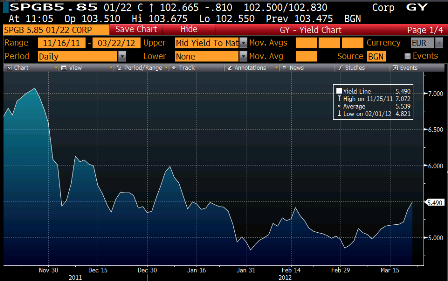

Lots of ‘restructuring talk’ going on- looking like another ‘bondholder tax’ of sorts?

From Reuters:

Analysts are divided as to whether Ireland’s national debt, which is forecast to peak at 119 percent of GDP in 2013, is sustainable. A policy paper by Ireland’s European partners and the IMF is being drawn up on a possible deal to refinance the promissory notes, IOUs used to recapitalise failed lenders Irish Nationwide Building Society and Anglo Irish Bank, Noonan said. Ireland would then seek the political support of its European partners. “I would like to see a situation where the repayment schedule on the Anglo Irish debt was more affordable and that would mean, in very simple terms, re-engineering the repayment schedule so we would have a longer time to repay at lower interest rates,” Noonan said. There was no prospect of a writedown of part of the principle, Noonan said. “It will have to be repaid,” he said, while warning that the talks on refinancing the promissory notes were unlikely to reach a conclusion soon. “It is a project where, if we’re successful, it will be in the medium term rather than immediately.”

By Arthur Beesley and Kilian Doyle

March 13 (Irish Times) — Taoiseach Enda Kenny has rejected calls for Ireland to follow Spain’s lead on demanding concessions from Europe, insisting the two countries were in completely different positions.

With no breakthrough imminent in the Government’s long campaign with Europe to restructure Ireland’s banking debt, Irish officials have privately raised the possibility of delaying a postpone a €3.1 billion bank debt repayment which falls due at the end of this month.

Minister for Finance Michael Noonan left open that possibility as he arrived in Brussels yesterday for talks with his EU counterparts, saying it was a long way to the end of the month and that nothing was ruled in or out.

Speaking in the Dáil today, the Taoiseach said he did not wish to give the public false hope the promissory note due to be paid on March 31st will be scrapped.

“This country is in a bailout programme, Spain is not,” said Mr Kenny. “So the money to pay the salaries of the gardaí, the teachers, the nurses and all of the other people in the country here comes from Europe.”

Euro zone finance ministers agreed last night to give Spain more leeway in cutting its deficit after the Madrid government said it would not meet its deficit target. Spain’s deficit target for 2012 will now be 5.3 per cent of GDP instead of the original 4.4 per cent agreed under new EU regulations.

Sinn Féin president Gerry Adams urged Mr Kenny to follow Spain’s lead. “I can’t,” the Taoiseach replied. “Spain is not in a bailout situation. It’s got excessive deficit and it’s got challenges itself. It’s got to get its deficit down by the end of 2013. Ireland is in a programme and has to get our debt down by 3 per cent by 2015.”

Mr Kenny insisted negotiations are under way to restructure the terms of Ireland’s European debt. However he said they were difficult, complex and very technical. “When you speak of the €3.1 billion in respect of the promissory notes, I’ve made it perfectly clear we are not going to raise any undue expectations here,” Mr Kenny added.

In Brussels today, however, EU economics commissioner Olli Rehn indicated in unambiguous terms that a delay in repayment of the debt would not be acceptable. His stance mirrors that of the European Central Bank, which is also resisting any delay.

“I actually wonder why this has to be asked at all because the principle in the European Union and in the long European legal and historical tradition is – in Latin – pacta sunt servanda, respect your commitments and obligations,” the commissioner said.

“The European Union is a community of law and that assumes by definition that each and every member state respects the commitments it has undertaken and this is valid in the case of Ireland as well. Any possible negotiation on the medium- to long-term solution is a separate issue.”

Dublin has been trying for months to renegotiate an EU-approved arrangement under which it is recapitalising the former Anglo Irish Bank and the former Irish Nationwide Building Society with expensive IOUs known as promissory notes.

A key consideration in this debate, a senior European official said yesterday, is whether any deal would help Ireland realise fiscal targets set under its EU-IMF bailout in a scenario in which economic growth is forecast to slow down.

Also in question is whether loss-incurring tracker-mortgages issued by other Irish banks could be moved as part of any restructuring deal to Irish Bank Resolution Corporation, as the former Anglo and Irish Nationwide are now known.