First, I think there isn’t enough political or popular support to leave the euro and go back to the drachma.

As previously discussed, it’s not obvious to the population or the political leadership that there is anything wrong with the euro itself.

Instead, it probably seems obvious the problem is the result of irresponsible leadership, and now they are all paying the price.

So staying with the euro, Greece has two immediate choices:

1. Negotiate the best austerity terms and conditions they can, and continue to muddle through.

2. Don’t accept them and default

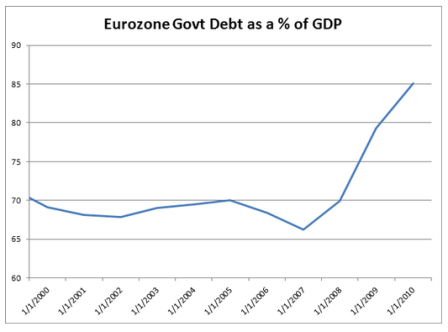

Accepting the terms of the austerity package offered means some combination of spending cuts, tax hikes, assets sales, etc. that still leaves a sizable deficit for the next few years, with a glide path to some presumably sustainable level of deficit spending.

Defaulting means no more borrowing at all for most likely a considerable period of time, which means at least for a while they will only be able to spend the actual tax revenue they take in, which means immediately going to a 0 deficit.

What matters to Greece, on a practical level, is how large a deficit they are allowed to run. This makes default a lot more painful than any austerity package that allows for the funding of at least some size deficit.

Therefore it’s makes the most sense for Greece to accept the best package they can negotiate, rather than to refuse and default.

Additionally, the funding Greece will need to keep going is probably funding to pay for goods and services from Germany and some of the other euro member nations.

In other words, if Germany wants to get paid for its stream of exports to Greece it must approve some kind of funding package.

Reminds me of a an old story Woody Allen popularized a while back:

Doctor: So what’s the problem?

Patient: It’s my brother. He thinks he’s a chicken.

Doctor: Have you tried to talk to him about it?

Patient: No

Doctor: Why not?

Patient: Well, we need the eggs

Likewise the euro zone needs the eggs, and so the most likely path continues to be some manner of ECB funding of the banking system and the national govt’s, as needed, last minute, kicking and screaming about how they need an exit strategy, etc. etc. etc. And the unspoken pressure relief valve is inflation, with a falling euro leading the march. It’s unspoken because the ECB has a single mandate of price stability, which is not compatible with a continuously falling euro, and because a strong euro is an important part of the union’s ideology. But a weak euro that adjusts the price level, as a practical matter, is nonetheless the only pressure relief valve they have for their debt issues in general. And, also as previously discussed, it looks like market forces may be conspiring to move it all in that direction.