Karim writes:

Highlights

- April Payrolls rise 115k, below expectations.

- March revised from 120k to 154k and February from 240k to 259k

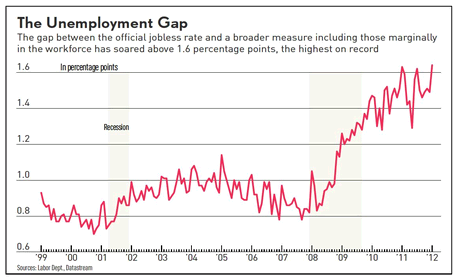

- Unemployment rate falls to new cycle low of 8.1% (already close to Fed’s year-end forecast of 7.8-8.0%) though due to drop in Participation Rate from 63.8% to 63.6%.

- Manufacturing employment growth slows from 41k to 16k (vs rise in ISM employment component)

- Leisure/Hospitality slows from 52k to 12k

- Retail rises from -21k to +29k

- Temp help rises from -9k to +21k

- Income equation on the weak side as no growth in average hourly earnings and index of aggregate hours up just 0.1%

- Diffusion index slows from 64.7 to 56.8, but still well within expansion zone.

- Median duration of unemployment falls from 19.9 weeks to 19.4 weeks, a new cycle low.

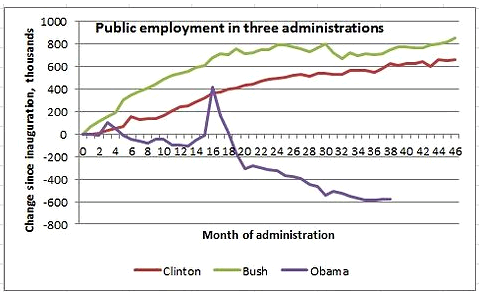

A lot of volatility in the job data, making it difficult to divine the broader trend:

Conclusion

- The Fed would most certainly have liked to see better headline job growth, but I don’t think this report is enough to push them into additional easing for the following reasons:

- Data is volatile and the net revisions were significant

- Unemployment rate continues to fall

- Inflation right at target

- Financial conditions (equities and credit spreads) remain loose.

- Structural issues continue to wane

Agreed on the conclusion. It will take a lot to get the Fed to do any more QE. Not the least reason being most of them know it doesn’t actually do anything apart from getting a lot of people scared and angry, including our esteemed politicians, for example, ready to make a propaganda show out of what they like to call ‘money printing.’

Of more concern, Bill Mitchell mentioned the drop in public sector employment may be dragging us down to negative growth. He may be right, as those paychecks are probably very ‘high multiple’ and require larger federal deficits to make up for the lost aggregate demand.

Actual multiples- propensities to spend out of income- are variable and hard to get a handle on, and therefore generally must be ‘reacted to’ with fiscal adjustments.

Unfortunately, however, all political forces are currently aligned towards deficit reduction.

And note the labor force participation rate is heading back to about where it was before women entered the labor force.