Rail Week Ending 15 December 2018: Economically Intuitive Sectors Continue In Contraction

Written by Steven Hansen

Week 50 of 2018 shows same week total rail traffic (from same week one year ago) improved according to the Association of American Railroads (AAR) traffic data. The economically intuitive sectors were in contraction this week.

Weak:

Highlights

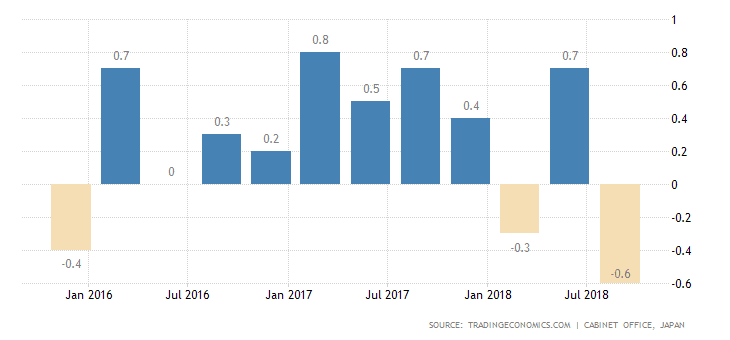

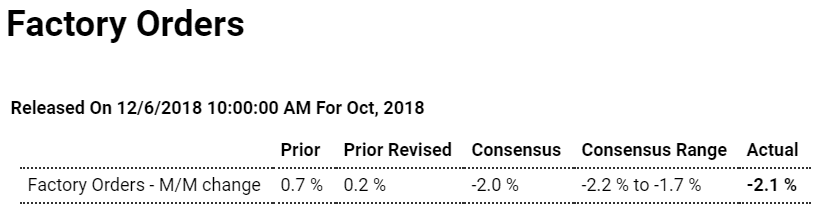

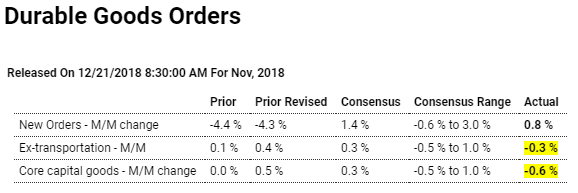

A swing higher for the always volatile aircraft group gave an outsized lift to durable goods orders in November, rising 0.8 percent but still under consensus for 1.4 percent. When excluding aircraft and other transportation equipment, durable goods orders fell 0.3 percent which is near Econoday’s low-end expectations. Under low-end expectations are core capital goods orders (nondefense ex-aircraft) which fell 0.6 percent in the month.

Aircraft orders, both civilian and defense, reversed two prior months of steep declines, rising 17.7 percent for the former and 15.4 percent for the latter. Primary metals at 1.0 percent, fabrications at 0.5 percent, and communications equipment at 0.8 percent all posted solid monthly gains.

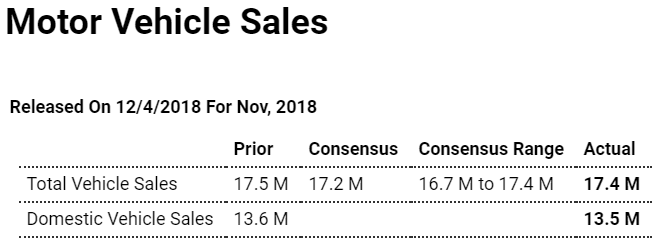

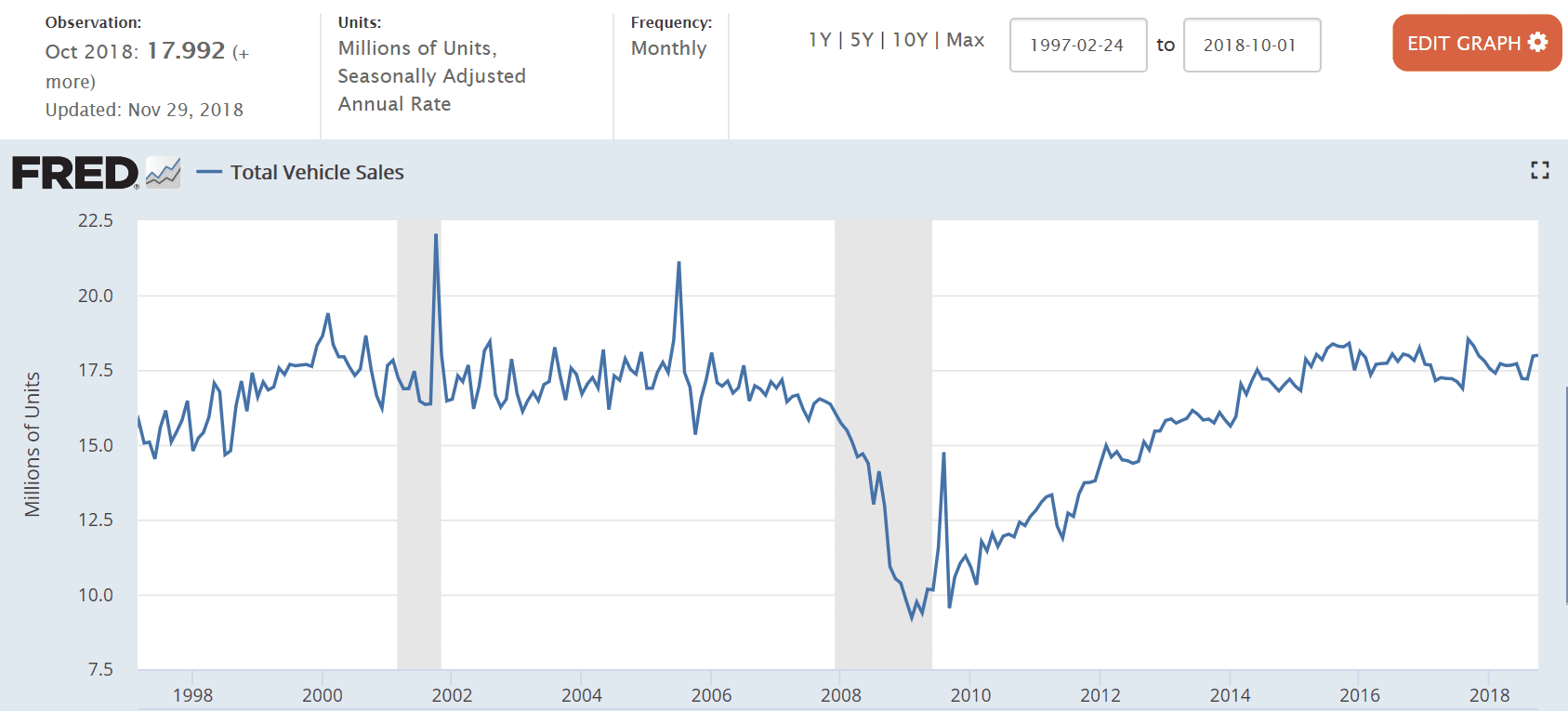

Elsewhere, however, orders were weak with electrical equipment down 0.7 percent, computers unchanged, and motor vehicles down 0.2 percent. The biggest disappointment, and the heart of the capital goods group, is machinery where November orders sank a very steep 1.7 percent.

The drop in capital goods orders is offset, however, by a large 5-tenths upward revision to October which now stands at plus 0.5 percent. And the upward October revision also includes core shipments which are inputs into GDP business investment and which now jumped 0.8 percent in the month in what is also a 5-tenths upward revision. Yet shipments for November, like orders, were weak at minus 0.1 percent.

Unfilled orders are another weakness, falling 0.1 percent after dipping 0.2 percent in October. Total shipments bounced back with a 0.7 percent November gain that follows a 0.4 percent decline with inventories up 0.3 and 0.2 percent in the two months. November’s build relative to shipments is favorable, drawing back the inventory-to-shipments ratio to a leaner 1.61 from 1.62.

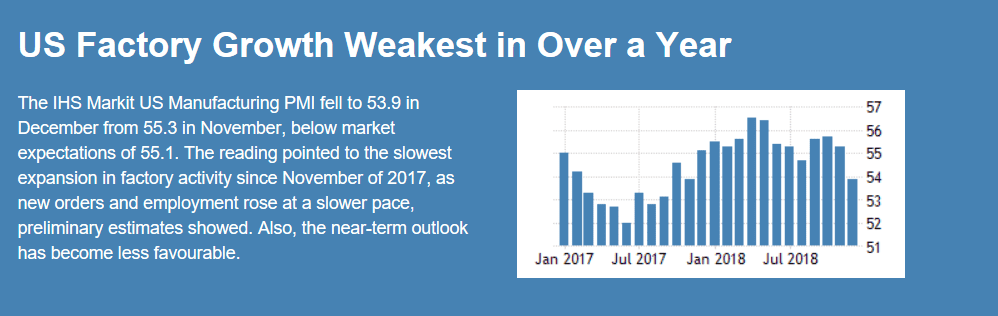

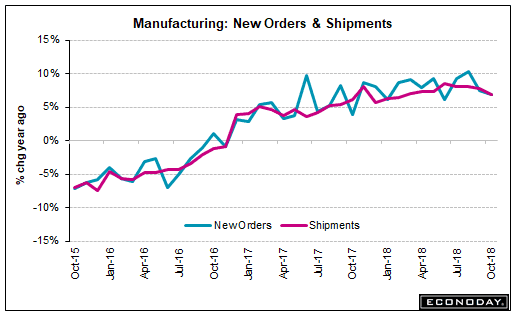

Certainly much of the news in today’s report is favorable though the dip in the ex-transportation reading and turn lower for capital goods do echo last week’s industrial production report, all pointing to a factory sector that may be losing a little steam going into year end. And a look at year-on-year change in today’s report points to the same, at 5.3 percent for total orders which is strong but lower than October and September and down from a peak of 12.1 percent in August.

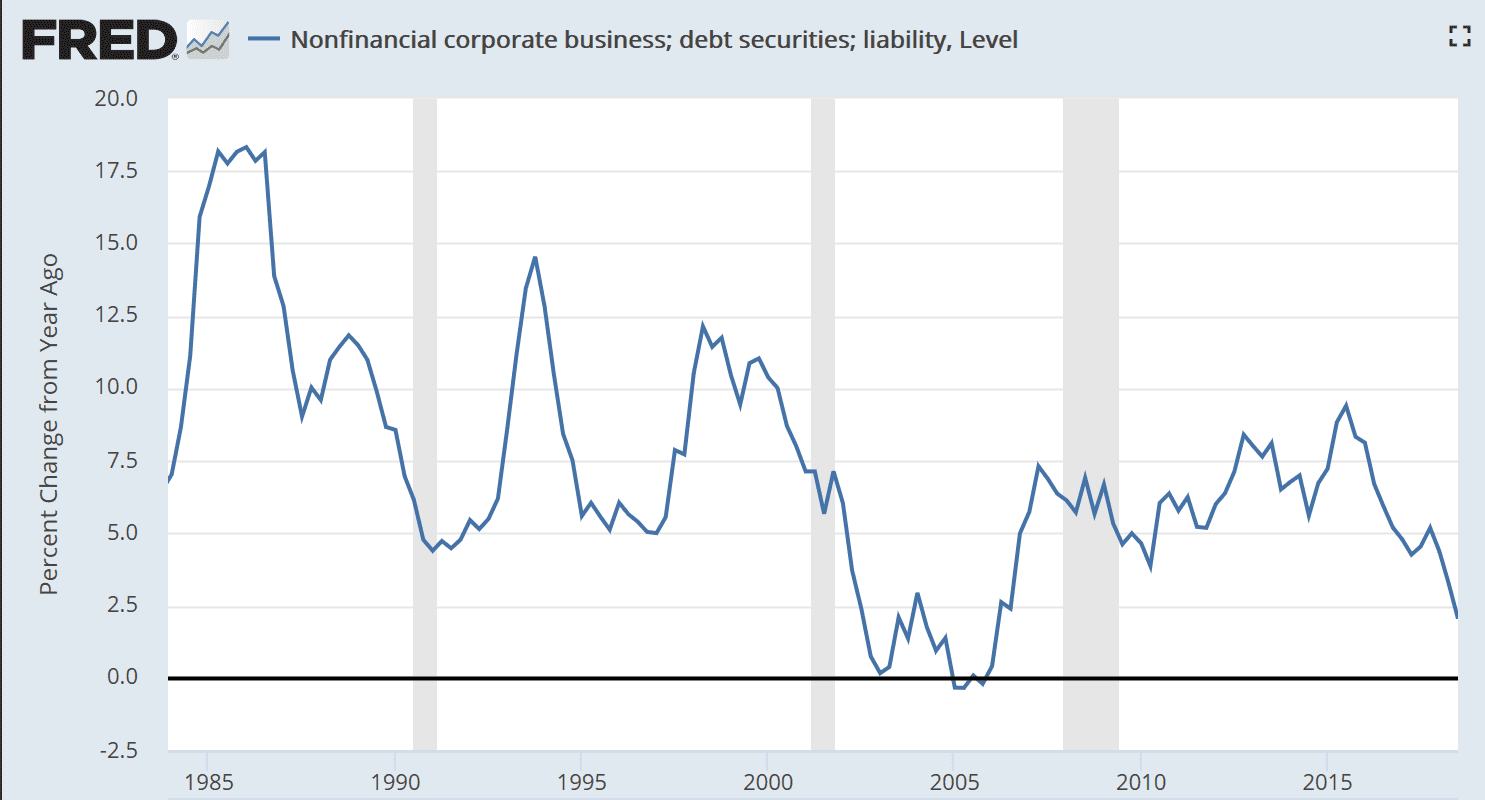

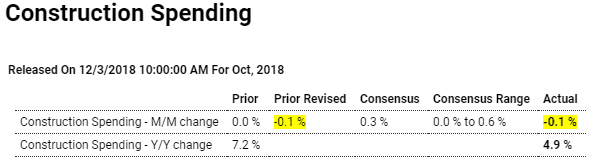

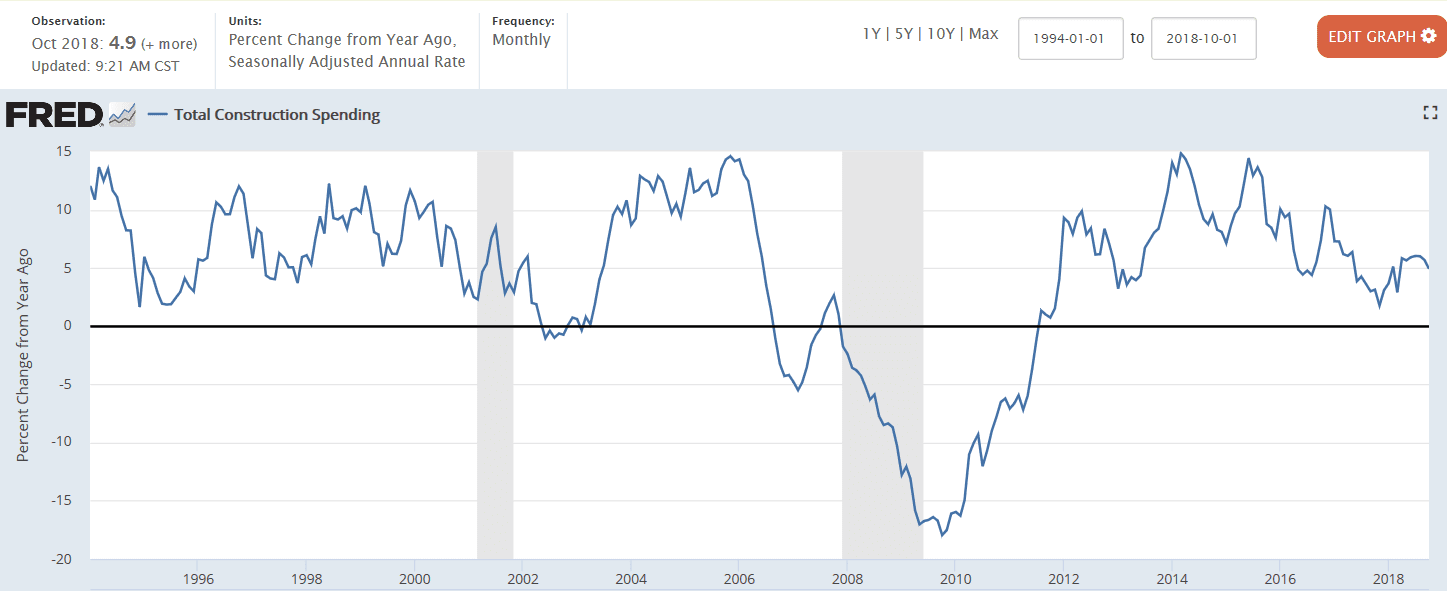

Not inflation adjusted, so still well below prior highs in real terms:

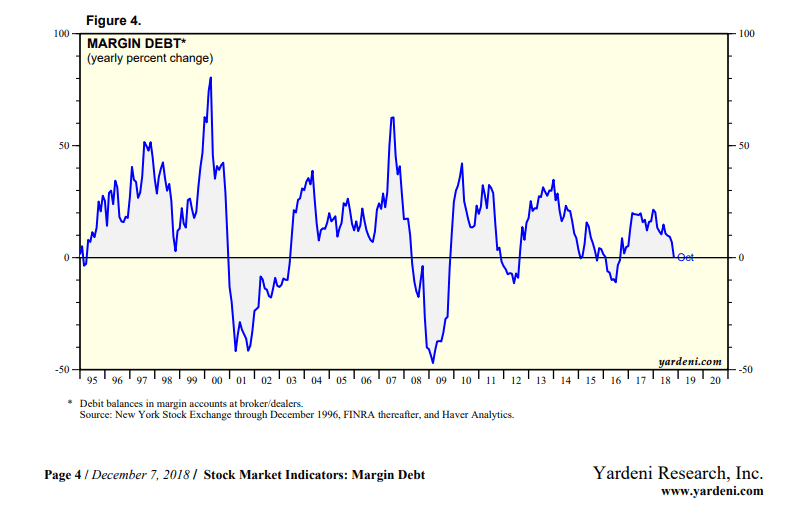

This is the series that got revised by a full $200 billion last year so I don’t read much into it…

Highlights

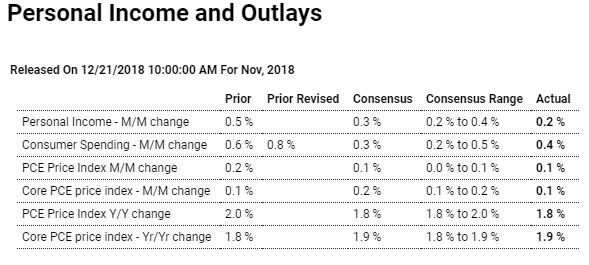

November was a mixed month for the consumer as personal income managed only a lower-than-expected 0.2 percent gain which is offset, however, by a solid and higher-than-expected 0.4 percent rise for consumer spending.

Price data are subdued, rising 0.1 percent for both the PCE and core PCE with year-on-year rates now both below the Federal Reserve’s 2 percent target, at 1.8 and 1.9 percent respectively.

Highlights

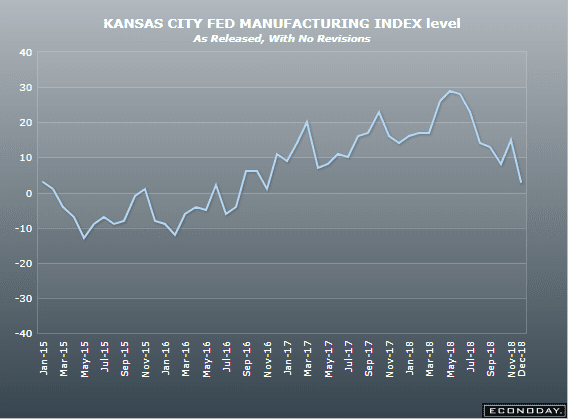

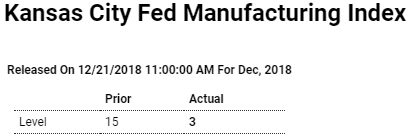

This morning’s durable goods report proved no better than mixed as have many of the recent regional manufacturing reports including Kansas City’s composite index for December which slowed to 3 for the lowest reading in more than two years.

New orders, at 4, are one of the lowest of the last two years with export orders especially weak at minus 7. Production moved sharply into the negative column at minus 18 with the workweek flat. Employment is a positive rising 2 points to 8 as are backlog orders which came in at 9 though down from November’s unusually strong rise of 18. Prices also moderated sharply including input costs and also selling prices which had been strong in this sample but are now flattening.

And flattening is a reasonable description for the nation’s factory sector in general, ending what was a strong 2018 with a bit of fizzle.