China Total Vehicle Sales

Vehicle sales in China tumbled 15.8 percent from a year earlier to 2.37 million in January 2019, following a 13 percent drop in the previous month. It was the seventh consecutive annual decrease in vehicle sales in the world’s largest auto market and the sharpest since January 2012 amid slowing economic growth. Still, new energy vehicle sales jumped 140 percent to 95,700 units, making the sector the best performing one among the whole automotive industry. Sales of pure electric vehicles increased 179.7 percent to 75,000 units and those of plug-in hybrids grew 54.6 percent to 21,000 units.

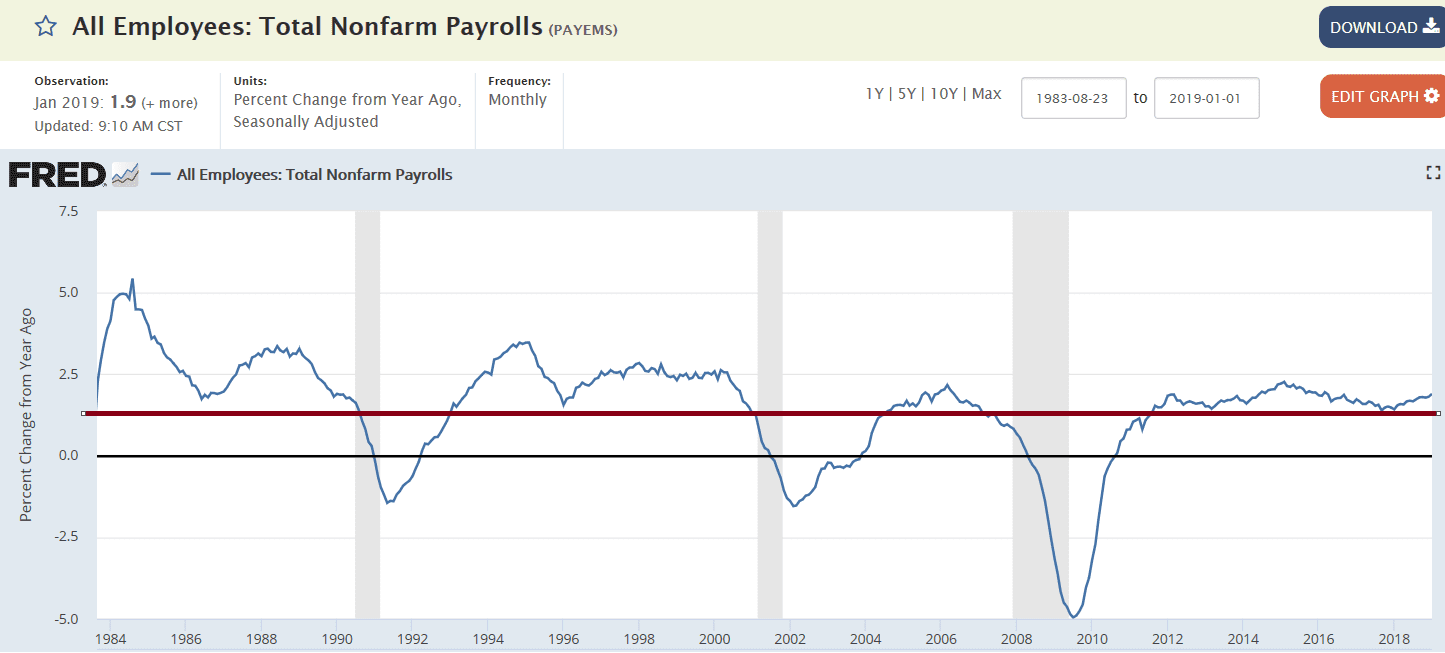

Starting to look more like most of the rest of the world:

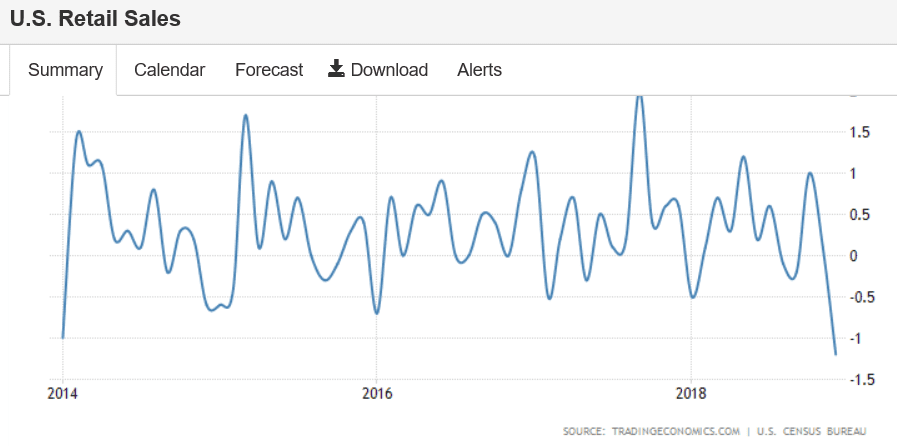

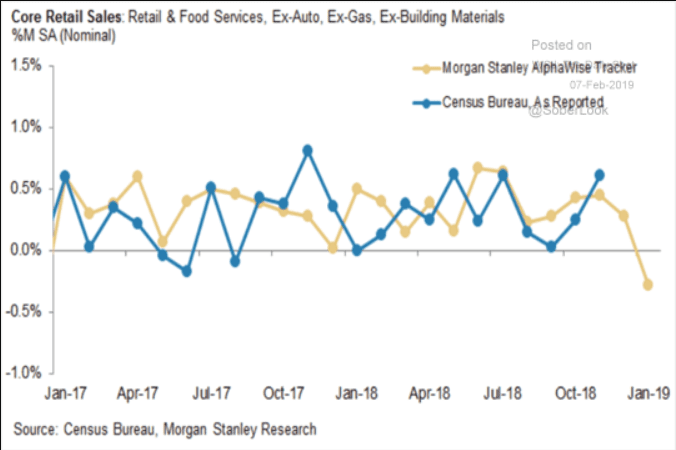

US retail trade fell by 1.2 percent from a month earlier in December 2018, following a revised 0.1 percent growth in November and missing market expectations of 0.2 percent gain. It was the steepest decline in trade since September 2009, as sales fell in almost all categories. Excluding automobiles, gasoline, building materials and food services, retail sales dropped 1.7 percent in December after an increase of 1 percent in November.

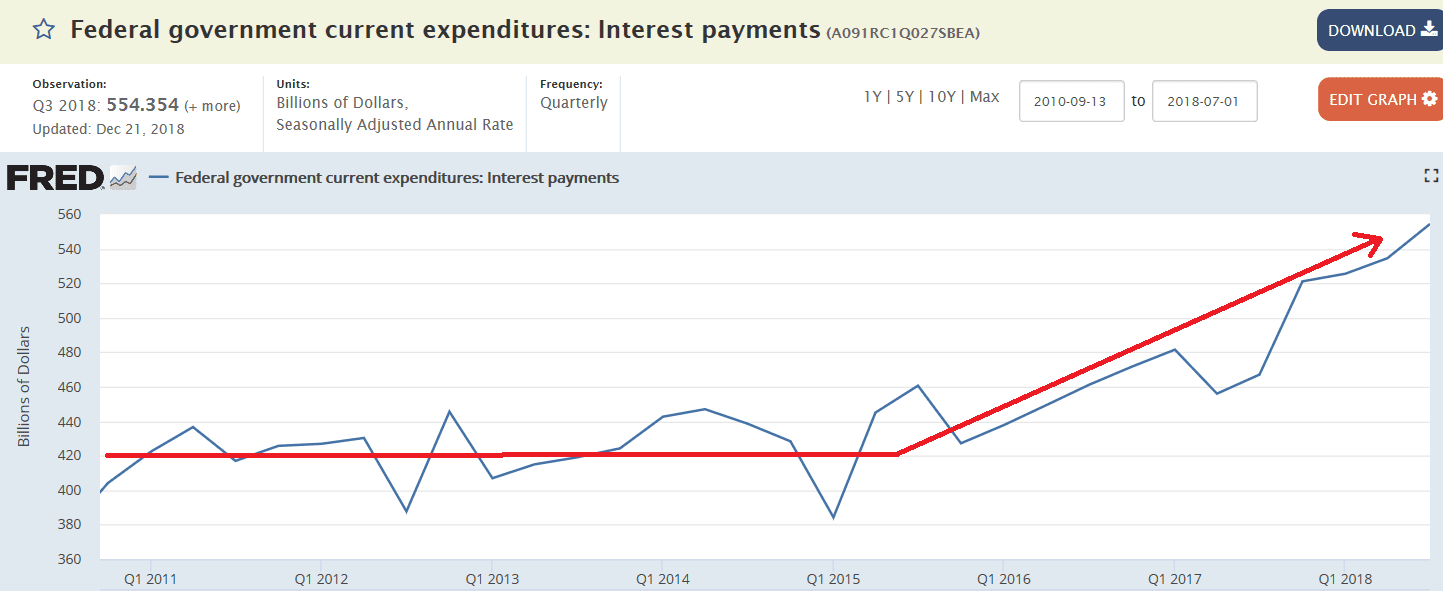

The economy has been getting a bit of support from Fed rate hikes as they increased federal interest expense paid to the economy. If they start cutting rates that support likewise goes away:

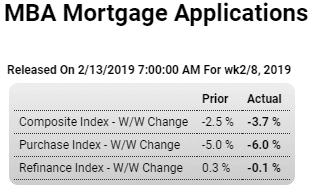

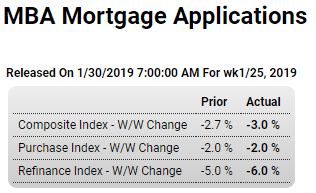

Getting even more serious- year over year down 6%:

Highlights

The purchase index fell for a fourth straight week and down steeply, at a 6.0 percent rate which is not only the weekly change but also the yearly change as well. The report attributes the fall to “renewed uncertainty about the domestic and global economy” which it said held buyers off the market. But citing strength in the labor market, the Mortgage Bankers’ Association expects purchase activity to pick up in the coming months.

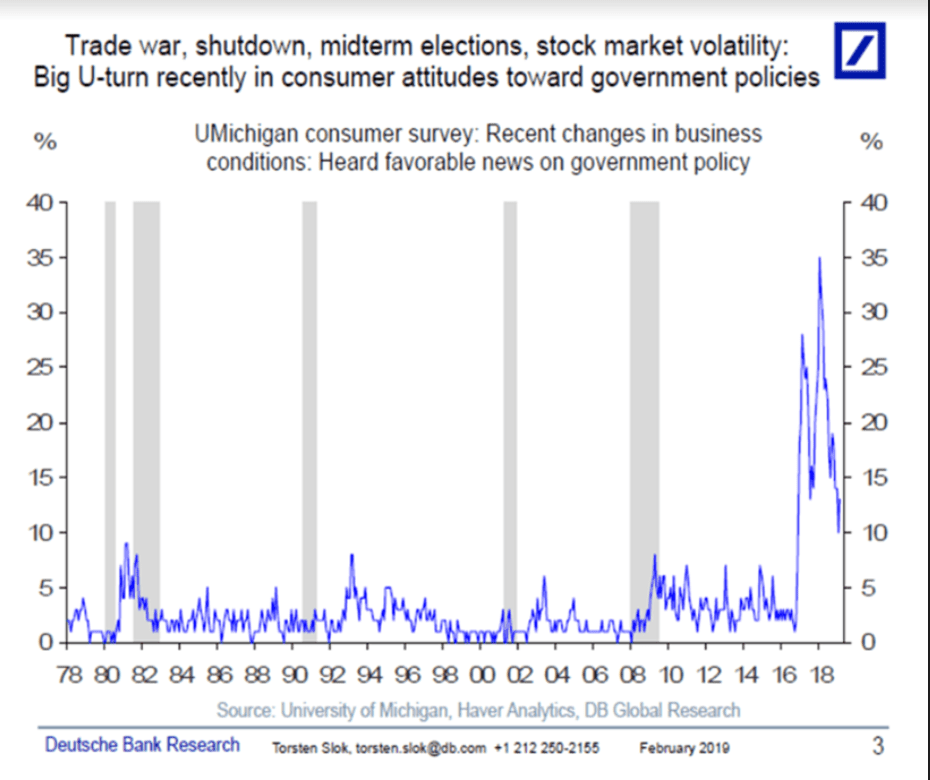

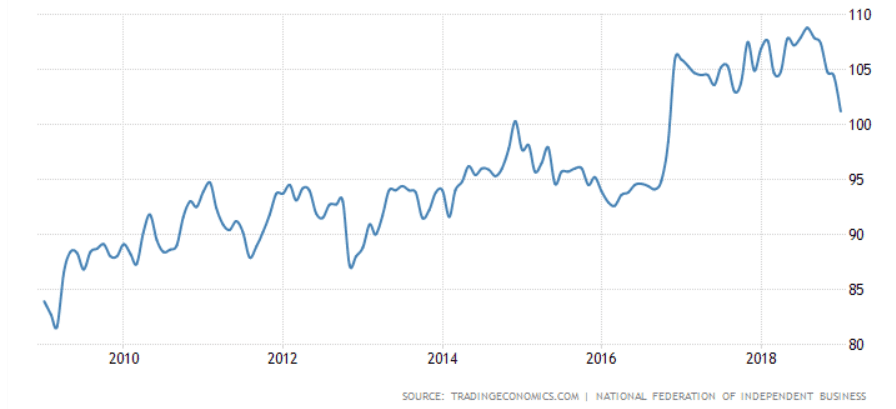

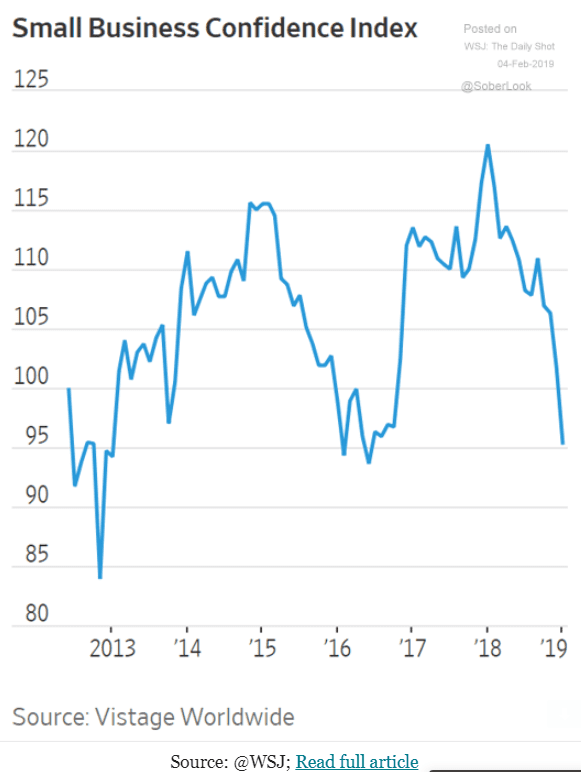

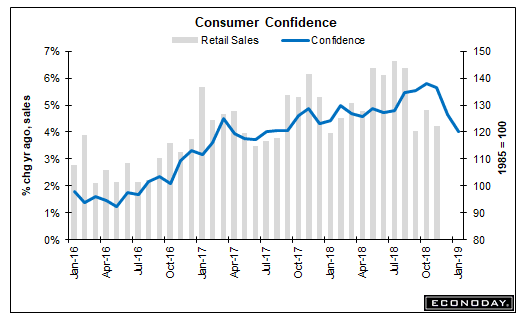

Trumped up expectations fading:

Highlights

Doubts about future economic growth diminished optimism among small business owners to the lowest level in 26 months, according to the NFIB’s Small Business Optimism Index, which fell 3.2 points in January to 101.2, below consensus expectations as well as the range of analysts’ forecasts. Though still above the long-term average of 98, the optimism reading has retreated sharply from the 45-year high set last August, and the fall in January mainly reflects a 10-point drop to a net 6 percent in expectations that the economy will improve, a 7-point decline to a net 16 percent in expectations that real sales will be higher, and a 7-point drop to a net 1 percent in plans to increase inventories.

The decline was broad-based, however, with 7 of the 10 components of the index retreating: plans to increase employment fell 5 points to a net 18, current job openings fell 4 points to a net 35 percent, the view that now is a good time to expand was down 4 points to a net 20 percent, and the view that current inventory is too low fell 2 points to a net minus 3 percent.

China’s Lunar New Year sales lose steam as economy slumps

(Nikkei) China’s Lunar New Year holidays through Sunday saw single-digit consumption growth for the first time on record, as an economic slump dampened one of the year’s biggest shopping seasons. Sales in the retail and food-and-drink industries grew 8.5% to 1.005 trillion yuan ($149 billion) over the weeklong holiday down 1.7 percentage points from 2018 and the lowest growth rate in data going back to 2005 when such data was first collected. The number of people traveling within China rose only around 7% year on year to 415 million, compared with growth of around 12% in 2018.

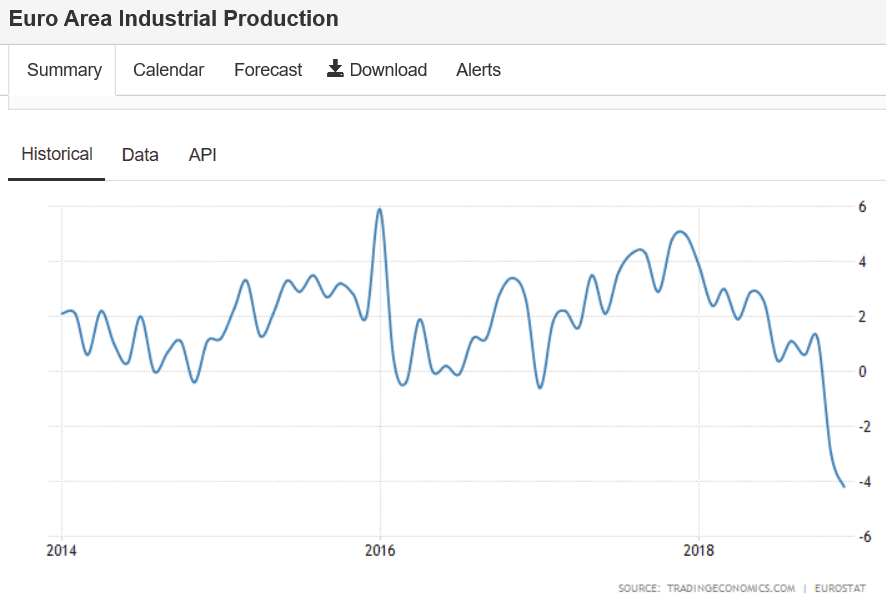

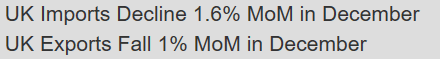

Slowing global trade more than Brexit?

Southern California Home Sales Were The Lowest For A December In 11 Years

New data released today by CoreLogic shows a total of 15,781 new and existing houses and condos were sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in December 2018. This number is down 8.2 percent month over month from 17,192 sales in November 2018,* and down 20.3 percent year over year from 19,800 sales in December 2017. Total Southern California home sales in December were the lowest for that month since December 2007 when 13,240 homes were sold.

Sales have fallen on a year-over-year basis for the last five consecutive months and in seven of the last eight months.

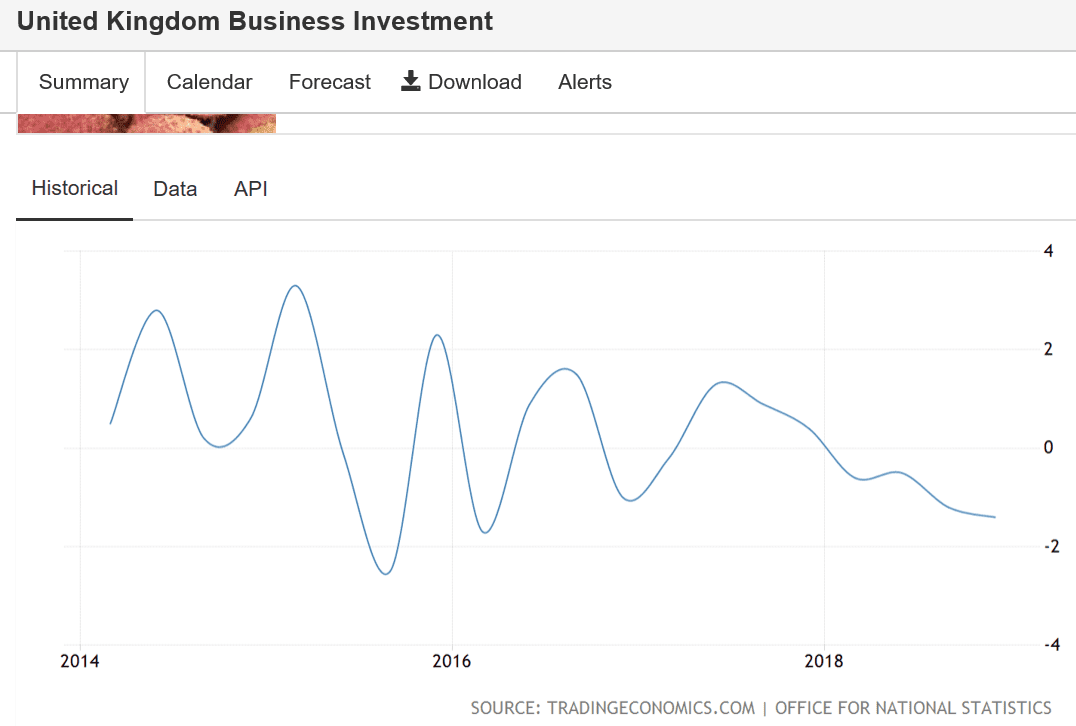

Stabilizing at current levels, which means no growth in capital expenditures:

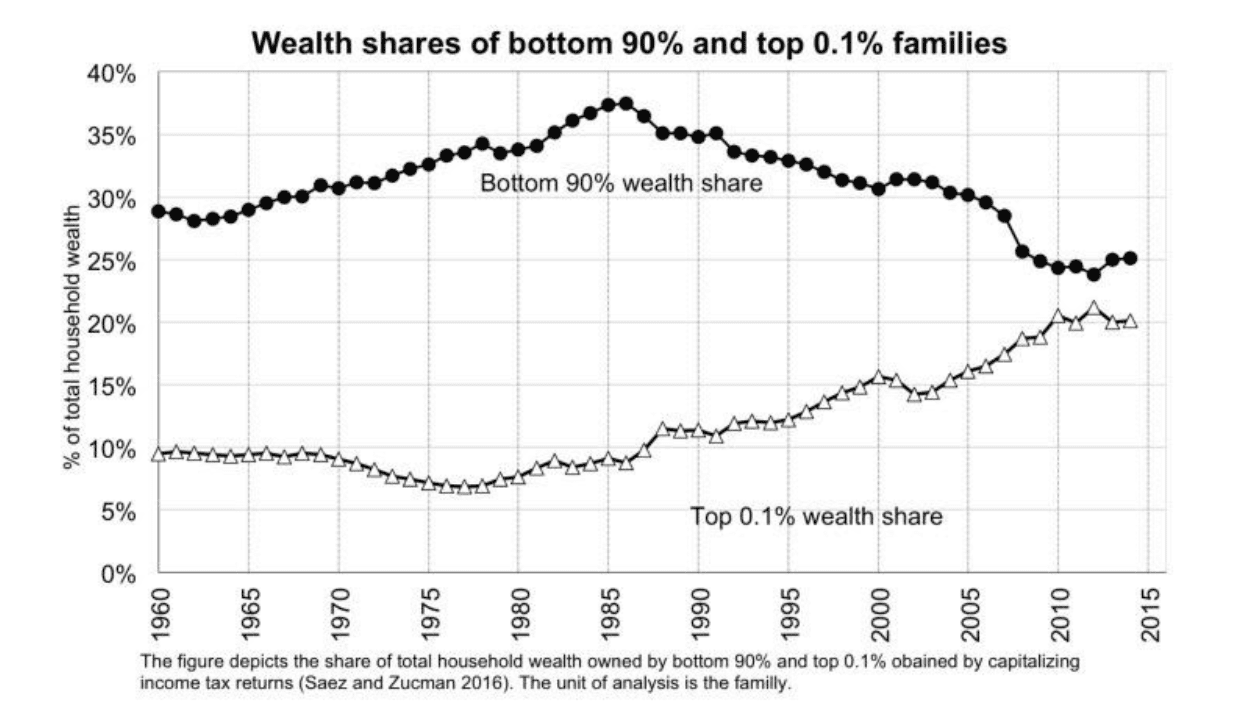

The ‘labor market’ is not a ‘fair game’ as people need to work to eat, and business only needs to hire if it likes the return prospects, so real wages should be expected to remain depressed without some form of outside support, which broke down in the 80’s with globalization policies, and the share of GDP going to capital began to rise:

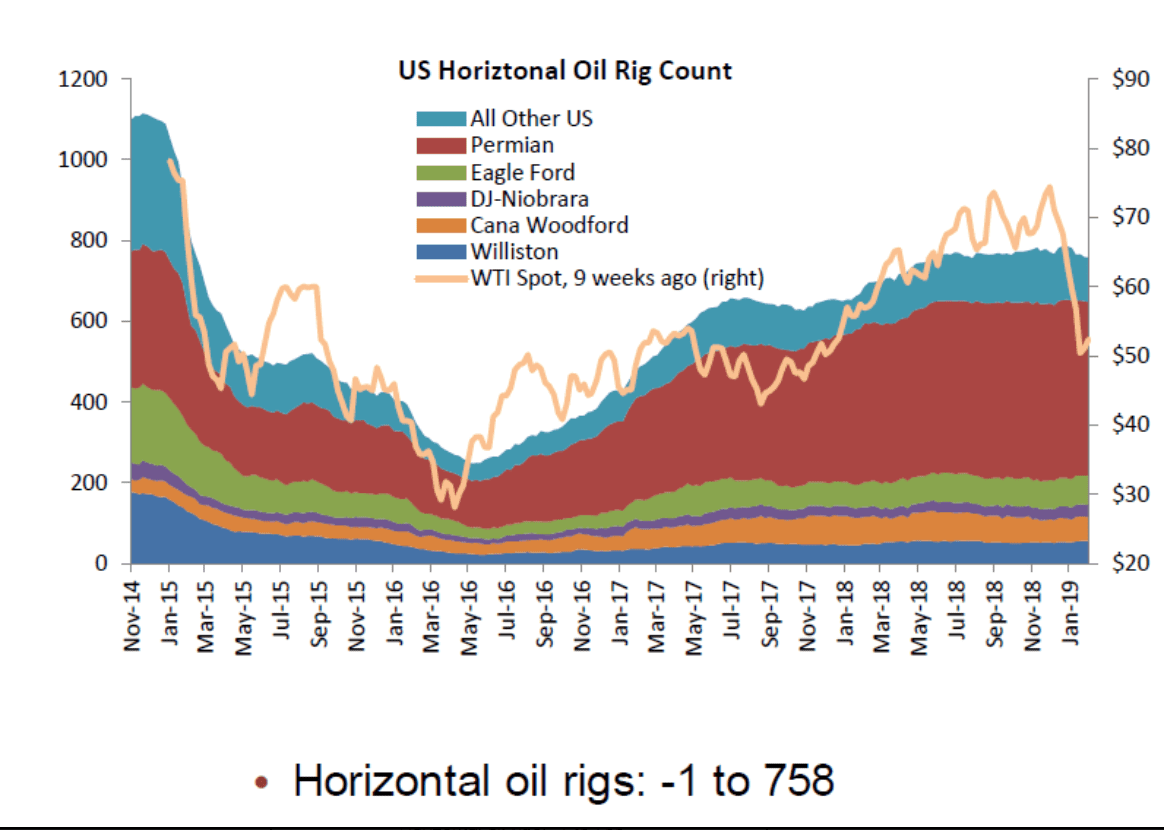

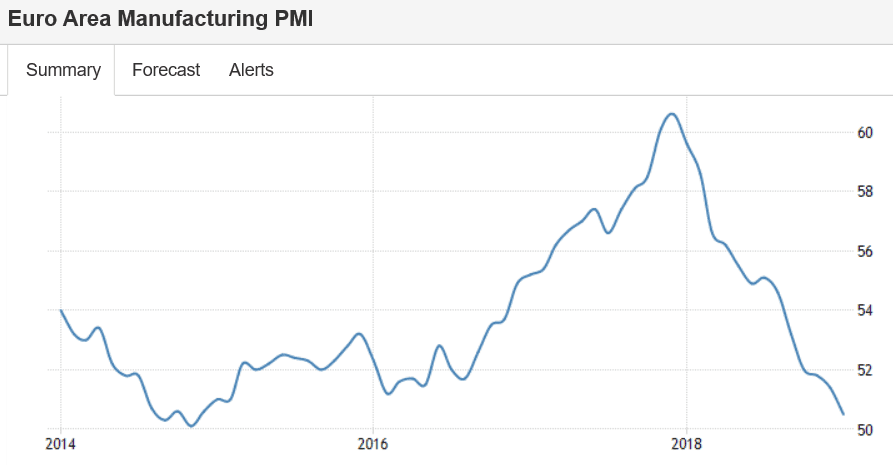

General weakness continues:

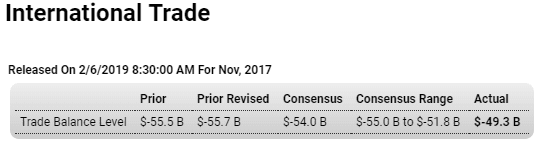

US imports way down, as reflected in general global weakness, and same for weak US exports. And also indicative of US weakness:

Highlights

A sharp pull back in imports, not strength in exports, led a much sharper-than-expected fall in November’s trade deficit to $49.3 billion. Imports, reflecting price declines for petroleum as well as a $4.3 billion drop in consumer goods especially cell phones, fell $7.7 billion in the month while exports also fell, down $1.3 billion and largely reflecting oil-related declines for supplies and materials.

Germany Balance of Trade

The German trade surplus decreased to EUR 13.9 billion in December 2018 from EUR 18.4 billion in the same month a year earlier. It was the smallest trade surplus since January 2016, mainly due to a sharp decline in exports.

Hong Kong Private Sector PMI

The seasonally adjusted Nikkei Hong Kong PMI inched higher to 48.2 in January 2019 from 48.0 in the previous month and marking the tenth straight month of contraction. New orders fell again, accompanied by lower sales to overseas markets, including China. At the same time, output continued to decline, while firms scaled back on purchasing activity and hiring.

Bank of England sees weakest UK outlook since 2009 on Brexit, global slowdown

The Bank of England said Britain faces its weakest economic growth in a decade this year as uncertainty over Brexit mounts and the global economy slows.

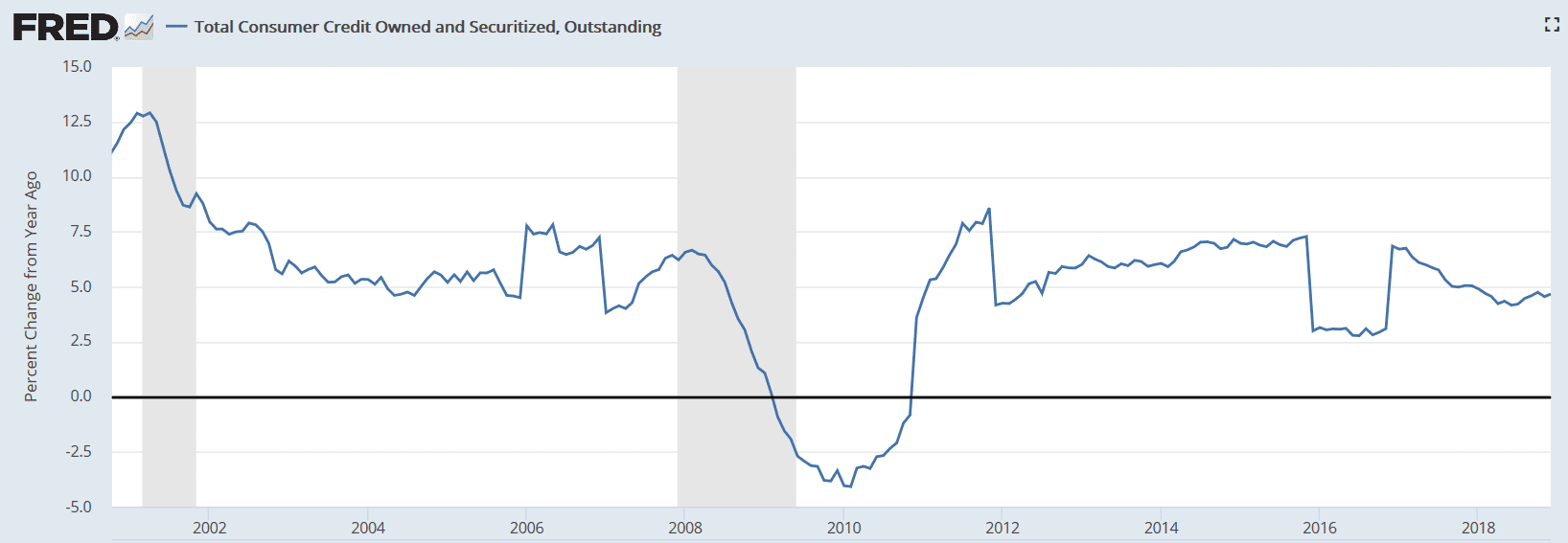

United States Consumer Credit Change

Consumer credit in the United States went up by USD 16.55 billion in December 2018, down from an upwardly revised USD 22.41 billion gain in the previous month and slightly below market expectations of a USD 17.0 billion rise. It was the lowest increase in three months. Revolving credit including credit card borrowing climbed USD 1.7 billion, compared to an upwardly revised USD 4.9 billion advance in November. Meantime, non-revolving credit including loans for education and automobiles jumped by USD 14.9 billion, after rising an upwardly revised USD 17.5 billion in the prior month.

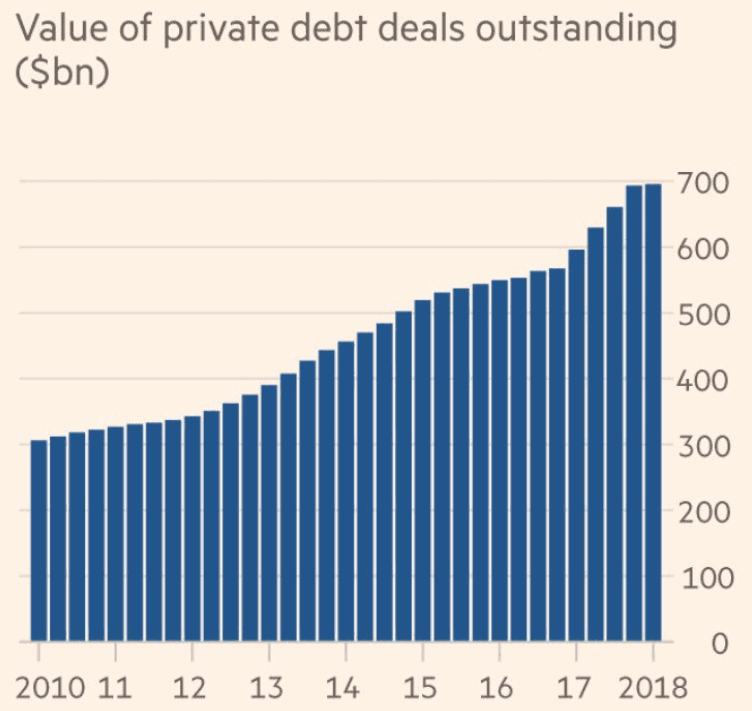

Looks like this source of private sector deficit spending may have been the driver behind about 1.5% of GDP growth, taking the place of bank lending. But most recently the growth looks to have slowed:

US Q1 earnings tipped for first decline in 3 years

(FT) Consensus estimates point to a 0.8 per cent drop in earnings per share this quarter, according to FactSet, a dramatic markdown from a forecast of 3.3 per cent growth at the end of December. With about half of the companies in the S&P 500 having reported their results, earnings for the fourth quarter rose 12.4 per cent overall. Analysts are expecting top-line growth of 5.7 per cent this quarter versus 6.5 per cent as of December 31. Wall Street analysts were calling for quarterly earnings growth of 1.6 per cent, 2.7 per cent and 9.9 per cent, respectively, for the last three quarters of the year.

Lots of headlines pointing to corporate weakness:

Amazon sales outlook falls short after record holiday quarter

(Reuters) Fast and free shipping helped the world’s largest online retailer boost revenue by 20 percent. Net income jumped 63 percent to $3 billion for the fourth quarter. Its international operating loss shrunk to $642 million in the quarter from $919 million a year earlier. The company forecast net sales of between $56 billion and $60 billion for the first quarter. Overall, net sales for the fourth quarter were $72.38 billion and beat analysts’ average estimate of $71.87 billion on the back of a strong holiday season, which includes the major U.S. shopping event Black Friday.

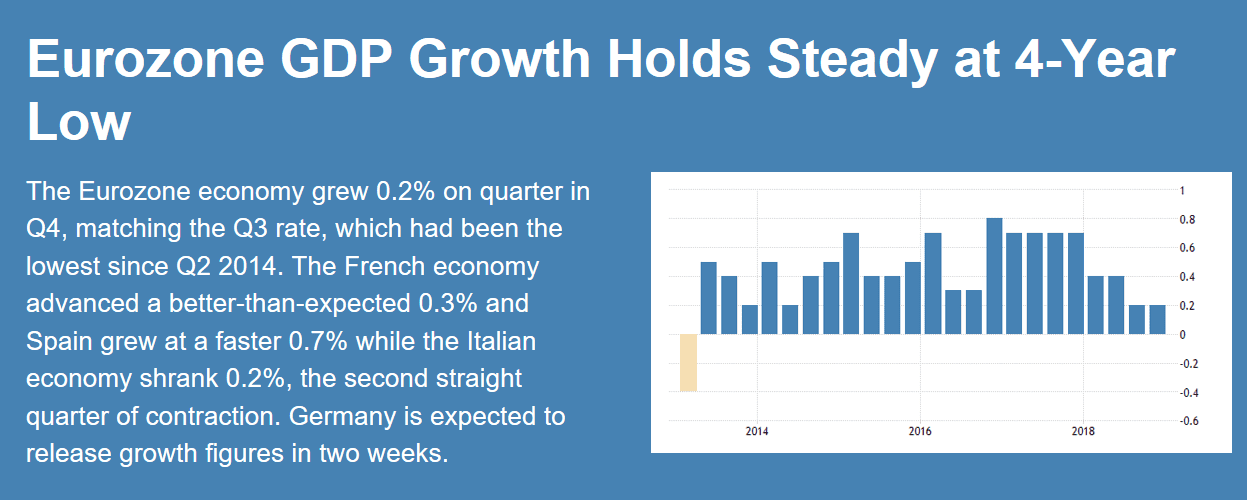

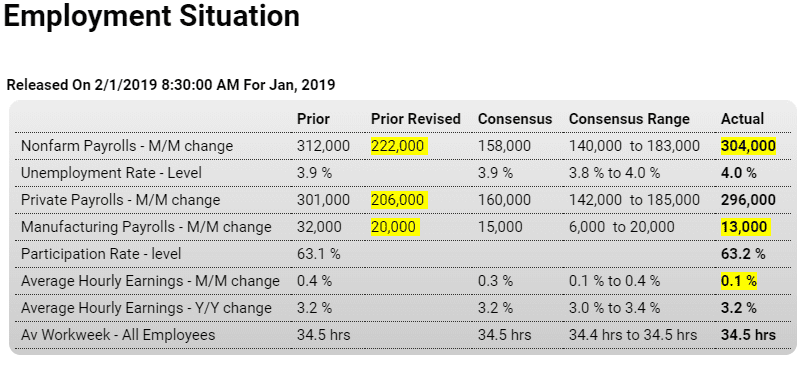

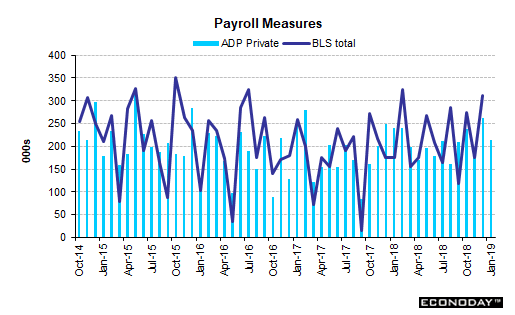

Seems to be holding up as the rest of the global economy is fading fast. The revisions are interesting, best not to judge a number until it’s at least a month old:

Seems to be nudging back up since the tax cuts, or maybe it all gets revised down next month to make it look more like the other indicators?

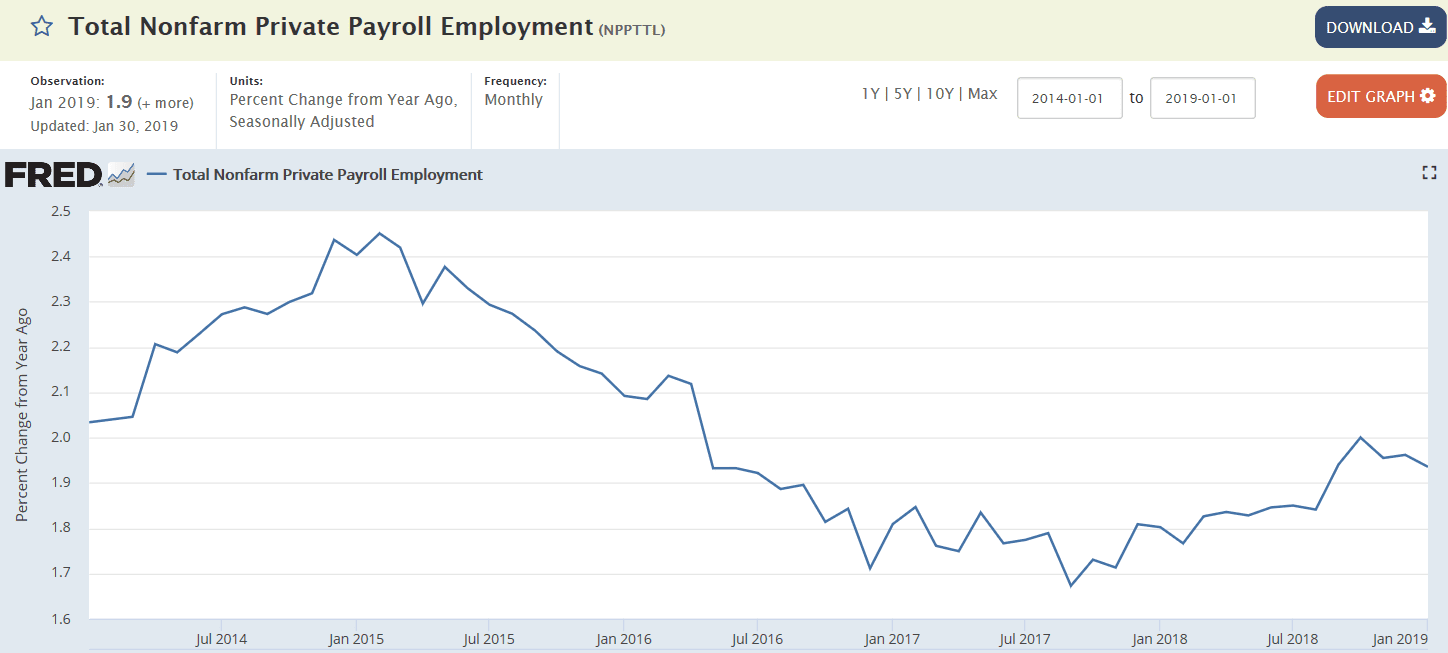

Private payrolls alone tell a somewhat different story:

Apple says China sales fell 27% last quarter

(Nikkei) Apple’s net sales in greater China, including the mainland, Hong Kong and Taiwan, fell 27% on the year to $13.17 billion for the three months ended Dec. 29 in results announced Tuesday. This marked the first downturn there in six quarters. Combined sales elsewhere, including the U.S., Europe and Japan, grew 1% to $71.1 billion, pointing to China as the central cause of the sluggish quarterly results. Greater China as a share of Apple’s sales shrank to 16% from 20%. Total sales for the quarter dropped 5% to $84.3 billion.

3M Lowers Profit Outlook for 2019

(WSJ) “Some of the things that we were expecting on tariffs haven’t turned out quite as bad as what we were estimating,” Financial Chief Nick Gangestad said. 3M now expects $70 million in higher raw material costs this year, including the effect of tariffs, compared with $100 million previously. But 3M said it was seeing a slowdown in some important markets including China and weaker demand globally in industries such as car and electronics production. The company expects potentially lower revenue growth and earnings of $10.45 to $10.90 a share this year, compared with its prior goal of $10.60 to $11.05 a share.

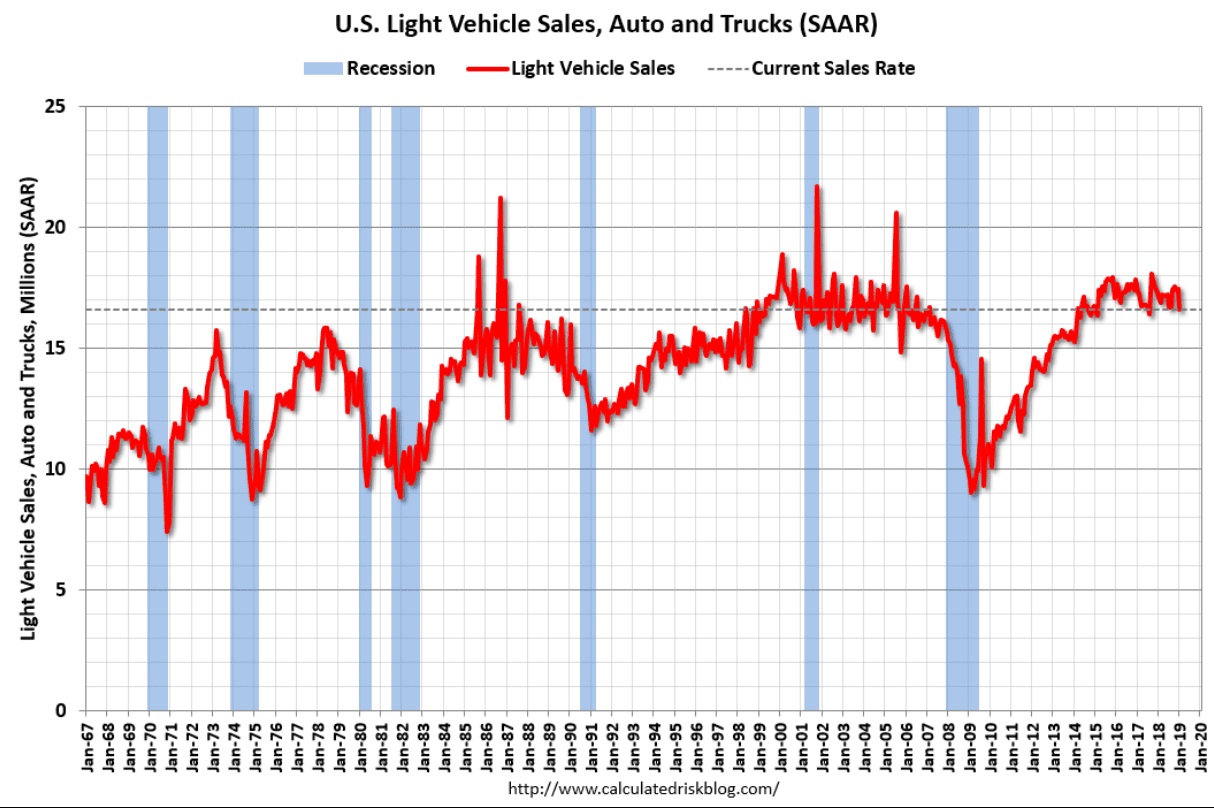

U.S. auto sales seen down in January: J.D. Power, LMC

(Reuters) U.S. auto sales in January are expected to fall about 1 percent from the same month in 2018, partly due to uncertainty around government shutdown causing some customers to delay purchases, according to industry consultants J.D. Power and LMC Automotive. Total vehicle sales in January are estimated to be about 1,141,300 vehicles, the consultancies said on Tuesday. Retail sales are expected to fall 2.4 percent to 864,300 vehicles in January, while the overall total seasonally adjusted annualized rate for vehicles is expected to be about 16.8 million vehicles, down 2.3 percent from a year ago.

Highlights

Purchase applications for home mortgages fell a seasonally adjusted 2 percent in the January 25 week, continuing the prior week’s cooling from the highest volume since 2010 seen at the start of the year. Year-on-year, unadjusted purchase applications gave up a 13 percent gain recorded in the prior week and plunged back into negative territory to a level 7 percent lower than a year ago. Applications for refinancing fell 6 percent from the prior week, pulling down the refinance share of mortgage activity by 2.5 percentage points to 42.0 percent. The average interest rate for 30-year fixed rate conforming mortgages ($484,350 or less) rose 1 basis point from the prior week to 4.75 percent. Note that results for the week were affected by the Martin Luther King Jr. Holiday, for which adjustments were made but which may still have distorted some comparisons. Despite the cooling in the last 2 weeks, purchase applications remain about 6 percent above the long term average and could give a boost to the housing market in the upcoming spring buying and selling season.

Way below expectations:

NAR: Pending Home Sales Index Decreased 2.2% in December

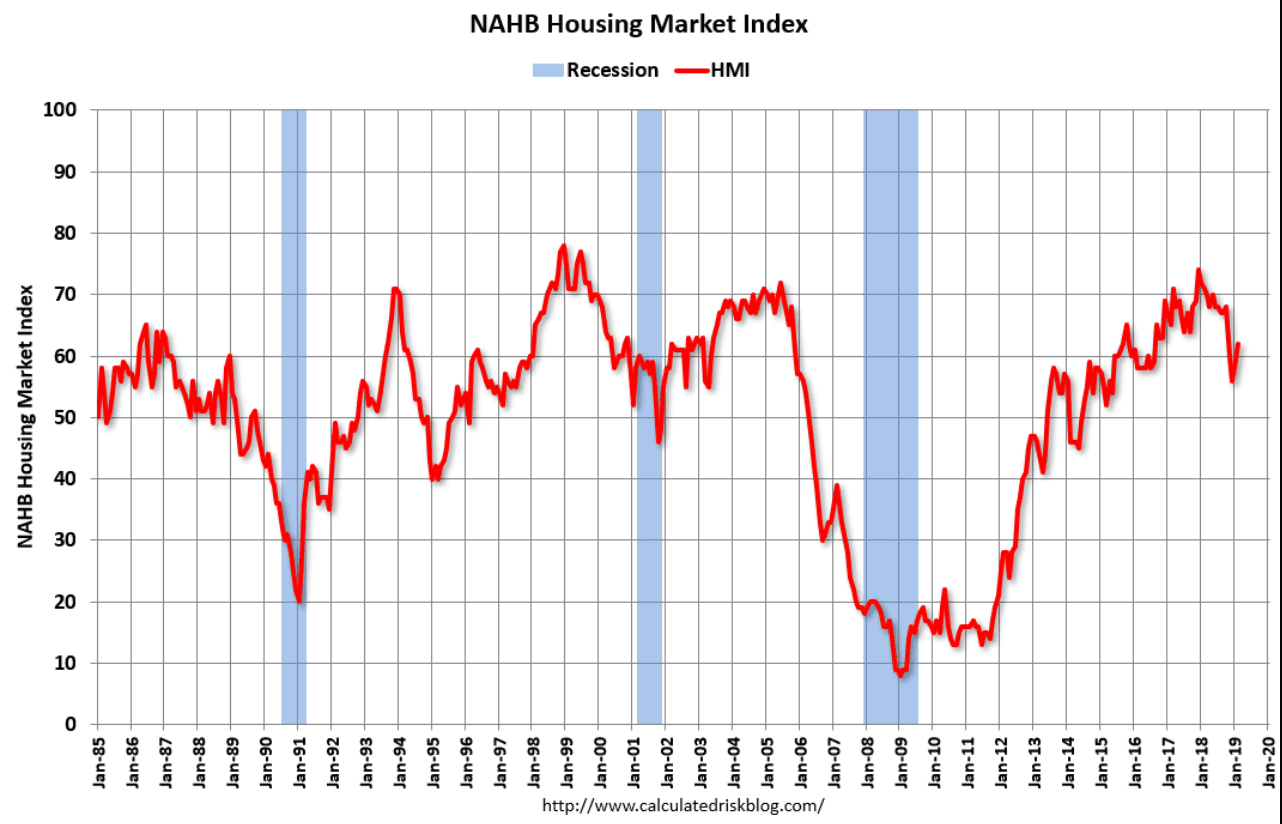

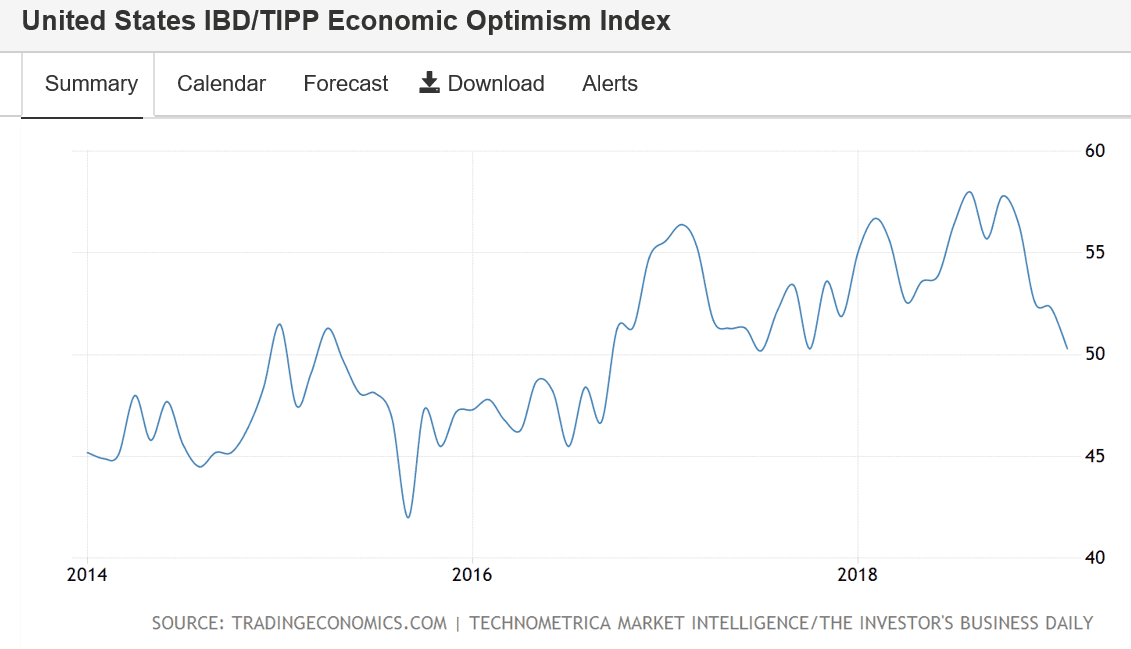

Still high but softening rapidly:

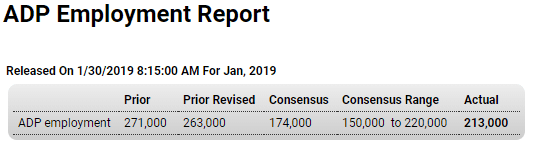

This forecast for Friday’s employment report is down from last month but still reasonably strong:

Highlights

ADP estimates that private payroll growth in Friday’s employment report for January will rise a higher-than-expected 213,000. Forecasters pegged ADP’s January estimate at 174,000 and see Friday’s private payrolls coming in at 160,000 vs 301,000 in December.

These seem to be popping up everywhere, with none of them getting it right… ;)

The Flamboyant Absurdity of ‘Modern Monetary Theory’

Modern Monetary Theory: A Cargo Cult

MMT Or Bust – A Big Government Fantasy For Leftists