Right….

Fears of OPEC-style gas cartel unfounded: Putin

Russian Prime Minister Vladimir Putin said Tuesday any fears that some countries could form an OPEC-style gas cartel were unfounded.

[top]

Right….

Fears of OPEC-style gas cartel unfounded: Putin

Russian Prime Minister Vladimir Putin said Tuesday any fears that some countries could form an OPEC-style gas cartel were unfounded.

[top]

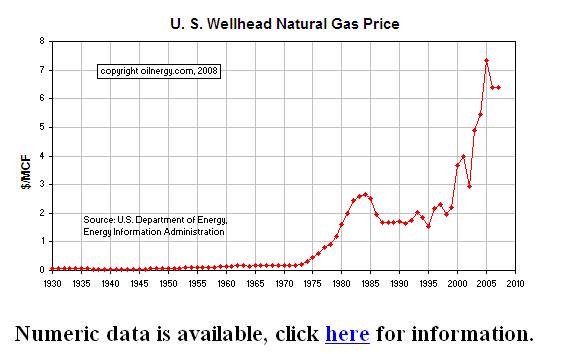

It was deregulated back in the 1970s, which brought out vast supplies causing utilities to substitute gas for oil and eventually break OPEC.

I don’t see that kind of supply response lurking today.

The Natural Gas Policy Act of 1978

In November of 1978, at the peak of the natural gas supply shortages, Congress enacted legislation known as the Natural Gas Policy Act (NGPA), as part of broader legislation known as the National Energy Act (NEA). Realizing that those price controls that had been put in place to protect consumers from potential monopoly pricing had now come full circle to hurt consumers in the form of natural gas shortages, the federal government sought through the NGPA to revise the federal regulation of the sale of natural gas. Essentially, this act had three main goals:

- Creating a single national natural gas market

- Equalizing supply with demand

- Allowing market forces to establish the wellhead price of natural gas

[top]

(an email exchange)

A few of things:

First, the rising wages in the 70’s led to bracket creep that put the budget in surplus in 1979 and resulted in a severe recession soon after.

This time around it is unlikely the inflation takes much of a dent out of the deficit so it’s more likely demand will be sustained to support prices. And, at least so far, Congress has acted to sustain demand and support prices with the latest fiscal package and more seemingly on the way.

Second, last time around the oil producers for the most part didn’t spend all that much of their new found revenues and thereby drained demand from the US economy. This time around they seem to be spending on infrastructure at a rate sufficient to drive our exports and keep gdp muddling through.

Third, I recall it was maybe the deregulation of nat gas that freed up a cheap substitute for electric utilities and unleashed a massive supply response as nat gas was substituted for crude at the elect power producers. After 1980 opec cut production by something like 15 million bpd to hold prices above 30 until they could cut no more without capping all their wells and the price tumbled to about 10 where it stood for a long time. This time around that kind of excess supply is nowhere in sight.

>

> On Thu, Jun 12, 2008 at 11:59 PM, Russell wrote:

>

> Stephan Roach is chairman of Morgan Stanley Asia, and pens

> this missive for the FT, in which he contextualizes why the

> Fed’s options are limited:

>

> ”Fears of 1970s-style stagflation are back in the air. Global

> bond markets are growing ever more nervous over this possibility,

> and US and European central bankers are talking increasingly

> tough about the perils of mounting inflation.

>

> Yet today’s stagflation risks are very different from those that

> wreaked such havoc 35 years ago. Unlike in that earlier period,

> wages in the developed economies have been delinked from prices.

> That all but eliminates the automatic indexation features of the

> once dreaded wage-price spiral – perhaps the most insidious

> feature of the “great inflation” of the 1970s. Moreover, as the

> stunning surge of the US unemployment rate in May suggests,

> slowing economic growth in the industrial economies is likely to

> open up further slack in labour markets, thereby putting downward

> cyclical pressure on wages over the next couple of years.

>

> But there is a new threat to global inflation that was not present

> in the 1970s. It is arising from the developing world, especially in

> Asia, where price pressures are lurching out of control. For

> developing Asia as a whole, consumer price index inflation hit 7.5

> per cent in April 2008, close to a 9½-year high and more than double

> the 3.6 per cent pace of a year ago. Sure, a good portion of the recent

> acceleration in pricing is a result of food and energy – critically

> important components of household budgets in poorer countries and

> yet items that many analysts mistakenly remove to get a cleaner read

> on underlying inflation. But even the residual, or “core”, inflation rate

> in developing Asia surged to 3.8 per cent in April, more than double

> the 1.8 per cent pace of a year ago…”

>

>

[top]