This Could Change Everything

By Dick Wagner

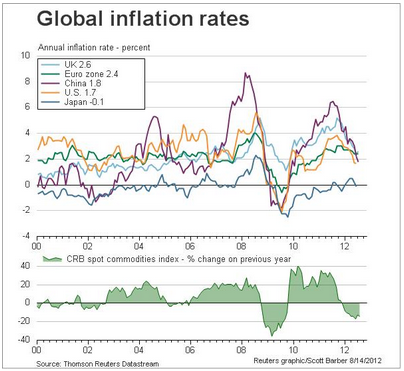

Global inflation rates

Interesting chart.

The way we define ‘inflation’ seems to be largely based on ‘cost plus’ pricing, seems?

German Economic Model Vindicated by GDP Data

As previously suggested, any sign of stabilization will be twisted into ‘austerity works’ rhetoric.

Yes, austerity has pushed deficits up the ugly way- higher unemployment comp and lower tax payments due to the slowing economy- to the point where the deficits gravitate to levels high enough for euro zone GDP to stabilize and even begin to grow a bit. (Presuming they don’t beat it down again with more austerity, which could very well be the case.)

For whatever reason they can’t seem to grasp the notion that it’s the deficits that support growth, as they fill in the ‘spending gap’ caused by taxes and ‘savings desires’ and that they could use deficits proactively to achieve growth from any starting point short of full employment.

German Economic Model Vindicated by GDP Data

By Catherine Boyle

August 14 (CNBC) — Germany’s reputation as the healthy man of Europe has been reinforced by better-than-expected growth in gross domestic product (GDP – click here for an explanation) for the second quarter, as growth contracted in the broader euro zone.

On Tuesday morning, euro zone GDP data for the second quarter shrank by 0.2 percent, as predicted by analysts polled by Reuters.

Germany, Europe’s biggest economy grew by 0.3 percent between April and July – not a huge leap, but better than most of the euro[EUR=X 1.2349 0.0018 (+0.15%) ] zone – as its export strength continued.

“Germany shows to some degree the way forward to other countries,” Daniel Morris, global strategist at JP Morgan Asset Management, told CNBC Europe’s ” Squawk Box” Tuesday.

“Germany’s point is if you run a low budget deficit you can still have economic growth. You can’t depend so much on government spending, fundamentally it has to be about the competitiveness of the economy, and Germany’s shown that.”

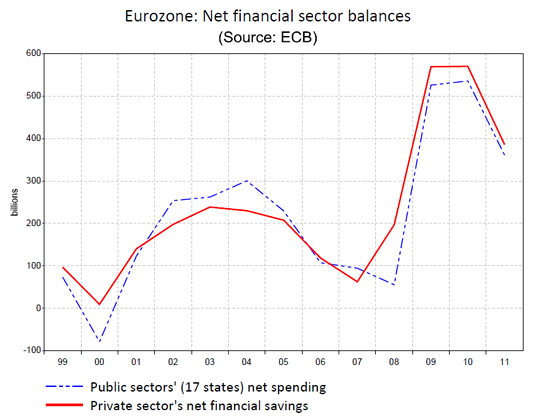

This chart found its way to an orthodox Italian blog last week

Romney and Ryan’s Disastrous Economic Plan – Forbes

Romney and Ryan’s Disastrous Economic Plan

By John T. Harvey

Paul Davidson on Paul Ryan’s economic knowledge in NY Times in 2009

>

> (email exchange)

>

> On Sat, Aug 11, 2012 at 1:32 PM, Paul wrote:

>

> In an op-ed ”Thirty Years Later, a Return to Stagflation” (Op-Ed, Feb. 14), Representative

> Paul D. Ryan, Republican of Wisconsin, argued that the stimulus plan will bring the

> combination of high inflation and high unemployment known as stagflation.

>

> Here is a copy of my February 22, 2009 published letter to the Editor of the New York

> Times evaluating Paul Ryan’s economics.

>

LETTERS; Can We Spend Our Way to Recovery?

February 22, 2009 (NYT)

To the Editor:

Paul D. Ryan repeats the tired idea that when the Federal Reserve prints money for the government to spend on economic recovery, the result will be inflation because ”it is a situation in which too few goods are being chased by too much money.” This is based on a false assumption that the output of the country will not increase when government lets contracts to businesses to produce more goods and services that will improve the productivity and health of our country.

If there is significant unemployment and idle capacity in the private sector (and who can deny that there is?), then this deficit spending will not cause inflation. Rather, the ”printed” money spent on a recovery plan creates profit opportunities that induce private enterprise to hire and produce more goods. Then there will be many more goods available for this money to chase and no inflation need occur.

Paul Davidson

Boynton Beach, Fla., Feb. 14, 2009

The writer is editor of The Journal of Post Keynesian Economics.

Romney Says Paul Ryan to Be His Republican Running Mate

A very hard right turn.

The right doesn’t like Romney, but would have voted for him any way just to thwart Obama. And, if anything, the right sees this as a Ryan ‘sell out’ which he’ll strive to show otherwise, hardening his positions on ‘fiscal responsibility’ and the rest.

What this does do, however, is frighten the ‘left’ that had abandoned Obama into now turning out to vote for him.

That is, this creates an anti Romney that hadn’t previously been there.

Romney Says Paul Ryan to Be His Republican Running Mate

August 11 (Reuters) — U.S. Republican presidential candidate Mitt Romney on Saturday said he has selected Congressman Paul Ryan, 42, as his vice presidential running mate.

Romney, the presumptive Republican nominee, announced that he has tapped the House of Representatives Budget Committee chairman at an event in front of the retired battleship USS Wisconsin – coincidentally named for Ryan’s home state.

The announcement marks the end a months-long search by Romney for a running mate to join him in facing Democratic President Barack Obama and Vice President Joe Biden in the Nov.6 election.

Greek funding

Falls under ‘will do whatever it takes’

;)

Greece is in the process of trying to secure funding from Greek local banks to payoff 2.6 bb in Greek Government bonds maturing this month (4.10% 8/20/12) that are owned by the ECB and EIB. The Eurozone turned down a request from Greece for a bridge loan to pay off the maturing bonds. For their part, the ECB rejected a proposal from Greece to delay the payoff until September when Greece hopes to receive its next tranche of funding. However, the local banks have apparently been given approval to lend Greece the funds it needs to pay off the bonds and avoid a default. The Greek banks will then be allowed to use the loans as collateral at the Bank of Greece’s ELA program to secure the funds for the loan to Greece.

Again, here is a non-standard measure being considered to fund sovereigns that involves central bank funding, even if it is not directly the ECB’s direct lending.

This is just another example of access to unlimited funding via central banks.

ECB Says It May Buy Bonds If Strict Conditionality Ensured

A mixed bag.

It addresses the solvency issue and can bring rates down to whatever the ECB wants them to pay.

But the ‘conditionality’ likely continues the contractionary bias it’s already introduced.

If pressed as implied, this is a prescription for rising unemployment and political turmoil.

The euro zone has massive ‘demand leakages’ into pension funds, corporate reserves, cash in circulation,

the desire of foreign governments to hold euro balances, etc. that are a powerful contractionary bias.

They can only be offset by deficit spending by the domestic private sector, the foreign sector (net exports)

or the euro zone public sector entities.

In my humble opinion

nothing less than full public sector recognition of this ‘accounting identity’

is a necessary prerequisite to a constructive response.

ECB Says It May Buy Bonds If Strict Conditionality Ensured

Aug. 9 (Bloomberg) — The European Central Bank said it may intervene in bond markets in tandem with Europe’s bailout funds if troubled nations commit to improving their economies and fiscal positions.

“The adherence of governments to their commitments and the fulfilment by the European Financial Stability Facility/European Stability Mechanism of their role are necessary conditions,”

the Frankfurt-based ECB said in its monthly bulletin today, echoing President Mario Draghi’s remarks on Aug. 2. The central bank “may undertake outright open market operations of a size adequate to reach its objective.”

The ECB is stepping up its crisis response after Spanish and Italian bond yields surged, exacerbating a sovereign debt crisis that has forced five of the 17-euro members into seeking external aid. Draghi last week justified any potential intervention, saying rising borrowing costs in “several countries and financial fragmentation hinders the effective working of monetary policy.”

Still, “in order to create the fundamental conditions for such risk premia to disappear, policy makers in the euro area need to push ahead with fiscal consolidation, structural reform and European institution-building with great determination,”

the ECB said. “Governments must stand ready to activate the EFSF/ESM in the bond market when exceptional financial market circumstances and risks to financial stability exist — with strict and effective conditionality.”

Market Tensions

A further worsening of the crisis is likely to hurt economic growth in the euro area, “with the ongoing tensions in financial markets and heightened uncertainty weighing on confidence and sentiment,” the report said.

Today’s bulletin also contains the quarterly survey of professional forecasters. Their estimate for 2012 inflation remained unchanged at 2.3 percent. For 2013, they expect annual price gains to average 1.7 percent, down from 1.8 percent previously estimated, and for 2014 they predict 1.9 percent. The longer term inflation forecast remained at 2 percent.

On growth, the forecasters predict a 0.3 percent contraction for 2012, down from a 0.2 percent contraction expected last quarter. For 2013, they anticipate growth of 0.6 percent, down from a previous estimate of 1 percent. For 2014, they see the economy expanding 1.4 percent.

Brent Crude price

Looks like the Saudi gift to the US economy might have been short lived?

No telling what they are up to…