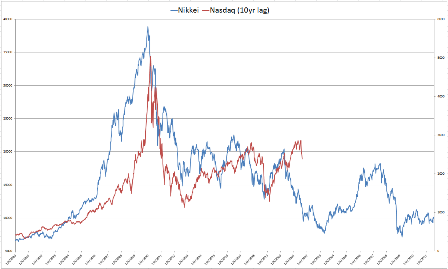

Their multi year budget surplus and subsequent crash was about 10 years ahead of ours.

Glad we learned from their mistakes…

Click here for larger graph

If these forecasts turn out to be correct it means a hard landing was avoided.

However, China’s stock market prices, anecdotal evidence on property prices, and commodity price performance is suggesting it could already be a lot worse than forecast.

Morgan Stanley, Deutsche Bank Cut Forecasts for China Growth

August 17 (Bloomberg) — Morgan Stanley (MS) and Deutsche Bank AG cut estimates for China’s economic growth as the debt burdens and elevated unemployment of developed nations threaten demand for exports.

Morgan Stanley cut a forecast for next year to 8.7 percent from 9 percent, in an e-mailed note today. Deutsche Bank lowered a prediction for this year to 8.9 percent from 9.1 percent, in a report yesterday.

Starbucks Brews D.C. $$ Boycott

Starbucks claims it has rallied ‘hundreds’ of people in support of a call by its CEO to suspend campaign contributions to Congress and Obama until Washington produces a long-term deficit plan.

Link: Congressman Ryan: Apologize Now About the US Being the Next Greece

Feel free to comment on the site, thanks!

Lots of refi’s with the low rates but not much in the way of new purchases:

As bad as it’s ever been.

I could turn it all around over a two day weekend.

Full FICA suspension

One time revenue distribution to the state govts of $500 per capita

$8/hr Federally funded transition job for anyone willing and able to work

(see my ‘proposals’ on this website)

Unemployment starts falling towards 4%

Stocks double in short order bailing out pension funds

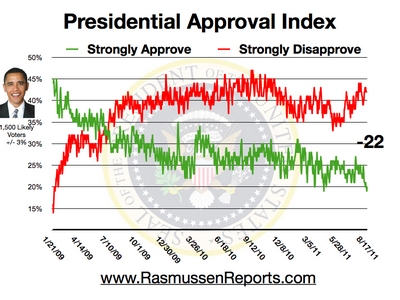

Strong approve would go to 65%

Strong disapprove would go to less than 35%…

They see it all about managing expectations.

So with the announcement they managed interest rate expectations a bit lower out to 2013.

But now they are concerned they managed expectations about economic growth and employment lower as well, which they believe works to lower actual growth and employment.

So now they are trying to adjust both a bit back in the other directions.

*DJ Fed’s Plosser: FOMC Statement On Econ Too Negative -Bloomberg Radio

*DJ Fed’s Plosser: Extending Policy To ’13 `Inappropriate’ -Bloomberg Radio

*DJ Fed’s Plosser: Expects Will Have To Raise Rates Before ’13 -Bloomberg Radio

Andea Terzi is a former student of Paul Davidson, now a professor of economics at Franklin College, Lugano, Switzerland.

The institutional structure in the euro zone has been it’s own undoing since inception, very much like we all described at that time.

Current policy responses continue to support the same repressive fiscal policies that again look to be driving the otherwise prosperous euro zone into negative GDP growth.

The glimmer of hope may be that they have discovered the sector balance approach.

The next step in the right direction would be a recognition of the actual causations.

From Professor Tezi:

Does the ECB understand sector financial balances?The August 2011 Monthly Bulletin of the European Central Bank has an interesting chart of financial balances of different sectors in the euro area. The chart is reproduced below.

The figure shows how rising deficits in Europe in 2008 and 2009 have produced higher net financial savings in the private sector.

This is evidence that automatic (anti-cyclical) stabilizers worked as usual: as growth declines, or goes negative, tax revenues fall, government deficits increase, and this stops the economy from falling further. This can only work, however, until market-constrained governments in the euro area begin acting pro-cyclically. Governments acting pro-cyclically during recessions means that deficit reductions will reduce private savings below the desired level, and this means a further fall of demand and incomes.

Looking at 2010, and considering that the euro area’s current account balance is marginally negative, there is evidence of this pro-cyclical effect, as government deficits declined, and net private lending inevitably declined.

What is remarkable is how the ECB interprets the chart:

With euro area total investment growing faster than saving, the net borrowing of the euro area increased (to 0.9% of GDP, expressed as a four-quarter sum). From a sectoral point of view, this masked further rebalancing between sectors, with another reduction in government net borrowing (the government de?cit falling to 5.5% of GDP on a four-quarter moving-sum basis, from a peak of 6.7% in the ?rst quarter of 2010) and a further decline in households net lending, while the net borrowing of NFCs increased sharply. (ECB, Monthly Bulletin, August, 2011, pp. 37-8)

The ECB is assuming that savings are needed to finance investment and sector rebalancing is always a good thing. And it makes no reference to the connection between financial balances and nominal GDP growth.

In plain language, this is what the ECB is telling us:In 2010, Euro area’s savings were insufficient to finance investment. Business needed to borrow to finance their investments and households savings were not enough to fill the gap. This is why the euro area runs a current account deficit, and is a net borrower. European governments, however, are doing their part by reducing their own net borrowing, thus contributing to a progressive rebalancing in financial deficits/surpluses across sectors.

For the ECB, the government net borrowing bar getting shorter (in the chart above) is a reason for optimism. In our reading, this optimism is unwarranted, and what the ECB calls “rebalancing between sectors” is a most worrying financial development of the euro area.

According to a video appearing on the left-leading website Think Progress, a reporter asked Perry what he would do about the Federal Reserve.

Standing next to a “Perry President” sign, the governor replied, “If this guy prints more money between now and the election, I don’t know what y’all would do to him in Iowa, but we would treat him pretty ugly down in Texas.”

“I mean, printing more money to play politics at this particular time in American history, is almost treacherous, or treasonous, in my opinion,” he added.

Right answer, wrong reason.

Whatever…

Fitch Affirms US Triple-A Rating, Outlook Stable

August 16 (Reuters) — Fitch Ratings said on Tuesday it affirmed the United States’ top-notch credit rating at Triple-A, giving the world’s largest economy a reprieve after it was downgraded by Standard & Poor’s little more than a week ago.

Fitch said the outlook for the rating was stable.

“The affirmation of the US ‘AAA’ sovereign rating reflects the fact that the key pillars of US’s exceptional creditworthiness remains intact: its pivotal role in the global financial system and the flexible, diversified and wealthy economy that provides its revenue base,” Fitch said in its statement.

“Monetary and exchange rate flexibility further enhances the capacity of the economy to absorb and adjust to ‘shocks’.”

However, Fitch warned the outlook for the rating depended on the economy and the political process in Washington to reduce the public debt.

It said an upward revision to medium to long term projections for public debt either as a result of weaker than expected economic recovery or failure of the joint committee to agree on at least $1.2 trillion in deficit reduction would likely put the United States on negative outlook.

“The rating action would most likely be a revision of the rating Outlook to Negative, which would indicate a greater than 50 percent chance of a downgrade over a two-year horizon. Less likely would be a one-notch downgrade,” the statement said.