Over 6 weeks ago we distributed the attached Eurosystem Solutions paper.

It described the unique non-standard measures being used for by the Eurosystem and ECB to address bank solvency and national solvency issues and the movement towards a real solution involving the ECB.

Now the ECB has announced what is very close to the real solution: unlimited bond purchases.

Regardless of conditionality, or even in spite of conditionality, this is the crossing of the line into the notion that there is an entity that can credit accounts in Euro in unlimited amounts.

While conditionality is the apparent necessary circumstance, and it’s likely national authorities will play along, these ECB purchases will have to take place regardless of conditionality. If Spain says they can’t comply, is the ECB going to let them default? The ECB has done all this to avoid Spanish default.

The best case is for the markets to recognize the ECB backstop and so regular purchases aren’t very necessary. There will be lots of movement towards coordination of budgets and banking supervision.

But the ECB line has been crossed.

Sixteen years after our AVM/III July 1996 Bretton Woods conference that identified the severe credit problems with the looming Maastrict rules (1/1/99), and eleven years after Warren’s famous paper on the potential European credit crisis “The Rites of Passage” we are finally seeing the necessary repair to the EMU.

There still remain political obstacles, court challenges and the like, but the imperatives to avoid a complete collapse of the Euro financial system have driven virtually all the important constituents to this necessary path of solution.

Daily Archives: September 7, 2012 @ 12:47 pm (Friday)

August Payrolls-Stall Speed

Karim writes:

Very poor job data with a gain of only 96k and a net revision of -41k. Somewhat offsetting is the 0.2% drop in the unemployment rate from 8.3 to 8.1% (which along with April 2012 is the lowest since January 2009). The biggest swing (and miss) was manufacturing employment, which shifted from a gain of 23k to a fall of 15k, indicating that global economic weakness is affecting U.S. exporters. Indicators of domestic demand fared better as trade swung from a gain of 11k to 29k jobs, finance from -2k to +7k, and leisure/hospitality from 28k to 34k.

Though August payroll data is typically revised higher, the data affirms the notion the economy is hovering around or just below trend growth of 2-2.5%.

The data increases the chances of QE3, unsterilized and possibly open-ended purchases of Agency MBS and USTs, but I still think later in the year. An open-ended program likely requires a consensus Fed economic forecast, which is still a work-in-progress. Next week’s FOMC meeting will be contentious, and a close call, however.

Other data highlights:

- The drop in the unemployment rate came as a result of a drop in the participation rate from 63.7% to 63.5% (labor force fell by 368k).

- The U6 measure improved from 15% to 14.7%, but the median duration of unemployment rose from 16.7 weeks to 18 weeks.

- Average hourly earnings were unchanged and aggregate hours gained 0.1%, a weakish combination for personal income.

- The diffusion index dropped from 54.3 to 50.2

Some interesting charts from SMR:

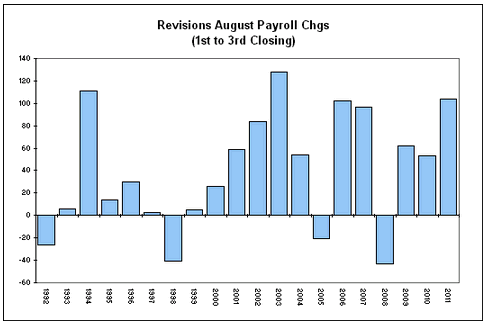

Over the past 20 years August payrolls have been revised upward between the 1st and 3rd release on 16 occasions.

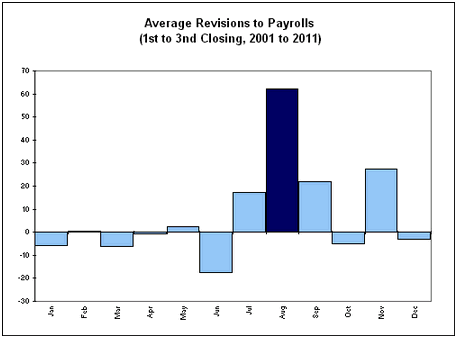

The magnitude of the August payroll revisions over the past 10 years has far exceeded any other month of the year. Over this period the August reading has been revised upward by an average of 62,000, in contrast to the next largest month (November) at +27,600.