Corporate Profits

Highlights

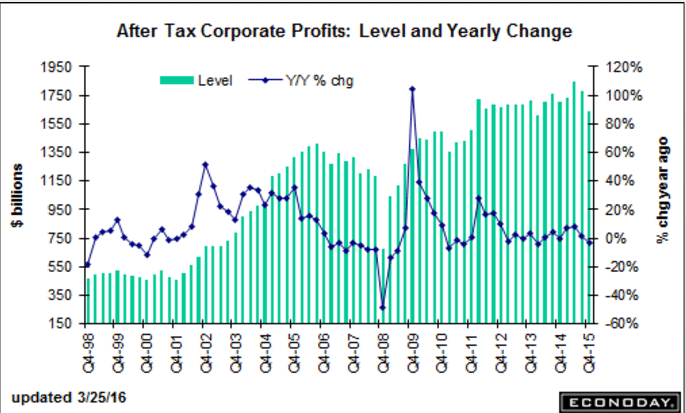

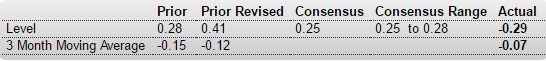

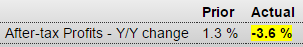

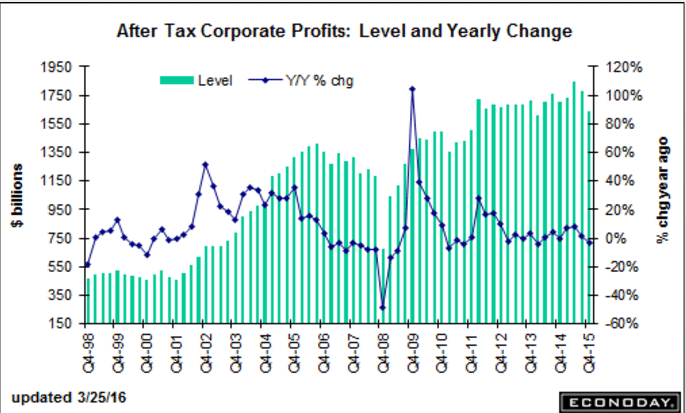

Held down by declines in the petroleum and chemical industries, corporate profits in the fourth quarter came in at $1.640 trillion, down a year-on-year 3.6 percent. Profits are after tax without inventory valuation or capital consumption adjustments.

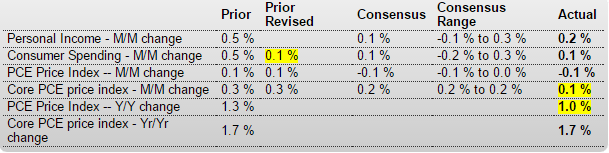

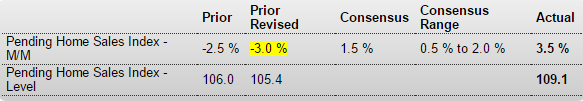

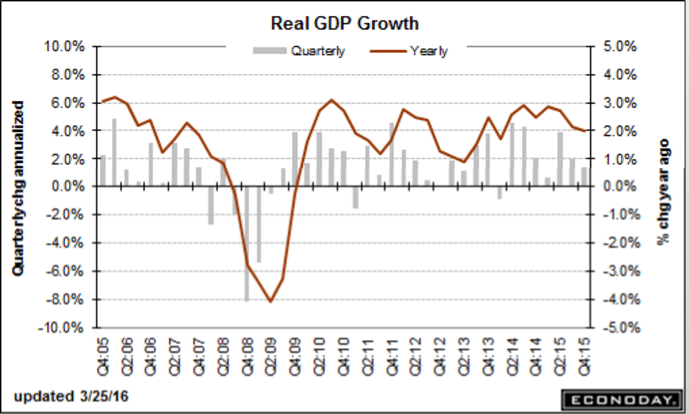

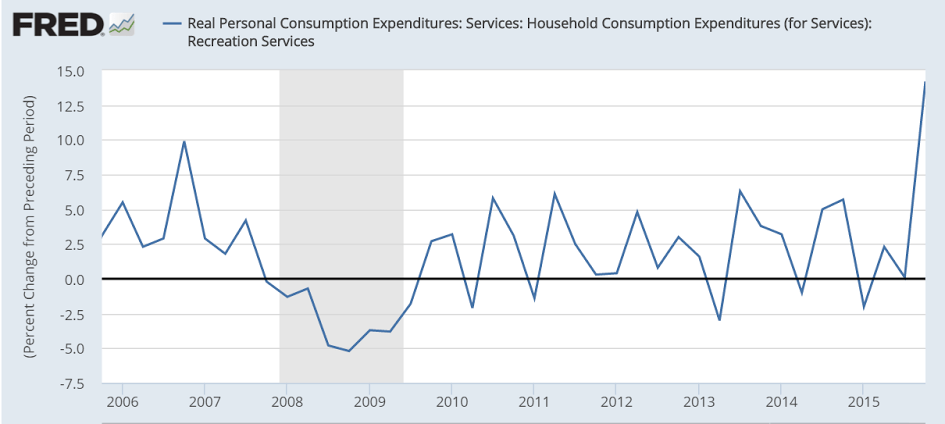

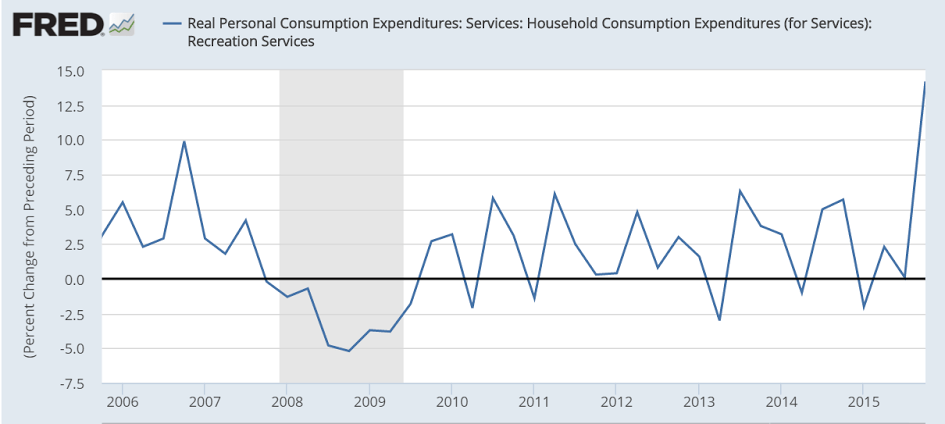

Revised up, but seems the odd looking spike in ‘recreational services’ that alone added most of the upward revision is likely to reverse in Q1, subtracting that much more from current forecasts, with real disposable personal income was revised lower as well. That said, you might want to see the table of changes, and note how many relatively large changes there were, up and down, all subject to reversion and revision:

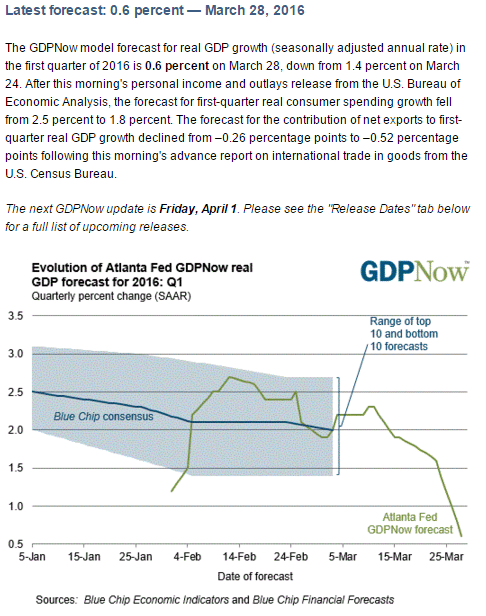

GDP

Highlights

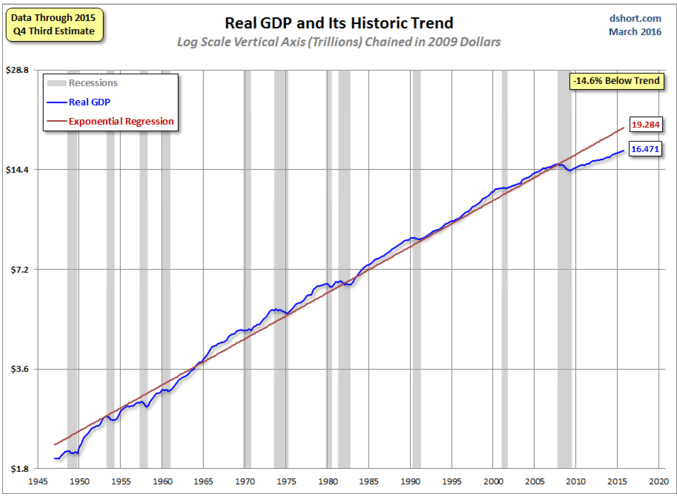

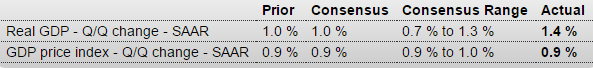

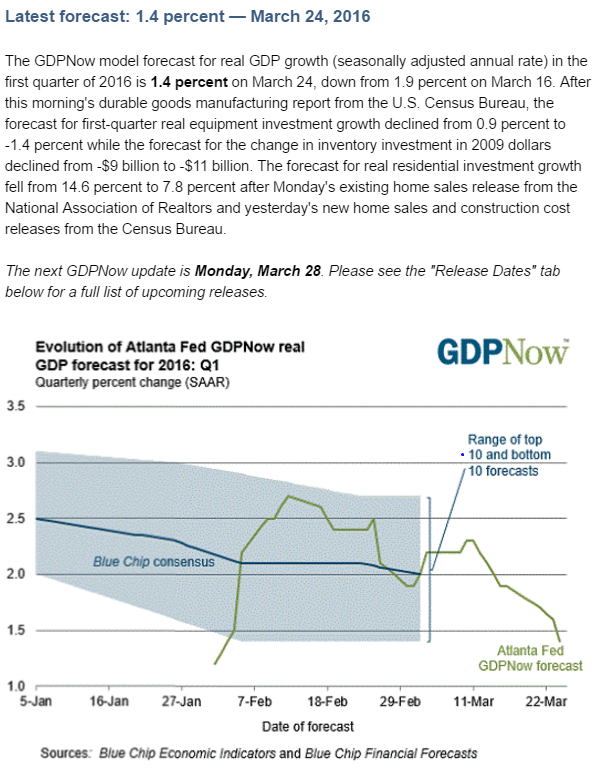

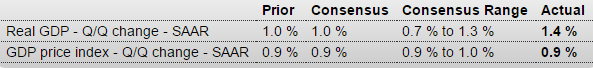

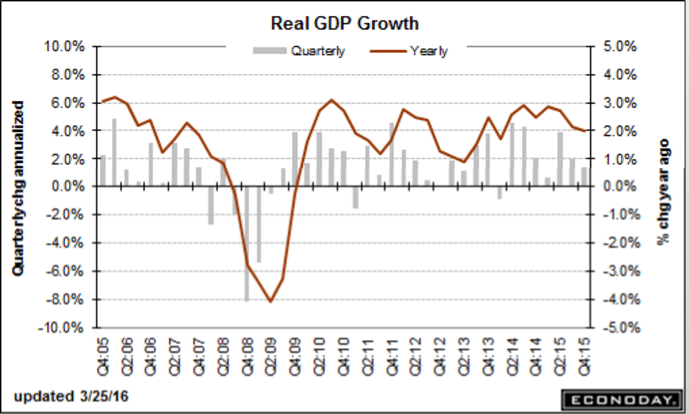

Real GDP came in stronger than expected in the fourth quarter, at an annualized plus 1.4 percent for the third estimate vs expectations for 1.0 percent. The second estimate was also 1.0 percent with the first estimate at plus 0.7 percent.

The third estimate got a boost from an upward revision for personal consumption expenditures which came in at a respectable 2.4 percent annualized rate for a 4 tenths increase from the prior estimate (a similar rate for the first quarter would be welcome). Residential fixed investment gave a 10.1 percent boost to the quarter, offset in part by a 2.1 percent decline on the non-residential side. Net exports cut 0.14 percent off the quarter, an improvement from minus 0.25 and 0.47 in the prior two estimates. Inventory cut 0.22 percent. Final sales came in at 1.6 percent, up 4 tenths from the initial estimate. Inflation was muted with the price index up 0.9 percent and the core up 1.3 percent.

In any case, the overall deceleration is clear, likely to have continued into Q1, and all subject to be revised lower over the next few years:

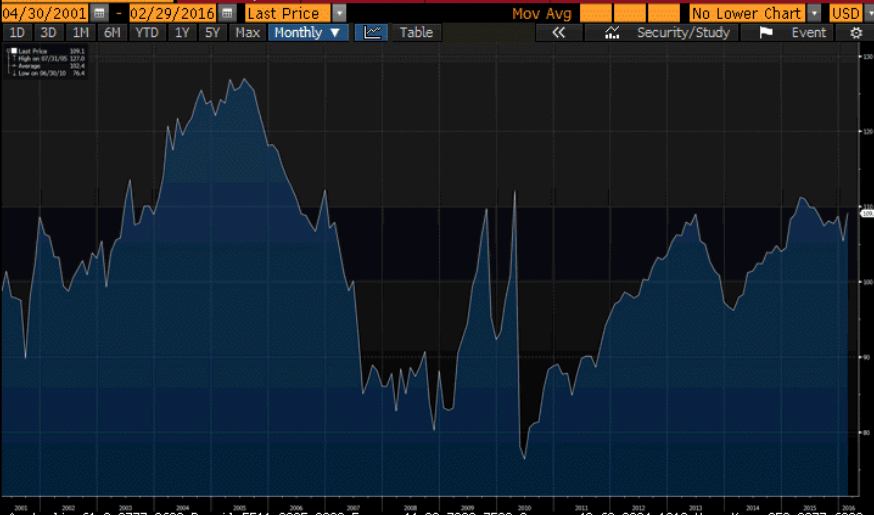

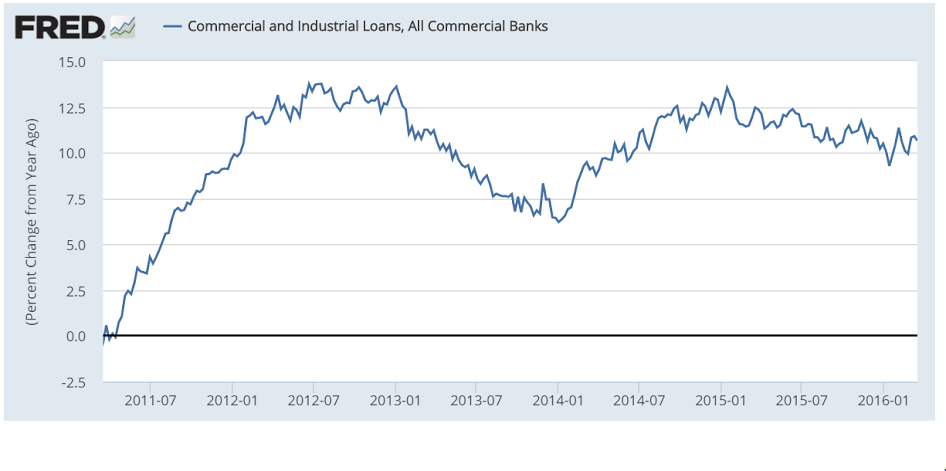

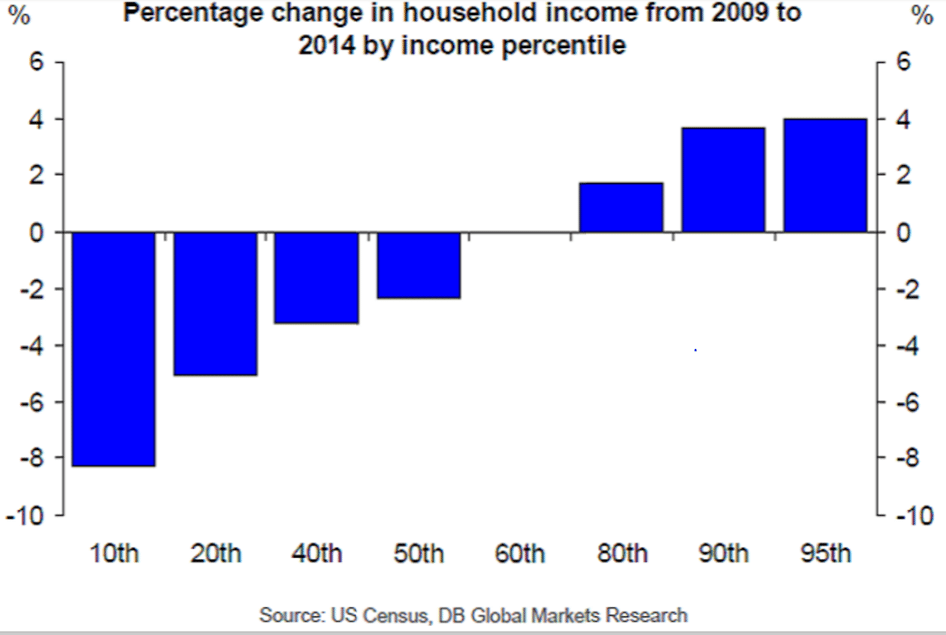

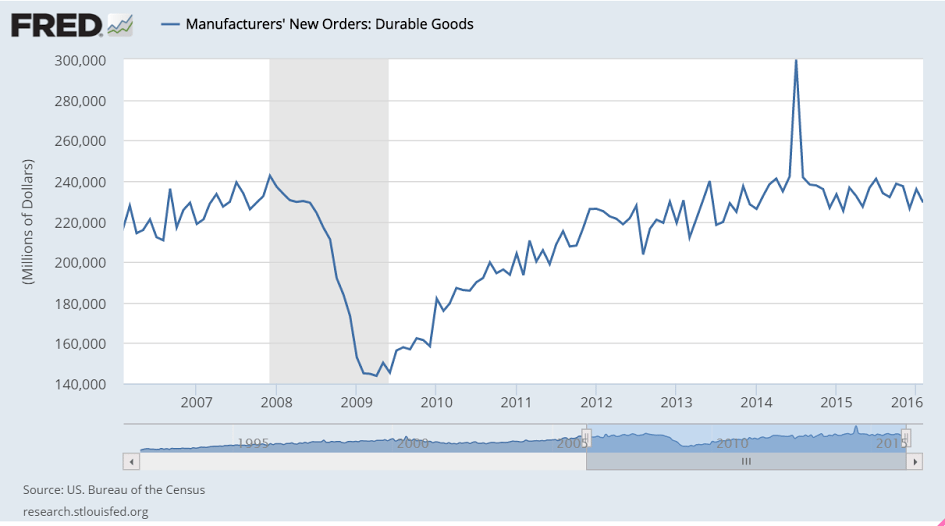

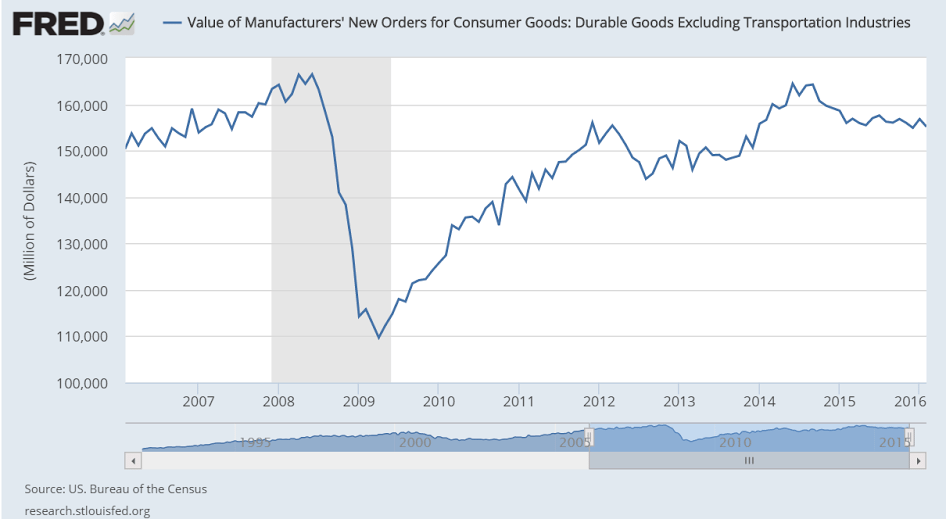

With limited govt deficit spending, and net imports rising, GDP is that much more dependent on private sector credit expansion. So this type of thing doesn’t help.

The article is a bit long, but the take away is the ongoing energy related credit contraction that spills over to the rest of the economy. And note how regulators tightening up is part of the pro cyclical nature of banking and the private sector, as previously discussed:

By Bradley Olson, Emily Glazer and Matt Jarzemsky

March 25 (WSJ) — Bad loans in the U.S. oil patch are on pace to soon outnumber good ones, an indication of the pressure on energy companies and their lenders from the crash in prices.

The number of energy loans labeled as “classified,” or in danger of default, is on course to extend above 50% this year at several major banks, including Wells Fargo & Co. and Comerica Inc., according to bankers and others in the industry.

In response, several major banks are reducing their exposure to the energy sector by attempting to sell off souring loans, declining to renew them or clamping down on the ability of oil and gas companies to tap credit lines for cash, according to more than a dozen bankers, lawyers and others familiar with the plans.

The pullback is curtailing the flow of money to companies struggling to survive a prolonged stretch of low prices, likely quickening the path to bankruptcy for some firms. About 175 companies are at high risk of not being able to meet financial stipulations in their loan agreements, according to Deloitte LLP.

Since the start of last year, 51 North American oil-and-gas producers have filed for bankruptcy, cases totaling $17.4 billion in cumulative debt, according to law firm Haynes and Boone LLP. That trails the number from September 2008 to December 2009 during the global financial crisis, when there were 62 filings of oil and gas producers, but it is expected to grow.

“This has the makings of a gigantic funding crisis” for energy companies, said William Snyder, head of Deloitte’s U.S. restructuring unit. If oil prices, which closed at $39.46 a barrel Thursday, remain at around $40 a barrel this year, “that’s fairly catastrophic.”

While U.S. oil prices have rebounded from their February low of $26.21, they remain down about 36% from last year’s highs amid a global glut of supply.

Since late last year, regulators have been leaning on banks to be tougher in their labeling of bad loans. That has also been a factor in driving up the rate of troubled debt, bankers said.

Earlier this month, the Office of the Comptroller of the Currency published an updated manual for energy lending that establishes stricter guidelines for loans tied to future oil-and-gas production. One guideline banks use to classify loans as “substandard and worse” is if the creditor has debt generally more than four times greater than operating income, before depreciation and amortization expense.

That high a ratio was rare when crude prices began to plunge in 2014 but will be the average across the sector by the end of the year, estimates energy investment bank Tudor, Pickering, Holt & Co.

The updated manual follows a series of calls in recent weeks between the OCC and banks around energy lending guidelines, people familiar with the calls said.

Many of the souring energy loans are revolving-credit facilities, backed by future barrels of oil and gas, which are typically used by companies for short-term needs. Usually, around a half dozen banks share the risk on the “revolvers,” reducing exposure. But as oil prices remain low there is less profitable work the energy firms can do, which makes their loans riskier for the banks who must hold more capital against them.

Although some bank loans may be replaced by debt from hedge funds or private equity, many of those who step in to fill the void left by banks will do so seeking more control over the companies with an eye toward taking over if the companies aren’t able to turn things around. That’s different from banks, which were key enablers of drillers in recent years, and have worked to keep companies afloat and avoid foreclosure. The prices being discussed include a discount to the loan value in the range of 65 to 90 cents on the dollar, potential buyers said.

Global oil-and-gas sector debt totaled $3 trillion in 2014, three times what it was at the end of 2006, according to the most recent figures from the Bank for International Settlements, a central-banking group based in Switzerland. The oil-price plunge has worsened the financial picture for energy borrowers and lenders around the world because it directly affects the value of oil reserves and other assets backing some of the debt.

The situation is particularly acute in the U.S., where many small and midsize companies borrowed heavily to expand during the shale boom and are now weighed down with debt as low oil and gas prices have made their assets unprofitable to produce.

Regional banks that lent to energy companies have the most concentrated exposure. While the biggest U.S. banks have already set aside hundreds of millions of dollars for potential losses, their lending to the sector is a smaller part of their overall business. About 1.5% to 3% of the loan portfolios of Bank of America Corp., Citigroup Inc., J.P. Morgan Chase & Co. and Wells Fargo were outstanding to the oil-and-gas sector in January, according to Goldman Sachs Group Inc. and Evercore ISI.

“I’m not worried about it bringing the industry down,” said Thomas Hoenig, vice chairman of the Federal Deposit Insurance Corp., in an interview. “We may have a bank failure but it should be one-off.”

However, the lending shakeout could be significant for U.S. oil-and-gas producers, which face a biannual review by banks of their reserves that is widely expected to curtail their revolving credit lines. That credit, which has been critical for capital flexibility in the downturn, may be cut 20% to 30%, analysts said.

James J. Volker, chief executive of Whiting Petroleum Corp., one of the biggest producers in North Dakota’s Bakken formation, said at a Denver conference this month that he expected the company’s credit line to be reduced by $1 billion, or more than a third.

Still, he said he was optimistic Whiting would weather the storm, adding that the company was “well within” the rules established by its lenders.

“We have over 6,000 drilling locations in the Williston basin . . . so basically a large treasure trove, if you will, of locations to drill,” Mr. Volker said.

By Peter Grant

March 22 (WSJ) — Sales of U.S. commercial real estate plummeted in February, sending the clearest signal yet that a six-year bull market might be coming to an end.

Just $25.1 billion worth of office buildings, stores, apartment complexes and other commercial property changed hands last month, compared with $47.3 billion in the same month a year earlier, according to deal tracker Real Capital Analytics Inc. In January, sales were $46.2 billion.

Prices, which had been on a steady march higher since 2009, are beginning to plateau, and have started falling in certain sectors and geographies, according to analysts and market participants. An index of hotel values compiled by real-estate tracker Green Street Advisors, for example, was 10% lower in February than it was a year earlier, due in part to reduced business and international travel.

Overall, commercial-property values are leveling off. Green Street’s broad valuation index in February was 8.7% higher from one year earlier, but in the previous year the index rose 11%.

“Clearly there has been a plateauing,” said Jonathan Gray, global head of real estate for Blackstone Group, the world’s largest private property owner.

The question is whether February was a temporary blip or the beginning of a more lasting pullback. The Green Street index, which tracks higher-quality property owned by real-estate investment trusts, is 24% above its 2007 peak and 102% higher than the trough it hit in 2009.

Mr. Gray and others emphasize that the commercial-property market is much healthier than before the 2008 crash. Rents, occupancies and other fundamental factors are improving for most property types, analysts say. New supply growth has been limited, they point out.

“It’s too early to call the end of the cycle,” Mr. Gray said.

Still, some are heading for the exit. For example, Radnor, Pa.-based Brandywine Realty Trust has sold $765 million worth of property this year, including Cira Square, the former U.S. Post Office Building in Philadelphia.

Gerard Sweeney, Brandywine’s chief executive, said the real-estate investment trust is “accelerating” its property sales. “We’ve made the call that given where we are in the real-estate cycle, now is a good time for us to be harvesting value by selling,” he said.

The market has slowed primarily because of forces at work in the global capital markets rather than problems stemming from real estate itself. These forces, which also caused global stock markets to plummet in the first two months of this year, have made debt–the lifeblood of real estate–more expensive and more difficult to obtain.

The most dramatic sign has been the sharp decline in bonds backed by commercial mortgages. In 2015, about $100 billion of commercial mortgage-backed securities were issued. This year experts believe volume will fall to $60 billion to $75 billion.

Banks and insurance companies are filling part of the void. But they can charge more and be more selective, making loans primarily backed by trophy and fully leased buildings in strong markets. Borrowers in the riskiest deals, such as land purchases and new construction, are having a more difficult time finding financing.

“There are deals falling out of the system,” said Josh Zegen, managing principal of Madison Realty Capital, an investment firm with more than $1 billion of loans outstanding. “I’m able to be very choosy.”

The real-estate debt markets began to tighten at the end of last year as concerns grew about interest rates rising and new regulations on lenders, enacted in response to the world financial downturn, began to take effect.

Central banks eased up on their tightening of interest rates, but the real-estate debt market remained choppy at the beginning of the year as global stock and corporate-bond markets convulsed amid signs the Chinese economy was weakening.

As yields of junk bonds soared, real estate became a less attractive investment. At the same time, the spreads between real-estate borrowing rates and Treasury bonds widened greatly.

Today loans that would have been made with interest rates in the 4.5% to 5% range are now being made above 5%, market participants say. Borrowers who would have lent up to 75% of a property’s value have reduced their so-called loan-to-value ratios to between 65% and 70%.

Those changes mean that many real-estate investments that would have made sense before no longer do. Higher rates and tougher standards also make it more difficult for prices to continue rising.

“Buyers have been hearing ‘no’ from lenders for the first time in a while,” said Jim Costello, senior vice president at Real Capital Analytics.

Market participants point out that some conditions have improved slightly since the beginning of the year. For example, the stocks of real-estate investment trusts have rallied along with the broader market.

On Feb. 1, shares of REITs that specialize in shopping malls were trading at a 21.4% discount to the value of the property owned by those REITs, according to Green Street. That discount had declined to 19.1% as of March 15. For office property REITs, the discount declined to 21.4% from 24.5% during the same time frame.

By contrast, in March 2014, when the bull market in commercial property was still raging, malls were trading at only a 0.3% discount to asset value while office REITs traded at a 1.29% discount, according to Green Street.

Some buyers are looking at the market’s softening this year as a buying opportunity. Atlanta-based real-estate investment company Jamestown LP last month purchased a 49% stake in two New York office buildings–63 Madison Avenue and 200 Madison Avenue–in a deal that valued the pair at around $1.15 billion.

Michael Phillips, Jamestown’s president, said the firm will continue to pursue properties whose incomes can be increased through higher rents or redevelopment. For example, additional floors could be added to 63 Madison Avenue, according to real-estate experts.

“Growing net income will reduce the risk of any short-term capital markets challenge,” Mr. Phillips said.