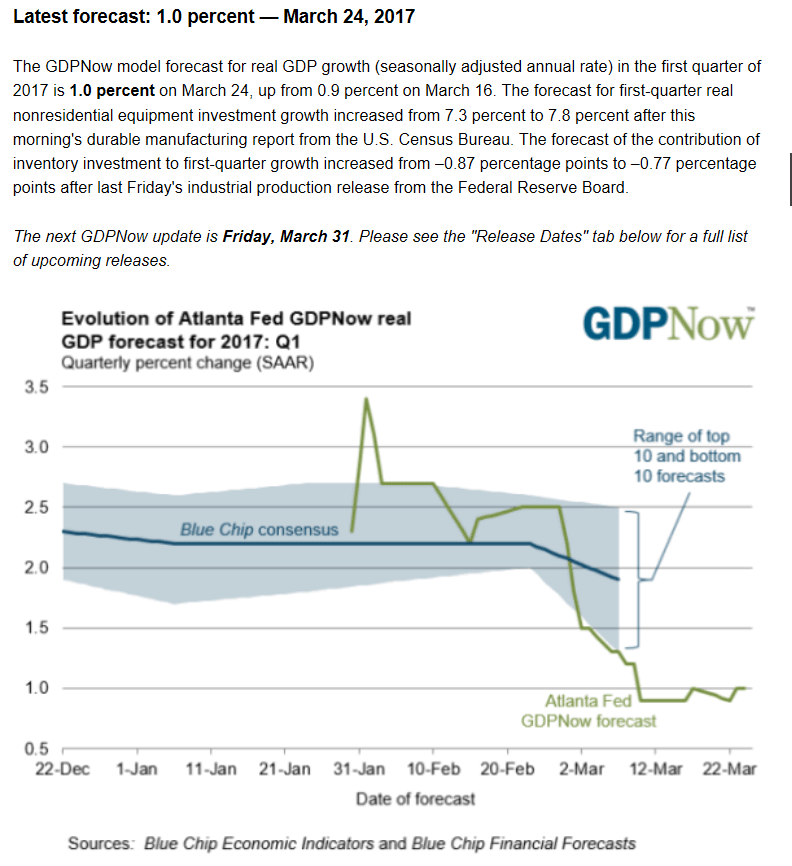

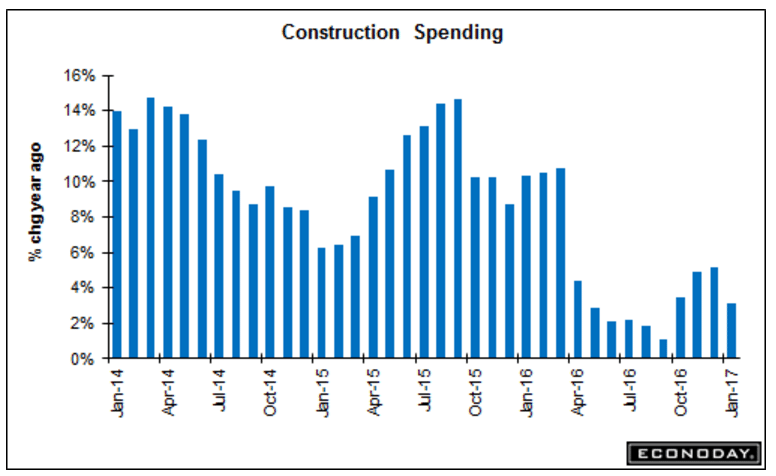

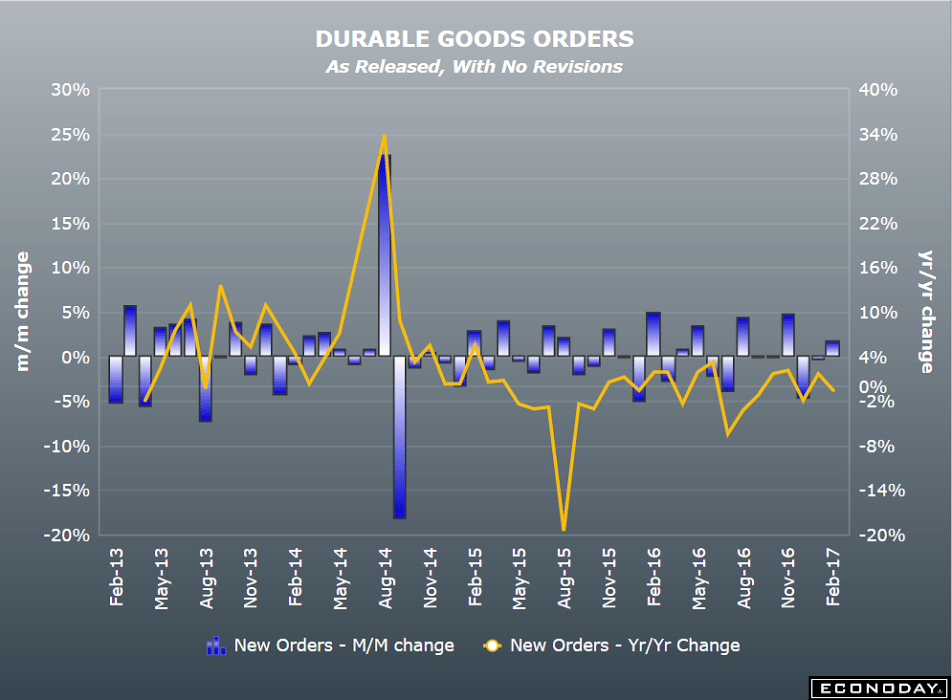

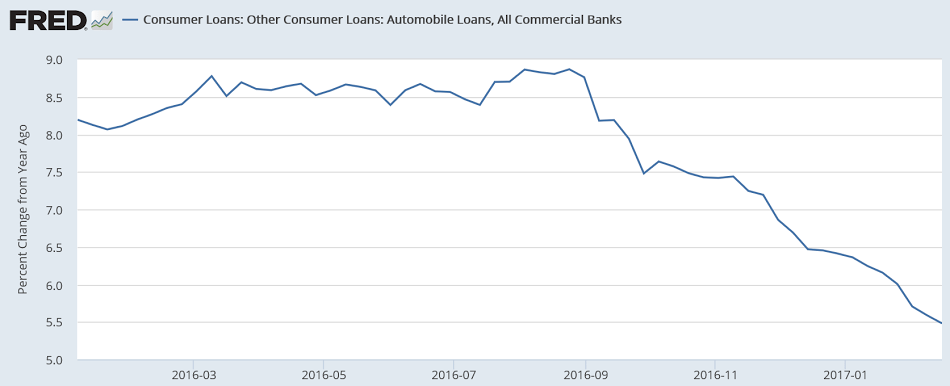

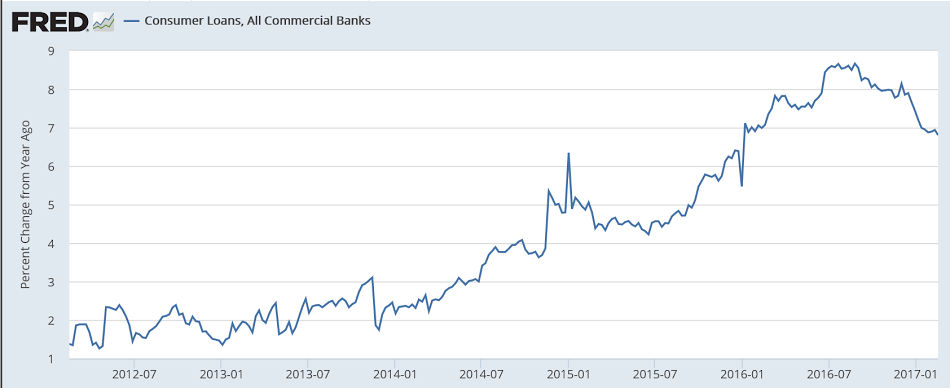

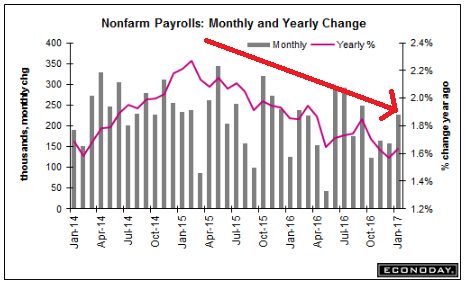

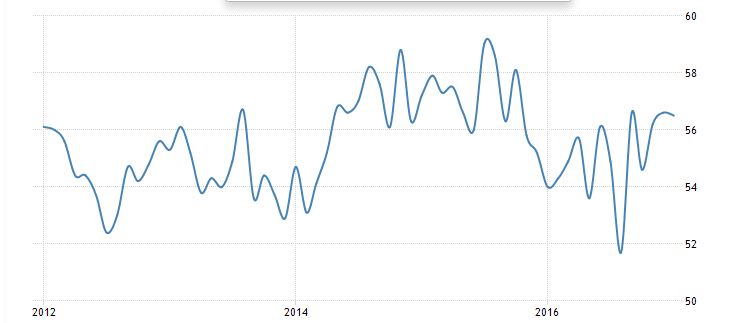

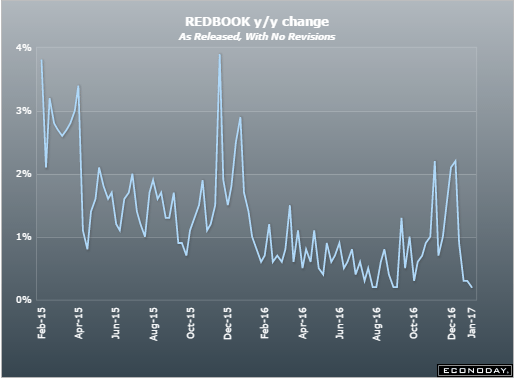

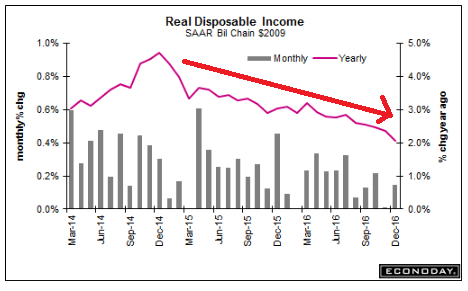

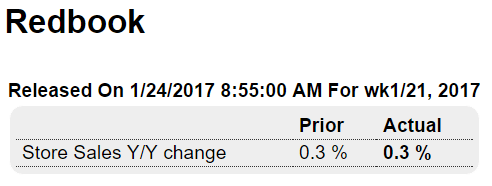

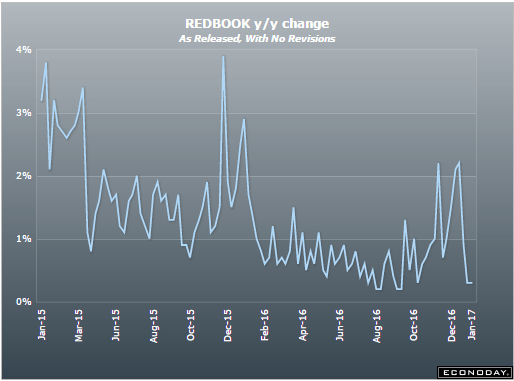

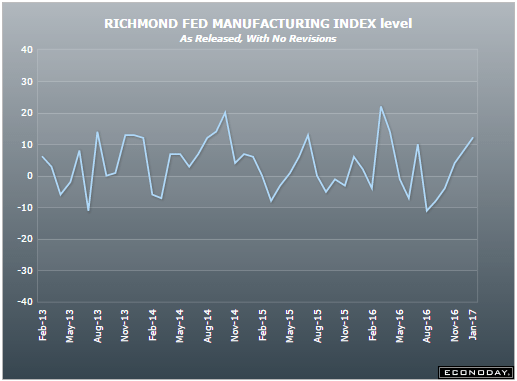

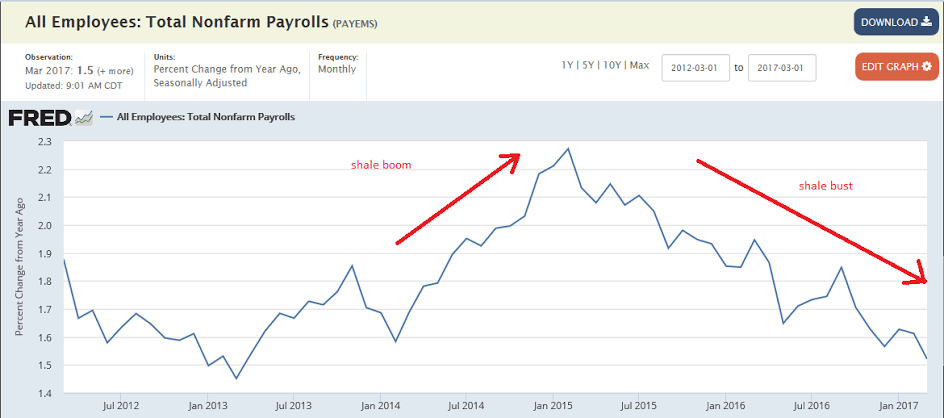

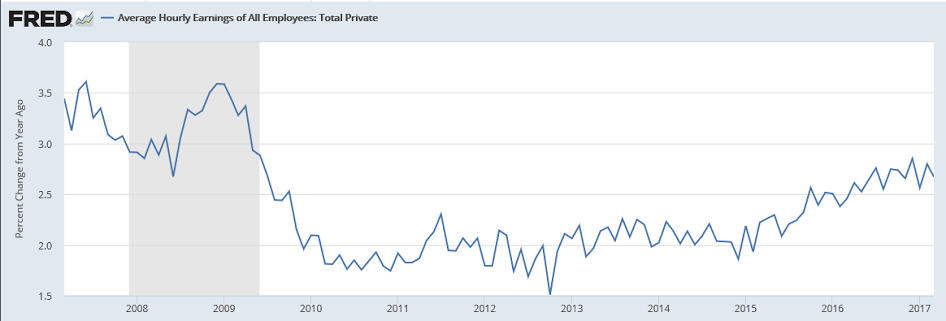

Looking at the chart today’s number looks entirely consistent with the near linear rate of deceleration since oil capex collapsed about 2 1/2 years ago or so. And so far there’s no reason to expect the trend to reverse:

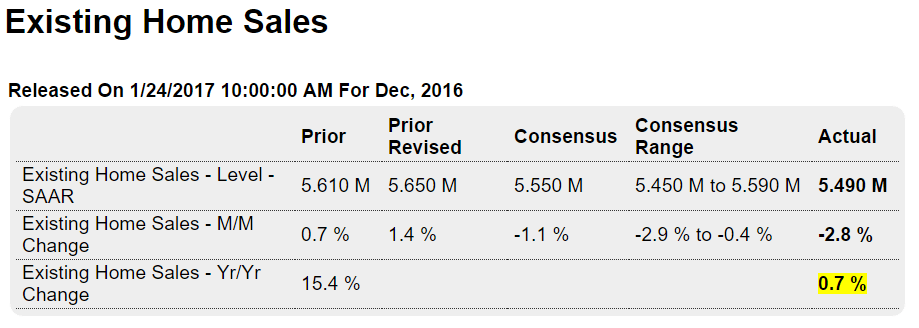

Highlights

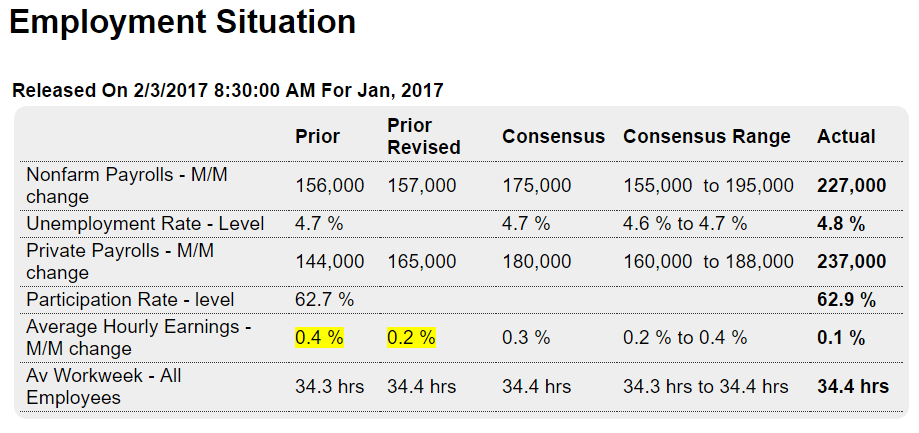

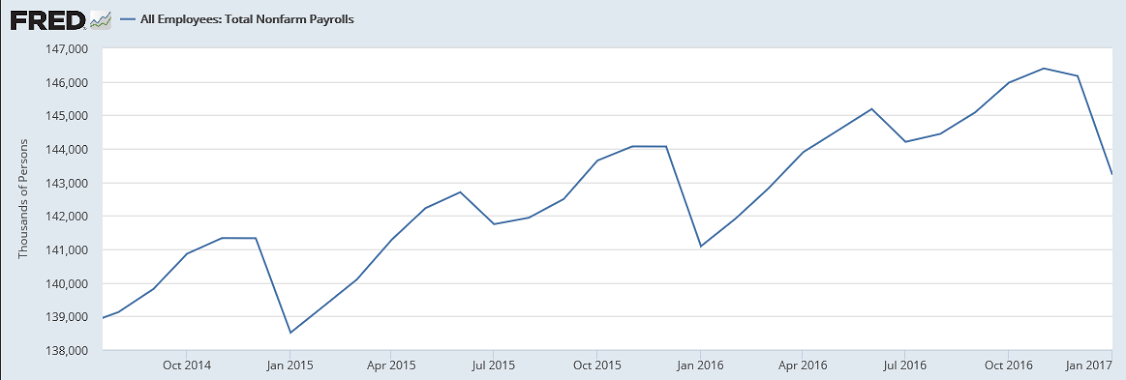

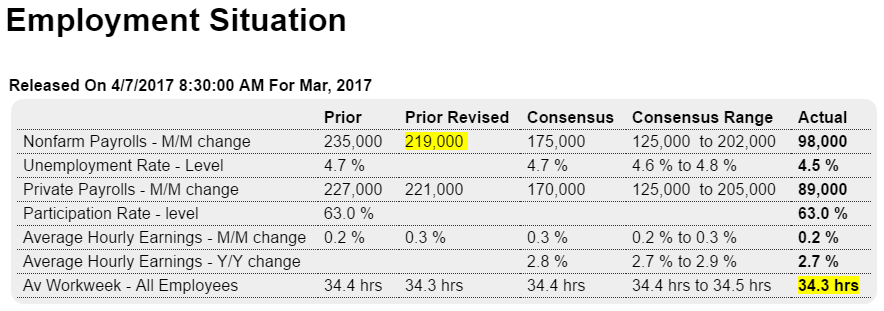

Throw ADP out, it was the weather in March! Or at least the Category 3 storm that swept the Northeast may explain a much weaker-than-expected 98,000 increase in March nonfarm payrolls. This compares with Econoday’s consensus for 175,000 and a low estimate of 125,000. It is also the weakest reading since May last year.

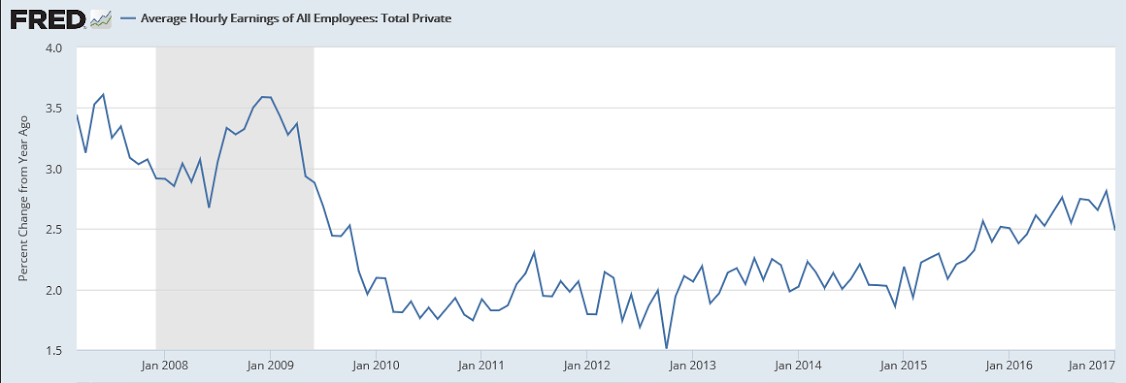

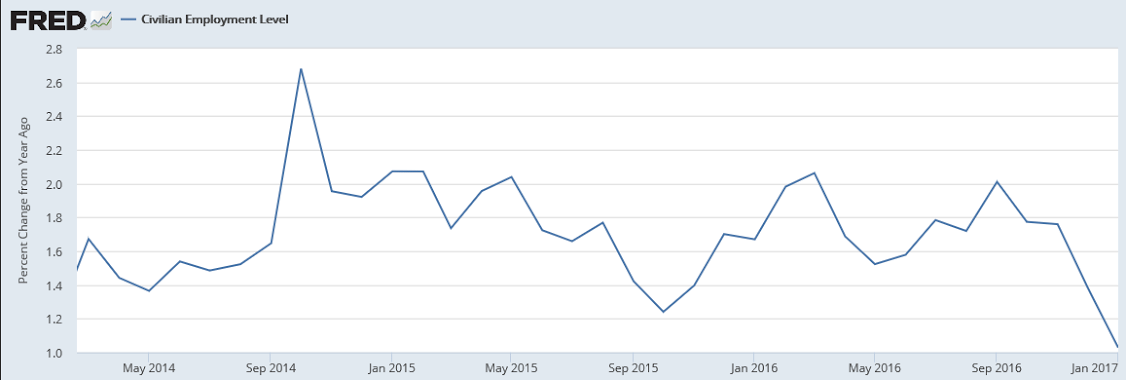

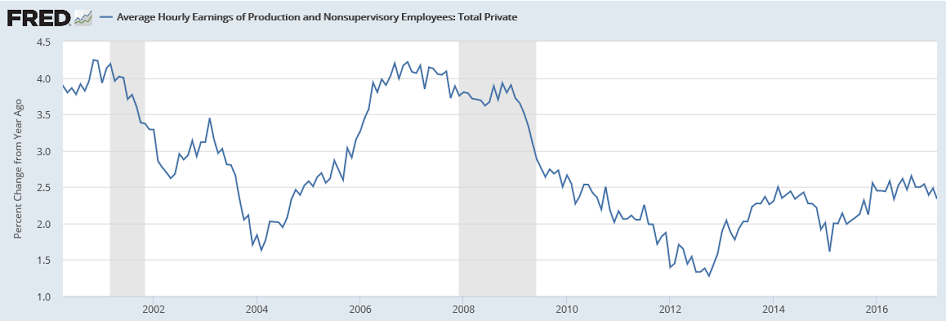

But there is one standout sign of strength in the report and that’s the unemployment rate which fell a very sharp 2 tenths to 4.5 percent as the number of unemployed fell by 326,000 to 7.2 million. This is the lowest unemployment rate since the height of the last expansion in April 2007 and it raises the issue of wage inflation which, however, has yet to build. Average hourly earnings rose only 0.2 percent in the month for a year-on-year rate that, at 2.7 percent, is down 1 tenth in the month and further away from the 3 percent line.

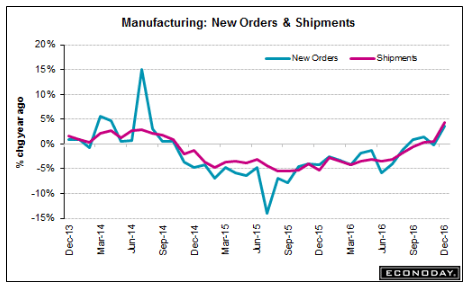

Lack of highly skilled entrants is one likely reason for the lack of wage traction but soft economic conditions may also be a factor. The average workweek slipped in the month to 34.3 hours from 34.4 hours with manufacturing declining to 40.6 hours from 40.8. For manufacturing production, this points to an abrupt and unexpected interruption and one perhaps consistent with heavy weather.

Retail trade fell 30,000 in March following February’s 31,000 decline. Trade & transportation payrolls decreased 27,000 following a 16,000 decline. But both manufacturing and mining show useful gains, at 11,000 each and with construction, despite the weather, still rising 6,000. The government hiring freeze put in place in late January didn’t hurt March payrolls for this reading which rose 9,000.

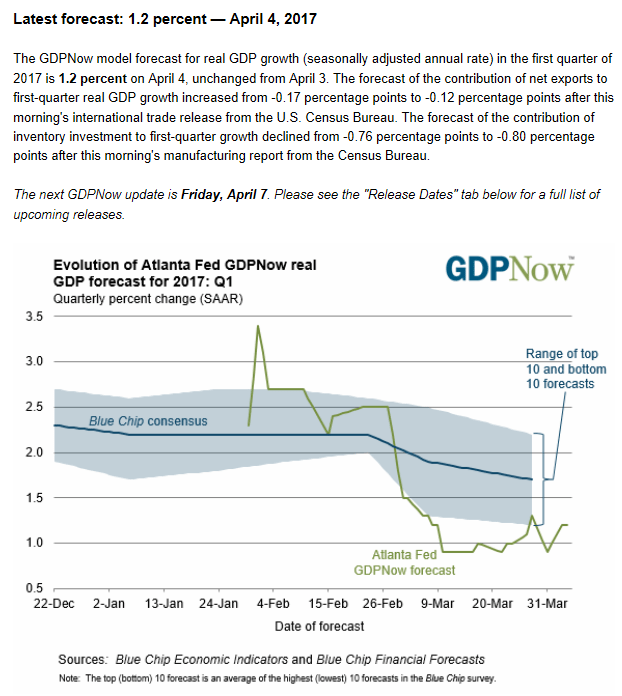

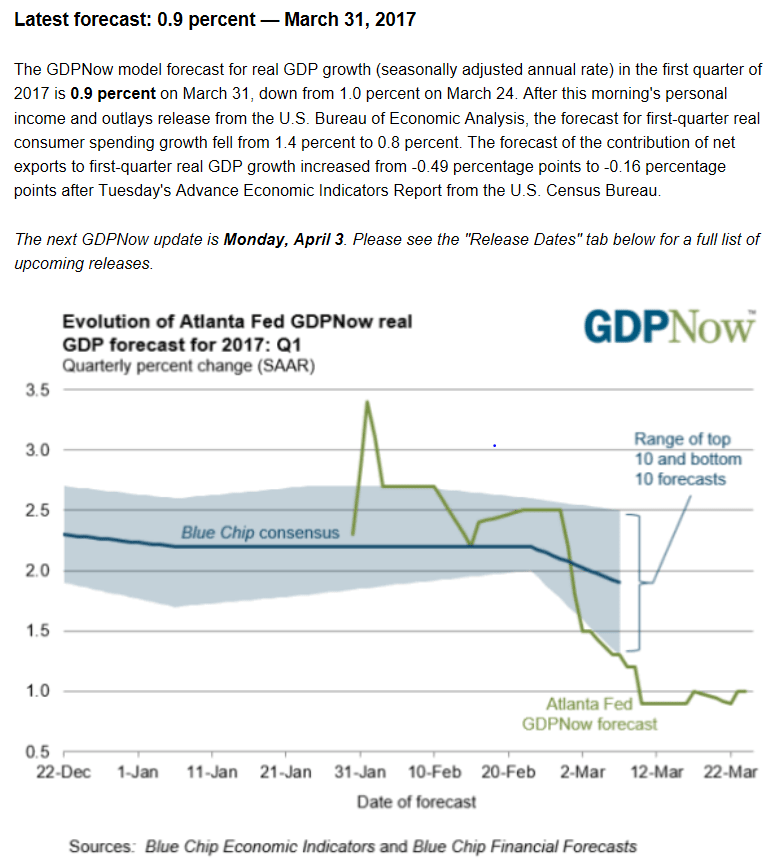

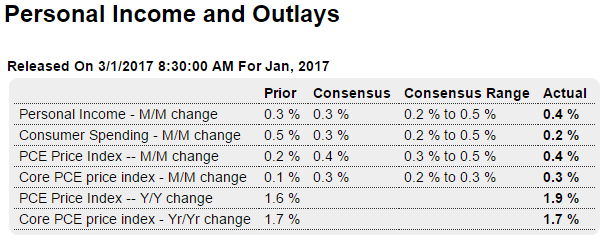

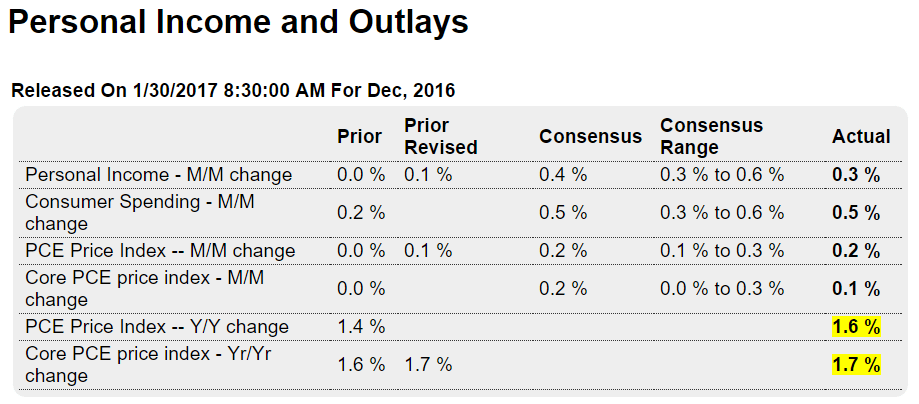

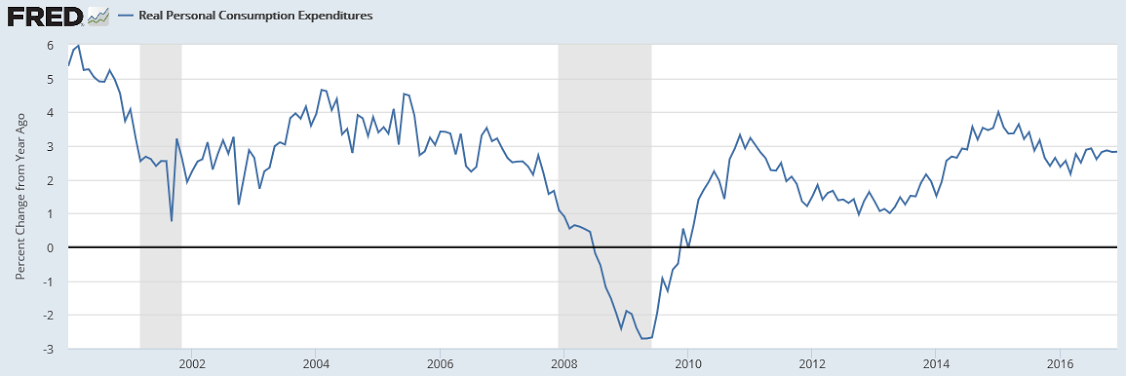

The big storm hit during the sample week of the employment report and apparently delayed new hiring, or at least that will be today’s takeaway. Though there may be a snapback ahead for April payrolls and despite the drop in the number of unemployed, the report does tone down the economic outlook and hints at March trouble for consumer spending which had already opened the year off softly.

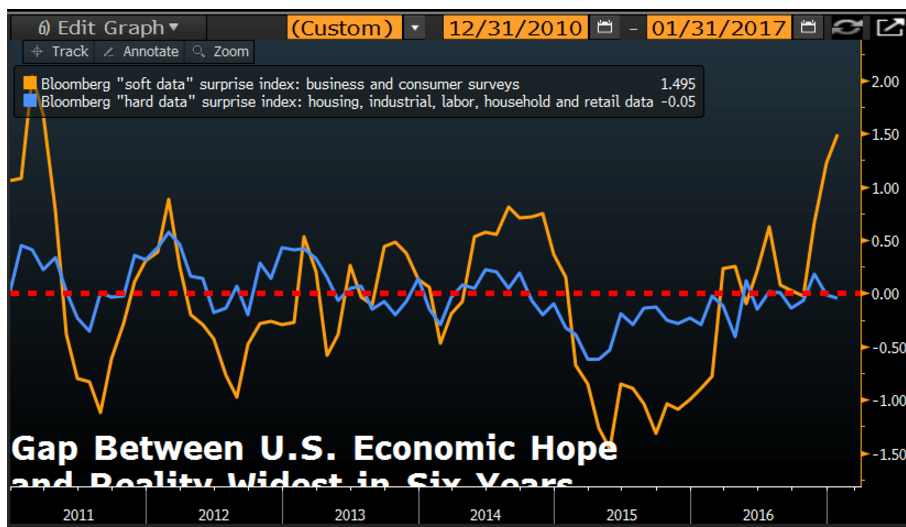

Not looking good/who would’ve thought?

;)