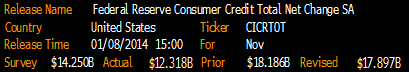

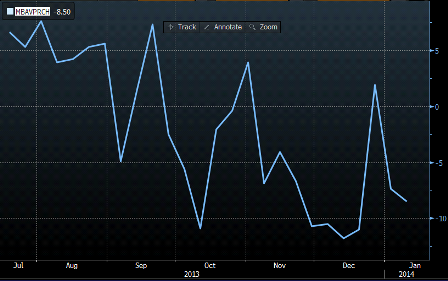

Purchase apps up vs last week, down vs this time last year:

Highlights

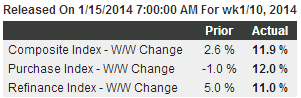

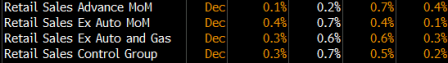

MBA’s index for purchase applications surged 12.0 percent in the January 10 week, boosted by a sizable decline in mortgage rates. But one week is only one week and the trend for purchase applications is still definitely down, though the latest gain does lift the index back to its level in mid-November. Refinancing applications also got a boost from lower rates, up 11.0 percent in the week. The average rate for conforming 30-year mortgages ($417,000 or less) fell 6 basis points in the week to 4.72 percent.

Purchase apps y/y:

Full size image

Purchase apps:

Full size image