Fed also re opening swap lines to ECB – looks ready to do more unsecured dollar lending to them and maybe others.

They look to be doing what they did last time around to keep libor down – lend unsecured to bad credits. High risk but it does get rates down.

On Fri, Apr 30, 2010 at 12:23 PM, Jason wrote:

Confluence of events..

Month end bid for treasuries

Goldman stock down 14 and financial CDS wider creating some fears for financial sector

Greece flight to quality concerns going into the weekend

Fed to begin expanding the Term deposit facility which will remove excess cash and remove downward pressure on term LIBOR

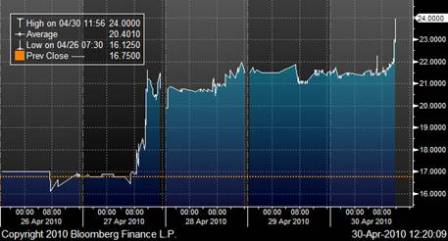

LIBOR quoted for Monday as 35.375 / 35.5 +1

1y OIS-LIBOR 5 day chart:

Result

2y spreads leading the way wider +5 to 23.5

Still cheap though

Press Release

Release Date: April 30, 2010

For immediate release

The Federal Reserve Board has approved amendments to Regulation D (Reserve Requirements of Depository Institutions) authorizing the Reserve Banks to offer term deposits to institutions that are eligible to receive earnings on their balances at Reserve Banks. These amendments incorporate public comments on the proposed amendments to Regulation D that were announced on December 28, 2009.

Term deposits, which are deposits with specified maturity dates that are held by eligible institutions at Reserve Banks, will be offered through a Term Deposit Facility (TDF). Term deposits will be one of several tools that the Federal Reserve could employ to drain reserves when policymakers judge that it is appropriate to begin moving to a less accommodative stance of monetary policy. The development of the TDF is a matter of prudent planning and has no implication for the near-term conduct of monetary policy.

The amendments approved by the Board are a necessary step in the implementation of the TDF. As noted in the attached Federal Register notice, the Federal Reserve anticipates that it will conduct small-value offerings of term deposits under the TDF in coming months to ensure the effective operation of the TDF and to help eligible institutions to become familiar with the term-deposit program. More detailed information about the structure and operation of the TDF, including information on the steps necessary for eligible institutions to participate in the program, will be provided later.

The amendments will be effective 30 days after publication in the Federal Register, which is expected shortly.