Just noticed this. PR has had over 500,000 move to the states for economic reasons:

For many Puerto Rico residents, it’s time to leave the island

Note: Puerto Rico is not included in the national employment report.

FYI:

Highlights

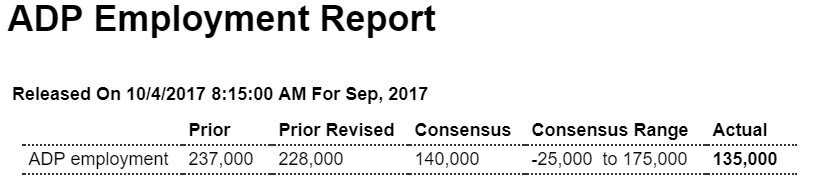

Hurricanes didn’t scramble ADP’s sample too much in September with their private payroll estimate at 135,000 which is very close to Econoday’s consensus for 140,000. The result is down sharply from August but is still constructive and consistent with a strong labor market, especially given the disruptions in Texas from Hurricane Harvey and in Florida from Hurricane Irma.

ADP’s estimate for August is revised only modestly lower, down 9,000 to 228,000 which is still far above the government’s initial total of 165,000. The spread between these readings hint, however uncertainly, at an upward revision to August data in Friday’s employment report.

Econoday’s consensus for private payroll growth in Friday’s report is 117,000 though the range of estimates is very wide, between 20,000 and 150,000. Watch later this morning for the non-manufacturing report from the Institute For Supply Management whose employment index will offer another indication on what to expect for Friday.

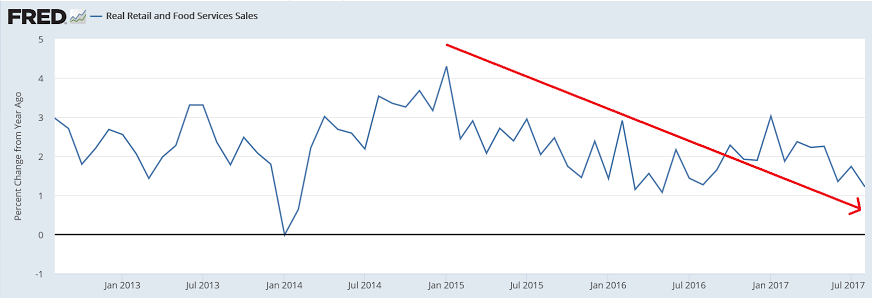

Holiday sales not forecast to add any more to growth than they did last year:

Holiday Sales Forecasts Are Rosy, but Not for All Retailers

Oct 3 (WSJ) — On Tuesday, the National Retail Federation said it expects holiday retail sales, which excludes autos, gasoline and restaurants, to increase between 3.6% and 4% in November and December, up from $655.8 billion last year. Last year, holiday spending fell in line with the group’s 3.6% growth forecast, but in 2015 the results were well short of the NRF’s prediction of a 3.7% gain. Christmas falls 32 days after Thanksgiving this year and is on a Monday, not a Sunday, which gives shoppers an extra weekend to shop. “Over all, the industry is very strong,” Matthew Shay, NRF chief executive said on a call with reporters. “Brick and mortar is getting better and more effective online.”

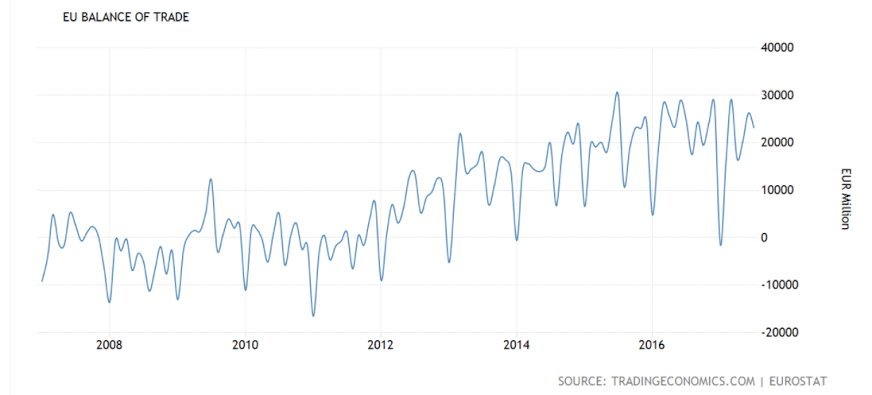

This is a tax increase for the macro economy:

EU to reform sales tax, prepares changes to rates

Oct 3 (Reuters) — The European Commission will propose on Wednesday changes to the way sales taxes are levied in the European Union. The new measures on value-added tax would mostly tackle frauds in which companies pocket VAT revenues from cross-border sales instead of paying them to the local government. The move would also end the practice of companies avoiding VAT by basing themselves in countries with low VAT rates. They will now, as a general rule, have to pay the VAT charged by the country where their products are sold. That principle has already been established by temporary regulations. The proposed reform would make that permanent.

My take is he’s exactly right, as I’ve been suggesting for more than 20 years:

Tillerson reportedly described Trump as ‘a moron’ and was set to resign in July

Rex Tillerson says he ‘never considered’ resigning; does not deny calling Trump ‘moron’

Interesting outburst from the President: